by Calculated Risk on 5/12/2014 09:39:00 AM

Monday, May 12, 2014

MBA: Applications for New Home Purchases Increased in April 2014

From the MBA: Applications for New Home Purchases Increased in April 2014

The Mortgage Bankers Association’s (MBA) Builder Application Survey (BAS) data for March 2014 shows mortgage applications for new home purchases increased by 5 percent relative to the previous month. This change does not include any adjustment for typical seasonal patterns.A couple of comments:

...

The MBA estimate of new single-family home sales were running at a seasonally adjusted annual rate of 419,000 units in April 2014, based on data from the BAS. The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors. The BAS market coverage was rebenchmarked this month to an estimate of over 30 percent of annual sales volume based on data from the Census Bureau.

The seasonally adjusted estimate for April is an increase of five percent from the revised March pace of 400,000 units.

1) So far the MBA Builder survey hasn't been helpful in predicting Census Bureau reports. As an example, last month the MBA estimated March new home sales at 479,000 on a seasonally adjusted annual rate basis (SAAR), and the Census Bureau reported sales of 384,000 SAAR. Not close.

2) Now the MBA has increased market coverage, so maybe the survey will be more useful. A 419,000 SAAR would be up from March, but down from 446,000 in April 2013.

Sunday, May 11, 2014

Sunday Night Futures

by Calculated Risk on 5/11/2014 08:12:00 PM

A somewhat strange story on inflation in the WSJ: Markets Watch, Warily, for a Small Bump in Inflation

Normally, a move of a couple of tenths of a percentage point in the inflation measures wouldn't matter much to anyone. But the stakes are high now as Federal Reserve officials justify their plan to keep short-term interest rates near zero in part because inflation is running so far below their 2% objective.Uh, the Fed expects inflation to move up towards 2%, and if it doesn't, the Fed might slow or stop the tapering of QE3 asset purchases. In her testimony last week, Fed Chair Yellen said: "Looking ahead, I expect that economic activity will expand at a somewhat faster pace this year than it did last year, that the unemployment rate will continue to decline gradually, and that inflation will begin to move up toward 2 percent."

Fed officials expect inflation to move from near 1% to 1.5% by year-end. If it moves up sooner or more than they expect, officials could consider raising rates sooner than planned.

emphasis added

The most recent FOMC projections show PCE inflation moving up to 1.5% to 1.6% by Q4, but the Fed wouldn't raise rates sooner just because inflation rate moved closer to 2% this year - unless employment indicators improved significantly too.

And another sentence from the WSJ article:

The persistent low inflation has befuddled economists who thought Fed easy-money policies would spark rampant price gains.Well, yes, some economists had the wrong model, but most economists realized that easy-money policies wouldn't lead to inflation in a depressed economy (I've been making fun of incorrect inflation forecasts for years). Eventually we will see a little more inflation - and an increase in inflation towards 2% would be good news - not something to watch "warily" for.

Monday:

• At 2:00 PM ET, the Monthly Treasury Budget Statement for April. Note: The CBO's estimate is the deficit through April in fiscal 2014 was $301 billion, compared to $488 billion for the same period in fiscal 2013.

Weekend:

• Schedule for Week of May 11th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 5 and DOW futures are up 47 (fair value).

Oil prices were mixed over the last week with WTI futures at $100.07 per barrel and Brent at $107.89 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.62 per gallon (might have peaked, and only slightly above the level of a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

FNC: Residential Property Values increased 9.1% year-over-year in March

by Calculated Risk on 5/11/2014 10:26:00 AM

In addition to Case-Shiller, CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their March index data. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.6% from February to March (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.2% and 0.4% in March. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

The year-over-year change slowed slightly in March, with the 100-MSA composite up 9.1% compared to March 2013. In February, the year-over-year increase was 9.2%. The index is still down 22.2% from the peak in 2006.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the year-over-year change based on the FNC index (four composites) through March 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

There is still no clear evidence in the FNC index of a slowdown in price increases yet.

The March Case-Shiller index will be released on Tuesday, May 27th, and I expect Case-Shiller to show a slowdown in price increases.

Saturday, May 10, 2014

Schedule for Week of May 11th

by Calculated Risk on 5/10/2014 01:01:00 PM

The key reports this week are April retail sales on Tuesday and April housing starts on Friday.

For manufacturing, the April Industrial Production and Capacity Utilization report, and the May NY Fed (Empire State) and Philly Fed surveys, will be released this week.

For prices, PPI will be released on Wednesday, and CPI will be released on Thursday.

Fed Chair Janet Yellen speaks on Thursday "Small Businesses and the Economy".

Two key quarterly reports will be released this week: the NY Fed Q1 Report on Household Debt and Credit on Tuesday, and the Mortgage Bankers Association (MBA) Q1 National Delinquency Survey on Thursday.

2:00 PM ET: The Monthly Treasury Budget Statement for April. Note: The CBO's estimate is the deficit through April in fiscal 2014 was $301 billion, compared to $488 billion for the same period in fiscal 2013.

7:30 AM ET: NFIB Small Business Optimism Index for April.

8:30 AM ET: Retail sales for April will be released.

8:30 AM ET: Retail sales for April will be released.This graph shows retail sales since 1992 through March 2014. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales increased 1.1% from February to March (seasonally adjusted), and sales were up 3.8% from March 2013.

The consensus is for retail sales to increase 0.4% in April, and to increase 0.6% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for March. The consensus is for a 0.4% increase in inventories.

11:00 AM: The Q1 2014 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York. Note: "In conjunction with the release of the report, the New York Fed will also post an update to a recent blog discussing the impact of student loan debt on housing and auto markets."

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Producer Price Index for April from the BLS. The consensus is for a 0.2% increase in prices.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 317 thousand from 319 thousand.

8:30 AM ET: Consumer Price Index for April. The consensus is for a 0.3% increase in CPI in April and for core CPI to increase 0.1%.

8:30 AM: NY Fed Empire Manufacturing Survey for May. The consensus is for a reading of 5.0, up from 1.3 in April (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.This graph shows industrial production since 1967.

The consensus is for no change in Industrial Production, and for Capacity Utilization to decrease to 79.1%.

10:00 AM: the Philly Fed manufacturing survey for May. The consensus is for a reading of 12.5, down from 16.6 last month (above zero indicates expansion).

10:00 AM: The May NAHB homebuilder survey. The consensus is for a reading of 48, up from 47 in April. Any number below 50 indicates that more builders view sales conditions as poor than good.

10:00 AM: The Mortgage Bankers Association (MBA) Q1 2014 National Delinquency Survey (NDS).

6:10 PM: Speech by Fed Chair Janet Yellen, Small Businesses and the Economy, National Small Business Week 2014, Washington, D.C

8:30 AM: Housing Starts for April.

8:30 AM: Housing Starts for April. Total housing starts were at 946 thousand (SAAR) in March. Single family starts were at 635 thousand SAAR in March.

The consensus is for total housing starts to increase to 980 thousand (SAAR) in April.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for May). The consensus is for a reading of 84.5, up from 84.1 in April.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for April 2014.

Unofficial Problem Bank list unchanged at 509 Institutions

by Calculated Risk on 5/10/2014 07:09:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 9, 2014.

Changes and comments from surferdude808:

Very unusual week for the Unofficial Problem Bank List as there are no changes to report. So the total remains at 509 institutions with assets of $163.3 billion.

While activity slows between the end of the month update of the FDIC and the mid-month update of the OCC, there normally is a news report of an action termination or an exit through merger or failure to report. This is only the fifth week since the publication of the list that no changes have occurred with the last being the week ending November 23, 2012.

Next Friday, the OCC should release an update on its recent actions. By the end of the month, along with a release on its recent enforcement action activity, the FDIC should release Q1 industry results and updated Official Problem Bank figures. It has been ten weeks since the last release of the official figures and the difference between the unofficial (then 566, now 502) and official lists (467) has been reduced from 99 to 42 institutions.

Friday, May 09, 2014

The Projected Improvement in Life Expectancy

by Calculated Risk on 5/09/2014 03:10:00 PM

Here is something different, but it is important when looking at demographics ...

The following data is from the CDC United States Life Tables, 2009 by Elizabeth Arias released earlier this year.

The most frequently used life table statistic is life expectancy (ex), which is the average number of years of life remaining for persons who have attained a given age (x). ... Another way of assessing the longevity of the period life table cohort is by determining the proportion that survives to specified ages. ... To illustrate, 56,572 persons out of the original 2009 hypothetical life table cohort of 100,000 (or 56.6%) were alive at exact age 80. In other words, the probability that a person will survive from birth to age 80, given 2009 age-specific mortality, is 56.6%.Instead of look at life expectancy, here is a graph of survivors out of 100,000 born alive, by age for three groups: those born in 1900-1902, born in 1949-1951 (baby boomers), and born in 2009.

emphasis added

Click on graph for larger image.

Click on graph for larger image.There was a dramatic change between those born in 1900 (blue) and those born mid-century (orange). The risk of infant and early childhood deaths dropped sharply, and the risk of death in the prime working years also declined significantly.

The CDC is projecting further improvement for childhood and prime working age for those born in 2009, but they are also projecting that people will live longer.

The second graph uses the same data but looks at the number of people who die before a certain age, but after the previous age. As an example, for those born in 1900 (blue), 12,448 of the 100,000 born alive died before age 1, and another 5,748 died between age 1 and age 5.

The second graph uses the same data but looks at the number of people who die before a certain age, but after the previous age. As an example, for those born in 1900 (blue), 12,448 of the 100,000 born alive died before age 1, and another 5,748 died between age 1 and age 5.The peak age for deaths didn't change much for those born in 1900 and 1950 (between 76 and 80, but many more people born in 1950 will make it).

Now the CDC is projection the peak age for deaths - for those born in 2009 - will increase to 86 to 90! Using these stats - for those born in 2014 - about half will make it to the next century.

Also the number of deaths for those younger than 20 will be very small (down to mostly accidents, guns, and drugs). Self-driving cars might reduce the accident components of young deaths.

An amazing statistic: for those born in 1900, about 13 out of 100,000 made it to 100. For those born in 1950, 199 are projected to make to 100 - an significant increase. Now the CDC is projecting that 2,056 out of 100,000 born in 2009 will make it to 100. Stunning!

Some people look at this data and worry about supporting all the old people. To me, this is all great news - the vast majority of people can look forward to a long life - with fewer people dying in childhood or during their prime working years. Awesome!

Hotels: On track for Strongest Year since 2000

by Calculated Risk on 5/09/2014 12:03:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 3 May

In year-over-year measurements, the industry’s occupancy increased 7.5 percent to 67.4 percent. Average daily rate increased 5.6 percent to finish the week at US$116.41. Revenue per available room for the week was up 13.6 percent to finish at US$78.42.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

emphasis added

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at the highest level since 2000.

The following graph shows the seasonal pattern for the hotel occupancy rate for the last 15 years using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014 and black is for 2009 - the worst year since the Great Depression for hotels. Note: 2001 was briefly worse than 2009 in September.

Year 2000 was the best year for hotel occupancy until late in the year when 2005 had the highest occupancy rate (due to hurricane Katrina).

Right now it looks like 2014 will be the best year since 2000 for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

BLS: Jobs Openings at 4.0 million in March

by Calculated Risk on 5/09/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 4.0 million job openings on the last business day of March, little changed from 4.1 million in February, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in March for total nonfarm and total private. The quits level was little changed in government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for March, the most recent employment report was for April.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in March to 4.014 million from 4.125 million in February.

The number of job openings (yellow) are up 3.5% year-over-year compared to March 2013.

Quits increased in March and are up sharply year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market. It is a good sign that job openings are over 4 million for the second consecutive month, and that quits are increasing.

Thursday, May 08, 2014

Friday: Job Openings

by Calculated Risk on 5/08/2014 08:01:00 PM

Q1 GDP looks worse. Q2 GDP looks better. A couple of short excerpts ...

From the WSJ on Q1: Trade Data Indicate Economy Contracted

J.P. Morgan Chase economists now estimate GDP contracted at a 0.8% pace in the first three months of 2014. Macroeconomic Advisers pegged the decline at 0.6%. Even some of the more optimistic estimates point to slight output shrinkage in the first quarter. Barclays Capital economists see a 0.2% decline and BNP Paribas put the GDP drop at a 0.1% pace.And on Q2 from the WSJ: Economists See Growth Rebound

According to The Wall Street Journal's May survey of 48 economists, the consensus forecast is for annualized real growth in gross domestic product of 3.3%, better than the 3% pace projected in the April survey. ... Nine in the Journal's survey are forecasting second-quarter growth of 4% or better.Q2 should be solid.

Friday:

• At 10:00 AM ET, the Job Openings and Labor Turnover Survey for March from the BLS. In February, the number of job openings were up 4% year-over-year compared to February 2013, and Quits were up about 5% year-over-year.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for March. The consensus is for a 0.5% increase in inventories.

Will Mortgage Rates be down year-over-year in late June?

by Calculated Risk on 5/08/2014 05:48:00 PM

It is fun to try to guess future headlines, and it looks like we might see "Mortgage Rates down year-over-year" in late June.

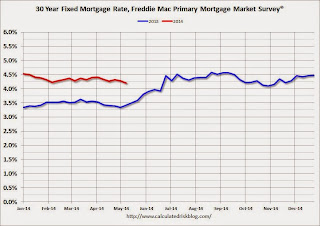

From Freddie Mac: 30-Year Fixed-Rate Mortgage Hits Low for the Year

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving down further and following the decline in Treasury yields as the economic growth for the first quarter came in well below market expectations. At 4.21 percent, the 30-year fixed-rate mortgage is at its lowest since the week of November 7, 2013.

30-year fixed-rate mortgage (FRM) averaged 4.21 percent with an average 0.6 point for the week ending May 8, 2014, down from last week when it averaged 4.29 percent. A year ago at this time, the 30-year FRM averaged 3.42 percent.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of 30 year fixed mortgage rates - according to the PMMS - for 2013 (blue) and 2014 (red).

Mortgage rates jumped to 4.46% in late June 2013, and it is possible that rates will be lower in late June 2014 (currently 4.21%).