by Calculated Risk on 1/18/2014 08:15:00 AM

Saturday, January 18, 2014

Schedule for Week of January 19th

This will be light week for economic releases. The key report this week is existing home sales on Thursday.

For manufacturing, the Kansas City Fed January survey will be released this week.

For commercial real estate (CRE), the Architecture Billings Index will be released.

All US markets will be closed in observance of the Martin Luther King, Jr. Day holiday.

No economic releases scheduled.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 330 thousand from 326 thousand.

9:00 AM: The Markit US PMI Manufacturing Index Flash for January. The consensus is for an increase to 55.0 from 54.4 in December.

9:00 AM: FHFA House Price Index for November 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for sales of 4.90 million on seasonally adjusted annual rate (SAAR) basis. Sales in November were at a 4.90 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.96 million SAAR.

As always, a key will be inventory of homes for sale.

11:00 AM: the Kansas City Fed manufacturing survey for January.

No economic releases scheduled.

Friday, January 17, 2014

Bank Failure #1 in 2014: DuPage National Bank, West Chicago, Illinois

by Calculated Risk on 1/17/2014 07:25:00 PM

From the FDIC: Republic Bank of Chicago, Oak Brook, Illinois, Assumes All of the Deposits of DuPage National Bank, West Chicago, Illinois

As of September 30, 2013, DuPage National Bank had approximately $61.7 million in total assets and $59.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $1.6 million. Compared to other alternatives, Republic Bank of Chicago's acquisition was the least costly resolution for the FDIC's DIF. DuPage National Bank is the 1st FDIC-insured institution to fail in the nation this year.It will probably be a slow year for the FDIC, but there still quite a few "problem" banks that could fail.

Lawler: Early Read on Existing Home Sales in December

by Calculated Risk on 1/17/2014 04:20:00 PM

From housing economist Tom Lawler:

Based on realtor association/MLS reports from across the country, I estimate that US existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.96 million in December, up 1.2% from both November’s seasonally adjusted pace and last December’s seasonally adjusted pace. I estimate that unadjusted sales (as measured by the NAR) showed a slightly higher YOY growth than SA sales, reflecting this December’s higher business day count than last December.

YOY sales results varied massively across the country. California home sales showed a sizable YOY drop last month, reflecting a large decline in “distressed” sales as well as a steep decrease in investor buying of both distressed and non-distressed sales, combined with relatively flat sales to owner occupants. Phoenix and Las Vegas also experienced big YOY declines, for similar reasons. Some realtors attributed the weak sales to low inventories, but a better way to put it was that sales were down sharply from a year ago in these areas because of a lack of inventory priced either attractively for investment/rental purposes or at prices readily affordable to many potential buyers.

A few areas where the government shutdown appeared to impact closed sales in November experienced a rebound in closed sales in December. For example, in November closed MLS-based sales in the DC metro market were down much more sharply than “normal” on the month, and were off 13.7% YOY. Closed sales bounced back up last month, and were up 9.7% YOY. However, new pending sales in December were down sharply in December, and were off 7.0% YOY, suggesting that “something else” (including high listing prices) was negatively impacting sales in the area.

There were several other markets where closed sales rebounded in December from November but where pending sales in December looked weak.

On the inventory front, the inventory of existing homes for sale typically declines significantly from November to December in most (but not all) parts of the country, and that was clearly the case last month. In fact, inventories as reported by realtor associations/MLS declined by a bit more than the “seasonal” norm in a significant number of markets. Based on these reports as well as reports by various entities that track listings, I’d “guesstimate” that the monthly decline in the inventory of existing homes for sale from November to December was about 8.3%, compared to last December’s monthly drop (as estimated by the NAR) of 8.0%.

Trying to gauge the level of the NAR’s existing home inventory estimate for December, however, is a bit trickier. The monthly decline in the NAR’s existing home inventory estimate in November was significantly smaller both than realtor association/MLS reports and listing trackers reports would have suggested, and I think it is likely that the NAR’s inventory estimate will be revised downward. It is worth noting that the NAR’s preliminary inventory estimate has been revised downward in each of the last six reports (by an average of 1.8%), and that last November’s preliminary inventory estimate was revised downward in the subsequent report by 2.0%. If November’s inventory estimate is revised downward by 1.9%, AND December’s estimate is 8.3% lower than November’s estimate, then the December estimate will be up 2.7% from a year earlier. (You have to be a NUT to try to estimate the NAR data!)

Finally, based on realtor association/MLS reports, my “gueestimate” is that the NAR’s estimate of the median existing SF home sales price is December will be up by about 8.0% from a year earlier. (The November MSP was up 9.4% YOY).

CR Note: The NAR will release the December Existing home sales report next Thursday, and the early consensus is for sales of 5.0 million SAAR (Close to Lawler's estimate).

Housing Starts in 2013: 18% Annual Increase, Still Sixth Lowest Level on Record

by Calculated Risk on 1/17/2014 01:54:00 PM

A few key points:

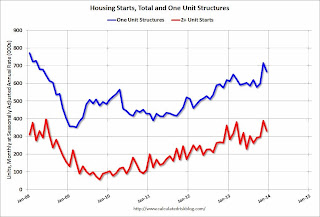

• Housing starts increased 18.3% in 2013 (initial estimate). This was another solid year-over-year increase.

• Even after increasing 28% in 2012 and 18% in 2013, the 923 thousand housing starts in 2013 were the sixth lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the three lowest years were 2008 through 2012). Also, this was the fifth lowest year for single family starts since 1959 (only 2009 through 2012 were lower).

• Starts averaged 1.5 million per year from 1959 through 2000. Demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will probably increase another 50%+ from the 2013 level.

• Residential investment and housing starts are usually the best leading indicator for economy. Nothing is foolproof as a leading indicator, but this suggests the economy will continue to grow over the next couple of years.

The following table shows annual starts (total and single family) since 2005:

| Housing Starts (000s) | ||||

|---|---|---|---|---|

| Total | Change | Single Family | Change | |

| 2005 | 2,068.3 | --- | 1,715.8 | --- |

| 2006 | 1,800.9 | -12.9% | 1,465.4 | -14.6% |

| 2007 | 1,355.0 | -24.8% | 1,046.0 | -28.6% |

| 2008 | 905.5 | -33.2% | 622.0 | -40.5% |

| 2009 | 554.0 | -38.8% | 445.1 | -28.4% |

| 2010 | 586.9 | 5.9% | 471.2 | 5.9% |

| 2011 | 608.8 | 3.7% | 430.6 | -8.6% |

| 2012 | 780.6 | 28.2% | 535.5 | 24.4% |

| 2013 | 923.4 | 18.3% | 617.8 | 15.4% |

I expect another solid increase for housing starts in 2014.

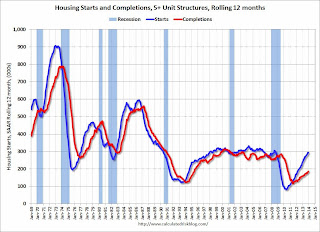

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries in 2014, but probably still below the 1997 through 2007 level of multi-family completions. Multi-family starts will probably move mostly sideways in 2014.

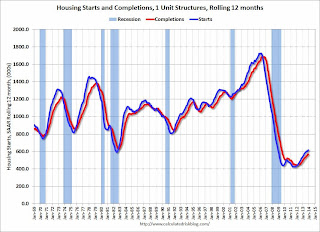

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Starts are moving up, and completions are following.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

BLS: 4.0 Million Job Openings in November

by Calculated Risk on 1/17/2014 11:16:00 AM

Update: I misread the "quits" in the report. Quits actually increased in November (ht Chris).

From the BLS: Job Openings and Labor Turnover Summary

There were 4.0 million job openings on the last business day of November, little changed from October, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.3 percent) and separations rate (3.1 percent) were unchanged in November. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. Layoffs and discharges are involuntary separations initiated by the employer. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in November for total nonfarm and total private and was little changed for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for November, the most recent employment report was for December.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in November to 4.001 million from 3.931 million in October.

The number of job openings (yellow) is up 5.6% year-over-year compared to November 2012 and this is the first time job openings have been above 4 million since 2008..

Quits increased (updated) in November and are up about 13% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market. It is a good sign that job openings are at the highest level since 2008.

Preliminary January Consumer Sentiment declines to 80.4

by Calculated Risk on 1/17/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for January was at 80.4, down from the December reading of 82.5.

This was below the consensus forecast of 83.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

I expect to see sentiment at post-recession highs very soon.

Fed: Industrial Production increased 0.3% in December

by Calculated Risk on 1/17/2014 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production rose 0.3 percent in December, its fifth consecutive monthly increase. For the fourth quarter as a whole, industrial production advanced at an annual rate of 6.8 percent, the largest quarterly increase since the second quarter of 2010; gains were widespread across industries. Following increases of 0.6 percent in each of the previous two months, factory output rose 0.4 percent in December and was 2.6 percent above its year-earlier level. The production of mines moved up 0.8 percent; the index has advanced 6.6 percent over the past 12 months. The output of utilities fell 1.4 percent after three consecutive monthly gains. At 101.8 percent of its 2007 average, total industrial production in December was 3.7 percent above its year-earlier level and 0.9 percent above its pre-recession peak in December 2007. Capacity utilization for total industry moved up 0.1 percentage point to 79.2 percent, a rate 1.0 percentage point below its long-run (1972–2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.2% is still 1.0 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.3% in December to 101.3. This is 22% above the recession low, and 0.9 percent above the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were at expectations, however previous months were revised up.

Housing Starts at 999 Thousand Annual Rate in December

by Calculated Risk on 1/17/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 999,000. This is 9.8 percent below the revised November estimate of 1,107,000, but is 1.6 percent above the December 2012 rate of 983,000.

Single-family housing starts in December were at a rate of 667,000; this is 7.0 percent below the revised November figure of 717,000. The December rate for units in buildings with five units or more was 312,000.

An estimated 923,400 housing units were started in 2013. This is 18.3 percent above the 2012 figure of 780,600.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 986,000. This is 3.0 percent below the revised November rate of 1,017,000, but is 4.6 percent above the December 2012 estimate of 943,000.

Single-family authorizations in December were at a rate of 610,000; this is 4.8 percent below the revised November figure of 641,000. Authorizations of units in buildings with five units or more were at a rate of 350,000 in December.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in December (Multi-family is volatile month-to-month).

Single-family starts (blue) also decreased in December following the sharp increase in November.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was slightly above expectations of 985 thousand starts in December. I'll have more later ... but this was a solid year with starts up 18.3 percent from 2012.

Thursday, January 16, 2014

Friday: Housing Starts, Industrial Production, Consumer Sentiment, JOLTS

by Calculated Risk on 1/16/2014 09:00:00 PM

First, here is a price index for commercial real estate that I follow. From CoStar: Commercial Real Estate Prices Post Steady Gains in November

COMMERCIAL PROPERTY PRICES CONTINUED THEIR STEADY UPWARD TRAJECTORY IN NOVEMBER: With the U.S. economy on more solid footing during the fourth quarter of 2013 and demand for commercial real estate space on the rise, pricing continued on a steady upward trajectory in November 2013. The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—advanced by 0.8% and 1.1%, respectively in November 2013, and rose by a more robust 10.9% and 7.8%, respectively, over the last year.Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

...

ABSORPTION EXPANDS AT FASTEST RATE SINCE 2007: Tenants occupied an additional 380 million square feet of office, retail and industrial space throughout the U.S. in 2013, the largest annual gain in net absorption over the past six years. The Investment Grade segment of the market continued to dominate in space absorption. However, the pace of absorption in the General Commercial segment has improved significantly as the recovery is accelerating in the secondary and tertiary markets. The General Commercial segment’s share of total net absorption increased from being less than 30% for the last several years to 32% in 2013.

...

DISTRESS SALES REMAIN LOW: The percentage of commercial property selling at distressed prices was slightly more than 13% in November 2013, down roughly two-thirds from the peak in 2011. Technology and energy-driven markets including Houston, Denver, Dallas, and Austin have experienced some of the strongest declines in the share of distress property sales activity over the last year, with a reduction of 80% or more.

emphasis added

Friday:

• At 8:30 AM ET, Housing Starts for December. The consensus is for total housing starts to decrease to 985 thousand (SAAR) in December.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for December. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.1%.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for January). The consensus is for a reading of 83.5, up from 82.5 in December.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for November from the BLS.

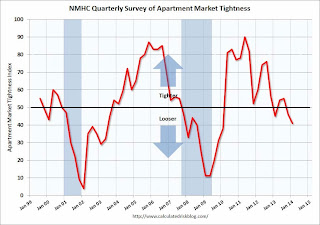

NMHC Survey: Apartment Market Conditions Softer in Q4

by Calculated Risk on 1/16/2014 01:44:00 PM

From the National Multi Housing Council (NMHC): Apartment Markets Soften Slightly According to NMHC Survey

Apartment market conditions weakened a bit in January compared with three months earlier. The market tightness (41), sales volume (41) and debt financing (42) indexes were all a little below the breakeven level of 50, although the equity financing index rebounded to 50.

“Apartment markets are little changed from October,” said Mark Obrinsky, NMHC’s Senior Vice President for Research and Chief Economist. “At least half of our respondents to each of our four main questions reported conditions as unchanged from three months earlier. Although markets are a little looser than in October, this is largely seasonal; overall markets remain fairly tight.

“New supply is finally starting to arrive at levels that will more closely match overall demand. In a few markets, we are seeing completions a little higher than absorptions, but this is likely to be short term in nature. Fundamentally, demand for apartment homes should be strong for the rest of the decade (and beyond) – provided only that the economy remains on track.”

...

The Market Tightness Index declined to 41 from 46. Slightly more than half (56 percent) of respondents reported unchanged conditions, and approximately one-third (31 percent) saw conditions as looser than three months ago. The index last indicated overall improving conditions in July 2013. Some respondents noted that the decline was typical for this time of year and that conditions remain fairly tight.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates loosening from the previous quarter. The quarterly decrease was small, but indicates looser market conditions.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. This survey now suggests vacancy rates are near a bottom.