by Calculated Risk on 10/08/2014 02:00:00 PM

Wednesday, October 08, 2014

FOMC Minutes: "Costs of downside shocks to the economy would be larger than those of upside shocks"

Note: Not every member of the FOMC agrees, but I think this is the key sentence: "the costs of downside shocks to the economy would be larger than those of upside shocks because, in current circumstances, it would be less problematic to remove accommodation quickly, if doing so becomes necessary, than to add accommodation".

There was also some discussion about the impact of a strong dollar (weaker exports, lower inflation).

From the Fed: Minutes of the Federal Open Market Committee, September 16-17, 2014. Excerpts:

Inflation had been running below the Committee's longer-run objective, and the readings on consumer prices over the intermeeting period were somewhat softer than during the preceding four months, in part because of declining energy prices. Most participants anticipated that inflation would move gradually back toward its objective over the medium term. However, participants differed somewhat in their assessments of how quickly inflation would move up. Some cited the stability of longer-run inflation expectations at a level consistent with the Committee's objective as an important factor in their forecasts that inflation would reach 2 percent in coming years. Participants' views on the responsiveness of inflation to the level and change in resource utilization varied, with a few seeing labor markets as sufficiently tight that wages and prices would soon begin to move up noticeably but with some others indicating that inflation was unlikely to approach 2 percent until the unemployment rate falls below its longer-run normal level. While most viewed the risk that inflation would run persistently below 2 percent as having diminished somewhat since earlier in the year, a couple noted the possibility that longer-term inflation expectations might be slightly lower than the Committee's 2 percent objective or that domestic inflation might be held down by persistent disinflation among U.S. trading partners and further appreciation of the dollar.

In their discussion of the appropriate path for monetary policy over the medium term, meeting participants agreed that the timing of the first increase in the federal funds rate and the appropriate path of the policy rate thereafter would depend on incoming economic data and their implications for the outlook. That said, several participants thought that the current forward guidance regarding the federal funds rate suggested a longer period before liftoff, and perhaps also a more gradual increase in the federal funds rate thereafter, than they believed was likely to be appropriate given economic and financial conditions. In addition, the concern was raised that the reference to "considerable time" in the current forward guidance could be misunderstood as a commitment rather than as data dependent. However, it was noted that the current formulation of the Committee's forward guidance clearly indicated that the Committee's policy decisions were conditional on its ongoing assessment of realized and expected progress toward its objectives of maximum employment and 2 percent inflation, and that its assessment reflected its review of a broad array of economic indicators. It was emphasized that the current forward guidance for the federal funds rate was data dependent and did not indicate that the first increase in the target range for the federal funds rate would occur mechanically after some fixed calendar interval following the completion of the current asset purchase program. If employment and inflation converged more rapidly toward the Committee's goals than currently expected, the date of liftoff could be earlier, and subsequent increases in the federal funds rate target more rapid, than participants currently anticipated. Conversely, if employment and inflation returned toward the Committee's objectives more slowly than currently anticipated, the date of liftoff for the federal funds rate could be later, and future federal funds rate target increases could be more gradual. In addition, some participants saw the current forward guidance as appropriate in light of risk-management considerations, which suggested that it would be prudent to err on the side of patience while awaiting further evidence of sustained progress toward the Committee's goals. In their view, the costs of downside shocks to the economy would be larger than those of upside shocks because, in current circumstances, it would be less problematic to remove accommodation quickly, if doing so becomes necessary, than to add accommodation. A number of participants also noted that changes to the forward guidance might be misinterpreted as a signal of a fundamental shift in the stance of policy that could result in an unintended tightening of financial conditions.

Participants also discussed how the forward-guidance language might evolve once the Committee decides that the current formulation no longer appropriately conveys its intentions about the future stance of policy. Most participants indicated a preference for clarifying the dependence of the current forward guidance on economic data and the Committee's assessment of progress toward its objectives of maximum employment and 2 percent inflation. A clarification along these lines was seen as likely to improve the public's understanding of the Committee's reaction function while allowing the Committee to retain flexibility to respond appropriately to changes in the economic outlook. One participant favored using a numerical threshold based on the inflation outlook as a form of forward guidance. A few participants, however, noted the difficulties associated with expressing forward guidance in terms of numerical thresholds for some set of economic variables. Another participant indicated a preference for reducing reliance on explicit forward guidance in the statement and conveying instead guidance regarding the future stance of monetary policy through other mechanisms, including the SEP. It was noted that providing explicit forward guidance regarding the future path of the federal funds rate might become less important once a highly accommodative stance of policy is no longer appropriate and the process of policy normalization is well under way.

It was generally agreed that when changes to the forward guidance become appropriate, they will likely present communication challenges, and that caution will be needed to avoid sending unintended signals about the Committee's policy outlook.

emphasis added

CBO Estimate: Budget Deficit declines to 2.8% of GDP

by Calculated Risk on 10/08/2014 11:17:00 AM

From the CBO: Monthly Budget Review for September 2014

The federal government ran a budget deficit of $486 billion in fiscal year 2014, the Congressional Budget Office (CBO) estimates—$195 billion less than the shortfall recorded in fiscal year 2013, and the smallest deficit recorded since 2008. Relative to the size of the economy, that deficit—at an estimated 2.8 percent of gross domestic product (GDP)—was slightly below the average experienced over the past 40 years, and 2014 was the fifth consecutive year in which the deficit declined as a percentage of GDP since peaking at 9.8 percent in 2009. By CBO’s estimate, revenues were about 9 percent higher and outlays were about 1 percent higher in 2014 than they were in the previous fiscal year. CBO’s deficit estimate is based on data from the Daily Treasury Statements; the Treasury Department will report the actual deficit for fiscal year 2014 later this month.This is an improvement over the recent estimate. The Treasury will release their fiscal year 2014 report on Friday.

A deficit of $486 billion for 2014 would be $20 billion smaller than the shortfall that CBO projected in its August 2014 report An Update to the Budget and Economic Outlook: 2014 to 2024.

emphasis added

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 10/08/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 3, 2014. ...

The Refinance Index increased 5 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier to the highest level since early July. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 8 percent lower than the same week one year ago....

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.30 percent from 4.33 percent, with points decreasing to 0.19 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

Refinance activity is very low this year and 2014 will be the lowest since year 2000.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 8% from a year ago.

Tuesday, October 07, 2014

Wednesday: FOMC Minutes

by Calculated Risk on 10/07/2014 08:17:00 PM

From Zillow: 30-Year Fixed Mortgage Rates Fall Below 4%; Current Rate is 3.96%, According to Zillow Mortgage Rate Ticker

The 30-year fixed mortgage rate on Zillow® Mortgages is currently 3.96 percent, down twelve basis points from this time last week. The 30-year fixed mortgage rate spiked to 4.30 percent on Wednesday, then hovered around 4.06 percent for most of the week before falling to the current rate.For daily rates, the Mortgage News Daily has a series that tracks the Freddie Mac PMMS very well, and is usually updated daily around 3 PM ET. The MND data is based on actual lender rate sheets, and is mostly "the average no-point, no-origination rate for top-tier borrowers with flawless scenarios". (this tracks the Freddie Mac series).

“Mortgage rates inched up briefly last week on the heels of Friday’s stronger than expected jobs report before falling sharply on Monday, hitting 11-week lows,” said Erin Lantz, vice president of mortgages at Zillow. “This week, with limited U.S. economic data slated for release, we expect rate movement to remain muted.”

MND reports that average 30 Year fixed mortgage rates decreased today to 4.09% from 4.13% on Monday.

One year ago rates were at 4.30%. Here is a table from Mortgage News Daily:

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, FOMC Minutes for the meeting of September 16-17, 2014.

Phoenix Real Estate in September: Sales down 1%, Cash Sales down Sharply, Inventory up 13%

by Calculated Risk on 10/07/2014 04:15:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in September were down 1.0% year-over-year and at the lowest for September since 2008. Note: This is the smallest year-over-year sales decline this year.

2) Cash Sales (frequently investors) were down about 25% to 25.7% of total sales. Non-cash sales were up 10.3% year-over-year. So the slight year-over-year decline in sales is probably due to less investor buying.

3) Active inventory is now up 13.2% year-over-year - and at the highest level for September since 2011 (when prices bottomed in Phoenix). Note: This is the smallest year-over-year inventory increase this year, so the inventory build may be slowing.

Inventory has clearly bottomed in Phoenix (A major theme for housing in 2013). And more inventory (a theme this year) - and less investor buying - suggested price increases would slow sharply in 2014.

According to Case-Shiller, Phoenix house prices bottomed in August 2011 (mostly flat for all of 2011), and then increased 23% in 2012, and another 15% in 2013. Those large increases were probably due to investor buying, low inventory and some bounce back from the steep price declines in 2007 through 2010. Now, with more inventory, price increases have flattened out in 2014.

As an example, the Phoenix Case-Shiller index through July shows prices up less than 1% in 2014, and the Zillow index shows Phoenix prices flat over the last year!

| September Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Sept-08 | 6,179 | --- | 1,041 | 16.8% | 54,4271 | --- |

| Sept-09 | 7,907 | 28.0% | 2,776 | 35.1% | 38,340 | -29.6% |

| Sept-10 | 6,762 | -14.5% | 2,904 | 42.9% | 45,202 | 17.9% |

| Sept-11 | 7,892 | 16.7% | 3,470 | 44.0% | 26,950 | -40.4% |

| Sept-12 | 6,478 | -17.9% | 2,849 | 44.0% | 21,703 | -19.5% |

| Sept-13 | 6,313 | -2.5% | 2,106 | 33.4% | 23,405 | 7.8% |

| Sept-14 | 6,252 | -1.0% | 1,609 | 25.7% | 26,492 | 13.2% |

| 1 September 2008 probably includes pending listings | ||||||

Fed: Q2 Household Debt Service Ratio near Record Low

by Calculated Risk on 10/07/2014 03:19:00 PM

The Fed's Household Debt Service ratio through Q2 2014 was released today: Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3 2013.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio decreased in Q2, and is near the record low set in Q4 2012. Note: The financial obligation ratio (FOR) is also near a record low (not shown)

Also the DSR for mortgages (blue) are near the low for the last 30 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

This data suggests household cash flow is in much better shape than a few years ago.

Goldman: The Housing Recovery Resumes

by Calculated Risk on 10/07/2014 01:22:00 PM

A few excerpts from a research note by Goldman Sachs economist David Mericle Housing: The Recovery Resumes

Overall, the message from the broad housing data flow is consistent with the national accounts data. Real residential investment grew at an 8.8% rate in Q2 and is tracking at nearly 15% in Q3. But how confident can we be that the recent turnaround will be sustained?On mortgage credit, an interesting article from Trey Garrison at HousingWire: Is mortgage credit loosening or not?

We continue to see substantial upside for the housing sector in the long run. This view is driven by the large gap between the current annual run rate of housing starts, which have averaged about 1 million over the last three months, and our housing analysts' projection of a long-run equilibrium demand for new homes of about 1.5-1.6 million per year, estimated as the sum of trend household formation and demolition of existing homes.

The question in the near term is how quickly and reliably that gap will close. Two factors are essential for the outlook:

1. Housing affordability. The first key factor is potential homeowners' ability to finance a mortgage. ... The index worsened last year as mortgage rates rose, but continues to point to a modestly higher level of affordability than usual. In addition, the recent data are encouraging ...

2. Mortgage credit availability. The second key factor is mortgage lending standards ... tight mortgage lending standards have been an obstacle to the housing sector's recovery, a concern frequently highlighted by Fed Chair Janet Yellen. But lending standards have shown some gradual easing in recent years, and the sudden easing in standards on prime mortgages reported in the Fed's Q3 Senior Loan Officer Opinion Survey is an encouraging sign.

The Federal Reserve Board's Quarterly Senior Loan Officer Survey of credit conditions indicates that mortgage credit loosened in Q2 2014.CR Note: Eventually mortgage credit will loosen, and that will be a positive for housing.

BofA Merrill Lynch Global Research score trends of actual purchase mortgages closed on a monthly basis, and they find the opposite is true: aggregate FICO scores for purchase mortgages continue to move higher.

“We think the explanation of the difference is that while FICO trends are lower in all financing channels (such as conventional or government), the highest quality channels are increasing share of mortgages closed, hence the aggregate score is rising,” BAML analysts say.

BLS: Jobs Openings at 4.8 million in August, Up 23% Year-over-year

by Calculated Risk on 10/07/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 4.8 million job openings on the last business day of August, up from 4.6 million in July, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits was little changed in August at 2.5 million.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for August, the most recent employment report was for September.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in August to 4.835 million from 4.605 million in July.

The number of job openings (yellow) are up 23% year-over-year compared to August 2013 and the highest since January 2001.

Quits are up 5% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

It is a good sign that job openings are over 4 million for the seventh consecutive month - and the highest since January 2001 - and that quits are increasing year-over-year.

CoreLogic: House Prices up 6.4% Year-over-year in August

by Calculated Risk on 10/07/2014 08:49:00 AM

Notes: This CoreLogic House Price Index report is for August. The recent Case-Shiller index release was for July. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rose by 6.4 Percent Year Over Year in August 2014

Home prices nationwide, including distressed sales, increased 6.4 percent in August 2014 compared to August 2013. This change represents 30 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased 0.3 percent in August 2014 compared to July 2014.

...

Excluding distressed sales, home prices nationally increased 5.9 percent in August 2014 compared to August 2013 and 0.3 percent month over month compared to July 2014. Also excluding distressed sales, 49 states and the District of Columbia showed year-over-year home price appreciation in August, with Mississippi being the only state to experience a year-over-year decline. ...

“The pace of year-over-year appreciation continues to slow down as real estate markets find more balance. Home price appreciation reached a peak of almost 12 percent year-over-year in October 2013 and has since subsided to the current pace of 6 percent,” said Mark Fleming, chief economist at CoreLogic. “Continued moderation of home price appreciation is a welcomed sign of more balanced real estate markets and less pressure on affordability for potential home buyers in the near future.”

emphasis added

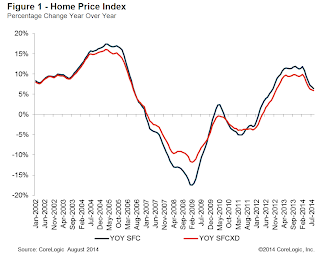

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.3% in August, and is up 6.4% over the last year.

This index is not seasonally adjusted, and the index will probably turn negative month-to-month in September.

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increases continue to slow.

This index was up 8.2% YoY in May, 7.2% in June, 6.8% in July, and now 6.4% in August.

Monday, October 06, 2014

Tuesday: Job Openings

by Calculated Risk on 10/06/2014 08:42:00 PM

An international economic overview from Bonddad: International Week in Review: The Sky Is Not Falling, But the Calculus Has Changed. Excerpt:

At times like this, gloom and doom commentary begins to take center stage as “sky is falling” headlines become click bait for various websites. Unfortunately for the bearish crowd a careful analysis indicates we are not near a major, cataclysmic market or economic event. However, it is clear that the underlying calculus regarding macro-economic analysis has changed, caused by a combination of increased geopolitical conflict, potentially higher interest rates in the US and UK and the ripple effects from this development, and growing economic concern regarding the EU, Japan and, to a lesser extent Australia.Tuesday:

• At 10:00 AM ET, the Job Openings and Labor Turnover Survey for August from the BLS. Jobs openings decreased slightly in July to 4.673 million from 4.675 million in June.

• At 3:00 PM, Consumer Credit for August from the Federal Reserve. The consensus is for credit to increase $20.5 billion.