by Calculated Risk on 1/19/2014 11:56:00 AM

Sunday, January 19, 2014

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in December

Note: The NAR will release existing home sales and inventory for December this coming Thursday. It is also interesting to look at the trend for distressed sales (foreclosures and short sales), and for all cash buyers (frequently investors).

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in December.

From CR: Total "distressed" share is down in all of these markets, and down significantly in most.

Short sales are down sharply in all of these markets (this was a real change in 2013, and I expect further declines in short sales in 2014).

Important Note on short sales: Historically the IRS has considered debt forgiveness (like short sales) as taxable income. In 2007, Congress passed a measure to exempt most forgiven mortgage debt from being considered taxable income (this helped increase short sale activity). This measure expired on Dec 31, 2013. However, according to a letter from the IRS:

"[I]f a property owner cannot be held personally liable for the difference between the loan balance and the sales price, we would consider the obligation as a nonrecourse obligation. In this situation, the owner would not treat the cancelled debt as income."So in states that passed anti-deficiency provisions (like California), this means many loans will be considered nonrecourse by the IRS (and forgiven debt will not be taxed). In other states, forgiven debt will be taxed.

Foreclosures are down in all of these areas too (except Springfield, Ill).

The All Cash Share (last two columns) is mostly declining year-over-year. It appears investors are pulling back in markets like Las Vegas and SoCal - probably because of fewer distressed sales and higher prices.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Dec-13 | Dec-12 | Dec-13 | Dec-12 | Dec-13 | Dec-12 | Dec-13 | Dec-12 | |

| Las Vegas | 20.7% | 45.8% | 8.5% | 9.5% | 29.2% | 55.3% | 44.4% | 55.2% |

| Reno | 24.0% | 47.0% | 4.0% | 10.0% | 28.0% | 57.0% | ||

| Phoenix | 9.5% | 27.2% | 7.5% | 12.2% | 17.1% | 39.4% | 34.6% | 45.4% |

| Sacramento | 12.0% | 40.0% | 7.3% | 11.5% | 19.3% | 51.5% | 19.5% | 39.6% |

| Minneapolis | 5.4% | 12.4% | 17.3% | 26.7% | 22.7% | 39.1% | ||

| Mid-Atlantic | 8.0% | 13.0% | 9.3% | 9.7% | 17.3% | 22.7% | 19.3% | 20.3% |

| Orlando | 13.6% | 30.4% | 19.1% | 20.1% | 32.7% | 50.5% | 44.9% | 53.6% |

| California * | 15.5% | 26.7% | 6.7% | 15.8% | 22.2% | 42.5% | ||

| Bay Area CA* | 10.5% | 23.6% | 4.5% | 12.1% | 15.0% | 35.7% | 22.5% | 29.9% |

| So. California* | 13.2% | 26.7% | 5.8% | 14.2% | 19.0% | 40.9% | 27.7% | 35.8% |

| Hampton Roads | 29.1% | 31.7% | ||||||

| Northeast Florida | 36.2% | 42.7% | ||||||

| Toledo | 36.5% | 41.6% | ||||||

| Tucson | 32.3% | 33.1% | ||||||

| Des Moines | 23.1% | 21.6% | ||||||

| Omaha | 23.9% | 20.6% | ||||||

| Pensacola | 35.5% | 32.7% | ||||||

| Wichita | 30.2% | 30.6% | ||||||

| Memphis* | 21.0% | 25.6% | ||||||

| Birmingham AL | 22.5% | 34.0% | ||||||

| Springfield IL** | 17.7% | 14.2% | ||||||

| *share of existing home sales, based on property records | ||||||||

| **Single Family Only | ||||||||

Saturday, January 18, 2014

Recovery Measures: Three out of Four Ain't Bad

by Calculated Risk on 1/18/2014 05:03:00 PM

Here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

Three of the indicators are above pre-recession levels (GDP and Personal Income less Transfer Payments and Industrial Production). Only employment is still below the pre-recession peak.

Click on graph for larger image.

Click on graph for larger image.

The first graph is for real GDP through Q3 2013.

Real GDP returned to the pre-recession peak in Q2 2011, and has hit new post-recession highs for ten consecutive quarters.

At the worst point - in Q2 2009 - real GDP was off 4.3% from the 2007 peak.

The second graph shows real personal income less transfer payments as a percent of the previous peak through the September report.

The second graph shows real personal income less transfer payments as a percent of the previous peak through the September report.

This indicator was off 8.2% at the worst point.

Real personal income less transfer payments surged in December 2012 due to a one time surge in income as some high income earners accelerated earnings to avoid higher taxes in 2013 (I've left December 2012 out going forward). Real personal income less transfer payments are now above the pre-recession peak.

The third graph is for industrial production through December 2013.

The third graph is for industrial production through December 2013.

Industrial production was off 16.9% at the trough in June 2009.

Now industrial production is 0.9% above the pre-recession peak.

The final graph is for employment and is through December 2013. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

Three out of four indicators ain't bad, but employment is probably the most important indicator and unfortunately payroll employment is still 0.9% below the pre-recession peak.

Three out of four indicators ain't bad, but employment is probably the most important indicator and unfortunately payroll employment is still 0.9% below the pre-recession peak.

Employment will probably be back to pre-recession levels in mid-2014.

Unofficial Problem Bank list declines to 605 Institutions

by Calculated Risk on 1/18/2014 01:16:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for January 17, 2014.

Changes and comments from surferdude808:

The Unofficial Problem Bank List had many changes as the OCC released details of its latest enforcement action activity and the closing of a national bank. In all, there were eight removals leaving the list at 605 institutions with assets of $199.8 billion. Aggregate assets fell under $200 billion for the first time since May 2009. A year ago, there were 826 institutions with assets of $308.7 billion on the list.

During the week, every manner of exit possible was used as there were four action terminations, two voluntary liquidations, one merger, and one failure, which has not happened since almost a year ago during the week ending January 18, 2013. Actions were terminated against Community State Bank, National Association, Ankeny, IA ($560 million); Community Bank-Wheaton/Glen Ellyn, Glen Ellyn, IL ($351 million); The First National Bank of Winnsboro, Winnsboro, TX ($134 million); and The Headland National Bank, Headland, AL ($102 million). Prosperity Bank, Saint Augustine, FL ($748 million) found a merger partner in order to get itself off the list.

The two voluntary liquidations were Liberty Bank, F.S.B., West Des Moines, IA ($267 million) and Capmark Bank, Midvale, UT ($120 million). It has been more than six months since the last voluntary liquidation of a bank on the list. The OCC got the FDIC liquidation crew cranked up for the first time in 2014 by closing DuPage National Bank, West Chicago, IL ($62 million). This is the 57th institution headquartered in Illinois that has failed as a result of the Great Recession. With a count of 57, Illinois only trails Georgia and Florida with 87 and 70 failures, respectively.

We do not anticipate for the FDIC to release its enforcement action activity through December 2013 next week, rather they will likely release on Friday, January 31st. After the FDIC release, the institution count on the list should drop below 600.

Schedule for Week of January 19th

by Calculated Risk on 1/18/2014 08:15:00 AM

This will be light week for economic releases. The key report this week is existing home sales on Thursday.

For manufacturing, the Kansas City Fed January survey will be released this week.

For commercial real estate (CRE), the Architecture Billings Index will be released.

All US markets will be closed in observance of the Martin Luther King, Jr. Day holiday.

No economic releases scheduled.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 330 thousand from 326 thousand.

9:00 AM: The Markit US PMI Manufacturing Index Flash for January. The consensus is for an increase to 55.0 from 54.4 in December.

9:00 AM: FHFA House Price Index for November 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for sales of 4.90 million on seasonally adjusted annual rate (SAAR) basis. Sales in November were at a 4.90 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.96 million SAAR.

As always, a key will be inventory of homes for sale.

11:00 AM: the Kansas City Fed manufacturing survey for January.

No economic releases scheduled.

Friday, January 17, 2014

Bank Failure #1 in 2014: DuPage National Bank, West Chicago, Illinois

by Calculated Risk on 1/17/2014 07:25:00 PM

From the FDIC: Republic Bank of Chicago, Oak Brook, Illinois, Assumes All of the Deposits of DuPage National Bank, West Chicago, Illinois

As of September 30, 2013, DuPage National Bank had approximately $61.7 million in total assets and $59.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $1.6 million. Compared to other alternatives, Republic Bank of Chicago's acquisition was the least costly resolution for the FDIC's DIF. DuPage National Bank is the 1st FDIC-insured institution to fail in the nation this year.It will probably be a slow year for the FDIC, but there still quite a few "problem" banks that could fail.

Lawler: Early Read on Existing Home Sales in December

by Calculated Risk on 1/17/2014 04:20:00 PM

From housing economist Tom Lawler:

Based on realtor association/MLS reports from across the country, I estimate that US existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.96 million in December, up 1.2% from both November’s seasonally adjusted pace and last December’s seasonally adjusted pace. I estimate that unadjusted sales (as measured by the NAR) showed a slightly higher YOY growth than SA sales, reflecting this December’s higher business day count than last December.

YOY sales results varied massively across the country. California home sales showed a sizable YOY drop last month, reflecting a large decline in “distressed” sales as well as a steep decrease in investor buying of both distressed and non-distressed sales, combined with relatively flat sales to owner occupants. Phoenix and Las Vegas also experienced big YOY declines, for similar reasons. Some realtors attributed the weak sales to low inventories, but a better way to put it was that sales were down sharply from a year ago in these areas because of a lack of inventory priced either attractively for investment/rental purposes or at prices readily affordable to many potential buyers.

A few areas where the government shutdown appeared to impact closed sales in November experienced a rebound in closed sales in December. For example, in November closed MLS-based sales in the DC metro market were down much more sharply than “normal” on the month, and were off 13.7% YOY. Closed sales bounced back up last month, and were up 9.7% YOY. However, new pending sales in December were down sharply in December, and were off 7.0% YOY, suggesting that “something else” (including high listing prices) was negatively impacting sales in the area.

There were several other markets where closed sales rebounded in December from November but where pending sales in December looked weak.

On the inventory front, the inventory of existing homes for sale typically declines significantly from November to December in most (but not all) parts of the country, and that was clearly the case last month. In fact, inventories as reported by realtor associations/MLS declined by a bit more than the “seasonal” norm in a significant number of markets. Based on these reports as well as reports by various entities that track listings, I’d “guesstimate” that the monthly decline in the inventory of existing homes for sale from November to December was about 8.3%, compared to last December’s monthly drop (as estimated by the NAR) of 8.0%.

Trying to gauge the level of the NAR’s existing home inventory estimate for December, however, is a bit trickier. The monthly decline in the NAR’s existing home inventory estimate in November was significantly smaller both than realtor association/MLS reports and listing trackers reports would have suggested, and I think it is likely that the NAR’s inventory estimate will be revised downward. It is worth noting that the NAR’s preliminary inventory estimate has been revised downward in each of the last six reports (by an average of 1.8%), and that last November’s preliminary inventory estimate was revised downward in the subsequent report by 2.0%. If November’s inventory estimate is revised downward by 1.9%, AND December’s estimate is 8.3% lower than November’s estimate, then the December estimate will be up 2.7% from a year earlier. (You have to be a NUT to try to estimate the NAR data!)

Finally, based on realtor association/MLS reports, my “gueestimate” is that the NAR’s estimate of the median existing SF home sales price is December will be up by about 8.0% from a year earlier. (The November MSP was up 9.4% YOY).

CR Note: The NAR will release the December Existing home sales report next Thursday, and the early consensus is for sales of 5.0 million SAAR (Close to Lawler's estimate).

Housing Starts in 2013: 18% Annual Increase, Still Sixth Lowest Level on Record

by Calculated Risk on 1/17/2014 01:54:00 PM

A few key points:

• Housing starts increased 18.3% in 2013 (initial estimate). This was another solid year-over-year increase.

• Even after increasing 28% in 2012 and 18% in 2013, the 923 thousand housing starts in 2013 were the sixth lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the three lowest years were 2008 through 2012). Also, this was the fifth lowest year for single family starts since 1959 (only 2009 through 2012 were lower).

• Starts averaged 1.5 million per year from 1959 through 2000. Demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will probably increase another 50%+ from the 2013 level.

• Residential investment and housing starts are usually the best leading indicator for economy. Nothing is foolproof as a leading indicator, but this suggests the economy will continue to grow over the next couple of years.

The following table shows annual starts (total and single family) since 2005:

| Housing Starts (000s) | ||||

|---|---|---|---|---|

| Total | Change | Single Family | Change | |

| 2005 | 2,068.3 | --- | 1,715.8 | --- |

| 2006 | 1,800.9 | -12.9% | 1,465.4 | -14.6% |

| 2007 | 1,355.0 | -24.8% | 1,046.0 | -28.6% |

| 2008 | 905.5 | -33.2% | 622.0 | -40.5% |

| 2009 | 554.0 | -38.8% | 445.1 | -28.4% |

| 2010 | 586.9 | 5.9% | 471.2 | 5.9% |

| 2011 | 608.8 | 3.7% | 430.6 | -8.6% |

| 2012 | 780.6 | 28.2% | 535.5 | 24.4% |

| 2013 | 923.4 | 18.3% | 617.8 | 15.4% |

I expect another solid increase for housing starts in 2014.

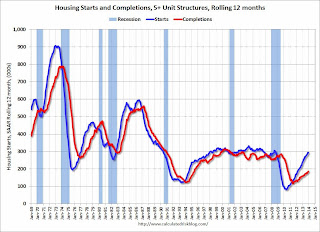

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries in 2014, but probably still below the 1997 through 2007 level of multi-family completions. Multi-family starts will probably move mostly sideways in 2014.

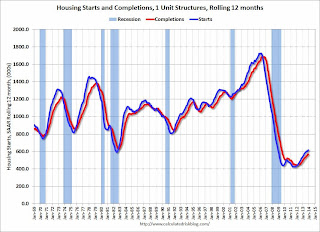

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Starts are moving up, and completions are following.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

BLS: 4.0 Million Job Openings in November

by Calculated Risk on 1/17/2014 11:16:00 AM

Update: I misread the "quits" in the report. Quits actually increased in November (ht Chris).

From the BLS: Job Openings and Labor Turnover Summary

There were 4.0 million job openings on the last business day of November, little changed from October, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.3 percent) and separations rate (3.1 percent) were unchanged in November. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. Layoffs and discharges are involuntary separations initiated by the employer. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in November for total nonfarm and total private and was little changed for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for November, the most recent employment report was for December.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in November to 4.001 million from 3.931 million in October.

The number of job openings (yellow) is up 5.6% year-over-year compared to November 2012 and this is the first time job openings have been above 4 million since 2008..

Quits increased (updated) in November and are up about 13% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market. It is a good sign that job openings are at the highest level since 2008.

Preliminary January Consumer Sentiment declines to 80.4

by Calculated Risk on 1/17/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for January was at 80.4, down from the December reading of 82.5.

This was below the consensus forecast of 83.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

I expect to see sentiment at post-recession highs very soon.

Fed: Industrial Production increased 0.3% in December

by Calculated Risk on 1/17/2014 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production rose 0.3 percent in December, its fifth consecutive monthly increase. For the fourth quarter as a whole, industrial production advanced at an annual rate of 6.8 percent, the largest quarterly increase since the second quarter of 2010; gains were widespread across industries. Following increases of 0.6 percent in each of the previous two months, factory output rose 0.4 percent in December and was 2.6 percent above its year-earlier level. The production of mines moved up 0.8 percent; the index has advanced 6.6 percent over the past 12 months. The output of utilities fell 1.4 percent after three consecutive monthly gains. At 101.8 percent of its 2007 average, total industrial production in December was 3.7 percent above its year-earlier level and 0.9 percent above its pre-recession peak in December 2007. Capacity utilization for total industry moved up 0.1 percentage point to 79.2 percent, a rate 1.0 percentage point below its long-run (1972–2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.2% is still 1.0 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.3% in December to 101.3. This is 22% above the recession low, and 0.9 percent above the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were at expectations, however previous months were revised up.