by Calculated Risk on 7/30/2014 02:00:00 PM

Wednesday, July 30, 2014

FOMC Statement: More Tapering

Another $10 billion reduction in asset purchases. Two key statement changes: "a range of labor market indicators suggests that there remains significant underutilization of labor resources" and "Inflation has moved somewhat closer to the Committee's longer-run objective".

FOMC Statement:

Information received since the Federal Open Market Committee met in June indicates that growth in economic activity rebounded in the second quarter. Labor market conditions improved, with the unemployment rate declining further. However, a range of labor market indicators suggests that there remains significant underutilization of labor resources. Household spending appears to be rising moderately and business fixed investment is advancing, while the recovery in the housing sector remains slow. Fiscal policy is restraining economic growth, although the extent of restraint is diminishing. Inflation has moved somewhat closer to the Committee's longer-run objective. Longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators and inflation moving toward levels the Committee judges consistent with its dual mandate. The Committee sees the risks to the outlook for economic activity and the labor market as nearly balanced and judges that the likelihood of inflation running persistently below 2 percent has diminished somewhat.

The Committee currently judges that there is sufficient underlying strength in the broader economy to support ongoing improvement in labor market conditions. In light of the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions since the inception of the current asset purchase program, the Committee decided to make a further measured reduction in the pace of its asset purchases. Beginning in August, the Committee will add to its holdings of agency mortgage-backed securities at a pace of $10 billion per month rather than $15 billion per month, and will add to its holdings of longer-term Treasury securities at a pace of $15 billion per month rather than $20 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee's sizable and still-increasing holdings of longer-term securities should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee's dual mandate.

The Committee will closely monitor incoming information on economic and financial developments in coming months and will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings. However, asset purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on the Committee's outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy remains appropriate. In determining how long to maintain the current 0 to 1/4 percent target range for the federal funds rate, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Stanley Fischer; Richard W. Fisher; Narayana Kocherlakota; Loretta J. Mester; Jerome H. Powell; and Daniel K. Tarullo. Voting against was Charles I. Plosser who objected to the guidance indicating that it likely will be appropriate to maintain the current target range for the federal funds rate for "a considerable time after the asset purchase program ends," because such language is time dependent and does not reflect the considerable economic progress that has been made toward the Committee's goals.

emphasis added

GDP: A Few Graphs

by Calculated Risk on 7/30/2014 09:48:00 AM

A few graphs based on the GDP report (including revisions).

The first graph shows the contribution to percent change in GDP for residential investment (RI) and state and local governments since 2005.

This shows the huge slump in RI during the housing bust (blue), followed by the unprecedented period of state and local austerity (red) not seen since the

Depression.

Click on graph for larger image.

Click on graph for larger image.

State and local government spending bounced back in Q2, and I expect state and local governments to continue to make a positive contribution to GDP in 2014.

RI (blue) added to GDP growth for a few years, before subtracting in Q4 2013 and Q1 2014. RI bounced back in Q2, and since RI is still very low, I expect RI to make a positive contribution to GDP for some time.

The second graph shows residential investment as a percent of GDP.

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

I'll add details for investment in offices, malls and hotels next week.

Overall this was a solid report. Private investment rebounded in Q2, and that is the key to more growth going forward.

BEA: Real GDP increased at 4.0% Annualized Rate in Q2

by Calculated Risk on 7/30/2014 08:30:00 AM

From the BEA: Gross Domestic Product: Second Quarter 2014 (Advance Estimate) Annual Revision: 1999 through First Quarter 2014

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 4.0 percent in the second quarter of 2014, according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP decreased 2.1 percent (revised).The advance Q2 GDP report, with 4.0% annualized growth, was above expectations of a 2.9% increase. Also Q1 was revised up.

...

The increase in real GDP in the second quarter primarily reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, exports, nonresidential fixed investment, state and local government spending, and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

Personal consumption expenditures (PCE) increased at a 2.5% annualized rate - a decent pace.

Private investment rebounded with residential investment up 7.5% annualized, and equipment up 5.3%. Change in private inventories added 1.66 percentage points to growth after subtracting 1.16 in Q1.

Overall this was a solid report. I'll have more later on the report and revisions.

ADP: Private Employment increased 218,000 in July

by Calculated Risk on 7/30/2014 08:15:00 AM

Private sector employment increased by 218,000 jobs from June to July according to the July ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 235,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "The July employment gain was softer than June, but remains consistent with a steadily improving job market. At the current pace of job growth unemployment will quickly decline. Layoffs are still receding and hiring and job openings are picking up. If current trends continue, the economy will return to full employment by late 2016.”

The BLS report for July will be released on Friday.

MBA: Mortgage Purchase Applications Increase Slightly in Latest MBA Weekly Survey

by Calculated Risk on 7/30/2014 07:01:00 AM

From the MBA: Purchase Applications Increase Slightly in Latest MBA Weekly Survey

Mortgage applications decreased 2.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 25, 2014. ...

The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 0.2 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 4.33 percent, with points increasing to 0.24 from 0.23 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 12% from a year ago.

Tuesday, July 29, 2014

Wednesday: Q2 GDP, FOMC Statement, ADP Employment

by Calculated Risk on 7/29/2014 11:59:00 PM

First, for a very interesting discussion on GDP and seasonality see: GDP: Seasons and revisions . Too bad the BEA doesn't release NSA data any more - but the graph is interesting.

And the Atlanta Fed released their final GDPNow for Q2:

The final GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2014 was 2.7 percent on July 25, unchanged from its July 17 reading. The first GDPNow model forecast for GDP growth in the third quarter will be released August 1.Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 235,000 payroll jobs added in July, down from 280,000 in June.

• At 8:30 AM, Gross Domestic Product, 2nd quarter 2014 (advance estimate); Includes historical revisions from the BEA. The consensus is that real GDP increased 2.9% annualized in Q2.

• At 2:00 PM, the FOMC Statement. No change in interest rates is expected (for a long time). However the FOMC is expected to reduce QE3 asset purchases by $10 billion per month at this meeting.

Zillow: Case-Shiller House Price Index expected to slow further year-over-year in June

by Calculated Risk on 7/29/2014 09:00:00 PM

The Case-Shiller house price indexes for May were released this morning. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Case-Shiller Forecast: Expecting Further Slowdowns Ahead

The Case-Shiller data for May 2014 came out this morning, and based on this information and the June 2014 Zillow Home Value Index (ZHVI, released July 20th), we predict that next month’s Case-Shiller data (June 2014) will show that both the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased by 8.1 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from May to June will be flat for the 20-City Composite Index and 0.1 percent for the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for June will not be released until Tuesday, August 26.So the Case-Shiller index will probably show a lower year-over-year gain in June than in May (9.3% year-over-year).

| Zillow June 2014 Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | June 2013 | 173.17 | 171.70 | 159.46 | 157.92 |

| Case-Shiller (last month) | May 2014 | 185.33 | 185.79 | 170.64 | 171.04 |

| Zillow Forecast | YoY | 8.1% | 8.1% | 8.1% | 8.1% |

| MoM | 1.0% | 0.1% | 1.0% | 0.0% | |

| Zillow Forecasts1 | 187.2 | 185.8 | 172.4 | 171.0 | |

| Current Post Bubble Low | 146.45 | 149.87 | 134.07 | 137.13 | |

| Date of Post Bubble Low | Mar-12 | Feb-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 27.8% | 24.0% | 28.6% | 24.6% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 7/29/2014 01:46:00 PM

There has always been a clear seasonal pattern for house prices, but the seasonal differences have been more pronounced since the housing bust.

Even in normal times house prices tend to be stronger in the spring and early summer than in the fall and winter. Recently there has been a larger than normal seasonal pattern mostly because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have had a larger negative impact on prices in the fall and winter.

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index since 2001 (both through May). The seasonal pattern was smaller back in the early '00s, and increased since the bubble burst.

It appears we've already seen the strongest month this year (NSA) for both Case-Shiller NSA and CoreLogic. This suggests both indexes will turn negative seasonally (NSA) earlier this year than the previous two years - perhaps in the August reports.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

It appears the seasonal factor has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

House Prices: Real Prices and Price-to-Rent Ratio decline in May

by Calculated Risk on 7/29/2014 11:52:00 AM

I've been expecting a slowdown in year-over-year prices as "For Sale" inventory increases, and the slowdown is here! The Case-Shiller Composite 20 index was up 9.3% year-over-year in May; the smallest year-over-year increase since January 2013.

This is still a very strong year-over-year change, but on a seasonally adjusted monthly basis, the Case-Shiller Composite 20 index was down 0.3% in May. This was the first monthly decrease since prices bottomed in early 2012. (Note: The seasonal factor is skewed by foreclosures).

On a real basis (inflation adjusted), prices actually declined for the second consecutive month. The price-rent ratio also declined in May for the Case-Shiller Composite 20 index.

It is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $280,000 today adjusted for inflation (40%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2014), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through May) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2014), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through May) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to mid-2004 levels (and also back up to Q2 2008), and the Case-Shiller Composite 20 Index (SA) is back to October 2004 levels, and the CoreLogic index (NSA) is back to January 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 2001 levels, the Composite 20 index is back to July 2002, and the CoreLogic index back to January 2003.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q1 2002 levels, the Composite 20 index is back to November 2002 levels, and the CoreLogic index is back to May 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to early 2000 levels. And real prices (and the price-to-rent ratio) have declined for two consecutive months using Case-Shiller Comp 20.

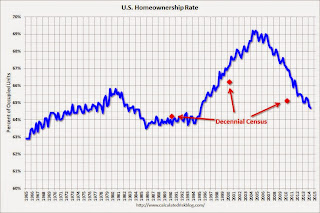

HVS: Q2 2014 Homeownership and Vacancy Rates

by Calculated Risk on 7/29/2014 10:15:00 AM

The Census Bureau released the Housing Vacancies and Homeownership report for Q2 2014 this morning.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 64.7% in Q2, from 64.8% in Q1.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

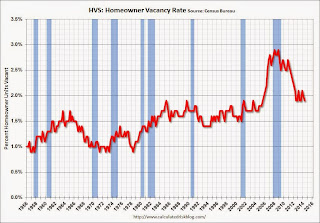

The HVS homeowner vacancy decreased to 1.9% in Q2.

The HVS homeowner vacancy decreased to 1.9% in Q2.

It isn't really clear what this means. Are these homes becoming rentals?

Once again - this probably shows that the general trend is down, but I wouldn't rely on the absolute numbers.

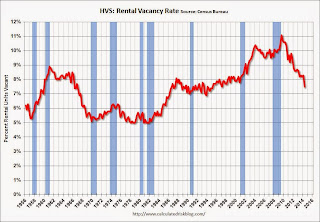

The rental vacancy rate decreased in Q2 to 7.5% from 8.3% in Q1.

The rental vacancy rate decreased in Q2 to 7.5% from 8.3% in Q1.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate - and Reis reported that the rental vacancy rate is at the lowest level since 2001 - and might be close to a bottom.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply.