by Calculated Risk on 8/11/2014 04:34:00 PM

Monday, August 11, 2014

Weekly Update: Housing Tracker Existing Home Inventory up 13.3% YoY on Aug 11th

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data released was for June and indicated inventory was up 6.5% year-over-year).

Fortunately Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data, for 54 metro areas, for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays.

Inventory in 2014 (Red) is now 13.3% above the same week in 2013.

Inventory is also about 3.2% above the same week in 2012. According to several of the house price indexes, house prices bottomed in early 2012, and low inventories were a key reason for the subsequent price increases. Now that inventory is back above 2012 levels, I expect house price increases to slow (and possibly decline in some areas).

The second graph is monthly using the NAR data for several selected years. The steady increase in inventory in 2005 (yellow) helped me call the top of the housing bubble.

The second graph is monthly using the NAR data for several selected years. The steady increase in inventory in 2005 (yellow) helped me call the top of the housing bubble.

Inventory was high from 2006 through 2010, with the peak year in 2007 (orange on this graph).

Inventory started declining significantly in 2011 (light blue), and the helped me call the bottom for house prices in February 2012 (see The Housing Bottom is Here).

Now inventory is increasing, although using the NAR monthly data, inventory was still below the level in 2012 for June (6.5% above June 2013).

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory would be up 10% to 15% year-over-year at the end of 2014 based on the NAR report. Right now it looks like inventory might increase more than I expected.

Kolko: "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

by Calculated Risk on 8/11/2014 01:15:00 PM

CR Note: This is from Trulia chief economist Jed Kolko: Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data

The housing crisis substantially changed the seasonal pattern of housing activity: relative to conventional home sales, which peak in summer, distressed home sales are more evenly spread throughout the year and sell at a discount. As a result, in years when distressed sales constitute a larger share of overall sales, the seasonal swings in home prices get bigger while the seasonal swings in sales volumes get smaller.

Sharply changing seasonal patterns create problems for seasonal adjustment methods, which typically estimate seasonal adjustment factors by averaging several years’ worth of observed seasonal patterns. A sharp but ultimately temporary change in the seasonal pattern for housing activity affects seasonal adjustment factors more gradually and for more years than it should. Despite the recent normalizing of the housing market, seasonal adjustment factors are still based, in part, on patterns observed at the height of the foreclosure crisis, causing home price indices to be over-adjusted in some months and under-adjusted in others.

Unfortunately, many have concluded that the solution to the problem of changing seasonal patterns is to downplay or ignore seasonally adjusted housing data until the foreclosure crisis is far enough in the past that it is no longer averaged into seasonal adjustment factors. Standard and Poor’s, publishers of the Case-Shiller home-price index, themselves warned in 2010 that “the unadjusted series is a more reliable indicator and, thus, reports should focus on the year-over-year changes where seasonal shifts are not a factor. Additionally, if monthly changes are considered, the unadjusted series should be used.” Even today, Case-Shiller home-price index press releases continue to emphasize non-seasonally-adjusted (NSA) changes over seasonally adjusted (SA) changes.

But ignoring seasonality during and after the foreclosure crisis is the opposite of what we should be doing. Changing seasonal patterns make seasonal adjustment more important. Because the foreclosure crisis caused seasonal swings in home prices to increase, NSA data were even less reflective of the true underlying trend than in normal times. Furthermore, when the true seasonal pattern is shifting, seasonality affects year-over-year changes (y/y), not just month-over-month (m/m) and other intra-year changes. Y/y changes are immune from seasonality concerns only if the true seasonal effect is the same for a given month in successive years.

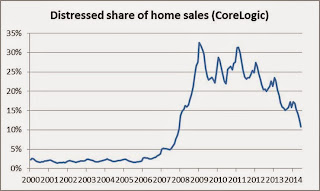

The solution is to develop better seasonal adjustment factors (SAFs). If distressed sales account for the change in seasonal patterns, then the shift in SAFs over these years should reflect the timing and magnitude of the distressed sales share. CoreLogic data show that the distressed share (REO plus short sales) of home sales rose sharply around 2008 and since then have fallen more than halfway back to normal:

The SAFs for the Case-Shiller index became more extreme between the pre-crisis years of the early 2000s and the height of the foreclosure crisis. However, the Case-Shiller SAFs increased in amplitude much more gradually than the spike in the distressed sales share, and in 2014 the SAFs remain near their most extreme levels despite the drop in distressed share.

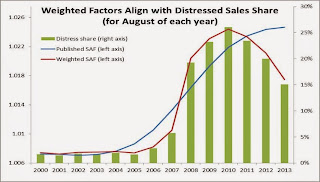

So, consider this simple adjustment: for each calendar month, treat the average Case-Shiller SAFs prior to the increase in amplitude (roughly 2004 and earlier) as the norm for that month, and treat the most extreme SAF for that month over the whole time period as an accurate reflection of the seasonal pattern when the distressed sales share peaked. Then, using this set of normal and extreme SAFs, calculate the “weighted seasonal adjustment factor” (WSAF) as the average of the normal and extreme SAF for each month, weighed by how the actual share of distressed sales compared with the extreme and normal share of distressed sales for that month. The resulting WSAFs look like this:

The WSAF series closely reflects timing of the rise and fall in distressed sales share, while the Case-Shiller SAF series changes much more slowly, as is clear from looking at the distressed share, the SAFs, and WSAFs for every August since 2000:

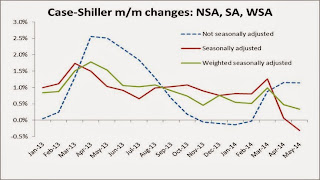

Applying these WSAFs to the unadjusted Case-Shiller 20-city index yields a weighted seasonally adjusted (WSA) index. We can compare the published NSA and SA price changes with the WSA price changes that reflect this alternative seasonal adjustment method. While the m/m SA change for May was -0.3%, the m/m WSA change was +0.3%. Here are NSA, SA, and WSA m/m changes since January 2013:

The WSA changes show that there has been a gradual slowdown in home price gains, but prices are still increasing. WSA price changes offer no evidence that the housing recovery has gone into reverse, even though the SA index showed prices essentially flat in April and falling in May.

Finally: what do these WSAFs tell us about the value of seasonal adjustment? Two things. First: even though the published SA series is based on factors that don’t reflect the time-pattern of the foreclosure crisis perfectly, the published SA changes and the WSA changes look more similar to each other than either does to the NSA changes. If the WSA is a correct approach, then even the flawed published SA home price changes come a lot closer to the true m/m seasonally adjusted trend than the NSA price changes do. In other words, we should not ignore seasonal adjustment and rely on NSA m/m changes.

Second: when seasonal patterns are changing sharply, seasonality can affect y/y changes, too, not just intra-year changes. In March 2014, for instance, the NSA and SA y/y price increases for the Case-Shiller 20-city index were both 12.4%, but the WSA y/y price increase was 12.0%. The WSA y/y change is lower because it properly uses a more modest upward seasonal adjustment for March 2014 than for March 2013, but the published SAFs changed little between March 2013 and March 2014, and of course the NSA y/y change assumes that the seasonal factors in successive Marches are identical and cancel each other out. In other months, though, such as May 2014, the WSA y/y change is quite similar to the NSA and SA y/y changes.

The solution to changing seasonal patterns, therefore, is to develop better seasonal adjustment factors, not to ignore seasonality. Using flawed seasonal adjustment factors – or, worse, relying on non-seasonally-adjusted data – clouds our view of the housing recovery, both today and for several years to come.

FNC: Residential Property Values increased 8.0% year-over-year in June

by Calculated Risk on 8/11/2014 10:27:00 AM

In addition to Case-Shiller, CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their June index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.8% from May to June (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.8% and 0.9% in June. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

The year-over-year (YoY) change slowed in May, with the 100-MSA composite up 8.0% compared to June 2013. For FNC, the YoY increase has been slowing since peaking in February at 9.4%.

The index is still down 20.0% from the peak in 2006.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the year-over-year change based on the FNC index (four composites) through June 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

All of the price indexes are now showing a slowdown in price increases.

The June Case-Shiller index will be released on Tuesday, August 26th, and I expect Case-Shiller to show a further slowdown in YoY price increases.

Fed's Fischer: "The Great Recession--Moving Ahead"

by Calculated Risk on 8/11/2014 08:31:00 AM

From Fed Vice Chairman Stanley Fischer: The Great Recession--Moving Ahead. Here is a brief excerpt:

In the United States, three major aggregate demand headwinds appear to have kept a more vigorous recovery from taking hold. The unusual weakness of the housing sector during the recovery period, the significant drag--now waning--from fiscal policy, and the negative impact from the growth slowdown abroad--particularly in Europe--are all prominent factors that have constrained the pace of economic activity.Fischer is referring to the research of Atif Mian and Amir Sufi (see: House of Debt). I expected a slow recovery in housing due to the overhang of distressed properties, but I do think more could have been done to deal with housing (although some attempts at helping housing - like the housing tax credit - were clear policy blunders).

The housing sector was at the epicenter of the U.S. financial crisis and recession and it continues to weigh on the recovery. After previous recessions, vigorous rebounds in housing activity have typically helped spur recoveries. In this episode, however, residential construction was held back by a large inventory of foreclosed and distressed properties and by tight credit conditions for construction loans and mortgages. Moreover, the wealth effect from the decline in housing prices, as well as the inability of many underwater households to take advantage of low interest rates to refinance their mortgages, may have reduced household demand for non-housing goods and services. Indeed, some researchers have argued that the failure to deal decisively with the housing problem seriously prolonged and deepened the crisis. ...

From Fischer:

The stance of U.S. fiscal policy in recent years constituted a significant drag on growth as the large budget deficit was reduced. Historically, fiscal policy has been a support during both recessions and recoveries. In part, this reflects the operation of automatic stabilizers, such as declines in tax revenues and increases in unemployment benefits, that tend to accompany a downturn in activity. In addition, discretionary fiscal policy actions typically boost growth in the years just after a recession. In the U.S., as well as in other countries--especially in Europe--fiscal policy was typically expansionary during the recent recession and early in the recovery, but discretionary fiscal policy shifted relatively fast from expansionary to contractionary as the recovery progressed. ...Both the second headwind (U.S. fiscal policy) and third headwind (slow global growth) are related to the pivot to austerity in both the U.S. and Europe.

A third headwind slowing the U.S. recovery has been unexpectedly slow global growth, which reduced export demand. Over the past several years, a number of our key trading partners have suffered negative shocks.

Sunday, August 10, 2014

Sunday Night Futures

by Calculated Risk on 8/10/2014 07:58:00 PM

Joe Weisenthal at Business Insider does a great job of tying together some of my recent posts on demographics (Thanks Joe!): The Analyst Who Nailed The Housing Crash Is Quietly Revealing The Next Big Thing.

Weisenthal concludes with some very interesting analysis from Matt Busigin:

And while we're talking about housing, we should also take just a minute to talk about inflation. Matt Busigin wrote a great piece last year, talking about the non-monetary causes of inflation, and how demographics is a much bigger driver of inflation than people realize. Many of the same factors discussed above could contribute to higher inflation, as a younger workforce moves into its first homes and first cars, and has real buying power for the first time.Monday:

• At 3:15 AM ET, Speech by Fed Vice Chairman Stanley Fischer, The Great Recession: Moving Ahead, At the Swedish Ministry of Finance Conference: The Great Recession – Moving Ahead, Stockholm, Sweden

Weekend:

• Schedule for Week of Aug 10th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are flat and DOW futures are up 12 (fair value).

Oil prices were down slightly over the last week with WTI futures at $97.67 per barrel and Brent at $104.91 per barrel. A year ago, WTI was at $104, and Brent was at $109 - so prices are down a little year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.47 per gallon (down about a dime from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Update: Framing Lumber Prices

by Calculated Risk on 8/10/2014 02:33:00 PM

Here is another graph on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs. Then prices declined over 25% from the highs by mid-year 2013.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand), however prices haven't fallen as sharply either.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through last week (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up about 8% from a year ago, and CME futures are up about 7% year-over-year.

Saturday, August 09, 2014

Schedule for Week of August 10th

by Calculated Risk on 8/09/2014 01:01:00 PM

The key report this week is July retail sales on Wednesday.

For manufacturing, the July Industrial Production and Capacity Utilization report, and the August NY Fed (Empire State) survey, will be released this week.

For prices, PPI will be released on Friday.

Also the NY Fed Q2 Report on Household Debt and Credit will be released on Thursday.

3:15 AM ET: Speech by Fed Vice Chairman Stanley Fischer, The Great Recession: Moving Ahead, At the Swedish Ministry of Finance Conference: The Great Recession – Moving Ahead, Stockholm, Sweden

7:30 AM ET: NFIB Small Business Optimism Index for July.

10:00 AM: Job Openings and Labor Turnover Survey for June from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for June from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

In May, the number of job openings (yellow) were up 19% year-over-year compared to May 2013, and Quits were up 15% year-over-year.

2:00 PM ET: The Monthly Treasury Budget Statement for July. Note: The CBO's estimate is the deficit through July in fiscal 2014 was $462 billion, compared to $607 billion for the same period in fiscal 2013.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

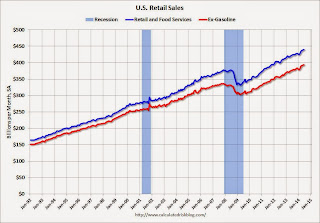

8:30 AM ET: Retail sales for July will be released.

8:30 AM ET: Retail sales for July will be released.This graph shows retail sales since 1992 through June 2014. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales increased 0.2% from May to June (seasonally adjusted), and sales were up 4.3% from June 2013.

The consensus is for retail sales to increase 0.2% in July, and to increase 0.4% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.4% increase in inventories.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 295 thousand from 289 thousand.

11:00 AM: The Q2 2014 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York.

8:30 AM: NY Fed Empire Manufacturing Survey for August. The consensus is for a reading of 20.0, down from 25.6 in July (above zero is expansion).

8:30 AM: The Producer Price Index for July from the BLS. The consensus is for a 0.1% increase in prices.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for a reading of 82.3, up from 81.8 in July.

Unofficial Problem Bank list declines to 449 Institutions

by Calculated Risk on 8/09/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 8, 2014.

Changes and comments from surferdude808:

Two removals lowered the number of institutions on the Unofficial Problem Bank List to 449. Assets declined by $3.0 billion to $142.7 billion. A year earlier, the list held 723 institutions with assets of $255 billion. Enforcement actions were terminated against MetaBank, Storm Lake, IA ($1.9 billion Ticker: CASH) and First American Bank, Fort Dodge, IA ($1.1 billion). Next Friday, we anticipate the OCC to provide an update on its enforcement action activities.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 449.

Friday, August 08, 2014

Sacramento Housing in July: Total Sales down 4.5% Year-over-year, Equity Sales up 9%, Active Inventory increased 68%

by Calculated Risk on 8/08/2014 06:43:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a long time, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In July 2014, 12.3% of all resales were distressed sales. This was down from 13.3% last month, and down from 23.1% in July 2013. This is the post-bubble low.

The percentage of REOs was at 6.2%, and the percentage of short sales was 6.1%.

Here are the statistics for July.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes increased 68.0% year-over-year in July.

Cash buyers accounted for 20.9% of all sales, down from 25.5% in July 2013, but up from 19.8% last month (frequently investors). This has been trending down, and it appears investors are becoming much less of a factor in Sacramento.

Total sales were down 4.5% from July 2013, but conventional equity sales were up 8.9% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

Summary: Distressed sales down sharply (at post bubble low), Cash buyers down significantly, normal equity sales up 8.9% year-over-year, and inventory up significantly. So price increases should slow, and builders will slow too (with more inventory), and we might see lower land prices in some of these areas.

As I've noted before, we are seeing a similar pattern in other distressed areas.

Lawler: Fannie, Freddie in Q2

by Calculated Risk on 8/08/2014 02:56:00 PM

From housing economist Tom Lawler:

Yesterday Fannie Mae and Freddie Mac both released their quarterly financial results for the second quarter of 2014. On the earnings front Fannie reported that both GAAP net income and comprehensive income last quarter were $3.7 billion, meaning that Fannie expects to pay Treasury $3.7 billion in dividends in September. That payment would bring total dividends paid to Treasury of $130.5 billion, compared to $116.1 billion in cumulative cash draws from Treasury since 2008. Freddie Mac reported GAAP net income of $1.4 billion and comprehensive income of $1.9 billion, meaning that Freddie expects to pay Treasury $1.9 billion in dividends in September. That payment would bring total dividends paid to Treasury of $88.2 billion, compared to $71.3 billion of cumulative cash draws from Treasury since 2008.

Here are some summary delinquency rate stats for the conventional SF mortgage books of both companies.

| Payment Status, Fannie Conventional SF Mortgage Book | |||

|---|---|---|---|

| 6/30/2014 | 3/31/2014 | 6/30/2013 | |

| 30 to 59 days delinquent | 1.46% | 1.40% | 1.85% |

| 60 to 89 days delinquent | 0.42% | 0.40% | 0.51% |

| seriously delinquent | 2.05% | 2.19% | 2.77% |

| Payment Status, Freddie Conventional SF Mortgage Book | |||

|---|---|---|---|

| 6/30/2014 | 3/31/2014 | 6/30/2013 | |

| One month past due | 1.53% | 1.40% | 1.80% |

| Two month's past due | 0.48% | 0.47% | 0.55% |

| Seriously delinquent | 2.05% | 2.20% | 2.79% |

Here are some summary stats for SF REO activity at both companies.

| Freddie SF REO Activity | Fannie SF REO Activity | |||||

|---|---|---|---|---|---|---|

| Acquisitions | Dispositions | Inventory | Acquisitions | Dispositions | Inventory | |

| Q4/10 | 23,771 | 26,589 | 72,079 | 45,962 | 50,260 | 162,489 |

| Q1/11 | 24,707 | 31,627 | 65,159 | 53,549 | 62,814 | 153,224 |

| Q2/11 | 24,788 | 29,348 | 60,599 | 53,697 | 71,202 | 135,719 |

| Q3/11 | 24,378 | 25,381 | 59,596 | 45,194 | 58,297 | 122,616 |

| Q4/11 | 24,758 | 23,819 | 60,535 | 47,256 | 51,344 | 118,528 |

| Q1/12 | 23,805 | 25,033 | 59,307 | 47,700 | 52,071 | 114,157 |

| Q2/12 | 20,033 | 26,069 | 53,271 | 43,783 | 48,674 | 109,266 |

| Q3/12 | 20,302 | 22,660 | 50,913 | 41,884 | 43,925 | 107,225 |

| Q4/12 | 18,672 | 20,514 | 49,071 | 41,112 | 42,671 | 105,666 |

| Q1/13 | 17,881 | 18,984 | 47,968 | 38,717 | 42,934 | 101,449 |

| Q2/13 | 16,418 | 19,763 | 44,623 | 36,106 | 40,635 | 96,920 |

| Q3/13 | 19,441 | 16,945 | 47,119 | 37,353 | 33,332 | 100,941 |

| Q4/13 | 16,941 | 16,753 | 47,307 | 32,208 | 29,920 | 103,229 |

| Q1/14 | 14,384 | 18,126 | 43,565 | 31,896 | 32,727 | 102,398 |

| Q2/14 | 10,592 | 18,023 | 36,134 | 31,678 | 37,280 | 96,796 |

Fannie Mae reported that for foreclosures completed in the first six months of 2014, the average number of days from the borrowers’ last paid installment on their mortgage to when the related properties were added to Fannie’s REO inventory was 918 – or slightly over 2 ½ years. Average days to foreclosure were especially long in New York (1,371), Florida (1,332), and New Jersey (1,307).

Freddie Mac reported that for foreclosures completed in the first six months of 2014, the average number of days from the borrowers’ last scheduled payment to when the related properties were added to Freddie’s REO inventory was 875 days. Average days to foreclosure ranged from 403 in Missouri to 1,337 in New Jersey.

Fannie Mae’s average charged guaranty fee on SF mortgages acquisitions last quarter was 62.6 bp, little changed from 63.0 bp in the previous quarter but up considerably from 25.7 bp average in 2010. Pursuant to the Temporary Payroll Tax Cut Continuation Act of 2011 (the “TCCA”), on April 1, 2012 Fannie increased Gfees by 10 bp, and the incremental revenue from this 10 bp is remitted to Treasury.

Freddie Mac’s average charged guaranty fee on SF mortgage acquisitions last quarter was 58 bp, up from 56 bp in the previous quarter and well above the 25 bp average in 2010. Pursuant to the TCCA, on April 1, 2012 Freddie increased Gfees by 10 bp, and the incremental revenue from this 10 bp is remitted to Treasury.

Fannie Mae’s “national” home price index, a unit-weighted repeat sales index based on purchase transactions in Fannie-Freddie acquisitions and public deed data, increased by 5.9% from the second quarter of 2013 to the second quarter of 2014. In 2013 this HPI increased by 8.3% (Q4/Q4).

Freddie Mac’s “national” home price index, a value-weighted repeat transactions index (using weights based on each state’s share of Freddie’s SF book) based on repeat transactions on residential properties acquired by Freddie or Fannie (purchase transactions and some refinance transactions), increased by 6.1% from June 2013 to June 2014. In 2013 this HPI increased by 9.3%.