by Calculated Risk on 10/22/2014 09:01:00 AM

Wednesday, October 22, 2014

AIA: Architecture Billings Index increases in September, "Robust Construction Conditions Ahead"

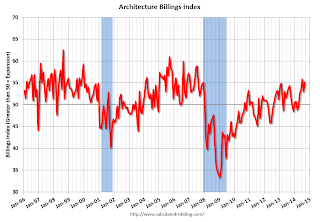

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Shows Robust Conditions Ahead for Construction Industry

With all geographic regions and building project sectors showing positive conditions, there continues to be a heightened level of demand for design services signaled in the latest Architecture Billings Index (ABI). As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the September ABI score was 55.2, up from a mark of 53.0 in August. This score reflects an increase in design activity (any score above 50 indicates an increase in billings). The new projects inquiry index was 64.8, following a mark of 62.6 the previous month.

The AIA has added a new indicator measuring the trends in new design contracts at architecture firms that can provide a strong signal of the direction of future architecture billings. The score for design contracts in August was 56.8.

“Strong demand for apartment buildings and condominiums has been one of the main drivers in helping to keep the design and construction market afloat in recent years,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “There continues to be a healthy market for those types of design projects, but the recently resurgent Institutional sector is leading to broader growth for the entire construction industry.”

• Regional averages: South (55.3) , Midwest (55.1), West (54.2), Northeast (51.0) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 55.2 in September, up from 53.0 in August. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the readings over the last year suggest an increase in CRE investment this year and in 2015.

BLS: CPI increases 0.1% in September, Core CPI 0.1%, Cost-Of-Living Adjustment 1.7%

by Calculated Risk on 10/22/2014 08:30:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in September on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.7 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was close to the consensus forecast of no change for CPI, and a 0.1% increase in core CPI.

...

The index for all items less food and energy increased 0.1 percent in September. ... The 12-month change in the index for all items less food and energy also remained at 1.7 percent.

Cost-Of-Living Adjustment (COLA): The BLS reported CPI-W increased to 234.170 in September, for a Q3 average of 234.242. In Q3 2013, CPI-W average 230.33. The annual Social Security Cost-Of-Living Adjustment will be 1.7%.

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 10/22/2014 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 11.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 17, 2014. This week’s results did not include an adjustment for the Columbus Day holiday. ...

The Refinance Index increased 23 percent from the previous week to the highest level since November 2013. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier....

...

“Continuing concerns about weak economic growth in Europe and a few US economic indicators that came in below expectations caused a flight to quality into US Treasuries last week, leading to sharp drops in interest rates,” said Mike Fratantoni, MBA’s Chief Economist. “Mortgage rates have fallen close to 30 basis points over the last four weeks. Refinance application volume reached the highest level since November 2013 as a result, and the average loan balance for refinance applications increased to $306,400, the highest level in the survey’s history.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.10 percent, the lowest level since May 2013, from 4.20 percent, with points increasing to 0.21 from 0.17 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 66% from the levels in May 2013.

Even with the recent increase in activity - as people who purchased in the last year or so refinance - refinance activity is very low this year and 2014 will be the lowest since year 2000.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 9% from a year ago.

Tuesday, October 21, 2014

Wednesday: Consumer Price Index

by Calculated Risk on 10/21/2014 08:42:00 PM

Here is a forecast for 2015 from the MBA: MBA Sees Originations Increasing Seven Percent in 2015

The Mortgage Bankers Association announced today that it expects to see $1.19 trillion in mortgage originations during 2015, a seven percent increase from 2014. While MBA anticipates purchase originations will increase 15 percent, it expects refinance originations to decrease three percent.Wednesday:

MBA’s forecast predicts purchase originations will increase to $731 billion in 2015, up from $635 billion in 2014. In contrast, refinances are expected to drop to $457 billion, from $471 billion, in 2014.

For 2016, MBA is forecasting purchase originations of $791 billion and refinance originations of $379 billion for a total of $1.17 trillion.

“We are projecting that home purchase originations will increase in 2015 as the US economy continues on its current path of stronger growth, job gains and declining unemployment. The job market has shown sustained improvement this year; with robust monthly increases in both payroll jobs and job openings,” said Michael Fratantoni, MBA’s Chief Economist and Senior Vice President for Research and Industry Technology. “We are forecasting that strong job growth, coupled with still low mortgage rates, should translate to an increase in home sales and purchase originations.

emphasis added

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Consumer Price Index for September. The consensus is for no change in CPI in September and for core CPI to increase 0.1%.

NOTE: When CPI is released on Wednesday, the Cost-of-living adjustment for 2015 will be released. If CPI-W is unchanged in September, COLA will be around 1.7%.

• During the day, the AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

DataQuick: California Foreclosure Starts Lowest Since 2005

by Calculated Risk on 10/21/2014 05:42:00 PM

From DataQuick: Golden State Foreclosure Starts Continue to Decline

Lending institutions initiated formal foreclosure proceedings last quarter on the lowest number of California homes in more than eight years, the result of a recovering real estate market and the dwindling pool of toxic home loans made in 2006 and 2007, Irvine-based CoreLogic DataQuick reported.

A total of 16,833 Notices of Default (NoDs) were recorded at county recorders offices during the July-through-September period. That was down 3.9 percent from 17,524 for the prior quarter, and down 17.1 percent from 20,314 in third-quarter 2013, according to CoreLogic DataQuick data.

Last quarter's NoD tally was the lowest since fourth-quarter 2005, when 15,337 NoDs were recorded. NoDs peaked in first-quarter 2009 at 135,431, while the low was 12,417 NoDs in third-quarter 2004. The NoD statistics go back to 1992.

...

"This home repo pipeline isn't exactly drying up, but it sure is diminishing. Its negative effect on the overall market is only a fraction of what it was several years ago, and is really only still noticeable in some pockets of the hardest-hit markets of the Inland Empire and Central Valley," said John Karevoll, a CoreLogic DataQuick analyst.

To some extent the level of NoD filings in recent quarters probably reflects the rate at which servicers are able to process paperwork. The 20,314 NoDs filed in third-quarter 2013 were followed by 18,120 the following quarter and then 19,215 in 2014Q1; 17,524 in 2014Q2; and 16,833 last quarter.

Most of the loans going into default are still from the 2005-2007 period. Last quarter the median origination quarter for defaulted loans was third-quarter 2006. That has been the case for more than five years, indicating that weak underwriting standards peaked then.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of Notices of Default (NoD) filed in California each year. 2014 is in red (estimate based on Q1, Q2 and Q3).

Last year was the lowest year for foreclosure starts since 2005, and 2013 was also below the levels in 1997 through 2000 when prices were rising following the much smaller late '80s housing bubble / early '90s bust in California.

Overall foreclosure starts are close to a normal level in California (foreclosure starts were over 50,000 in 2004 and 2005 when prices were rising quickly).

Note: Foreclosures are still higher than normal in states with a judicial foreclosure process.

LA area Port Traffic in September: Imports Highest since 2006, Exports Soft

by Calculated Risk on 10/21/2014 03:48:00 PM

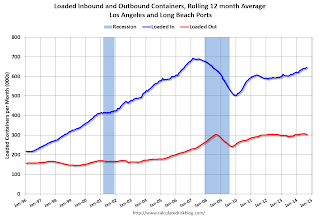

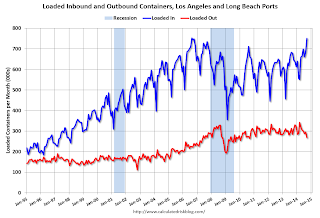

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for September since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 0.9% compared to the rolling 12 months ending in August. Outbound traffic was down 0.4% compared to 12 months ending in August.

Inbound traffic has been increasing, and outbound traffic has been mostly moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 10.6% year-over-year in September, exports were down 5.6% year-over-year.

This might suggest retailers are expecting a happy holiday season.

BLS: Thirty-one States had Unemployment Rate Decreases in September

by Calculated Risk on 10/21/2014 01:31:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

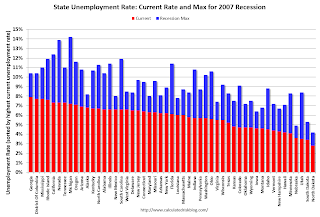

Regional and state unemployment rates were generally little changed in September. Thirty-one states had unemployment rate decreases from August, 8 states had increases, and 11 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

Georgia had the highest unemployment rate among the states in September, 7.9 percent. North Dakota again had the lowest jobless rate, 2.8 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. Georgia had the highest unemployment rate in September at 7.9%.

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 8% (light blue); Nine states are still at or above 7% (dark blue).

A Few Comments on September Existing Home Sales

by Calculated Risk on 10/21/2014 11:02:00 AM

A few comments ...

• Once again housing economist Tom Lawler's forecast of 5.14 million SAAR was closer than the consensus (5.05 million) to the NAR reported sales (5.17 million). It is getting harder for Lawler to beat the "consensus" because it appears several analysts are waiting for Lawler's estimate before submitting their own!

• "The sky is falling! The sky is falling!" Maybe not ... Remember those analysts who incorrectly claimed that declining year-over-year existing home sales were a sign that the "housing recovery" was over? That was wrong, and I correctly pointed out: 1) the "housing recovery" is mostly new home sales and housing starts - not existing home sales, 2) declining overall existing home sales were a positive if the decline was related to fewer distressed sales.

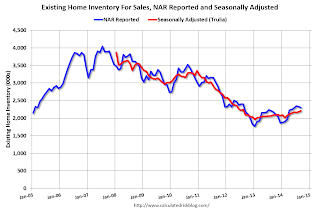

• The most important number in the NAR report each month is inventory. This morning the NAR reported that inventory was up 6.0% year-over-year in September. It is important to note that the NAR inventory data is "noisy" and difficult to forecast based on other data.

The headline NAR inventory number is not seasonally adjusted, even though there is a clear seasonal pattern. Trulia chief economist Jed Kolko has sent me the seasonally adjusted inventory. NOTE: The NAR does provide a seasonally adjusted months-of-supply, although that is in the supplemental data.

This shows that inventory bottomed in January 2013 (on a seasonally adjusted basis), and inventory is now up about 12.5% from the bottom. On a seasonally adjusted basis, inventory was up 1.4% in September compared to August.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, many "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

And it appears investor buying is declining year-over-year. From the NAR:

All-cash sales were 24 percent of transactions in September, up slightly from August (23 percent) but down from 33 percent in September of last year. Individual investors, who account for many cash sales, purchased 14 percent of homes in September, up from 12 percent last month but below September 2013 (19 percent). Sixty-three percent of investors paid cash in September.And another key point: The NAR reported total sales were down 1.7% from September 2013, but normal equity sales were probably up year-over-year, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed homes – foreclosures and short sales – increased slightly in September to 10 percent from 8 percent in August, but are down from 14 percent a year ago. Seven percent of September sales were foreclosures and 3 percent were short sales.Last year in September the NAR reported that 14% of sales were distressed sales.

A rough estimate: Sales in September 2013 were reported at 5.26 million SAAR with 14% distressed. That gives 740 thousand distressed (annual rate), and 4.52 million equity / non-distressed. In September 2014, sales were 5.17 million SAAR, with 10% distressed. That gives 520 thousand distressed - a decline of about 30% from September 2013 - and 4.65 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up slightly.

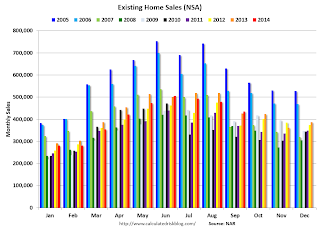

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in September (red column) were at the highest level for September since 2006.

Overall this was a solid report.

Earlier:

• Existing Home Sales in September: 5.17 million SAAR, Inventory up 6.0% Year-over-year

Existing Home Sales in September: 5.17 million SAAR, Inventory up 6.0% Year-over-year

by Calculated Risk on 10/21/2014 10:00:00 AM

The NAR reports: Existing-Home Sales Rebound in September

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 2.4 percent to a seasonally adjusted annual rate of 5.17 million in September from 5.05 million in August. Sales are now at their highest pace of 2014, but still remain 1.7 percent below the 5.26 million-unit level from last September. ...

Total housing inventory at the end of September fell 1.3 percent to 2.30 million existing homes available for sale, which represents a 5.3-month supply at the current sales pace. Despite fewer homes for sale in September, unsold inventory is still 6.0 percent higher than a year ago, when there were 2.17 million existing homes available for sale.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September (5.17 million SAAR) were 2.4% higher than last month, and were 1.7% below the September 2013 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 2.30 million in September from 2.33 million in August. Headline inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 2.30 million in September from 2.33 million in August. Headline inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 6.0% year-over-year in September compared to September 2013.

Inventory increased 6.0% year-over-year in September compared to September 2013. Months of supply was at 5.3 months in September.

This was above expectations of sales of 5.09 million. For existing home sales, the key number is inventory - and inventory is still low, but up year-over-year. I'll have more later ...

Monday, October 20, 2014

Tuesday: Existing Home Sales

by Calculated Risk on 10/20/2014 08:09:00 PM

From Dina ElBoghdady at the WaPo: How a top housing regulator plans to make it easier to get a mortgage. Excerpts:

It’s unclear if Watt's downpayment plan will do much to ease access to credit. The average downpayment remains lower today than it was in more normal, pre-housing bubble times, said Sam Khater, chief deputy economist at CoreLogic. That’s because the Federal Housing Administration – which backs loans with as little as 5 percent down -- has a larger share of the mortgage market than usual, Khater said. Having Fannie and Freddie also accept downpayments as low as 5 percent would only help on the fringes, Khater said.From David Stevens, MBA President: MBA’s Stevens Applauds FHFA Steps to Ease Credit for Homebuyers

...

Today, the average credit score on a loan backed by Fannie and Freddie is close to 745, versus about 710 in the early 2000s, according to Moody’s Analytics.

“Offering lenders better clarity around representation and warranty requirements will ensure lenders are accountable for any material mistakes they may make in the loan process, yet acknowledges the fact that minor, immaterial loan defects should not automatically trigger a repurchase request. As a result, lenders will be more confident in offering mortgages to qualified borrowers within the full boundaries of the GSEs’ credit requirements.Tuesday:

• At 10:00 AM, Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 5.09 million on seasonally adjusted annual rate (SAAR) basis. Sales in August were at a 5.05 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.14 million SAAR. A key will be the reported year-over-year increase in inventory of homes for sale.

• Also at 10:00 AM, Regional and State Employment and Unemployment (Monthly) for September 2014