by Calculated Risk on 10/24/2014 10:00:00 AM

Friday, October 24, 2014

New Home Sales increased slightly to 467,000 Annual Rate in September

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 467 thousand.

August sales were revised down from 504 thousand to 466 thousand, and July sales were revised down from 427 thousand to 404 thousand.

"Sales of new single-family houses in September 2014 were at a seasonally adjusted annual rate of 467,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.2 percent above the revised August rate of 466,000 and is 17.0 percent above the September 2013 estimate of 399,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply was unchanged in September at 5.3 months.

The months of supply was unchanged in September at 5.3 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of September was 207,000. This represents a supply of 5.3 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

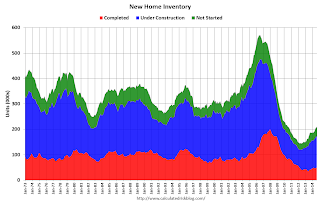

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In September 2014 (red column), 38 thousand new homes were sold (NSA). Last year 31 thousand homes were sold in September. This was the best September since 2007.

The high for September was 99 thousand in 2005, and the low for September was 24 thousand in 2011.

This was close to expectations of 460,000 sales in September, although there were downward revisions to sales in June, July and August.

I'll have more later today.

Black Knight: Mortgage Delinquencies decreased in September

by Calculated Risk on 10/24/2014 08:01:00 AM

According to Black Knight's First Look report for September, the percent of loans delinquent decreased in September compared to August, and declined by 12% year-over-year.

Also the percent of loans in the foreclosure process declined further in September and were down 33% over the last year. Foreclosure inventory was at the lowest level since February 2008.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 5.67% in September, down from 5.90% in August. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 1.76% in September from 1.80% in August.

The number of delinquent properties, but not in foreclosure, is down 388,000 properties year-over-year, and the number of properties in the foreclosure process is down 435,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for September in early November.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Sept 2014 | Aug 2014 | Sept 2013 | Sept 2012 | |

| Delinquent | 5.67% | 5.90% | 6.46% | 7.40% |

| In Foreclosure | 1.76% | 1.80% | 2.63% | 3.87% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,760,000 | 1,852,000 | 1,935,000 | 2,170,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,118,000 | 1,143,000 | 1,331,000 | 1,530,000 |

| Number of properties in foreclosure pre-sale inventory: | 893,000 | 913,000 | 1,328,000 | 1,940,000 |

| Total Properties | 3,771,000 | 3,908,000 | 4,593,000 | 5,640,000 |

Thursday, October 23, 2014

Friday: New Home Sales

by Calculated Risk on 10/23/2014 09:01:00 PM

The Inland Empire comes full circle ... from the Chris Kirkham at the LA Times: Strong growth is forecast for Inland Empire

[T]he Inland Empire is now the fastest-growing region in Southern California — a trend predicted to continue over the next five years, according to an economic forecast released Thursday.I was very bearish on the Inland Empire during the housing bubble. Here is what I wrote in 2006: Housing: Inverted Reasoning?

The availability of land for development, combined with proximity to ports and major transportation corridors, has given Riverside and San Bernardino counties a growth advantage over more built-out coastal areas over the last two years. Unlike the housing bubble of the mid-2000s — when much of the Inland Empire's job growth was tied to construction and real estate — the economic recovery has been spread across a wider range of industries, such as professional services and goods distribution.

emphasis added

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.This time construction is only a small part of the recovery in the Inland Empire - and that is good news!

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

Friday:

• Early, the Black Knight Financial Services' "First Look" at September Mortgage Data.

• At 10:00 AM ET, New Home Sales for September from the Census Bureau. The consensus is for a decrease in sales to 460 thousand Seasonally Adjusted Annual Rate (SAAR) in September from 504 thousand in August.

FDIC Releases Economic Scenarios for 2015 Stress Testing

by Calculated Risk on 10/23/2014 06:00:00 PM

From the FDIC: FDIC Releases Economic Scenarios for 2015 Stress Testing

The Federal Deposit Insurance Corporation (FDIC) today released the economic scenarios that will be used by certain financial institutions with total consolidated assets of more than $10 billion for stress tests required under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.Here is an excel spreadsheet with the scenarios.

The baseline, adverse, and severely adverse scenarios include key variables that reflect economic activity, including unemployment, exchange rates, prices, income, interest rates, and other salient aspects of the economy and financial markets.

The baseline scenario represents expectations of private sector economic forecasters. The adverse and severely adverse scenarios are not forecasts, rather, they are hypothetical scenarios designed to assess the strength and resilience of financial institutions and their ability to continue to meet the credit needs of households and businesses under stressed economic conditions.

Note: I'm not even on "recession watch", and I think the baseline is the most likely scenario for the next couple of years. However I think these regular stress tests are very helpful for regulators.

The first table is a summary of the baseline scenario (basically in line with most economic forecasts for GDP and unemployment).

| Stress Test Baseline Scenario | ||||

|---|---|---|---|---|

| GDP1 | Unemployment2 | DOW3 | House Prices3 | |

| 2014 | 2.2% | 5.9% | 6.5% | 4.1% |

| 2015 | 2.9% | 5.4% | 5.1% | 2.5% |

| 2016 | 2.9% | 5.3% | 5.3% | 3.0% |

| 2017 | 2.7% | 5.3% | 5.3% | 3.0% |

2 Unemployment is for Q4 of each year.

3 The change in the DOW and House Prices is from Q4 of the preceding year to Q4.

The second table is the adverse scenario. This is moderate recession, but a slow recovery. Under the adverse scenario, unemployment peaks at 8% in 2017. The DOW declines about 28% from peak to trough, and house prices fall 13%.

| Stress Test Adverse Scenario | ||||

|---|---|---|---|---|

| GDP1 | Unemployment2 | DOW3 | House Prices3 | |

| 2014 | 1.3% | 6.4% | 0.0% | 2.6% |

| 2015 | -0.3% | 7.6% | -16.3% | -7.7% |

| 2016 | 1.4% | 8.0% | -7.8% | -5.6% |

| 2017 | 2.0% | 8.0% | 0.1% | 0.9% |

The third table is the severely adverse scenario. This is a severe recession, but a fairly quick recovery. Under the severely adverse scenario, unemployment peaks at 10.1% in 2016. The DOW declines about 58% and house prices fall 25%.

| Stress Test Severely Adverse Scenario | ||||

|---|---|---|---|---|

| GDP1 | Unemployment2 | DOW3 | House Prices3 | |

| 2014 | 0.4% | 6.9% | -11.7% | 1.9% |

| 2015 | -3.7% | 9.9% | -49.8% | -14.9% |

| 2016 | 2.1% | 9.9% | 33.9% | -11.0% |

| 2017 | 3.9% | 9.1% | 43.1% | 2.0% |

A Few Comments on QE

by Calculated Risk on 10/23/2014 01:54:00 PM

A few comments on QE:

• The FOMC is expected to announce the end of QE3 on Wednesday October 29th, following the FOMC meeting next week.

• Most research shows that the primary impact of QE on interest rates is from the size of the Fed balance sheet ("stock") as opposed to the impact on supply and demand ("flow"). This means that interest rates will not spike when QE ends (something I've noted at the conclusion of previous QE purchases).

• The positive impact of QE on the economy was probably modest and was the result of lower interest rates. QE probably lowered interest rates 50 bps (maybe more or less). However monetary policy has been the only game in town since fiscal policy has had a negative impact on the economy over the last 4 years (my view is the pivot to austerity was a mistake, and the actions of Congress for the last 3+ years have been negative for the economy).

• The possible negative impacts of QE (such as inflation, weak dollar) never materialized. Inflation remains below the Fed's target, and the U.S. dollar has strengthened recently. As I noted yesterday, without the recent increases in shelter (rent and OER), inflation would be close to 1% year-over-year. Without QE, inflation might be dangerously low!

• At the end of the previous rounds of QE, the economy was still struggling from the effects of the housing bust and financial crisis. Households were still deleveraging in the aggregate. Now the economy is in much better shape, and the effects of the crisis are diminishing. Therefore I do not expect another round of QE during this recovery (although I think the first rate hike might be later than most people expect).

• On inflation: Some people are warning that inflation will pick up as the economy gains traction (because of the size of the Fed's balance sheet). That is possible, but I don't expect a rapid increase in inflation. Many of the factors that led to sharply rising inflation in the '70s are not currently present (like wages and contracts tied to CPI and different demographics).

• My view is QE was not a panacea, but overall QE was a success. I was a frequent critic of the Fed prior to the financial crisis - I think the Fed was almost anti-regulation during the housing bubble, and initially the Fed was behind the curve when the crisis was looming - however once Bernanke became aware of the severity of the crisis, the Fed was aggressive and effective. Perhaps they were a little slow in implementing QE3 - and with low inflation an argument could be made now to extend QE - but overall I think QE was a success.

Philly Fed: State Coincident Indexes increased in 43 states in September

by Calculated Risk on 10/23/2014 12:13:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for September 2014. In the past month, the indexes increased in 43 states, decreased in four, and remained stable in three, for a one-month diffusion index of 78. Over the past three months, the indexes increased in 44 states, decreased in five, and remained stable in one, for a three-month diffusion index of 78Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In September, 45 states had increasing activity (including minor increases). This measure declined sharply during the winter, but is close to normal for a recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green again.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green again.

FHFA: House Prices increased 0.5% in August, Up 4.8% Year-over-year

by Calculated Risk on 10/23/2014 09:10:00 AM

This house price index is only for houses with Fannie or Freddie mortgages.

From the FHFA: FHFA House Price Index Up 0.5 Percent in August

U.S. house prices rose in August, up 0.5 percent on a seasonally adjusted basis from the previous month, according to the Federal Housing Finance Agency (FHFA) monthly House Price Index (HPI). The previously reported 0.1 percent increase in July was revised to reflect a 0.2 percent increase.

The FHFA HPI is calculated using home sales price information from mortgages sold to or guaranteed by Fannie Mae and Freddie Mac. From August 2013 to August 2014, house prices were up 4.8 percent. The U.S. index is 5.8 percent below its April 2007 peak and is roughly the same as the August 2005 index level. This is the ninth consecutive monthly house price increase.

For the nine census divisions, seasonally adjusted monthly price changes from July 2014 to August 2014 ranged from -0.6 percent in the New England and South Atlantic divisions to +1.2 percent in the Mountain division. The 12-month changes were all positive ranging from +1.9 percent in the Middle Atlantic division to +7.8 percent in the Pacific division.

emphasis added

Weekly Initial Unemployment Claims increase to 283,000, 4-Week Average lowest since May 2000

by Calculated Risk on 10/23/2014 08:35:00 AM

The DOL reports:

In the week ending October 18, the advance figure for seasonally adjusted initial claims was 283,000, an increase of 17,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 264,000 to 266,000. The 4-week moving average was 281,000, a decrease of 3,000 from the previous week's revised average. This is the lowest level for this average since May 6, 2000 when it was 279,250. The previous week's average was revised up by 500 from 283,500 to 284,000.The previous week was revised up to 266,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 281,000.

This was slightly below the consensus forecast of 285,000 and suggests few layoffs.

Wednesday, October 22, 2014

Thursday: Unemployment Claims, FHFA House Price Index

by Calculated Risk on 10/22/2014 07:41:00 PM

From Kathleen Madigan at the WSJ: Why Rising Rents Haven’t Pumped Up Inflation

For the 12 months ended in September, [owners’ equivalent rent] OER is up 2.7%, up from 2.2% a year ago. (Actual rent paid by tenants is up a faster 3.3%.)Without OER, inflation would be even lower. If we look at shelter1, All times less Shelter is up just 1.1% year-over-year, and All items less food, shelter, and energy is only up 0.9%.

OER is the big gorilla in the inflation room. It accounts for 24% of the total CPI and 31% of the core. So why isn’t the accelerating OER rate pushing up the core? Because other factors are offsetting the upward push.

The biggest drag is the downward pressure on goods prices coming from overseas. ... On the service side, other major categories have seen a slowdown in markups.

Rents can't keep rising this quickly without rising wages. And without rising rents, inflation would be even lower.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 285 thousand from 264 thousand.

• Also at 8:30 AM, the Chicago Fed National Activity Index for September. This is a composite index of other data.

• At 9:00 AM, the FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% increase.

• At 9:00 AM, the Kansas City Fed manufacturing survey for October.

1 From the BLS: "Rent of primary residence (rent) and Owners' equivalent rent of primary residence (rental equivalence) are the two main shelter components of the Consumer Price Index (CPI)."

QE Timeline Update

by Calculated Risk on 10/22/2014 04:31:00 PM

With QE3 expected to end next week, by request, here is an updated timeline of QE (and Twist operations):

• November 25, 2008: Press Release: $100 Billion GSE direct obligations, $500 billion in MBS

• December 16, 2008 FOMC Statement: Evaluating benefits of purchasing longer-term Treasury Securities

• January 28, 2009: FOMC Statement: FOMC Stands Ready to expand program.

• March 18, 2009: FOMC Statement: Expand MBS program to $1.25 trillion, buy up to $300 billion of longer-term Treasury securities

• March 31, 2010: QE1 purchases were completed at the end of Q1 2010.

• August 27, 2010: Fed Chairman Ben Bernanke hints at QE2: Analysis: Bernanke paves the way for QE2

• November 3, 2010: FOMC Statement: $600 Billion QE2 announced.

• June 30, 2011: QE2 purchases were completed at the end of Q2 2011.

• September 21, 2011: "Operation Twist" announced. "The Committee intends to purchase, by the end of June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years and to sell an equal amount of Treasury securities with remaining maturities of 3 years or less."

• June 20, 2012: "Operation Twist" extended. "The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities."

• August 31, 2012: Fed Chairman Ben Bernanke hints at QE3: Analysis: Bernanke Clears the way for QE3 in September

• September 13, 2012: FOMC Statement: $40 Billion per month QE3 announced.

• December 12, 2012: FOMC Statement: Announced completion of "Operation Twist", expanded QE3 to $85 Billion per month.

• May 22, 2013: In Testimony to Congress, The Economic Outlook, Fed Chairman Ben Bernanke said “If we see continued improvement and we have confidence that that is going to be sustained, then in the next few meetings, we could take a step down in our pace of purchases.” (aka "Taper Tantrum").

• June 19, 2013: In Chairman Bernanke’s Press Conference, Bernanke said "If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year."

• December 18, 2013: FOMC Statement: Announced "tapering" of QE3. Note: QE3 tapered $10 billion per month at each meeting of 2014.

• October 29, 2013: FOMC expected to complete QE3 (next week).