by Calculated Risk on 2/07/2014 10:02:00 AM

Friday, February 07, 2014

Comments on Employment Report: Disappointing Payroll Number

This was another disappointing employment report, but there were several positive - as an example there were upward revisions to prior months, the unemployment rate declined while the participation rate increased (a good sign), the number of long term unemployed declined, and the number of people working part time for economic reasons declined sharply.

Private payroll employment increased 142 thousand and is now 291 thousand below the previous peak (total employment is still 866 thousand below the peak in January 2008). It is likely that private employment will be at a new high in March.

Of course government employment was down again, and even state and local employment is barely above the post-recession minimum (last graph).

This is the second consecutive month with a disappointing headline payroll number, but my outlook hasn't changed (I still expect payroll employment to pickup this year). Of course if the employment data continues at this level, I'll change my mind.

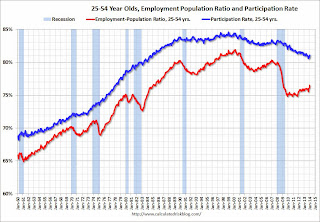

Employment-Population Ratio, 25 to 54 years old

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in January to 81.1% from 80.7%, and the 25 to 54 employment population ratio increased to 76.5% from 76.1%. This was a large increase in participation, and as the recovery continues, I expect the participation rate for this group to increase.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses. At the recent pace of improvement, it appears employment will be back to pre-recession levels next year (Of course this doesn't include population growth).

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) fell by 514,000 to 7.3 million in January. These individuals were working part time because their hours had been cut back or because they were unable to find full-time work.These workers are included in the alternate measure of labor underutilization (U-6) that declined to 12.7% in January. This is the lowest level since November 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.646 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 3.878 in December. This is the lowest level since March 2009 (this might have been impacted by the expiration of extended unemployment benefits). This is trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In January 2014, state and local governments lost 17,000 jobs.

It appears state and local employment employment has bottomed. Of course Federal government layoffs are ongoing.

January Employment Report: 113,000 Jobs, 6.6% Unemployment Rate

by Calculated Risk on 2/07/2014 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 113,000 in January, and the unemployment rate was little changed at 6.6 percent, the U.S. Bureau of Labor Statistics reported today. ...

After accounting for the annual adjustment to the population controls, the civilian labor force rose by 499,000 in January, and the labor force participation rate edged up to 63.0 percent. Total employment, as measured by the household survey, increased by 616,000 over the month, and the employment-population ratio increased by 0.2 percentage point to 58.8 percent.

...

The change in total nonfarm payroll employment for November was revised from +241,000 to +274,000, and the change for December was revised from +74,000 to +75,000. With these revisions, employment gains in November and December were 34,000 higher than previously reported.

...

[Benchmark revision] The total nonfarm employment level for March 2013 was revised upward by 369,000 (+347,000 on a not seasonally adjusted basis, or 0.3 percent). ... This revision incorporates the reclassification of jobs in the QCEW. Private household employment is out of scope for the establishment survey. The QCEW reclassified some private household employment into an industry that is in scope for the establishment survey--services for the elderly and persons with disabilities. This reclassification accounted for an increase of 466,000 jobs in the establishment survey. This increase of 466,000 associated with reclassification was offset by survey error of -119,000 for a total net benchmark revision of +347,000 on a not seasonally adjusted basis. Historical time series have been reconstructed to incorporate these revisions.

Click on graph for larger image.

Click on graph for larger image.The headline number was well below expectations of 181,000 payroll jobs added.

The first graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

Employment is 0.6% below the pre-recession peak (866 thousand fewer total jobs).

NOTE: The second graph is the change in payroll jobs ex-Census - meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

The third graph shows the unemployment rate.

The unemployment rate decreased in January to 6.6% from 6.7% in December.

The fourth graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased in January to 63.0% from 62.8% in December. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio increased in January to 58.8% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

This was a disappointing employment report, however there were some positives including upward revisions to previous reports, a decline in the unemployment rate, and an increase in the participation rate. I'll have much more later ...

Thursday, February 06, 2014

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 2/06/2014 06:24:00 PM

My Employment Preview for January: Taking the Over. The annual revision will be released tomorrow too (and revisions to prior months will be important).

From Tim Duy: Another Month, Another Employment Report

I will venture a guess of a 200k gain in nonfarm payrolls for January. ... This is a bit over consensus of 181k, but pretty much right in the middle of the range of estimates (125k-270k). Full disclosure: Last month my forecast was wildly optimistic. Still, I think that report was an outlier. Overall I don't see that the pace of improvement in the labor market has changed dramatically one way or another in the last few months. The economy have been generating 180-200k jobs a month for two years despite the ups and downs in the data. I suspect underlying activity continues to support a similar trend. Any improvements that were evident prior to the December report were likely modest.CR Note: Unlike Duy, I was pessimistic last month.

Friday:

• At 8:30 AM ET, the Employment Report for January will be released. The consensus is for an increase of 181,000 non-farm payroll jobs in January, up from the 74,000 non-farm payroll jobs added in December. The consensus is for the unemployment rate to be unchanged at 6.7% in January.

• At 3:00 PM, Consumer Credit for December from the Federal Reserve. The consensus is for credit to increase $12.0 billion in December.

Lawler: Expect Downward Revisions to Census Q4 New Home Sales, Broad-Based Builder Optimism for 2014

by Calculated Risk on 2/06/2014 02:08:00 PM

From economist Tom Lawler:

Below is a table showing some stats for nine large publicly-traded home builders reporting results for the quarter and year ending December 31.

There are a couple of observations. First, “home sales” at these builders defined as net orders in 2013 were up just 6.9%, from 2012, while “home sales” rightly defined as settlements (closed sales) were up 21.6%.

Second, net orders at these builders did not experience the fourth quarter rebound suggested by Census’ estimate of new SF home sales, and net orders at these builders were up for the year by far less than Census’ estimate of new SF home sales.

There are several possible reasons for these differences. First, of course, the market share of these large builders may have fallen significantly. Second, builder net orders in a quarter are that quarter’s gross orders less sales cancellations in that quarter, while Census new home sales are, in effect, gross orders less orders on homes for which a previously signed contract had been canceled. Third, there may be (and appears to be) a timing difference between when a builder logs an order and when that order is reflected in Census’ Survey of Construction. (Builder net orders “lead” Census new home sales). And finally, the Census data, and especially the preliminary data – which is subject to huge revisions – may “suck.”

While the above factors make it “most difficult” to compare builder results with Census new home sales data, I have found that builder results have been useful in projecting revisions to Census new home sales. Based on these builder results, I would expect that Census’ estimates of new home sales in the fourth quarter of 2013 will be revised downward significantly.

While results varied massively across builders, there were several common “themes” across many builders. First, fueled by low mortgage rates, low new and existing home inventories, and some “pent-up” demand, builders as a group experienced a significant increase in net home orders starting in the latter part of 2012 and continuing into the spring of 2013. While many builders responded by increasing significantly land acquisitions and development spending in 2012 and 2013, many builders were unable to meet demand, partly reflecting longer-than-normal development timelines related to “supply-chain” issues. Many responded by increasing prices substantially, in some areas at a pace seldom seen. When mortgage rates subsequently rose sharply, the combination of higher mortgage rates and substantially higher new home prices resulted in a significant slowdown in net home orders. While mortgage rates eased somewhat in the latter part of last year, orders did not rebound much (or for some builders at all), mainly reflecting potential buyers balking at the higher home prices.

That slowdown did not dampen most builders’ optimism for the 2014 spring selling season, and most builders have the land/lots to increase substantially their community counts this year, and plan to do so. One reason for their optimism is that the previous hikes in prices have at many builders pushed margins up well above “normal” levels, meaning they can drive higher revenues with higher volumes without price increases, and in fact can be “quite profitable” by holding prices even if construction costs rise. As such, a reasonable assumption for new home prices from the end of 2013 to the end of 2014 would be “flattish.”

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 12/13 | 12/12 | % Chg | 12/13 | 12/12 | % Chg | 12/13 | 12/12 | % Chg |

| D.R. Horton | 5,454 | 5,259 | 3.7% | 6,188 | 5,182 | 19.4% | $263,542 | $236,067 | 11.6% |

| PulteGroup | 3,214 | 3,926 | -18.1% | 4,964 | 5,154 | -3.7% | $325,000 | $287,000 | 13.2% |

| NVR | 2,631 | 2,625 | 0.2% | 3,342 | 2,788 | 19.9% | $365,300 | $331,900 | 10.1% |

| The Ryland Group | 1,428 | 1,502 | -4.9% | 2,178 | 1,578 | 38.0% | $314,000 | $270,000 | 16.3% |

| Beazer Homes | 895 | 932 | -4.0% | 1,038 | 1,038 | 0.0% | $279,300 | $235,500 | 18.6% |

| M/I Homes | 793 | 673 | 17.8% | 1,120 | 887 | 26.3% | $292,000 | $273,000 | 7.0% |

And here is a table showing some stats for calendar-year 2013 compared to calendar-year 2012.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Calendar Year | '13 | '12 | % Chg | '13 | '12 | % Chg | '13 | '12 | % Chg |

| D.R. Horton | 25,315 | 22,513 | 12.4% | 25,161 | 19,954 | 26.1% | $255,646 | $228,395 | 11.9% |

| PulteGroup | 17,080 | 19,039 | -10.3% | 17,766 | 16,505 | 7.6% | $305,000 | $276,000 | 10.5% |

| NVR | 11,800 | 10,954 | 7.7% | 11,834 | 9,843 | 20.2% | $349,043 | $317,073 | 10.1% |

| The Ryland Group | 7,263 | 5,781 | 25.6% | 7,035 | 4,897 | 43.7% | $296,000 | $262,000 | 13.0% |

| Beazer Homes | 4,989 | 5,111 | -2.4% | 5,056 | 4,603 | 9.8% | $262,004 | $229,126 | 14.3% |

| M/I Homes | 3,787 | 3,020 | 25.4% | 3,472 | 2,765 | 25.6% | $286,000 | $264,000 | 8.3% |

| Total | 70,234 | 66,418 | 5.7% | 70,324 | 58,567 | 20.1% | $289,824 | $261,263 | 10.9% |

Trulia: Asking House Prices up 11.4% year-over-year in January

by Calculated Risk on 2/06/2014 11:24:00 AM

From Trulia chief economist Jed Kolko: 5 Truths of Tech-Hub Housing Costs

In January, asking home prices rose 1.1% month-over-month, the largest monthly gain since June 2013. But the quarter-over-quarter price increase of 2.1% remains below spring 2013 levels, when asking prices accelerated at their fastest rate in the recovery. Year-over-year, asking prices are up 11.4% nationally and are positive in 97 of the 100 largest metros.It appears the year-over-year asking price gains are slowing, but asking prices are still increasing. In November, asking prices were up 12.2% year-over-year. In December, the year-over-year increase in asking home prices slowed slightly to 11.9%. And in January, the year-over-year increase was 11.4%.

emphasis added

Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases, but at a slower rate, over the next few months on a seasonally adjusted basis.

Trade Deficit increased in December to $38.7 Billion

by Calculated Risk on 2/06/2014 08:58:00 AM

The Department of Commerce reported this morning:

[T]otal December exports of $191.3 billion and imports of $230.0 billion resulted in a goods and services deficit of $38.7 billion, up from $34.6 billion in November, revised. December exports were $3.5 billion less than November exports of $194.8 billion. December imports were $0.6 billion more than November imports of $229.4 billion.The trade deficit was larger than the consensus forecast of $36.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through December 2013.

Click on graph for larger image.

Click on graph for larger image.Imports increased, and exports decreased in December.

Exports are 15% above the pre-recession peak and up 1% compared to December 2012; imports are just below the pre-recession peak, and up about 1% compared to December 2012.

The second graph shows the U.S. trade deficit, with and without petroleum, through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $91.34 in December, down from $94.69 in November, and down from $95.16 in December 2012. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China was mostly unchanged at $24.47 billion in December, from $24.53 billion in December 2012. A majority of the trade deficit is related to China.

Overall it appears exports are picking up a little, and imports (ex-oil) are increasing too.

Weekly Initial Unemployment Claims decrease to 331,000

by Calculated Risk on 2/06/2014 08:33:00 AM

The DOL reports:

In the week ending February 1, the advance figure for seasonally adjusted initial claims was 331,000, a decrease of 20,000 from the previous week's revised figure of 351,000. The 4-week moving average was 334,000, an increase of 250 from the previous week's revised average of 333,750.The previous week was revised up from 348,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased slightly to 334,000.

This was the lower than the consensus forecast of 337,000.

Wednesday, February 05, 2014

Thursday: Unemployment Claims, Trade Deficit

by Calculated Risk on 2/05/2014 09:17:00 PM

From Tim Duy: No End To Tapering Yet. Excerpt:

I don't think the Fed believes that the end of asset purchases is impacting global markets because they are convinced that tapering is not tightening. If it is tightening, then why should global markets react? And even if it was tightening, the Fed wouldn't see it as their problem in the first place. ...We have seen a few weak economic reports recently such as the December employment report, auto sales in January, and the ISM manufacturing survey for January. But I don't think the recent weakness is a significant concern for the Fed - unless the weakness continues.

Bottom Line: The Fed isn't ready to change course. Recent turbulence is enough to peak their curiosity, not enough to suggest that tapering was premature.

Thursday:

• Early: the Trulia Price Rent Monitors for January. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 337 thousand from 348 thousand.

• Also at 8:30 AM, the Trade Balance report for December from the Census Bureau. The consensus is for the U.S. trade deficit to increase to $36.0 billion in December from $34.3 billion in November.

Fed Survey: Banks eased lending standards, Experienced increased demand

by Calculated Risk on 2/05/2014 04:10:00 PM

From the Federal Reserve: The January 2014 Senior Loan Officer Opinion Survey on Bank Lending Practices

The January 2014 Senior Loan Officer Opinion Survey on Bank Lending Practices addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months. Domestic banks, on balance, reported having eased their lending standards on many types of business and consumer loans and having experienced increases in loan demand, on average, over the past three months.

Regarding loans to businesses, the January survey results generally indicated that, on balance, banks eased their lending policies for commercial and industrial (C&I) loans to firms of all sizes and experienced stronger demand for such loans over the past three months. ...

On net, domestic institutions also reported having eased standards for most types of commercial real estate (CRE) loans and having experienced stronger demand for such loans.

...

Changes in standards and terms on, and demand for, loans to households were mixed. The survey results indicated that a modest fraction of large banks had eased standards on prime residential real estate loans, but a similar fraction of small banks had tightened standards on such loans. A moderate fraction of banks reported, on balance, weaker demand for prime mortgage loans to purchase homes, and a large net fraction reported weaker demand for nontraditional mortgage loans. Demand for home equity lines of credit (HELOCs) was little changed. Respondents indicated that they had eased standards on credit card loans, auto loans, and other consumer loans. emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in lending standards and for CRE (commercial real estate) loans.

Banks are loosening their standards for CRE loans, and for various categories of CRE (right half of graph).

The second graph shows the change in demand for CRE loans.

Banks are seeing a pickup in demand for all categories of CRE.

Banks are seeing a pickup in demand for all categories of CRE.This suggests that we will see an increase in commercial real estate development in the near future.

Employment Preview for January: Taking the Over

by Calculated Risk on 2/05/2014 12:54:00 PM

Friday at 8:30 AM ET, the BLS will release the employment report for January. The consensus is for an increase of 181,000 non-farm payroll jobs in January, and for the unemployment rate to be unchanged at 6.7%.

Something to keep in mind - the cold weather clearly impacted the December payroll report, and although the weather was unusually bad in January too, the weather was close to normal during the BLS reference week. Goldman Sachs economist Jan Hatzius wrote last Friday:

Although the month of January as a whole was quite cold, the payroll survey week was actually somewhat warmer than normal ... Even excluding the weather impact, the December employment gain looks to be about 50,000 below the recent trend. In our view, this is implausibly weak relative to other job market measures ... This could result in a bounceback to an above-trend pace even outside the weather impact, although it is also possible that the December reading will be revised up.Here is a summary of recent data:

• The ADP employment report showed an increase of 175,000 private sector payroll jobs in January. This was close to expectations of 170,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month. But in general, this suggests employment growth close to expectations.

• The ISM manufacturing employment index decreased in January to 52.3%, from 55.8% in December. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 7,000 in January. The ADP report indicated a 12,000 decrease for manufacturing jobs in January

The ISM non-manufacturing employment index increased in January to 56.4% from 55.6% in December. A historical correlation between the ISM non-manufacturing index and the BLS employment report for non-manufacturing, suggests that private sector BLS reported payroll jobs for non-manufacturing increased by about 243,000 in January.

Taken together, these surveys suggest around 236,000 jobs added in January - above the consensus forecast.

• Initial weekly unemployment claims averaged close to 333,000 in January. This was down from an average of 359,000 in December. For the BLS reference week (includes the 12th of the month), initial claims were at 329,000; this was down sharply from 380,000 during the reference week in December.

This suggests fewer layoffs, and possibly more net payroll jobs added than the consensus forecast.

• The final January Reuters / University of Michigan consumer sentiment index decreased to 81.2 from the December reading of 82.5. This is frequently coincident with changes in the labor market, but there are other factors too.

• The small business index from Intuit showed a 10,000 increase in small business employment in January. This is still pretty low.

• Conclusion: As usual the data was mixed. The ADP report was lower in January compared to December, the Intuit small business index showed sluggish hiring, and consumer sentiment decreased slightly in January.

However weekly claims for the reference week were down sharply, and the ISM surveys suggest a larger increase in payrolls.

There is always some randomness to the employment report, but my guess is the report will be over the consensus forecast of 181,000 nonfarm payrolls jobs added in January. Note: I took the under in December, took the consensus in November (close), and over in October, so I'm probably due to be wrong!!