by Calculated Risk on 7/16/2014 12:22:00 PM

Wednesday, July 16, 2014

DataQuick on SoCal: June Home Sales down 4% Year-over-year, Non-Distressed sales up Year-over-year

From DataQuick: Southland Home Sales Down from Last Year Again; Price Gains Throttle Back

Southern California homes sold at the slowest pace for a June in three years as investor purchases fell again and other would-be buyers continued to struggle with inventory and affordability constraints. ...Both distressed sales and investor buying is declining - and this has been dragging down overall sales. Even though total sales are still down year-over-year, the percent of non-distressed sales is up slightly year-over-year. There were 20,654 total sales this year in June, and 11.3% were distressed. In June 2013, there were 21,608 total sales, and 23.5% were distressed.

A total of 20,654 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 5.6 percent from 19,556 sales in May, and down 4.4 percent from 21,608 sales in June last year, according to DataQuick ...

On average, sales have increased 6.4 percent between May and June since 1988, when DataQuick’s statistics begin. Sales have fallen on a year-over-year basis for nine consecutive months. Sales during the month of June have ranged from a low of 18,032 in June 2008 to a high of 40,156 in June 2005. Last month was 23.7 percent below the June average of 27,069 sales. Sales haven’t been above the long-term average for more than eight years.

...

“Many of the market indicators we track continue to ease toward normalcy ... For example, the use of larger, so-called jumbo loans is up significantly this year, as is the use of adjustable-rate mortgages. Distressed property sales are way down and, related to that, investor and cash purchases are trending lower, toward more normal levels.” [said Andrew LePage, a DataQuick analyst].

Foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 5.3 percent of the Southland resale market last month. That was up slightly from a revised 5.0 percent the prior month and down from 9.0 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 6.0 percent of Southland resales last month. That was down from a revised 6.4 percent the prior month and down from 14.5 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 23.6 percent of the Southland homes sold last month. That was the lowest share since December 2010 ...

emphasis added

NAHB: Builder Confidence increased to 53 in July, Highest in Six Months

by Calculated Risk on 7/16/2014 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 53 in July, up from 49 in June. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Surpasses Key Benchmark in July

Builder confidence in the market for newly-built single-family homes reached an important milestone in July, rising four points to a reading of 53 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. Any reading over 50 indicates that more builders view sales conditions as good than poor.

...

“An improving job market goes hand-in-hand with a rise in builder confidence,” said NAHB Chief Economist David Crowe. “As employment increases and those with jobs feel more secure about their own economic situation, they are more likely to feel comfortable about buying a home.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three HMI components posted gains in July. The index gauging current sales conditions increased four points to 57, while the index measuring expectations for future sales rose six points to 64 and the index gauging traffic of prospective buyers increased three points to 39.

The HMI three-month moving average was up in all four regions, with the Northeast and Midwest posting a one-point and two-point gain to 35 and 48, respectively. The West registered a five-point gain to 52 while the South rose two points to 51.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was the first reading above 50 since January.

Fed: Industrial Production increased 0.2% in June

by Calculated Risk on 7/16/2014 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.2 percent in June and advanced at an annual rate of 5.5 percent for the second quarter of 2014. In June, manufacturing output edged up 0.1 percent for its fifth consecutive monthly gain, while the production at mines moved up 0.8 percent and the output of utilities declined 0.3 percent. For the second quarter as a whole, manufacturing production rose at an annual rate of 6.7 percent, while mining output increased at an annual rate of 18.8 percent because of gains in the extraction of oil and gas; by contrast, the output of utilities fell at an annual rate of 21.4 percent following a weather-related increase of 15.6 percent in the first quarter. At 103.9 percent of its 2007 average, total industrial production in June was 4.3 percent above its level of a year earlier. The capacity utilization rate for total industry was unchanged in June at 79.1 percent, a rate that is 1.0 percentage point below its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.1% is 1.0 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.2% in June to 103.9. This is 24.1% above the recession low, and 3.1% above the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were below expectations.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 7/16/2014 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 11, 2014. The previous week’s results included an adjustment for the July 4th holiday. ...

The Refinance Index decreased 0.1 percent from the previous week. The seasonally adjusted Purchase Index decreased 8 percent from one week earlier to the lowest level since February 2014. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.33 percent from 4.32 percent, with points increasing to 0.20 from 0.16 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

As expected, refinance activity is very low this year.

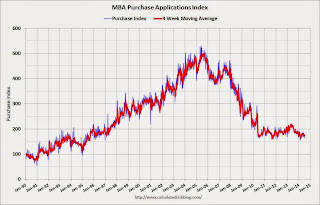

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 17% from a year ago.

Tuesday, July 15, 2014

Wednesday: Yellen, Industrial Production, PPI, Beige Book, Homebuilder Survey

by Calculated Risk on 7/15/2014 09:28:00 PM

For enjoyment, some thoughts from Paul Krugman on Life Without Cars.

I've been thinking about "IT-mediated car services" combined with self-driving cars. I agree with Krugman's points, but what does this mean for real estate and housing? How about no home garages? (I dislike big ugly home garages at the front of homes - so 20th Century!). And no garages or parking lots at work or restaurants (wasted space). Sure - there will still be garages to park the self-driving cars at night, but they could be located in undesirable areas. Fun to think about ...

Tuesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Producer Price Index for June from the BLS. The consensus is for a 0.3% increase in prices.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for June. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 79.2%.

• At 10:00 AM, the July NAHB homebuilder survey. The consensus is for a reading of 50, up from 49 in June. Any number above 50 indicates that more builders view sales conditions as good than poor.

• Also at 10:00 AM, Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Earlier: Empire State Manufacturing Survey at 4 Year High in July

by Calculated Risk on 7/15/2014 12:38:00 PM

From the NY Fed: Empire State Manufacturing Survey

Business conditions improved significantly for a third consecutive month for New York manufacturers, according to the July 2014 survey. The general business conditions index advanced six points to 25.6, a four-year high. ...A solid report.

Labor market conditions continued to improve. The index for number of employees climbed six points to 17.0, a level which indicated a solid increase in employment levels. The average workweek index retreated seven points to 2.3, and pointed to a slight increase in hours worked.

emphasis added

Yellen: Semiannual Monetary Policy Report to the Congress

by Calculated Risk on 7/15/2014 10:02:00 AM

Federal Reserve Chair Janet Yellen testimony "Semiannual Monetary Policy Report to the Congress" Before the Senate Banking, Housing, and Urban Affairs Committee, Washington, D.C. (starts at 10 AM ET):

In sum, since the February Monetary Policy Report, further important progress has been made in restoring the economy to health and in strengthening the financial system. Yet too many Americans remain unemployed, inflation remains below our longer-run objective, and not all of the necessary financial reform initiatives have been completed. The Federal Reserve remains committed to employing all of its resources and tools to achieve its macroeconomic objectives and to foster a stronger and more resilient financial system.Here is the C-Span Link

emphasis added

Here is the Bloomberg TV link.

Retail Sales increased 0.2% in June

by Calculated Risk on 7/15/2014 08:43:00 AM

On a monthly basis, retail sales increased 0.2% from May to June (seasonally adjusted), and sales were up 4.3% from June 2013. Sales in May were revised up from a 0.3% increase to a 0.5% increase. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for June, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $439.9 billion, an increase of 0.2 percent from the previous month, and 4.3 percent above June 2013. ... The April to May 2014 percent change was revised from +0.3 percent to +0.5 percent.

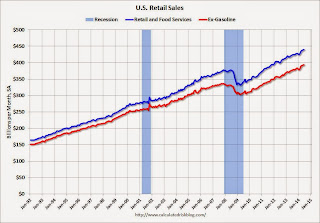

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos were up 0.4%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.6% on a YoY basis (4.3% for all retail sales).

Retail sales ex-gasoline increased by 4.6% on a YoY basis (4.3% for all retail sales).The increase in June was well below consensus expectations of a 0.6% increase - however sales in April and May were revised up (so total sales in June were actually above expectations, but the increase was below expectations due to the upward revisions to prior months).

Monday, July 14, 2014

Tuesday: Yellen, Retail Sales, NY Fed Mfg Survey

by Calculated Risk on 7/14/2014 09:11:00 PM

It is dry in California, from CBS: California Gears Up To Vote On Water Wasting Law Tuesday

The State Water Resources Control Board is set to vote Tuesday on tough new rules that would allow any public employee empowered to enforce laws to write tickets for wasting water. ... Violations would include watering during the day, rinsing driveways and washing a car without a shut off nozzle.Tuesday:

• At 8:30 AM ET, Retail sales for June will be released. The consensus is for retail sales to increase 0.6% in June, and to increase 0.5% ex-autos.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for July. The consensus is for a reading of 17.0, down from 19.3 in June (above zero is expansion).

• At 10:00 AM, Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Senate Banking, Housing, and Urban Affairs Committee, Washington, D.C.

• Also at 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for May. The consensus is for a 0.6% increase in inventories.

Weekly Update: Housing Tracker Existing Home Inventory up 13.1% YoY on July 14th

by Calculated Risk on 7/14/2014 06:49:00 PM

Here is another weekly update on housing inventory ...

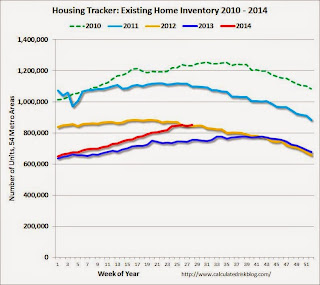

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data released was for May). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 13.1% above the same week in 2013. (Note: There are differences in how the data is collected between Housing Tracker and the NAR).

Inventory is also about 0.9% above the same week in 2012. This increase in inventory should slow price increases, and might lead to price declines in some areas.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory would be up 10% to 15% year-over-year at the end of 2014 based on the NAR report. Right now it looks like inventory might increase more than I expected.