by Calculated Risk on 5/19/2014 09:25:00 PM

Monday, May 19, 2014

Amusing: A False Story on Auto Inventory

For fun, an interesting story from Barry Ritholtz: The Truth About Auto Sales

This week, an e-mail landed in my inbox with the header “Unsold Cars.” ...From Snopes.com: Unsold Cars

Normally, I would have deleted the e-mail without a second thought. But several things about it warranted further notice.

The first were aerial photos of thousands of cars. Wow, this really was a lot of cars.

The second was the phrase “Timestamp: Friday, May 16th, 2014,” which suggests that these photos were brand new.

What struck me was how familiar it all looked. Maybe that was because I posted those same photos on The Big Picture blog and Business Insider in February 2009.

The origin of the photos was a Jan. 16, 2009, article in the Guardian by Nick Mead. Note that this was smack in the middle of the financial crisis, when anything purchased on credit simply froze

Claim: Photographs show thousands and thousands of unsold cars deteriorating until they are scrapped.From Matt Hardigree at Jalopnik.com That Zero Hedge Article On Unsold Cars Is Bullshit

FALSE

The visuals are strong, the headline is clear, and you almost don't have to read the article to viscerally understand the problem. I, more than anyone, get the appeal of this story because it seems to largely rip off an article I wrote — including the images and headline — more than five years ago (which itself was largely a rehash of a Guardian article)....Glad to see people knock this down so quickly. Unfortunately stories like this never really die ... and the original story hasn't been corrected.

I would think that most intelligent people would read this and obviously see the flaws but, alas, I've had enough emails about it this morning that I feel the need to refute it. And since it's a (bad) copy of something I wrote, I have an extra responsibility to kill this misunderstanding before it has a chance to spread.

Weekly Update: Housing Tracker Existing Home Inventory up 6.8% year-over-year on May 19th

by Calculated Risk on 5/19/2014 03:01:00 PM

Here is another weekly update on housing inventory ...

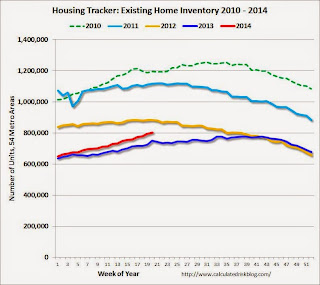

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for March). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 6.8% above the same week in 2013.

Inventory is still very low - still below the level in 2012 (yellow) when prices started increasing - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

CoreLogic on Housing: "Cash Sales Share Shows Clear Downward Year-Over-Year Trend"

by Calculated Risk on 5/19/2014 12:05:00 PM

From CoreLogic: Cash Sales Made up 40 Percent of Total Home Sales in February

Cash sales made up 40.2 percent of total home sales in February 2014, down from 43.7 percent the previous year and 40.8 percent the previous month. Cash sales share comparisons should be made on a year-over-year basis due to the seasonal nature of the housing market , and by that measurement, the trend in cash sales is clearly down. Prior to the housing crisis, the cash sales share of total home sales averaged approximately 25 percent. The peak occurred in January 2011, when cash transactions made up 46.2 percent of total home sales.Reports that cash sales were up sharply in 2014 were incorrect. This fits with data from Tom Lawler.

And a post from Sam Khater at CoreLogic: REO Inventory Rising Once Again

After reaching a trough in August of 2013 of 375,000 properties, the number of real estate owned (REO) properties increased 15 percent to 430,000 as of March 2014 (Figure 1). The increase in REO properties was broad based, rising in 46 states. While the increase was moderate nationally, some states had large increases. Idaho led the way with the stock of REO properties nearly doubling between August 2013 and March 2014. Maryland had the 2nd largest increase in the number of REO properties, which increased 78 percent, followed by Nevada (up 70 percent), Oregon (up 47 percent) and North Dakota (up 42 percent).

The rise in REOs across most states reflects several inter-related factors ...

This graph from CoreLogic shows the recent increase in REOs.

This graph from CoreLogic shows the recent increase in REOs.Note: The number of REOs at Fannie and Freddie was down slightly in Q1, but has increased in recent quarters. The FDIC reported a slight decrease in REOs in Q4 (dollars). So most of the recent increase in REOs reported by CoreLogic was probably due to private label (the worst of the worst).

LA area Port Traffic: Up year-over-year in April

by Calculated Risk on 5/19/2014 11:08:00 AM

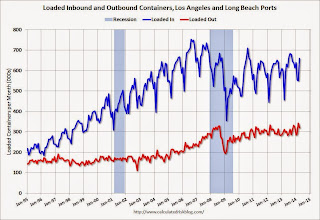

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for April since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 0.9% compared to the rolling 12 months ending in March. Outbound traffic was up 0.6% compared to 12 months ending in March.

Inbound traffic has generally been increasing, and outbound traffic has been moving up a little recently after moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Imports and exports were up solidly year-over-year in April, and this was an all time high for exports for the month of April.

Imports were close to the all time high for April (set in April 2006), and it is possible that imports will be at a record high later this year.

Congratulations to Breanna Grow, the 2014 recipient of the Doris "Tanta" Dungey scholarship!

by Calculated Risk on 5/19/2014 09:34:00 AM

Congratulations to Breanna Grow, the 2014 recipient of the Doris "Tanta" Dungey scholarship!

Here is a picture of Ms. Grow with Tanta's mother (via Tanta's sister Cathy).

A happy day for Tanta's family!

Note: For new readers, Tanta was my co-blogger from from Dec 2006 through November 2008. Please see: Sad News: Tanta Passes Away, NY Times: Doris Dungey, Prescient Finance Blogger, Dies at 47 and much more at In Memoriam: Doris "Tanta" Dungey and on the scholarship.

You can make an additional contribution to the Doris Dungey Endowed Scholarship.

Sunday, May 18, 2014

Sunday Night Futures

by Calculated Risk on 5/18/2014 10:01:00 PM

From Jon Hilsenrath at the WSJ: Fed's Rate-Change System Up for Revamp

In the past, the Fed changed its benchmark interest rate—the fed funds rate—by increasing or decreasing ... reserves. ...Weekend:

...

Since the crisis, the Fed has paid banks interest on the reserves they deposit with the central bank at a rate of 0.25%. When it comes time to raise rates across the economy, the Fed will lift this rate rather than altering the fed funds rate by changing the supply of reserves.

...

The Fed could shed light on the subject Wednesday when it releases minutes of an April meeting at which discussions of the issue intensified. And New York Fed President William Dudley may address the matter in a speech Tuesday.

• Schedule for Week of May 18th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 7and DOW futures are up 48 (fair value).

Oil prices were up over the last week with WTI futures at $102.05 per barrel and Brent at $109.85 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.62 per gallon (might have peaked, and slightly below the level of a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Quarterly Housing Starts by Intent, and compared to New Home Sales

by Calculated Risk on 5/18/2014 04:27:00 PM

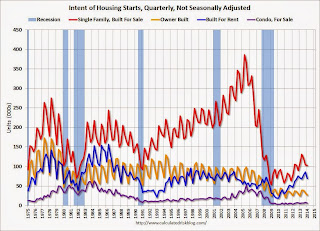

In addition to housing starts for April, the Census Bureau also released the Q1 "Started and Completed by Purpose of Construction" report last week.

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released last week showed there were 103,000 single family starts, built for sale, in Q1 2014, and that was below the 107,000 new homes sold for the same quarter, so inventory decreased slightly in Q1 (Using Not Seasonally Adjusted data for both starts and sales).

The first graph shows quarterly single family starts, built for sale and new home sales (NSA).

Click on graph for larger image.

Click on graph for larger image.In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are generally starting about the same number of homes that they are selling, and the inventory of under construction and completed new home sales is still very low.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control.

The second graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were down about 4% compared to Q1 2013 (however starts increased sharply in April).

Single family starts built for sale were down about 4% compared to Q1 2013 (however starts increased sharply in April). Owner built starts were up 8% year-over-year. And condos built for sale are just above the record low.

The 'units built for rent' has increased significantly, and were up 20% year-over-year in Q1.

CoStar: Commercial Real Estate prices increased in Q1, Distress Sales just 10% of all sales

by Calculated Risk on 5/18/2014 09:07:00 AM

Here is a price index for commercial real estate that I follow.

From CoStar: Major Commercial Real Estate Price Indices Advance In First Quarter

BROAD PRICING INDICES MOVE UPWARD IN FIRST QUARTER: The two broadest measures of aggregate pricing for commercial properties within the CCRSI — the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index — each finished the first quarter of 2014 on a positive note. The U.S. equal-weighted index, which represents lower-value properties, has the most momentum in early 2014, with pricing up 4.2% for the first quarter of 2014 and 17.1% year-over-year. Meanwhile the U.S. value-weighted index, which is more heavily weighted toward larger, higher-value properties, has already recovered to within 5% of its prior peak levels. As a result, pricing gains in the value-weighted Composite Index have slowed, advancing by a more modest 0.5% for the first quarter and 10.1% for the year ending in March 2014.

...

The percentage of commercial property selling at distressed prices has also fallen by more than two-thirds from the peak levels reached in 2011, to just 10% of all composite pair trades in the first quarter of 2014.

...

The Multifamily Index continued to post steady growth, advancing by 7.8% for the 12 months ended March 2014, even though pricing in the Prime Metros Index has surpassed its previous peak set in 2007 by 10%. Pricing in the overall Multifamily Index is now within 8% of its pre-recession peak.Given the steep competition and pricing for Class A assets in prime metro areas, recent pricing gains likely reflect shifting investor interest to Class B properties in primary markets and higher quality properties in secondary and tertiary markets.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Primary Property Type Quarterly indexes. Multi-family has recovered the most, and offices the least.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Saturday, May 17, 2014

Schedule for Week of May 18th

by Calculated Risk on 5/17/2014 01:02:00 PM

The key reports this week are April Existing Home Sales on Thursday and April New Home sales on Friday.

For manufacturing, the May Kansas City Fed survey will be released.

No economic releases scheduled.

No economic releases scheduled.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

11:30 AM, Fed Chair Janet Yellen Speaks, Commencement Remarks, At the New York University Commencement, New York, New York

2:00 PM: FOMC Minutes for the Meeting of April 29-30, 2014.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 297 thousand.

8:30 AM ET: Chicago Fed National Activity Index for April. This is a composite index of other data.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for sales of 4.67 million on seasonally adjusted annual rate (SAAR) basis. Sales in March were at a 4.59 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.70 million SAAR.

As always, a key will be inventory of homes for sale.

11:00 AM: the Kansas City Fed manufacturing survey for May.

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the March sales rate.

The consensus is for an in increase in sales to 420 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 384 thousand in March.

Unofficial Problem Bank list declines to 502 Institutions

by Calculated Risk on 5/17/2014 08:53:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 16, 2014.

Changes and comments from surferdude808:

As expected, the OCC provided an update on its recent enforcement action activity and the FDIC shuttered a bank this Friday. In all, there were seven removals from the Unofficial Problem Bank List leaving it at 502 institutions with assets of $161.2 billion. A year ago, the list held 770 institutions with assets of $284.1 billion.

Actions were terminated against Modern Bank, National Association, New York, NY ($678 million); American Bank and Trust Company, National Association, Davenport, IA ($368 million); Provident Community Bank, National Association, Rock Hill, SC ($323 million Ticker: PCBS); First Texoma National Bank, Durant, OK ($155 million); Mission Oaks National Bank, Temecula, CA ($96 million Ticker: MOKB); and Treasure State Bank, Missoula, MT ($66 million Ticker: TRSU).

AztecAmerica Bank, Berwyn, IL ($66 million) was the seventh bank failure this year. Since the on-set of the Great Recession, there have been 58 bank failures in Illinois, which only trails the 87 failures in Georgia and 70 failures in Florida.

Most likely, the FDIC will provide an update on its recent enforcement action activity in two weeks. Moreover, they will likely release industry results for the first quarter and refreshed problem bank list figures that week as well.