by Calculated Risk on 4/30/2014 11:41:00 AM

Wednesday, April 30, 2014

Q1 GDP: Investment Contributions

Private investment in Q1 was very weak.

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter centered average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.

Residential Investment (RI) made a negative contribution to GDP in Q1 for the second consecutive quarter (red).

Residential investment is so low - as a percent of the economy - that this 2 quarter decline is not much of a concern. However, for the rate of economic growth to increase, RI will probably have to make positive contributions.

Equipment and software investment also made a negative contribution in Q1, and the three quarter average is barely positive.

The contribution from nonresidential investment in structures was zero in Q1. Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in the recovery.

I expect to see investment to increase over the next few quarters - and that is key for stronger GDP growth.

BEA: Real GDP increased at 0.1% Annualized Rate in Q1

by Calculated Risk on 4/30/2014 08:30:00 AM

From the BEA: Gross Domestic Product: First Quarter 2014 (advance estimate)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 0.1 percent in the first quarter (that is, from the fourth quarter of 2013 to the first quarter of 2014), according to the "advance" estimate released by the Bureau of Economic Analysis.The advance Q1 GDP report, with 0.1% annualized growth, was below expectations of a 1.1% increase. Personal consumption expenditures (PCE) increased at a 3.0% annualized rate - a solid pace.

...

The increase in real GDP in the first quarter primarily reflected a positive contribution from personal consumption expenditures (PCE) that was partly offset by negative contributions from exports, private inventory investment, nonresidential fixed investment, residential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

However the the change in inventories subtracted 0.57 percentage points from growth in Q1, exports subtracted 0.83 percentage points, and both non-residential and residential investment were negative.

The first graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.The drag from state and local governments (red) appeared to have ended last year after an unprecedented period of state and local austerity (not seen since the Depression). However State and local governments subtracted from GDP in Q1.

Overall I expect state and local governments to continue to make a small positive contributions to GDP in 2014.

The blue bars are for residential investment (RI). RI added to GDP growth for 12 consecutive quarters, before subtracting in Q4 2013 and Q1 2014. However since RI is still very low, I expect RI to make a positive contribution to GDP in 2014.

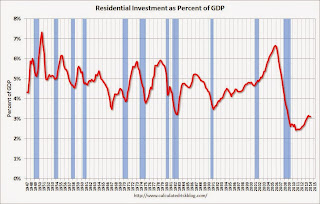

Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions.

Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions.I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

The third graph shows non-residential investment in structures, equipment and "intellectual property products".I'll add details for investment in offices, malls and hotels next week.

Overall this was a weak report, although PCE growth was decent. Private investment (even excluding the change in inventories) was negative, and that is the key to more growth going forward.

ADP: Private Employment increased 220,000 in April

by Calculated Risk on 4/30/2014 08:19:00 AM

Private sector employment increased by 220,000 jobs from March to April according to the April ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 210,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "The job market is gaining strength. After a tough winter employers are expanding payrolls across nearly all industries and company sizes. The recent pickup in job growth at mid-sized companies may signal better business confidence. Job market prospects are steadily improving.”

Note: ADP hasn't been very useful in directly predicting the BLS report on a monthly basis, but it might provide a hint. The BLS report for April will be released on Friday.

MBA: Mortgage Applications Decrease in Latest Survey, Refinance Activity Lowest Since 2008

by Calculated Risk on 4/30/2014 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 25, 2014. ...

The Refinance Index decreased 7 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. ...

“Both purchase and refinance application activity fell last week, and the market composite index is at its lowest level since December 2000,” said Mike Fratantoni, MBA’s Chief Economist. “Purchase applications decreased 4 percent over the week, and were 21 percent lower than a year ago. Refinance activity also continued to slide despite a 30-year fixed rate that was unchanged from the previous week. The refinance index dropped 7 percent to the lowest level since 2008, continuing the declining trend that we have seen since May 2013.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 4.49 percent, with points decreasing to 0.38 from 0.50 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 76% from the levels in May 2013 (almost one year ago).

With the mortgage rate increases, refinance activity will be very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 19% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index.

Tuesday, April 29, 2014

Wednesday: FOMC Announcement, Q1 GDP and more

by Calculated Risk on 4/29/2014 06:54:00 PM

From Goldman Sachs economist Kris Dawsey: FOMC Preview: A Bit Brighter

The April FOMC meeting will probably be a quiet one compared with the March meeting, with no press conference or Summary of Economic Projections (SEP) to be released. We anticipate that the Fed will want to make relatively few changes to the statement, especially in the monetary policy paragraphs. The largest changes will probably occur in the first paragraph on economic activity, reflecting the passing drag from adverse weather.Wednesday:

...

Regarding the FOMC's policy decision, a further $10bn/month tapering of asset purchases is almost a foregone conclusion, split equally between Treasuries and MBS. This would bring the monthly purchase amount down to $45bn ($25bn Treasuries and $20bn MBS), to take effect in May. ...

It appears likely that Minneapolis Fed President Kocherlakota—who lodged a dovish dissent at the March meeting—will not dissent to the April statement, based on a recent interview.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in April, up from 191,000 in March.

• At 8:30 AM, Q1 GDP (advance estimate). This is the advance estimate of Q1 GDP from the BEA. The consensus is that real GDP increased 1.1% annualized in Q1.

• At 9:45 AM, the Chicago Purchasing Managers Index for April. The consensus is for an increase to 56.9, up from 55.9 in March.

• At 2:00 PM, the FOMC Meeting Announcement. No change in interest rates is expected (for a long time). However the FOMC is expected to reduce QE3 asset purchases by $10 billion per month at this meeting.

An exciting time for the Data Tribe

by Calculated Risk on 4/29/2014 03:12:00 PM

This is an exciting time to be a member of the "data tribe" (those who follow data closely and are willing to change their views based on the data). There are two new internet sites worth following: The Upshot at the NY Times, and Vox (both feeds added to right sidebar).

Here is fun piece from Neil Irwin at The Upshot: No One Cares About Economic Data Anymore. That’s Good News.

If people in your office seem to be tingling with excitement this week, it is probably because of all the big economic news on the way. The two biggest regular United States economic reports are scheduled to come out, with first-quarter gross domestic product on tap for Wednesday and April jobs numbers out on Friday. Federal Reserve policy makers are meeting Tuesday and Wednesday for one of their regular sessions to set the nation’s monetary policy. And a variety of other important data releases are coming, including personal income and spending, manufacturing and home prices.Personally I'm excited about all the data to be released this week, but Irwin makes an excellent point. Most people don't feel the need to pay close attention any more.

What, no tingling? You’re not alone. Because as important as all that stuff is, it is substantially less important, and less interesting, than it has been any time in the last seven years. The economy has gotten boring, and that’s fantastic news — even if it would be even better news if that underlying growth path were a bit stronger.

P.S. A suggestion for The Upshot - drop the "The", just Upshot, it is cleaner.

NMHC Survey: Apartment Market Conditions Tighter in April 2014

by Calculated Risk on 4/29/2014 12:04:00 PM

From the National Multi Housing Council (NMHC): Overbuilding Overblown? Apartment Markets Expand in April NMHC Quarterly Survey

Apartment markets rebounded from a soft January, with all four indexes above the breakeven level of 50 in the latest National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. Last year’s concerns of overbuilding or lack of capital have largely eased, reflected in market tightness (56), sales volume (52), equity financing (53) and debt financing (63) all above 50 for the first time since April 2013.

“Supply appears to have ramped up enough to meet approximate ongoing demand with few, if any, signs of irrational exuberance,” said NMHC Senior Vice President of Research and Chief Economist Mark Obrinsky. “A handful of submarkets are facing a temporary surge in new deliveries that may put downward pressure on occupancy rates or rent growth. However, increased development costs could well keep a lid on new supply.”

...

The Market Tightness Index rose from 41 to 56. Almost half (47 percent) of respondents reported unchanged conditions, and approximately one-third (32 percent) saw conditions as tighter than three months ago, in contrast with January’s survey, where almost one-third saw conditions as looser than three months ago. This is the first time the index has indicated overall improving conditions since July 2013.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter. The quarterly increase was small, but indicates tighter market conditions.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. This survey has been bouncing around 50 - and now suggests vacancy rates might be close to a bottom.

HVS: Q1 2014 Homeownership and Vacancy Rates

by Calculated Risk on 4/29/2014 10:17:00 AM

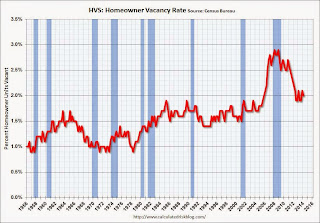

The Census Bureau released the Housing Vacancies and Homeownership report for Q1 2014 this morning.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate,except as a guide to the trend.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 64.8% in Q1, from 65.2% in Q4.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

The HVS homeowner vacancy decreased to 2.0% in Q1.

The HVS homeowner vacancy decreased to 2.0% in Q1.

It isn't really clear what this means. Are these homes becoming rentals?

Once again - this probably shows that the general trend is down, but I wouldn't rely on the absolute numbers.

The rental vacancy rate increased slightly in Q1 to 8.3% from 8.2% in Q4.

The rental vacancy rate increased slightly in Q1 to 8.3% from 8.2% in Q4.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate - and Reis reported that the rental vacancy rate is at the lowest level since 2001 - and might be close to a bottom.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply. However this does suggest that most of the bubble excess is behind us.

Case-Shiller: Comp 20 House Prices increased 12.9% year-over-year in February

by Calculated Risk on 4/29/2014 09:00:00 AM

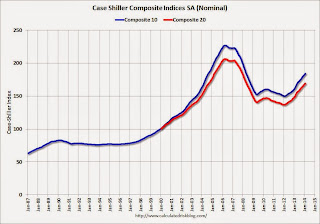

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3 month average of December, January and February prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Defy Weak Sales Numbers According to the S&P/Case-Shiller Home Price Indices

Data through February 2014, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, show that the annual rates of gain slowed for the 10-City and 20-City Composites. The Composites posted 13.1% and 12.9% in the twelve months ending February 2014.

Both Composites remained relatively unchanged month-over-month. Thirteen of the twenty cities declined in February. Cleveland had the largest decline of 1.6% followed by Chicago and Minneapolis at -0.9%. Las Vegas posted -0.1%, marking its first decline in almost two years. Tampa showed its largest decline of 0.7% since January 2012.

“Prices remained steady from January to February for the two Composite indices,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “The annual rates cooled the most we’ve seen in some time. The three California cities and Las Vegas have the strongest increases over the last 12 months as the West continues to lead. Denver and Dallas remain the only cities which have reached new post-crisis price peaks. The Northeast with New York, Washington and Boston are seeing some of the slowest year-over-year gains. However, even there prices are above their levels of early 2013. On a month-to-month basis, there is clear weakness. Seasonally adjusted data show prices rose in 19 cities, but a majority at a slower pace than in January.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 18.9% from the peak, and up 0.9% in February (SA). The Composite 10 is up 22.8% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 18.1% from the peak, and up 0.8% (SA) in February. The Composite 20 is up 23.4% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 13.1% compared to February 2013.

The Composite 20 SA is up 12.9% compared to February 2013.

Prices increased (SA) in 19 of the 20 Case-Shiller cities in February seasonally adjusted. (Prices increased in 7 of the 20 cities NSA) Prices in Las Vegas are off 44.5% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was at the consensus forecast for a 13.0% YoY increase. I'll have more on prices later.

Monday, April 28, 2014

Tuesday: Case-Shiller House Prices

by Calculated Risk on 4/28/2014 07:15:00 PM

Here is another graphic of changing demographics: The Next America. Some people look at this graphic and see the need to support an aging population - I look at this graphic, and I see one of the wonders of the 20th Century (increased life expectancy) - I also see that soon (by 2020) all of the largest cohorts will be under 40!

For Tuesday ... just wondering ... Will S&P post the press release online on a timely basis? And will the S&P website crash again?

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February. The consensus is for a 13.0% year-over-year increase in the Composite 20 index (NSA) for February. The Zillow forecast is for the Composite 20 to increase 12.8% year-over-year, and for prices to increase 0.6% month-to-month seasonally adjusted.

• At 10:00 AM, Conference Board's consumer confidence index for April. The consensus is for the index to increase to 83.0 from 82.3.

• Also at 10:00 AM, the Q1 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).