by Calculated Risk on 3/02/2014 10:36:00 AM

Sunday, March 02, 2014

LA Times: New Home construction still near record lows

From E. Scott Reckard at the LA Times: Supply of new homes for sale remains extremely low

About 15,000 new homes will be sold this year in the six-county region — 58% less than the 20-year average, predicts Pete Reeb, an economist with John Burns Real Estate Consulting in Irvine.Builders in LA have choices: build in more remote areas with open land - but those areas are still struggling, build smaller in-fill projects, or go vertical (high rise condominium projects). Over time, I expect the LA area to go vertical.

... Only about 10% of today's new projects are attached condominiums, compared with half in previous expansions, said housing consultant Jeff Meyers, who heads Meyers Research in Beverly Hills. ...

The delayed recovery in home construction owes to a variety of factors. Many smaller builders were wiped out by the housing crash, and those that remain can't get financial backing from institutional investors. The larger, publicly traded builders, meanwhile, are reviving stalled projects. But they remain leery of launching new developments in more affordable areas with open land, such as the Inland Empire, where income and employment remain depressed.

Developers are also struggling with a shortage of ready-to-build lots — those with government approvals, streets and utilities in place. That's because planning for new developments screeched to a halt when the housing market imploded. It will be at least next year before the slowly reviving process makes many new projects feasible, said Randall Lewis, executive vice president of Lewis Group ...

Saturday, March 01, 2014

Fannie Mae, Freddie Mac: Mortgage Serious Delinquency rate declined in January

by Calculated Risk on 3/01/2014 07:08:00 PM

Fannie Mae reported Friday that the Single-Family Serious Delinquency rate declined in January to 2.33% from 2.38% in December. The serious delinquency rate is down from 3.18% in January 2013, and this is the lowest level since November 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined in January to 2.34% from 2.39% in December. Freddie's rate is down from 3.20% in January 2012, and is at the lowest level since February 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The Fannie Mae serious delinquency rate has fallen 0.85 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in about eighteen months. Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in late 2015 or 2016.

Schedule for Week of March 2nd

by Calculated Risk on 3/01/2014 12:42:00 PM

This will be a busy week for economic data with several key reports including the February employment report on Friday.

Other key reports include the ISM manufacturing index on Monday, February vehicle sales on Monday, January Personal Income and Outlays on Monday, the ISM service index on Wednesday, and the January trade deficit report on Friday.

The Fed will release the Q4 Flow of Funds report on Thursday.

All day: Light vehicle sales for February. The consensus is for light vehicle sales to increase to 15.4 million SAAR in February (Seasonally Adjusted Annual Rate) from 15.2 million SAAR in January.

All day: Light vehicle sales for February. The consensus is for light vehicle sales to increase to 15.4 million SAAR in February (Seasonally Adjusted Annual Rate) from 15.2 million SAAR in January.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

8:30 AM ET: Personal Income and Outlays for January. The consensus is for a 0.2% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:00 AM ET: The Markit US PMI Manufacturing Index for February.

10:00 AM ET: ISM Manufacturing Index for February. The consensus is for an increase to 51.9 from 51.3 in January.

10:00 AM ET: ISM Manufacturing Index for February. The consensus is for an increase to 51.9 from 51.3 in January.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in January at 51.3%. The employment index was at 52.3%, and the new orders index was at 51.2%.

10:00 AM: Construction Spending for January. The consensus is for a 0.1% decrease in construction spending.

No economic releases scheduled.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 158,000 payroll jobs added in January, down from 175,000 in January.

10:00 AM: ISM non-Manufacturing Index for February. The consensus is for a reading of 53.6, down from 54.0 in January. Note: Above 50 indicates expansion, below 50 contraction.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Early: Trulia Price Rent Monitors for February. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 338 thousand from 348 thousand.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for January. The consensus is for a 0.5% decrease in January orders.

12:00 PM: Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: Employment Report for February. The consensus is for an increase of 150,000 non-farm payroll jobs in February, up from the 113,000 non-farm payroll jobs added in January.

The consensus is for the unemployment rate to be unchanged at 6.6% in February.

The following graph shows the percentage of payroll jobs lost during post WWII recessions through January.

The following graph shows the percentage of payroll jobs lost during post WWII recessions through January.The economy has added 8.5 million private sector jobs since employment bottomed in February 2010 (7.8 million total jobs added including all the public sector layoffs).

There are still almost 291 thousand fewer private sector jobs now than when the recession started in 2007.

8:30 AM: Trade Balance report for January from the Census Bureau.

8:30 AM: Trade Balance report for January from the Census Bureau. Imports increased, and exports decreased in December.

The consensus is for the U.S. trade deficit to increase to $39.0 billion in January from $38.7 billion in December.

3:00 PM: Consumer Credit for January from the Federal Reserve. The consensus is for credit to increase $14.5 billion in January.

Unofficial Problem Bank list declines to 566 Institutions

by Calculated Risk on 3/01/2014 10:21:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for February 28, 2014.

Changes and comments from surferdude808:

Busy week as the FDIC closed a couple of banks, provided an update on its enforcement action activities, and released industry results and the Official Problem Bank List for the fourth quarter of 2013. In all, there were 12 removals that dropped the unofficial list to 566 institutions with assets of $182.1 billion. Assets declined by $10.9 billion from last week with $4.5 billion coming from the update to assets through year-end 2013. A year ago, the list held 808 institutions with assets of $298.1 billion.

Among the 12 removals were six action terminations, four mergers, and two failures. Action were terminated against Patriot Bank, Houston, TX ($1.3 billion); Kaw Valley Bank, Topeka, KS ($364 million); Insouth Bank, Brownsville, TN ($301 million); Northpointe Bank, Grand Rapids, MI ($300 million); SouthernTrust Bank, Goreville, IL ($49 million); and D'Hanis State Bank, Hondo, TX ($47 million). Also, the FDIC terminated a Prompt Corrective Action order against Oxford Bank, Oxford, MI ($261 million Ticker: OXBC).

Removals through unassisted mergers include First Place Bank, Warren, OH ($2.5 billion Ticker: FPFC); Great Florida Bank, Coral Gables, FL ($1.0 billion Ticker: GFLB); First National Bank of New York, Merrick, NY ($255 million); and Premier Service Bank, Riverside, CA ($128 million).

After a month off, the FDIC got back to closing two banks -- Millennium Bank, National Association, Sterling, VA ($130 million Ticker: MBVA); and Vantage Point Bank, Horsham, PA ($63 million).

The FDIC told us this week there are 467 institutions with assets of $153 billion on the Official Problem Bank List. The unofficial list has 99 more institutions and $29.1 billion more in assets. The difference is down from 130 institutions and $47.2 billion in assets last quarter. The differences have narrowed from 157 institutions and $65 billion in assets a year ago. In contrast, the official list had higher totals four years ago with 58 and $76.9 billion more in institutions and assets, respectively.

Friday, February 28, 2014

Bank Failure #5 in 2014: Vantage Point Bank, Horsham, Pennsylvania

by Calculated Risk on 2/28/2014 06:14:00 PM

From the FDIC: First Choice Bank, Mercerville, New Jersey, Assumes All of the Deposits of Vantage Point Bank, Horsham, Pennsylvania

As of December 31, 2013, Vantage Point Bank had approximately $63.5 million in total assets and $62.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $8.5 million. Compared to other alternatives, First Choice Bank's acquisition was the least costly resolution for the FDIC's DIF. Vantage Point Bank is the 5th FDIC-insured institution to fail in the nation this year, and the first in Pennsylvania.A twofer Friday!

Bank Failure #4 in 2014: Millennium Bank, National Association, Sterling, Virginia

by Calculated Risk on 2/28/2014 05:45:00 PM

From the FDIC: WashingtonFirst Bank, Reston, Virginia, Assumes All of the Deposits of Millennium Bank, National Association, Sterling, Virginia

As of December 31, 2013, Millennium Bank, N.A. had approximately $130.3 million in total assets and $121.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $7.7 million. Compared to other alternatives, WashingtonFirst Bank's acquisition was the least costly resolution for the FDIC's DIF. Millennium Bank, N.A. is the 4th FDIC-insured institution to fail in the nation this year, and the first in Virginia.It is Friday! On pace for about the same number of bank failures as last year (24).

Lawler: If New Home Sales report Accurate, Suggests Large Builder Share Down

by Calculated Risk on 2/28/2014 04:06:00 PM

From housing economist Tom Lawler: Government New Home Sales Report, If Accurate, Suggests Large Builder Share Down; Aggressive Home Price Hikes May Be to Blame

The Commerce Department earlier this week estimated that new SF home sales ran at a seasonally adjusted annual rate of 468,000, up 9.6% from December’s upwardly-revised (to 427,000 from 414,000) pace. Estimated sales for October and November were revised downward slightly, and the estimated sales for the fourth quarter of 2013 were not revised.

While January’s new SF home sales estimate was somewhat higher than I expected, I was even more surprised that last quarter’s sales estimates were not revised downward. Most large publicly-traded home builders reporting on a calendar quarter showed relatively weak net orders last quarter compared to a year earlier, and the nine large builders I regularly track1 had combined net orders that were down 3.8% from a year earlier (not seasonally adjusted, of course.) That contrasts sharply with Census estimates showing an unadjusted YOY increase in sales last quarter of about 15%.

Of course, comparisons of builder results and Census sales estimates are tricky, given (1) the different treatment of cancellations; and (2) differences in the timing of the recognition of contract signings. Nevertheless, the difference results were “unusual,” and over the last two years builder results that varied materially from Census preliminary estimates have been a decent predictor of revisions to Census estimates of SF sales.

If in fact the Census sales estimates are reasonable (further revisions will occur, given its methodology), an implication would be that large builders’ share of the new SF home market declined significantly in the second half of last year. One possible reason is that many of the large publicly-traded builders, facing demand that exceeded their ability to supply new homes (in several instances because of “supply-chain” issues) in the early part of the year, jacked up prices by not just unusually large amounts, but by more than other builders. The combination of higher mortgage rates and these unusually aggressive price hikes not only slowed their sales, but also slowed their sales relative to other builders. Given that the huge price hikes at many large builders pushed margins on closed sales in the second half of last year to the highest levels in seven to eight years, it’s perhaps not “shocking” that other builders weren’t as aggressive.

Given the optimistic sales plans most of these large builders have for 2014 – backed by rapid expansions in their land/lot acquisitions over the last one-to-two years – it seems unlikely that these large publicly-traded builders will be able to hike prices much if at all this year unless they are will to see their share erode further, which seems unlikely.

1 D.R. Horton, Pulte, NVR, Ryland, Beazer, Meritage, Standard Pacific, MDC, and M/I.

Zillow: Negative Equity declines further in Q4 2013

by Calculated Risk on 2/28/2014 01:14:00 PM

From Zillow: Negative Equity Crosses 20 Percent Threshhold to End 2013

According to the fourth quarter Zillow Negative Equity Report, the national negative equity rate dipped below 20 percent to 19.4 percent for the first time in years, thereby reducing negative equity by roughly a third from its 31.4 percent peak in the first quarter of 2012. Negative equity has fallen for seven consecutive quarters as home values have risen, freeing almost 3.9 million homeowners nationwide in 2013. The national negative equity rate fell from 27.5 percent of all homeowners with a mortgage as of the end of the fourth quarter of 2012, and 21 percent in the third quarter. However, more than 9.8 million homeowners with a mortgage still remain underwater.The following graph from Zillow shows negative equity by Loan-to-Value (LTV) in Q4 2013 compared to Q4 2012.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From Zillow:

Figure 6 shows the loan-to-value (LTV) distribution for homeowners with a mortgage in 2013 Q4 versus 2012 Q4. Even though many homeowners are still underwater and haven’t crossed the 100 percent LTV threshold to enter into positive equity, they are moving in the right direction.Almost half of the borrowers with negative equity have a LTV of 100% to 120% (the light red columns). Most of these borrowers are current on their mortgages - and they have probably either refinanced with HARP or the loans are well seasoned (most of these properties were purchased in the 2004 through 2006 period, so borrowers have been current for eight years or so). In a few years, these borrowers will have positive equity.

The key concern is all those borrowers with LTVs above 140% (about 6.5% of properties with a mortgage according to Zillow). It will take many years to return to positive equity ... and a large percentage of these properties will eventually be distressed sales (short sales or foreclosures).

Note: CoreLogic will release their Q4 negative equity report in the next couple of weeks. For Q3, CoreLogic reported there were 6.4 million properties with negative equity, and that will be down further in Q4.

NAR: Pending Home Sales Index down 9% year-over-year

by Calculated Risk on 2/28/2014 10:59:00 AM

From the NAR: Pending Home Sales Hold Steady in January

The Pending Home Sales Index, a forward-looking indicator based on contract signings, edged up 0.1 percent to 95.0 in January from an upwardly revised 94.9 in December, but is 9.0 percent below January 2013 when it was 104.4.A few comments:

...

The December index reading was the lowest since November 2011, when it stood at 94.6.

The PHSI in the Northeast rose 2.3 percent to 79.0 in January, but is 5.3 percent below a year ago. In the Midwest the index declined 2.5 percent to 92.9 in January, and is 9.3 percent lower than January 2013. Pending home sales in the South increased 3.5 percent to an index of 111.2 in January, and is 5.5 percent below a year ago. The index in the West fell 4.8 percent in January to 84.2, and is 17.5 percent below January 2013.

Existing-home sales are expected to be weak in the first quarter

• Mr. Yun blamed some of the decline on the weather (the weather was unusually bad again in January), but the index remained weak in the South too (down 5.5% year-over-year and probably not weather), and in the West (partially related to low inventories).

• My view is there were several reasons for the decline in this index: weather in some areas, fewer distressed sales, less investor buying, fewer "pending" short sales, and low inventories. I think fewer distressed sales, fewer "pending" short sales, and less investor buying are all signs of a healthier market - even if overall sales decline.

• Mr Yun lowered has forecast for 2014 to 5.0 million existing home sales, down from his previous forecast of 5.1 million existing home sales this year. I'll take the under on his new forecast, and I think it would be a positive sign if sales were under 5 million in 2014 as long as distressed sales continue to decline and conventional sales increase.

• Of course, for housing, what really matters for the economy and employment is new home sales (not existing), and housing starts.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in February and March.

Final February Consumer Sentiment at 81.6, Chicago PMI at 59.8

by Calculated Risk on 2/28/2014 09:55:00 AM

Click on graph for larger image.

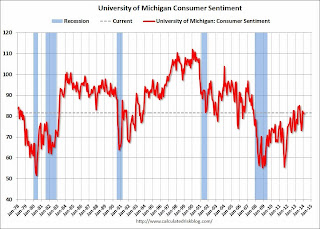

• The final Reuters / University of Michigan consumer sentiment index for February increased to 81.6 from the January reading of 81.2, and from the preliminary February reading of 81.2.

This was above the consensus forecast of 81.2. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

I expect to see sentiment at post-recession highs very soon.

• From the Chicago ISM:

February 2014:

The Chicago Business Barometer remained broadly unchanged at 59.8 in February compared with 59.6 in January, as a double-digit gain in Employment offset declines in New Orders, Production and Order Backlogs. ... Some panellists cited the negative effect of the poor weather on their business, although overall this appeared to have a minor impact that was only visible in longer supplier lead times.This was above the consensus estimate of 57.8.

After expanding at a faster rate in January, Production and New Orders decelerated in February, while a more pronounced set back was seen in Order Backlogs. In contrast, the Employment Indicator bounced back sharply in February, jumping out of contraction, and nearly reversing the declines seen in the previous two months.

Commenting on the MNI Chicago Report, Philip Uglow, Chief Economist at MNI Indicators said, “The latest Chicago Report confirms that the US economic recovery continued in February, with New Orders and Production remaining at high levels.”