by Calculated Risk on 3/19/2014 11:59:00 AM

Wednesday, March 19, 2014

Philly Fed: State Coincident Indexes increased in 48 states in January

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for January 2014. In the past month, the indexes increased in 48 states and remained stable in two, for a one-month diffusion index of 96. Over the past three months, the indexes increased in 50 states, for a three-month diffusion index of 100.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In January, 49 states had increasing activity(including minor increases). This measure has been and up down over the last few years ...

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is all green again.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is all green again.AIA: Architecture Billings Index increased slightly in February

by Calculated Risk on 3/19/2014 09:43:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Shows Slight Improvement

After starting out the year on a positive note, there was another minor increase in the Architecture Billings Index (ABI) last month. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the February ABI score was 50.7, up slightly from a mark of 50.4 in January. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 56.8, down from the reading of 58.5 the previous month.

“The unusually severe weather conditions in many parts of the country have obviously held back both design and construction activity,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “The March and April readings will likely be a better indication of the underlying health of the design and construction markets. We are hearing reports of projects that had been previously shelved for extended periods of time coming back online as the economy improves.”

Regional averages: South (52.8),West (50.5), Northeast (48.3), Midwest (47.6) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.7 in February, up from 50.4 in January. Anything above 50 indicates expansion in demand for architects' services. This index has indicated expansion during 16 of the last 19 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. Even when positive, this index was not as strong as during the '90s - or during the bubble years of 2004 through 2006 - because the vacancy rates are still high for many CRE sectors. However, the readings over the last year and a half suggest some increase in CRE investment in 2014.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 3/19/2014 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 14, 2014. ...

The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index also decreased 1 percent from one week earlier....

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.50 percent from 4.52 percent, with points decreasing to 0.26 from 0.29 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) decreased to 4.39 percent from 4.41 percent, with points decreasing to 0.19 from 0.20 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 70% from the levels in May 2013.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 18% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index - but this is still very weak.

Tuesday, March 18, 2014

Wednesday: FOMC

by Calculated Risk on 3/18/2014 09:24:00 PM

Another interesting post from Atif Mian, Amir Sufi at House of Debt: The Most Important Economic Chart

[O]wners of capital are getting a bigger share of GDP than before. In other words, the share of profits has risen faster than wages. Second, the highest paid workers are getting a bigger share of the wages that go to labor.Wednesday:

The net result is that families at the higher end of the income distribution have received more of the income produced by the economy since the 1980s. The latter fact has been documented meticulously by the brilliant research of Thomas Piketty and Emmanuel Saez.

The widening gap between productivity and median income is a defining issue of our time. It is not just about inequality – important as that issue is. The widening gap between productivity and median income has serious implications for macroeconomic stability and financial crises.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, the AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

• At 2:00 PM, the FOMC Meeting Announcement. The FOMC is expected to reduce monthly QE3 asset purchases from $65 billion per month to $55 billion per month at this meeting.

• Also at 2:00 PM, the FOMC Forecasts will be released. This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen will hold a press briefing.

LA area Port Traffic: Down year-over-year in February

by Calculated Risk on 3/18/2014 06:01:00 PM

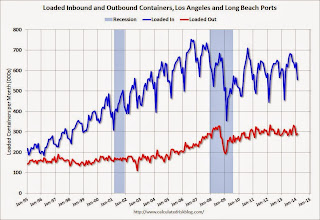

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for January since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was down 0.6% compared to the rolling 12 months ending in January. Outbound traffic was down 0.2% compared to 12 months ending in January.

Inbound traffic has generally been increasing, and outbound traffic has mostly been moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Inbound traffic was down 7% compared to February 2013 and outbound traffic was down 2%.

This suggests a decrease in trade the trade deficit with Asia in February.

A comment on Housing Starts

by Calculated Risk on 3/18/2014 01:41:00 PM

There were 123.5 thousand total housing starts in January and February this year (not seasonally adjusted, NSA), down 1% from the 124.8 thousand during the first two months of 2013.

Historically January and February are the two weakest months of the year for housing starts (NSA) due to winter weather - and the weather this year was especially severe - so I wouldn't read too much into the weak start for 2014. Note: Permits were up 5% for the first two months of 2014 compared to 2013 - still weak growth, but positive.

I don't blame all of the recent weakness on the weather (probably just a small factor) - there are also higher mortgage rates, higher prices and probably supply constraints in some areas. But I still think fundamentals support a higher level of starts, and I expect starts to pick up solidly again this year.

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family completions in 2014, but probably still below the 1997 through 2007 level of multi-family completions. Multi-family starts will probably move more sideways in 2014.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts have been moving up, and completions have followed.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Key Measures Shows Low Inflation in February

by Calculated Risk on 3/18/2014 11:15:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.2% annualized rate) in February. The 16% trimmed-mean Consumer Price Index also increased 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for February here. The price for fuel oil and other fuels increased sharply in February.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.2% annualized rate) in February. The CPI less food and energy increased 0.1% (1.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.0%, the trimmed-mean CPI rose 1.6%, and the CPI less food and energy rose 1.6%. Core PCE is for January and increased just 1.1% year-over-year.

On a monthly basis, median CPI was at 2.2% annualized, trimmed-mean CPI was at 1.9% annualized, and core CPI increased 1.4% annualized.

These measures suggest inflation remains below the Fed's target.

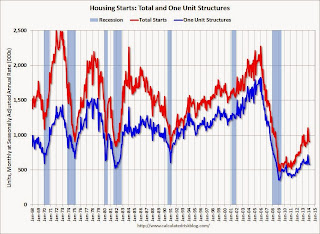

Housing Starts at 907 Thousand Annual Rate in February

by Calculated Risk on 3/18/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 907,000. This is 0.2 percent below the revised January estimate of 909,000 and is 6.4 percent below the February 2013 rate of 969,000.

Single-family housing starts in February were at a rate of 583,000; this is 0.3 percent above the revised January figure of 581,000. The February rate for units in buildings with five units or more was 312,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,018,000. This is 7.7 percent above the revised January rate of 945,000 and is 6.9 percent above the February 2013 estimate of 952,000.

Single-family authorizations in February were at a rate of 588,000; this is 1.8 percent below the revised January figure of 599,000. Authorizations of units in buildings with five units or more were at a rate of 407,000 in February.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased slightly in February (Multi-family is volatile month-to-month).

Single-family starts (blue) increased slightly in February.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was below expectations of 915 thousand starts in February. Note: Starts for January were revised up to 907 thousand from 880 thousand. I'll have more later.

Monday, March 17, 2014

Tuesday: Housing Starts, CPI

by Calculated Risk on 3/17/2014 08:39:00 PM

A reminder of a friendly bet I made with NDD on housing starts in 2014:

If starts or sales are up at least 20% YoY in any month in 2014, [NDD] will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.Of course, with the terms of the bet, we could both "win" at some point during the year. (I expect to "win" in a few months, but not now due to the severe weather and limited starts and sales in many parts of the country).

In February 2013, starts were at a 969 thousand seasonally adjusted annual rate (SAAR). For me to win, starts would have to be up 20% or at 1.162 million SAAR in February (not gonna happen). For NDD to win, starts would have to fall to 869 thousand SAAR (possible). NDD could also "win" if permits fall to 852 thousand SAAR from 952 thousand SAAR in February 2013.

Tuesday:

• At 8:30 AM ET, Consumer Price Index for February. The consensus is for a 0.1% increase in CPI in January and for core CPI to increase 0.1%.

• Also at 8:30 AM, Housing Starts for February. Total housing starts were at 880 thousand (SAAR) in January. Single family starts were at 573 thousand SAAR in January. The consensus is for total housing starts to increase to 915 thousand (SAAR) in February.

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in February

by Calculated Risk on 3/17/2014 05:56:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in February.

From CR: Total "distressed" share is down in all of these markets, mostly because of a sharp decline in short sales.

Foreclosures are down in most of these areas too, although foreclosures are up a little in Las Vegas (there was a state law change that slowed foreclosures dramatically in Nevada at the end of 2011 - so it isn't a surprise that foreclosures are up a little year-over-year). Orlando also saw a slight increase in foreclosures.

The All Cash Share (last two columns) is declining in most areas year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Feb-14 | Feb-13 | Feb-14 | Feb-13 | Feb-14 | Feb-13 | Feb-14 | Feb-13 | |

| Las Vegas | 14.0% | 37.9% | 12.0% | 10.2% | 26.0% | 48.1% | 46.8% | 59.5% |

| Reno** | 13.0% | 37.0% | 7.0% | 13.0% | 20.0% | 50.0% | ||

| Phoenix | 5.3% | 15.0% | 8.3% | 13.8% | 13.7% | 28.8% | 33.6% | 46.1% |

| Sacramento | 12.3% | 30.3% | 7.0% | 13.5% | 19.3% | 43.8% | 26.5% | 39.5% |

| Minneapolis | 5.0% | 11.3% | 25.3% | 32.7% | 30.3% | 43.9% | ||

| Mid-Atlantic | 7.7% | 13.6% | 10.9% | 12.1% | 18.6% | 25.6% | 21.4% | 22.8% |

| Orlando | 9.7% | 22.0% | 24.6% | 24.0% | 34.3% | 46.0% | 48.2% | 56.3% |

| California * | 9.6% | 22.4% | 8.2% | 17.9% | 17.8% | 40.3% | ||

| Bay Area CA* | 7.0% | 20.2% | 5.4% | 13.9% | 12.4% | 34.1% | 26.8% | 32.4% |

| So. California* | 9.4% | 22.4% | 6.8% | 16.2% | 16.2% | 38.6% | 30.9% | 36.9% |

| Chicago | 12.0% | NA | 33.0% | NA | 45.0% | 49.0% | ||

| Hampton Roads | 30.7% | 34.2% | ||||||

| Charlotte | 10.5% | 15.9% | ||||||

| Naples | 12.2% | 22.1% | ||||||

| Georgia*** | 35.3% | NA | ||||||

| Toledo | 41.8% | 46.7% | ||||||

| Des Moines | 22.4% | 21.9% | ||||||

| Peoria | 30.9% | 26.8% | ||||||

| Tucson | 37.0% | 39.5% | ||||||

| Pensacola | 41.0% | 36.1% | ||||||

| Memphis* | 22.1% | 29.0% | ||||||

| Springfield IL** | 17.9% | 26.4% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||