by Calculated Risk on 3/13/2014 02:21:00 PM

Thursday, March 13, 2014

DataQuick: February Bay Area Home Sales Slowest Since 2008

From DataQuick: Bay Area Home Sales Slowest Since 2008

Bay Area home buyers were kept scrambling last month as a continued lack of inventory contributed heavily to a six-year low in sales. ...And on distressed sales:

A total of 4,963 new and resale houses and condos sold in the nine-county Bay Area last month. That was the lowest for any February since 2008, when 3,989 homes sold. Last month’s sales rose 5.7 percent from 4,696 in January, and fell 8.2 percent from 5,404 in February 2013, according to San Diego-based DataQuick.

Since 1988, when DataQuick’s statistics begin, February sales have ranged from a low of 3,989 in 2008 to a high of 8,901 in 2002. Last month’s sales were 19.9 percent below the average number of February sales – 6,194 – since 1988. Sales haven’t been above average for any month in more than seven years.

“A number of factors can keep a lid on sales. Affordability, for example. Or hard-to-get mortgages. These factors certainly play a role today, but clearly the main culprit is an inadequate supply of homes for sale. It’s going to be fascinating to watch how things play out between now and June. At some point rising home prices will trigger a more significant increase in the number of homes on the market. It’s just a question of when,” said John Walsh, DataQuick president.

Distressed property sales – the combination of foreclosure resales and “short sales” – made up about 12.5 percent of last month’s resale market. That was down from 14.0 percent in January and down from 34.1 percent a year earlier.This decline in sales is due to several factors: limited inventory, higher prices, and fewer distressed sales. With the recent price increases, more inventory should come on the market this year.

Foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 5.4 percent of resales in February, up from a revised 5.2 percent the month before, and down from 13.9 percent a year ago. Foreclosure resales peaked at 52.0 percent in February 2009. The monthly average for foreclosure resales over the past 17 years is 9.9 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 7.0 percent of Bay Area resales last month. That was down from an estimated 8.8 percent in January and down from 20.2 percent a year earlier.

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in February

by Calculated Risk on 3/13/2014 10:58:00 AM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for several selected cities in February.

From CR: This is just a few markets for February - more to come.

Total "distressed" share is down in all of these markets, mostly because of a sharp decline in short sales.

Foreclosures are down in most of these areas too, although foreclosures are up a little in Las Vegas (there was a state law change that slowed foreclosures dramatically in Nevada at the end of 2011 - so it isn't a surprise that foreclosures are up a little year-over-year).

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably decline.

In general it appears the housing market is slowly moving back to normal.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Feb-14 | Feb-13 | Feb-14 | Feb-13 | Feb-14 | Feb-13 | Feb-14 | Feb-13 | |

| Las Vegas | 14.0% | 37.9% | 12.0% | 10.2% | 26.0% | 48.1% | 46.8% | 59.5% |

| Reno** | 13.0% | 37.0% | 7.0% | 13.0% | 20.0% | 50.0% | ||

| Phoenix | 5.3% | 15.0% | 8.3% | 13.8% | 13.7% | 28.8% | 33.6% | 46.1% |

| Sacramento | 12.3% | 30.3% | 7.0% | 13.5% | 19.3% | 43.8% | 26.5% | 39.5% |

| Minneapolis | 5.0% | 11.3% | 25.3% | 32.7% | 30.3% | 43.9% | ||

| Mid-Atlantic | 7.7% | 13.6% | 10.9% | 12.1% | 18.6% | 25.6% | 21.4% | 22.8% |

| So. California* | 9.4% | 22.4% | 6.8% | 16.2% | 16.2% | 38.6% | 30.9% | 36.9% |

| Hampton Roads | 30.7% | 34.2% | ||||||

| Memphis* | 22.1% | 29.0% | ||||||

| Springfield IL** | 17.9% | 26.4% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Retail Sales increased 0.3% in February

by Calculated Risk on 3/13/2014 08:55:00 AM

On a monthly basis, retail sales increased 0.3% from January to February (seasonally adjusted), and sales were up 1.5% from February 2013. Sales in December and January were revised down from a 0.4% decrease to a 0.6% decrease. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $427.2 billion, an increase of 0.3 percent from the previous month, and 1.5 percent above February 2013. ... The December 2013 to January 2014 percent change was revised from -0.4 percent to -0.6 percent.

Click on graph for larger image.

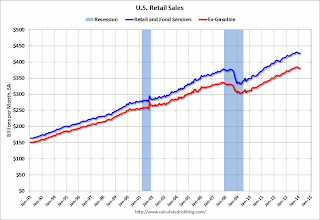

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos increased 0.3%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 2.2% on a YoY basis (1.5% for all retail sales).

Retail sales ex-gasoline increased by 2.2% on a YoY basis (1.5% for all retail sales).The increase in February was above consensus expectations, but the downward revisions to December and January were negatives.

However, it appears much of the weakness in January and February was due to the weather.

Weekly Initial Unemployment Claims decline to 315,000

by Calculated Risk on 3/13/2014 08:30:00 AM

The DOL reports:

In the week ending March 8, the advance figure for seasonally adjusted initial claims was 315,000, a decrease of 9,000 from the previous week's revised figure of 324,000. The 4-week moving average was 330,500, a decrease of 6,250 from the previous week's revised average of 336,750.The previous week was revised up from 323,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 330,500.

This was below the consensus forecast of 330,000. The 4-week average is mostly moving sideways ...

Wednesday, March 12, 2014

Thursday: Retail Sales, Unemployment Claims

by Calculated Risk on 3/12/2014 09:07:00 PM

Some more interesting analysis from Atif Mian and Amir Sufi: Weakening Economy or Just Bad Winter?

Retail spending by households in January 2014 was a major disappointment, coming in well below expectations. January 2014 was also one of the coldest months in memory in many parts of the country. Was the extreme cold weather to blame for weak retail spending? Or is the economy weakening? These questions are especially pressing given the release of data tomorrow on February 2014 retail spending–February again was a very cold month.Bottom line: Blame the weakness on the snow!

We use state-level data on new auto purchases to attack this question. Here is the basic idea. Not all states experienced a horrible January 2014 — in fact, much of the western part of the country actually was warmer than normal. We can use this variation across the country in January weather to see if national auto sales were brought down by states that experienced abnormally cold temperatures.

...

The evidence is pretty clear. New auto purchases in January 2014 were more than 5% down in states that were more than 7 degrees below their normal January temperature. New auto purchases were down slightly in states that were between -7 and -4 degrees below normal. In the rest of the country where temperatures were closer to normal, new auto purchases were quite strong.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 330 thousand from 323 thousand.

• Also at 8:30 AM, Retail sales for February will be released. The consensus is for retail sales to increase 0.2% in February, and to increase 0.1% ex-autos.

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales (business inventories) report for January. The consensus is for a 0.4% increase in inventories.

Lawler: Early Read on Existing Home Sales in February

by Calculated Risk on 3/12/2014 04:06:00 PM

From housing economist Tom Lawler:

Based on local realtor/MLS reports I have seen across the country, I estimate that US existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 4.60 million in February, down 0.4% from January’s seasonally adjusted pace. There is little doubt that severe weather in many parts of the country contributed to last month’s weak sales, as was the case in many areas in January.

Some of the biggest YOY declines in sales, however, were not in areas with “bad” weather, but where (1) there were big YOY declines in “distressed” sales, (2) big YOY declines in “investor” purchases; (3) big rebounds in home prices over the past year+; and (4) no growth, or in several area declines in primary-residence home purchases.

CR Note: Based on Lawler's estimate, sales will be down about 7% from the February 2013 sales rate of 4.95 million. Some of this weakness is weather related, but there are other factors (as Lawler noted there are fewer distressed sales, less investor buying, and higher prices).

Sacramento Housing in February: Total Sales down 17% Year-over-year, Equity (Conventional) Sales up 18%, Active Inventory increases 88%

by Calculated Risk on 3/12/2014 02:25:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For a long time, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In February 2014, 19.1% of all resales (single family homes) were distressed sales. This was down from 19.5% last month, and down from 43.8% in February 2013.

The percentage of REOs was at 6.6%, and the percentage of short sales was 12.5%.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales over the last 2 years (blue).

Active Listing Inventory for single family homes increased 87.8% year-over-year in February.

Cash buyers accounted for 26.5% of all sales, down from 26.6% last month (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 17.2% from February 2013, but conventional sales were up 17.8% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

As I've noted before, we are seeing a similar pattern in other distressed areas. This suggests what will happen in other areas: 1) Flat or declining overall existing home sales, 2) but increasing conventional sales, 3) Less investor buying, 4) more inventory, and 5) slower price increases.

Weekly Update: Housing Tracker Existing Home Inventory up 5.8% year-over-year on March 10th

by Calculated Risk on 3/12/2014 11:33:00 AM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for January). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2014 is now 5.8% above the same week in 2013 (red is 2014, blue is 2013).

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Las Vegas Real Estate in February: Year-over-year Non-contingent Inventory Doubles

by Calculated Risk on 3/12/2014 09:24:00 AM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports increasing home prices, slower sales

GLVAR said the total number of existing local homes, condominiums and townhomes sold in February was 2,518, down from 2,565 in January and down from 3,232 one year ago.There are several key trends that we've been following:

...

GLVAR continued to chart the transition from distressed to more traditional home sales, where lenders are not controlling the transaction. GLVAR has been reporting fewer short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. For instance, in February, 14 percent of all existing local home sales were short sales, down from 17 percent in January. Another 12 percent of all February sales were bank-owned properties, up from 11 percent in January.

GLVAR said 46.8 percent of all existing local homes sold in February were purchased with cash. That’s unchanged from January, but down from a peak of 59.5 percent set in February 2013.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service in February was 13,624. That’s up 0.6 percent from 13,537 single-family homes listed for sale at the end of January, but down 3.5 percent from 14,120 homes one year ago. ...

By the end of February, GLVAR reported 6,316 single-family homes listed without any sort of offer. That’s down 3.4 percent from 6,541 such homes listed in January, but still a 107.3 percent jump from one year ago.

emphasis added

1) Overall sales were down about 22% year-over-year.

2) Conventional sales are up 11% year-over-year. In February 2013, only 51.9% of all sales were conventional. This year, in February 2014, 74% were conventional.

3) The percent of cash sales is down year-over-year (investor buying appears to be declining).

4) and most interesting right now is that non-contingent inventory (year-over-year) is now increasing rapidly. Non-contingent inventory is up 107.3% year-over-year (more than double)!

Inventory has clearly bottomed in Las Vegas (A major theme for housing last year). And fewer distressed sales and more inventory means price increases will slow (a major theme for 2014).

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 3/12/2014 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 7, 2014. ...

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.52 percent from 4.47 percent, with points increasing to 0.29 from 0.28 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) increased to 4.41 percent from 4.37 percent, with points unchanged at 0.20 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 70% from the levels in May 2013.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 18% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index - but this is still very weak.

Note: Jumbo rates are still below conforming rates.