by Calculated Risk on 8/19/2014 10:14:00 AM

Tuesday, August 19, 2014

A few comments on July Housing Starts

This was a solid report for housing starts in July.

There were 585 thousand total housing starts during the first seven months of 2014 (not seasonally adjusted, NSA), up 9.1% from the 563 thousand during the same period of 2013. Single family starts are up 3%, and multi-family starts up 24%. The key weakness has been in single family starts.

Starts were up 21.7% year-over-year in July.

This solid year-over-year increase was due to a combination of more starts in July (highest this year), and an easier comparison to last year. There was a huge surge in housing starts early in 2013, and then a lull - and finally more starts at the end of the year.

This graph shows the month to month comparison between 2013 (blue) and 2014 (red).

Starts in Q1 averaged 925 thousand SAAR, and starts in Q2 averaged 997 thousand SAAR (up 8% from Q1). Q3 is off to a solid start.

This year, I expect starts to mostly increase throughout the year (Q1 will probably be the weakest quarter, and Q2 the second weakest). The comparisons will be easy for the next few months, and starts should finish the year up double digits from 2013.

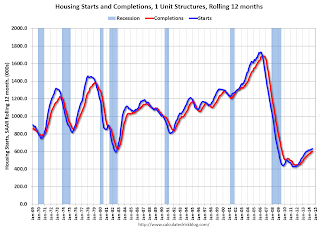

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family completions later this year and in 2015.

Single family starts had been moving up, but recently starts have been moving sideways on a rolling 12 months basis.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Housing Starts increase to 1.093 million Annual Rate in July

by Calculated Risk on 8/19/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 1,093,000. This is 15.7 percent above the revised June estimate of 945,000 and is 21.7 percent above the July 2013 rate of 898,000.

Single-family housing starts in July were at a rate of 656,000; this is 8.3 percent above the revised June figure of 606,000. The July rate for units in buildings with five units or more was 423,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,052,000. This is 8.1 percent above the revised June rate of 973,000 and is 7.7 percent above the July 2013 estimate of 977,000.

Single-family authorizations in July were at a rate of 640,000; this is 0.9 percent above the revised June figure of 634,000. Authorizations of units in buildings with five units or more were at a rate of 382,000 in July.

Click on graph for larger image.

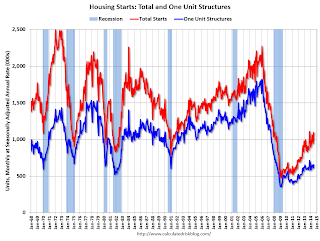

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in July (Multi-family is volatile month-to-month).

Single-family starts (blue) also increased in July.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was well above expectations of 963 thousand starts in July. Note: Starts for June were revised higher too.

This was a solid report with starts up 21.7% year-over-year in July.

Monday, August 18, 2014

Tuesday: Housing Starts, CPI

by Calculated Risk on 8/18/2014 08:45:00 PM

From Nick Timiraos at the WSJ: In Phoenix, a Realty Check as Market Moderates

Among the cities most battered by the 2006 bust, Phoenix was the first to snap back in 2011. Prices, off by 56% from peak, then rebounded sharply, trimming that drop by a third. The number of homes in some stage of foreclosure has fallen to about 4,300 homes today from more than 50,000 four years ago.The Phoenix market is slowly moving back to normal. There is still a ways to go until traditional buyers feel confident, but the sharp decline in distressed sales a clear positive.

Now, prices and sales are cooling off. Inventories of homes listed for sale have climbed to their highest level in three years while the number of houses sold in June fell 12% from a year earlier. ...

As the foreclosure boom that fueled much of the recovery fades, income and population growth are reasserting themselves as drivers of the housing market in places such as Phoenix. Meanwhile, lingering scars from the bust are playing out as some of the country's hottest housing markets struggle to pass the baton from bargain-hunting investors, who typically pay cash, to traditional buyers with mortgages.

Tuesday:

• At 8:30 AM ET, Consumer Price Index for July. The consensus is for a 0.1% increase in CPI in July and for core CPI to increase 0.2%.

• Also at 8:30 AM, Housing Starts for July. Total housing starts were at 893 thousand (SAAR) in June. Single family starts were at 575 thousand SAAR in June. The consensus is for total housing starts to increase to 963 thousand (SAAR) in July.

CoStar: Commercial Real Estate prices increased 10% year-over-year in June

by Calculated Risk on 8/18/2014 05:52:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Real Estate Prices Steadily Advance In Second Quarter

CCRSI COMPOSITE PRICE INDICES ADVANCED STEADILY IN SECOND QUARTER. Despite a modest pull-back in June 2014, CCRSI’s value-weighted U.S. Composite Index advanced 2.3% in the second quarter of 2014, and 9.7% for the 12-month period ending in June 2014. Reflecting the impact of larger, core-like property sales, the value-weighted U.S. Composite Index is now in line with its prerecession highs reached in 2007. The equal-weighted U.S. Composite Index, which tracks smaller, more numerous property trades typical of those in secondary markets, is now beginning to catch up with its value-weighted counterpart. It advanced 2.4% in the second quarter and 10% for the 12 months ending in June 2014.

...

PROPERTY SALES ACTIVITY ESCALATES. Boosted by a strong second quarter, repeat sale transaction volume reached nearly $39.3 billion in the first half of 2014 , an increase of 14.5% from the first half of 2013, and roughly on a par with the first half-year totals reached in 2006-07. Repeat-sale pair volume increased 8.8% in the Investment Grade segment and 27.2% in the General Commercial in the first half of 2014 over the same period one year earlier. Meanwhile, only 8.7% of properties are selling at distressed pricing as of the second quarter of 2014 — the lowest distress sales rate since the fourth quarter of 2008.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is almost back to the pre-recession peak, but the equal weighted is still well below the pre-recession peak.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down from over 30% at the peak, to 8.7% in June.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

LA area Port Traffic: A little soft due to strike in July

by Calculated Risk on 8/18/2014 01:43:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for June since LA area ports handle about 40% of the nation's container port traffic. IMPORTANT: There was a 5 day trucker strike at both the ports of Long Beach and Los Angeles that probably impacted traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.1% compared to the rolling 12 months ending in June. Outbound traffic was also down 0.1% compared to 12 months ending in June.

Inbound traffic has been increasing, and outbound traffic has been moving up a little recently after moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were down slightly year-over-year in July, exports were also down slightly year-over-year.

Overall traffic was a little soft in July probably due to the short strike. It is possible traffic will be close to the pre-recession peaks over the next few months.

BLS: State unemployment rates little changed in July

by Calculated Risk on 8/18/2014 11:01:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in July. Thirty states had unemployment rate increases from June, 8 states had decreases, and 12 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today. Forty-nine states and the District of Columbia had unemployment rate decreases from a year earlier and one state had an increase.

...

Mississippi had the highest unemployment rate among the states in July, 8.0 percent. North Dakota again had the lowest jobless rate, 2.8 percent.

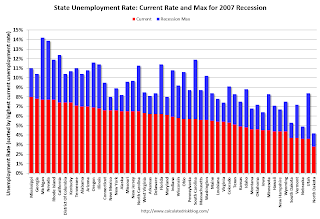

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. Mississippi had the highest unemployment rate in July at 8.0%.

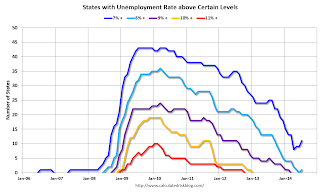

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).One state has an unemployment rate at or above 8% (light blue), and 11 states are still at or above 7% (dark blue).

NAHB: Builder Confidence increased to 55 in August, Highest since January

by Calculated Risk on 8/18/2014 10:00:00 AM

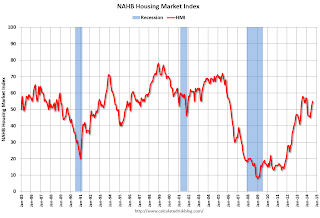

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 55 in August, up from 53 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Rises Two Points in August

Builder confidence in the market for newly built, single-family homes rose two points to 55 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for August, released today. This third consecutive monthly gain brings the index to its highest level since January.

...

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores from each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three HMI components posted gains in August. The indices gauging current sales conditions and expectations for future sales each rose two points to 58 and 65, respectively. The index gauging traffic of prospective buyers increased three points to 42.

“Each of the three components of the HMI registered consecutive gains for the past three months, which is a positive sign that builder confidence appears to be firming following an uneven spring,” said NAHB Chief Economist David Crowe. “Factors contributing to this rise include sustained job growth, historically low mortgage rates and affordable home prices, which are helping to unleash pent-up demand.”

Every region saw a gain in its three-month moving average HMI score in August. The Midwest posted a seven-point increase to 55 and the West registered a four-point gain to 56. The Northeast posted a two-point gain to 38 and the South was up one point to 52.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was the second consecutive reading above 50, and slightly above the consensus forecast of 53.

Sunday, August 17, 2014

Sunday Night Futures

by Calculated Risk on 8/17/2014 08:16:00 PM

From Jon Hilsenrath at the WSJ: The Outlook: Federal Reserve Bets It Won't Wait Too Long on Rates

Will the Fed fall behind the curve and keep interest rates too low for too long as the economy strengthens? The question looms as officials travel this week to their annual gathering in Jackson Hole, Wyo., where they and the world's leading central bankers discuss economic issues.CR Note: Two key points: 1) in the current environment, my sense is most FOMC members believe the risks are not symmetrical and that the risks from tightening too soon far outweigh the risk from being "behind the curve", and 2) the title of the Jackson Hole economic symposium this year is "Re-Evaluating Labor Market Dynamics" and I think on Friday Fed Chair Yellen will argue - using several employment metrics - that there is still significant slack in the labor markets.

...

A growing number of economists believe slack in labor markets is diminishing, making the economy prone to inflation and financial markets prone to overshooting with short-term interest rates near zero. The unemployment rate fell to 6.2% in July from 7.3% a year ago, a decline far faster than Fed officials expected.

Monday:

• At 10:00 AM ET, the August NAHB homebuilder survey. The consensus is for a reading of 53, unchanged from 53 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

• Also at 10:00 AM, Regional and State Employment and Unemployment (Monthly) for July 2014

Weekend:

• Schedule for Week of Aug 17th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 6 and DOW futures are up 48 (fair value).

Oil prices were down over the last week with WTI futures at $96.90 per barrel and Brent at $103.01 per barrel. A year ago, WTI was at $107, and Brent was at $110 - so prices are down year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.49 per gallon (down about a nickel from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Demolition as Stimulus

by Calculated Risk on 8/17/2014 10:59:00 AM

Gretchen Morgenson writes in the NY Times: In a Bank Settlement, Don’t Forget the Bulldozers

[T]he sheer size of the Bank of America settlement makes it an enormous opportunity, housing experts say, to help the forgotten victims of the mortgage crisis. These are people who still pay their mortgages and property taxes but are caught in the devastating cycle that zombie houses can create in a neighborhood. Many of these homeowners, already poor, are impoverished further by blight on their streets.In January 2009, I proposed adding a demolition plan to the stimulus package. This would have helped remove blight from many areas, and would have employed many idled construction workers. I think this was a small missed opportunity.

“We had hoped that with these settlements we could bring down the number of never-to-be-lived-in houses,” said Jim Rokakis, director of the Thriving Communities Institute, a program of the nonprofit Western Reserve Land Conservancy that works to take over and repurpose vacant properties in the Cleveland area. “Vacancy rates are 15 percent or higher, all as a result of the crisis. Now it’s a matter of burying the dead.”

Mr. Rokakis’s organization also works with 22 county land banks throughout the state, nonprofit entities that take over distressed properties and sell them for nominal amounts to people who will rebuild on them or, more commonly, turn them into gardens or community spaces.

Studies show that bulldozing distressed properties reduces foreclosure rates in the surrounding neighborhoods and can improve the values of nearby homes. An analysis conducted for the Western Reserve Land Conservancy found that demolishing 6,000 homes in and around Cleveland between 2009 and 2013 helped slow the fall in property values, generating a net benefit in retained property values of $1.40 for every dollar spent on demolition.

Saturday, August 16, 2014

Schedule for Week of August 17th

by Calculated Risk on 8/16/2014 01:03:00 PM

The key reports this week are July Housing Starts on Tuesday and Existing Home Sales on Thursday.

For manufacturing, the August Philly Fed survey will be released on Thursday.

For prices, July CPI will be released on Tuesday.

The key focus of the week will probably be on Fed Chair Janet Yellen's speech at Jackson Hole on Friday.

10:00 AM: The August NAHB homebuilder survey. The consensus is for a reading of 53, unchanged from 53 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for July 2014

8:30 AM: Consumer Price Index for July. The consensus is for a 0.1% increase in CPI in July and for core CPI to increase 0.2%.

8:30 AM: Housing Starts for July.

8:30 AM: Housing Starts for July. Total housing starts were at 893 thousand (SAAR) in June. Single family starts were at 575 thousand SAAR in June.

The consensus is for total housing starts to increase to 963 thousand (SAAR) in July.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes for the Meeting of July 29-30, 2014.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 305 thousand from 311 thousand.

10:00 AM: the Philly Fed manufacturing survey for August. The consensus is for a reading of 18.5, down from 23.9 last month (above zero indicates expansion).

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for sales of 5.00 million on seasonally adjusted annual rate (SAAR) basis. Sales in June were at a 5.04 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.09 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

10:00 AM: Speech by Fed Chair Janet Yellen, Labor Markets, At the Federal Reserve Bank of Kansas City Economic Symposium: Re-Evaluating Labor Market Dynamics, Jackson Hole, Wyoming