by Calculated Risk on 9/16/2014 08:01:00 PM

Tuesday, September 16, 2014

Wednesday: FOMC Statement and Press Conference, CPI, Home Builder Confidence

More previews on the FOMC statement and press conference:

From Jon Hilsenrath at the WSJ: How the Federal Reserve Could Tweak ‘Considerable Time’

"Given the economic backdrop, they don’t want to send a signal right now that rate increases are imminent,” Hilsenrath said. “I think what they do, at the end of the day, is they qualify it.” ... One of the headlines they’re going to come out with I expect to be formalizing some of their exit plan,” Hilsenrath said. “It becomes, in their mind, a lot for the market to digest if they announce their exit strategy and change their guidance at the same time."From Robin Harding at the Financial Times: Money Supply: A “considerable” challenge

The bottom line is that “considerable time” may survive in some form on Wednesday, but if so, I’ll be surprised if there is not a significant change to the statement that sets up its eventual departure.Wednesday:

excerpt with permission

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Consumer Price Index for August. The consensus is for no change in CPI in August and for core CPI to increase 0.2%.

• At 10:00 AM, the September NAHB homebuilder survey. The consensus is for a reading of 56, up from 55 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 2:00 PM, the FOMC Statement. The FOMC is expected to reduce monthly QE3 asset purchases from $25 billion per month to $15 billion per month at this meeting.

• Also at 2:00 PM, the FOMC projections will be released. This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

Lawler: Table of Distressed Sales and Cash buyers for Selected Cities in August

by Calculated Risk on 9/16/2014 04:31:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and cash buyers for several selected cities in August.

Comments from CR: Tom Lawler has been sending me this table every month for several years. I think it is very useful for looking at the trend for distressed sales and cash buyers in these areas. I sincerely appreciate Tom sharing this data with us!

On Orlando, Lawler notes: "MLS-based foreclosure sales in Orlando last month were up 30.1% from last August, while MLS-based short sales were down 64.9%."

On distressed: Total "distressed" share is down in all of these markets, mostly because of a sharp decline in short sales.

Short sales are down significantly in all of these areas.

Foreclosures are down in most of these areas too, although foreclosures are up sharply in Orlando, and up a little in Las Vegas and the Mid-Atlantic.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Aug-14 | Aug-13 | Aug-14 | Aug-13 | Aug-14 | Aug-13 | Aug-14 | Aug-13 | |

| Las Vegas | 11.5% | 25.0% | 8.9% | 8.0% | 20.4% | 33.0% | 32.1% | 52.5% |

| Reno** | 8.0% | 21.0% | 4.0% | 5.0% | 12.0% | 26.0% | ||

| Phoenix | 3.6% | 10.3% | 6.6% | 8.9% | 10.3% | 19.3% | 25.2% | 34.1% |

| Minneapolis | 2.5% | 5.5% | 8.1% | 15.2% | 10.6% | 20.7% | ||

| Mid-Atlantic | 4.1% | 7.6% | 8.9% | 7.0% | 13.0% | 14.6% | 17.5% | 17.5% |

| Orlando | 7.1% | 17.2% | 25.8% | 16.7% | 32.9% | 33.9% | 42.1% | 46.0% |

| California * | 6.0% | 11.4% | 5.4% | 7.8% | 11.4% | 19.2% | ||

| Bay Area CA* | 3.8% | 7.6% | 2.9% | 4.3% | 6.7% | 11.9% | 21.8% | 23.7% |

| So. California* | 5.9% | 11.5% | 5.0% | 7.0% | 10.9% | 18.5% | 24.4% | 28.4% |

| Hampton Roads | 18.6% | 21.0% | ||||||

| Northeast Florida | 33.3% | 36.7% | ||||||

| Georgia*** | 26.8% | N/A | ||||||

| Toledo | 32.2% | 30.1% | ||||||

| Des Moines | 16.0% | 16.8% | ||||||

| Memphis* | 11.7% | 16.5% | ||||||

| Birmingham AL | ||||||||

| Springfield IL** | ||||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Lawler: Early Read on Existing Home Sales in August

by Calculated Risk on 9/16/2014 02:14:00 PM

From housing economist Tom Lawler:

Based on August realtor association/board/MLS reports released so far, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.12 million, down 0.6% from July’s pace and down 3.9% from last August’s seasonally adjusted pace. I also estimate that unadjusted sales last month were down about 6% from a year ago.CR Note: The NAR is scheduled to release August existing home sales on Monday, September 22nd.

Based on realtor/MLS reports as well as other reports on home listings, I project that the NAR’s estimate of the number of existing homes for sales at the end of August will be 2.35 million, down 0.8% from July but up 6.3% from last August. Finally, I project that the NAR’s estimate of the median existing SF home sales price last month will be $217,500, up 3.7% from last August.

I also expect the NAR to revise downward its median existing SF home sales price for July to $222,600 from $223,900 – or to a YOY increase of 4.5% from a YOY increase of 5.1%. In the July report the NAR showed a YOY increase in the Northeast median existing SF home sales price of 2.7%, which was well above what state and local realtor reports would suggest.

On inventory, if Lawler is correct, this would put inventory in August down about 2% compared to August 2012 - two years ago - when prices started increasing faster. Now, with rising inventory, this should mean slower price increases.

Census: Poverty Rate declined in 2013, Real Median Income increased slightly

by Calculated Risk on 9/16/2014 10:28:00 AM

From the Census Bureau: Income, Poverty and Health Insurance Coverage in the United States: 2013

The nation’s official poverty rate in 2013 was 14.5 percent, down from 15.0 percent in 2012. The 45.3 million people living at or below the poverty line in 2013, for the third consecutive year, did not represent a statistically significant change from the previous year’s estimate.

Median household income in the United States in 2013 was $51,939; the change in real terms from the 2012 median of $51,759 was not statistically significant. This is the second consecutive year that the annual change was not statistically significant, following two consecutive annual declines.

...

These findings are contained in two reports: Income and Poverty in the United States: 2013 and Health Insurance Coverage in the United States: 2013.

Click on graph for larger image.

Click on graph for larger image. From Census:

• In 2013, real median household income was 8.0 percent lower than in 2007, the year before the most recent recession (Figure 1 and Table A-1).

• Median household income was $51,939 in 2013, not statistically different in real terms from the 2012 median of $51,759 (Figure 1 and Table 1). This is the second consecutive year that the annual change was not statistically significant, following two consecutive years of annual declines in median household income.

From Census:

From Census:• In 2013, the official poverty rate was 14.5 percent, down from 15.0 percent in 2012 (Figure 4). This was the first decrease in the poverty rate since 2006.

• In 2013, there were 45.3 million people in poverty. For the third consecutive year, the number of people in poverty at the national level was not statistically different from the previous year’s estimate.

• The 2013 poverty rate was 2.0 percentage points higher than in 2007, the year before the most recent recession.

BLS: Producer Price Index unchanged in August

by Calculated Risk on 9/16/2014 09:17:00 AM

The Producer Price Index for final demand was unchanged in August, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices advanced 0.1 percent in July and 0.4 percent in June. On an unadjusted basis, the index for final demand increased 1.8 percent for the 12 months ended in August.This was slightly lower than expectations, and was mostly due to a decline in energy products. However this is another indicator a low level of inflation.

...

The index for final demand goods moved down 0.3 percent in August, the largest decrease since a 0.7-percent drop in April 2013. Over 80 percent of the August decline is attributable to prices for final demand energy, which fell 1.5 percent. The index for final demand foods decreased 0.5 percent. Prices for final demand goods less foods and energy were unchanged.

emphasis added

Monday, September 15, 2014

LA area Port Traffic: Soft in August

by Calculated Risk on 9/15/2014 07:51:00 PM

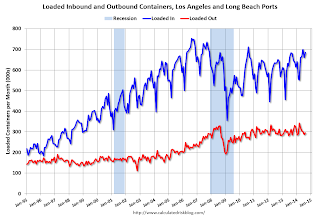

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for August since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Note: From the Port of Long Beach: Shipping surge cools after early ‘peak season’

Container cargo shipments declined by 9.1 percent in August at the Port of Long Beach, reflecting both early shipping by importers this year and the comparison to an August last year that was the Port’s busiest month since 2007. ... The downturn last month followed a surge in Long Beach from April through June 2014, when retailers shipped their products early ahead of the expiration of the longshore contract at the end of June.The contract was settled fairly quickly in July, and I expect traffic to increase over the next few months.

Last year’s August was very busy and started off the typical August through October “peak season.” That peak season may have occurred earlier this year.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was unchanged compared to the rolling 12 months ending in July. Outbound traffic was down 0.5% compared to 12 months ending in July.

Inbound traffic has been increasing, and outbound traffic has been moving up a little recently after moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). Imports were up slightly year-over-year in August, exports were down 6% year-over-year.

Overall traffic was a little soft in August, possibly due to concerns about a longer strike.

Las Vegas: Visitor Traffic on pace for record in 2014, Convention Attendance Returning

by Calculated Risk on 9/15/2014 02:28:00 PM

Just an update ... during the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to a new record high in 2012, although visitor traffic was down slightly in 2013.

Convention attendance in 2013 was still about 18% below the peak level in 2006. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Through July, visitor traffic in 2014 is running 3.9% above 2013 - and on a record pace.

Convention traffic is up 5.4% from last year, but is still way below the pre-recession peak - although I wonder if the previous convention peak was related to "How to Flip a House" and "How to Buy with no money" type conventions!

In general, the gamblers are back - and the conventions are returning.

Goldman's Hatzius: Expect "Considerable time" to remain in FOMC Statement this Meeting

by Calculated Risk on 9/15/2014 11:35:00 AM

Excerpts from a note by Goldman Sach's chief economist Jan Hatzius: Q&A on "Why Renege Now?"

Q: You expect the phrase “considerable time after the asset purchase program ends” to remain in the statement. Many others don’t; what are they missing?

A: Many are missing the distinction between a decision not to extend existing guidance and a decision to renege on existing guidance. Let’s compare the current situation with the runup to the last rate hike cycle, when the committee went from “considerable period” in August-December 2003 to “patient” in January 2004, “measured pace” in May 2004, and finally rate hikes in June 2004.

The shift from “considerable period” in December 2003 to “patient” in January 2004 is an example of a decision not to extend existing guidance. Informed observers concluded from this shift that the committee had retained its guidance that a hike would probably come no earlier than June, but was unwilling to go beyond that. And indeed, the first hike came in June.

But if the committee removed the phrase “considerable time after the asset purchase program ends” this week or replaced it with something weaker, it would not only decline to extend the existing guidance into the future, but would in fact renege on the existing guidance. That would be a much bigger step than in January 2004.

Q: But don't they have to change the guidance as QE ends?

A: Eventually yes, but we think September is too early because QE has another six weeks to run, assuming they taper the program down to $15bn per month this week and end it at the October 29-30 meeting.

Even a material change at the October meeting would be a shortening of the existing guidance. (By "material change" we mean anything that goes beyond deleting the phrase "after the asset purchase program ends.") For example, replacing "considerable time" by “some time” on October 30 might be interpreted to mean that the no-hikes guidance expires, say, in February instead of April. Of course, it is possible that the data surprise sufficiently on the upside or the outlook changes in some other way to justify a more material change at the October meeting--remember, the guidance is conditional on the outlook.

But barring such a surprise, the right time to make a substantive change in the guidance is the December meeting. There are three basic options at that point: 1) keep “considerable time” and effectively extend the no-hikes guidance past the end of April, 2) move to weaker terms such as “patient” or “some time” and thereby decline to extend the no-hikes guidance past the end of April, or 3) move to more qualitative guidance phrased in terms of the remaining amount of slack or the level of inflation relative to the target.

...

Q: Do you think your forecast implies a dovish surprise for the markets this week?

A: Probably, but not necessarily. It is clear that many market participants expect a change in the "considerable time" language. If we are right that the language will remain unchanged, this would likely be dovish for near-dated fed funds futures contracts. That said, there are a lot of moving parts in an FOMC meeting that includes a press conference and a new SEP. If other aspects of the statement such as the post-liftoff guidance sound more hawkish, that could negate or even overwhelm the impact of the liftoff guidance, at least for the longer-dated contracts. Also, regardless of any changes in the statement, we expect the "dots" to drift up a bit further in 2015-2016 and to show rates for 2017 that are well above current market pricing, although this already seems to be widely expected and might therefore not have much impact on its own. And finally, of course, we might just be wrong and “considerable time” might go after all.

Fed: Industrial Production decreased 0.1% in August

by Calculated Risk on 9/15/2014 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

The index of industrial production edged down 0.1 percent in August, and the index for manufacturing output decreased 0.4 percent; the declines were the first for each since January. The gains in July for both indexes were revised down. The declines in total industrial production and in manufacturing output in August reflected a decrease of 7.6 percent in the production of motor vehicles and parts, which had jumped more than 9 percent in July. Excluding motor vehicles and parts, factory output rose 0.1 percent in both July and August. The production at mines moved up 0.5 percent in August, and the output of utilities rose 1.0 percent. At 104.1 percent of its 2007 average, total industrial production in August was 4.1 percent above its year-earlier level. Capacity utilization for total industry decreased 0.3 percentage point in August to 78.8 percent, a rate 1.0 percentage point above its level of a year earlier and 1.3 percentage points below its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.9 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.8% is 1.0 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.1% in August to 104.1. This is 24.3% above the recession low, and 3.3% above the pre-recession peak.

The monthly change for Industrial Production was below expectations.

NY Fed: Empire State Manufacturing Survey indicates "business activity expanded at a robust pace" in September

by Calculated Risk on 9/15/2014 08:34:00 AM

From the NY Fed: Empire State Manufacturing Survey

The headline general business conditions index rose thirteen points to 27.5, a multiyear high. The new orders index moved up three points to 16.9, and the shipments index advanced two points to 27.1. ...This is the first of the regional surveys for September. The general business conditions index was well above the consensus forecast of a reading of 16.0, and indicates solid expansion (above zero suggests expansion). The index is at the highest level since 2009.

Employment indexes showed a slight increase in employment levels and hours worked. Indexes for the six-month outlook conveyed a high degree of optimism about future business conditions.

emphasis added