by Calculated Risk on 1/08/2014 02:00:00 PM

Wednesday, January 08, 2014

FOMC Minutes: "Proceed cautiously" with QE3 Tapering

From the Fed: Minutes of the Federal Open Market Committee, December 17-18, 2013 . Excerpt:

In their discussion of monetary policy in the period ahead, most members agreed that the cumulative improvement in labor market conditions and the likelihood that the improvement would be sustained indicated that the Committee could appropriately begin to slow the pace of its asset purchases at this meeting. However, members also weighed a number of considerations regarding such an action, including their degree of confidence in prospects for sustained above-potential economic growth, continued improvement in labor market conditions, and a return of inflation to its mandate-consistent level over time. Some also expressed concern about the potential for an unintended tightening of financial conditions if a reduction in the pace of asset purchases was misinterpreted as signaling that the Committee was likely to withdraw policy accommodation more quickly than had been anticipated. As a consequence, many members judged that the Committee should proceed cautiously in taking its first action to reduce the pace of asset purchases and should indicate that further reductions would be undertaken in measured steps. Members also stressed the need to underscore that the pace of asset purchases was not on a preset course and would remain contingent on the Committee's outlook for the labor market and inflation as well as its assessment of the efficacy and costs of purchases. Consistent with this approach, the Committee agreed that, beginning in January, it would add to its holdings of agency mortgage-backed securities at a pace of $35 billion per month rather than $40 billion per month, and add to its holdings of longer-term Treasury securities at a pace of $40 billion per month rather than $45 billion per month. While deciding to modestly reduce its pace of purchases, the Committee emphasized that its holdings of longer-term securities were sizable and would still be increasing, which would promote a stronger economic recovery by maintaining downward pressure on longer-term interest rates, supporting mortgage markets, and helping to make broader financial conditions more accommodative. The Committee also reiterated that it will continue its asset purchases, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. In the view of one member, a reduction in the pace of purchases was premature and, before taking such a step, the Committee should wait for more convincing evidence that economic growth was rising faster than its potential and that inflation would return to the Committee's 2 percent objective.

In their discussion of forward guidance about the target federal funds rate, a few members suggested that lowering the unemployment threshold to 6 percent could effectively convey the Committee's intention to keep the target federal funds rate low for an extended period. However, most members wanted to make no change to the threshold and instead preferred to provide qualitative guidance to clarify that a range of labor market indicators would be used when assessing the appropriate stance of policy once the threshold had been crossed. A number of members thought that the forward guidance should emphasize the importance of inflation as a factor in their decisions. Accordingly, almost all members agreed to add language indicating the Committee's anticipation, based on its current assessment of additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments, that it would be appropriate to maintain the current target range for the federal funds rate well past the time that the unemployment rate declines below 6-1/2 percent, especially if projected inflation continues to run below the Committee's longer-run objective. It was noted that this language might appear calendar-based rather than conditional on economic and financial developments, and one member objected to having forward guidance that might be seen as relatively inflexible in response to changes in members' views about the appropriate path of the target federal funds rate. However, those concerns generally were seen as outweighed by the benefit of avoiding tying the Committee's decision too closely to the unemployment rate alone, while still being clear about the Committee's intention to provide the monetary accommodation needed to support a return to maximum employment and stable prices.

emphasis added

Employment Preview for December: Taking the "Under"

by Calculated Risk on 1/08/2014 11:41:00 AM

Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus is for an increase of 200,000 non-farm payroll jobs in December, and for the unemployment rate to be unchanged at 7.0%.

Something to keep in mind - it is possible that the cold weather in December impacted the payroll report. Goldman Sachs economist Kris Dawsey wrote this week:

Adverse weather so far this winter―including record low temperatures set in parts of the country―has focused attention on the potential impact on economic data. For instance, our auto analysts note that disappointing December sales could in some part be attributed to unfavorable weather. Regarding the near-term data calendar, we expect that colder-than-normal weather during the survey period for the December payroll report probably pushed employment growth below its recent trend. (Our preliminary forecast is for a 175,000 gain in total payrolls to be released this Friday.)Here is a summary of recent data:

• The ADP employment report showed an increase of 238,000 private sector payroll jobs in December. This was above expectations of 205,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month. But in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index increased in December to 56.9%, from 56.5% in November. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs increased about 18,000 in November. The ADP report indicated a 19,000 increase for manufacturing jobs in December.

The ISM non-manufacturing employment index increased in December to 55.8% from 52.5% in November. A historical correlation between the ISM non-manufacturing index and the BLS employment report for non-manufacturing, suggests that private sector BLS reported payroll jobs for non-manufacturing increased by about 227,000 in December.

Taken together, these surveys suggest around 245,000 jobs added in December - above the consensus forecast.

• Initial weekly unemployment claims averaged close to 358,000 in December. This was up sharply from an average of 324,000 in November, but about the same as the 358,000 average in October. For the BLS reference week (includes the 12th of the month), initial claims were at 380,000; the highest level since March.

This suggests more layoffs, and possibly fewer net payroll jobs added than the consensus forecast.

• The final December Reuters / University of Michigan consumer sentiment index increased to 82.5 from the October reading of 75.1. This is frequently coincident with changes in the labor market, but in this case sentiment is recovering from the government shutdown.

• The small business index from Intuit showed a 20,000 increase in small business employment in December. This is the largest increase in this index since May, and suggests a pickup in small business hiring.

• Conclusion: As usual the data was mixed. The ADP report was higher in December than in November, and the ISM surveys suggest a larger increase in payrolls. Consumer sentiment increased (recovering from government shutdown). Also the Intuit small business index showed a pickup in hiring.

However weekly claims for the reference week were at the highest level since March (possibly weather related), and this suggests weather impacted the December employment report.

There is always some randomness to the employment report, but my guess is the report will be under the consensus forecast of 200,000 nonfarm payrolls jobs added in December.

Reis: Mall Vacancy Rates decline in Q4

by Calculated Risk on 1/08/2014 09:42:00 AM

Reis reported that the vacancy rate for regional malls declined to 7.9% in Q4, down from 8.2% in Q3. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate was declined to 10.4%, down from 10.5% in Q3. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist Ryan Severino:

[Strip Malls] The national vacancy rate for neighborhood and community shopping centers declined by 10 basis points during the fourth quarter. This was a slight improvement versus last quarter when vacancy was unchanged, but more or less in line with the pace of improvement since the market began to recover two years ago. ... Vacancies for neighborhood and community centers now stand at 10.4%, down 30 basis points during 2013, and down 70 basis points from the historical peak vacancy rate of 11.1% which was recorded over two years ago, during the third quarter of 2011. Yet there are some modestly hopeful signs.

Construction during the fourth quarter was the highest since the fourth quarter of 2011 while net absorption was the highest since the fourth quarter of 2007. The fact that net absorption exceeded construction by roughly 2.5 million SF during the quarter is certainly a heartening sign. This indicates that there is some semblance of demand for existing inventory and not simply the addition of pre‐leased space in the market.

...

[Regional] Malls continue to be the outperformers during the retail market recovery. As of the fourth quarter mall vacancies stand at 7.9%, down 30 basis points from the third quarter, down 70 basis points during 2013, and down 150 basis points from the historical high level reached during the third quarter of 2011.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

For strip malls, absorption has increased (highest since 2007), but new construction has increased too keeping the overall vacancy rate high. Some areas of the country are recovering faster than others (malls aren't transportable!), so there are areas with new construction while other areas are still struggling.

Mall vacancy data courtesy of Reis.

ADP: Private Employment increased 238,000 in December

by Calculated Risk on 1/08/2014 08:21:00 AM

Private sector employment increased by 238,000 jobs from November to December, according to the December ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 205,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "The job market ended 2013 on a high note. Job growth meaningfully accelerated and is now over 200,000 per month. Job gains are broad-based across industries, most notably in construction and manufacturing. It appears that businesses are growing more confident and increasing their hiring.”

Note: ADP hasn't been very useful in directly predicting the BLS report on a monthly basis, but it might provide a hint. The BLS report for December will be released on Friday.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 1/08/2014 07:01:00 AM

Note: This release is for two weeks ... from the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 3, 2014. The most recent week’s results include an adjustment to account for the New Year’s Day holiday, while the previous week’s results were adjusted for the Christmas holiday. ...

The Refinance Index increased 5 percent from the previous week after falling by 9 percent the week prior. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier but increased 2 percent the week prior. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 4.72 percent, with points unchanged at 0.28 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down sharply - and down 73% from the levels in early May - and last week was at the lowest level since November 2008

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 8% from a year ago.

Tuesday, January 07, 2014

Wednesday: ADP Employment, FOMC Minutes, Q4 Mall Vacancy Survey

by Calculated Risk on 1/07/2014 09:07:00 PM

Hopefully this will happen ... extending unemployment benefits is good economics, good policy, and the right thing to do. From the NY Times: Vote in Senate Starts Talks on Extending Unemployment Benefits

The three-month extension of benefits passed with no room to spare, on a vote of 60 to 37 ... Tuesday’s vote merely got the Senate to consider the unemployment bill formally. The six Republicans who voted yes included moderates like Senators Susan Collins of Maine and Lisa Murkowski of Alaska, but also conservatives from states with unemployment rates above the national average, like Senators Rob Portman of Ohio and Dan Coats of Indiana.Menzi Chinn at Econbrowser has the CBO analysis: Macro Implications of Extending Emergency Unemployment Compensation

This should be a non-partisan issue. Historically mainstream politicians of both parties (and most Americans) have supported emergency unemployment benefits when so many people are suffering from long term unemployment. It would be unprecedented not to extend the benefits.

Wednesday:

• Early: Reis Q4 2013 Mall Survey of rents and vacancy rates.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index for the previous two weeks.

• At 8:15 AM, the ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 205,000 payroll jobs added in December, down from 215,000 in November.

• At 2:00 PM, the Fed will release the FOMC Minutes for the Meeting of December 17-18, 2013.

• At 3:00 PM, Consumer Credit for November from the Federal Reserve. The consensus is for credit to increase $14.2 billion in November.

Zillow: Case-Shiller House Price Index expected to show 13.7% year-over-year increase in November

by Calculated Risk on 1/07/2014 05:02:00 PM

The Case-Shiller house price indexes for October were released last week. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close. It looks like another very strong month ...

From Zillow: Case-Shiller Expected to Show Continued Inflated Appreciation

The Case-Shiller data for October came out [last week], and based on this information and the November 2013 Zillow Home Value Index (ZHVI, released December 19th) we predict that next month’s Case-Shiller data (November 2013) will show that both the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased 13.7 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from October to November will be 0.6 percent for both the 20-City Composite and the 10-City Composite Home Price Indices (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for November will not be released until Tuesday, Jan. 28.The following table shows the Zillow forecast for the October Case-Shiller index.

... the ZHVI does not include foreclosure resales and shows home values for November 2013 up 7.1 percent from year-ago levels. More on the differences between a repeat sales index, including the Case-Shiller indices, and an imputed hedonic index like the ZHVI can be found here. We expect home value appreciation to continue to moderate through the end of 2013 and into 2014, rising 4.6 percent between November 2013 and November 2014 — a rate much more in line with historic appreciation rates.

| Zillow November Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Nov 2012 | 158.26 | 157.70 | 145.81 | 145.31 |

| Case-Shiller (last month) | Oct 2013 | 180.27 | 178.04 | 165.91 | 163.90 |

| Zillow Forecast | YoY | 13.7% | 13.7% | 13.7% | 13.7% |

| MoM | -0.2% | 0.6% | -0.1% | 0.6% | |

| Zillow Forecasts1 | 179.9 | 179.2 | 165.8 | 165.1 | |

| Current Post Bubble Low | 146.45 | 149.65 | 134.07 | 136.89 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 22.8% | 19.7% | 23.6% | 20.6% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Reis: Apartment Vacancy Rate declined to 4.1% in Q4 2013, Expected to increase slightly in 2014

by Calculated Risk on 1/07/2014 03:13:00 PM

Reis reported that the apartment vacancy rate declined in Q4 to 4.1% from 4.2% in Q3. In Q4 2012 (a year ago) the vacancy rate was at 4.6%, and the rate peaked at 8.0% at the end of 2009.

Some data and comments from Reis Senior Economist Ryan Severino:

Vacancy declined by 10 basis points during fourth quarter to 4.1%, in line with last quarter's 10 basis point decline. Over the last year the national vacancy rate has declined by 50 basis points, on par with the year‐over‐year rate from the last few quarters. Demand for apartments remains strong four years after the recovery began, even as construction activity has gradually been increasing. Not even the seasonal weakness normally observed during the fourth quarters of calendar years had much if any impact on the market dynamics. The national vacancy rate now stands 390 basis points below the cyclical peak of 8.0% observed right after the recession concluded in late 2009.

Shrugging off the typical seasonal weakness that is observed during the fourth quarter of calendar years, demand for apartments remained stout in the fourth quarter of 2013. The sector absorbed 50,728 units, the largest figure since the fourth quarter of 2010. For 2013, the sector absorbed almost 165,000 units, ahead of 2012 but below the incredibly robust demand of 2010 and 2011. Meanwhile completions during the third quarter were 41,683 units, the highest quarterly total in ten years since the fourth quarter of 2003 when the market delivered 41,995 units. As we have been warning for the last few quarters, supply growth is clearly on an upswing. Roughly 127,000 units were delivered during 2013. This is in line with the long‐term historical average level of completions and the highest annual total since 2009. Four years after the advent of a recovery in the apartment market, newly completed units continue to be absorbed.

Asking and effective rents both grew by 0.8% during the fourth quarter. ... rent growth for 2013 came in below rent growth in 2012. Given the incredibly low vacancy rate, rent growth this weak is unprecedented. Normally at such a low vacancy rate, rent growth is at least 100 basis points above current growth rates on an annual basis. Although the labor market continues to convalesce, it remains far too slack for rent growth to accelerate much. In the past when the national vacancy rate fell near 4%, the economy and the labor market were stronger than they currently are. Moreover, on a nominal basis, rents are at historically high levels, which is also restraining tenants' ability to pay higher rents in many markets.

...

The apartment market has been on quite a tear over the last four years, with demand seemingly insatiable. With the economy and labor market expected to improve in 2014, one would think that the good times will continue unabated. However, the tremendous performance in the apartment market has spurred a substantial increase in construction activity and this is dampening the outlook for 2014. Completions next year should total more than 160,000, roughly one‐third greater than the long‐term historical average for annual completions. Demand will not implode but will struggle to keep pace with escalating completions. Therefore, we anticipate that for the first time since 2009 the national vacancy rate will rise in 2014.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

New supply is finally coming on the market and the decline in the vacancy rate has slowed - and Reis is projecting a slight increase in the vacancy rate this year

Apartment vacancy data courtesy of Reis.

CoreLogic: House Prices up 11.8% Year-over-year in November

by Calculated Risk on 1/07/2014 09:31:00 AM

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rise by 11.8 Percent Year Over Year in November

Year over year, home prices nationwide, including distressed sales, increased 11.8 percent in November 2013 compared to November 2012. This change represents the 21st consecutive monthly year-over-year increase in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased by 0.1 percent in November 2013 compared to October 2013.

Excluding distressed sales, home prices increased 0.3 percent month over month in November 2013 compared to October 2013. On a year-over-year basis, home prices, excluding distressed sales, increased by 10.4 percent in November 2013 compared to November 2012. Distressed sales include short sales and real-estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that December 2013 home prices, including distressed sales, are expected to dip 0.1 percent month over month from November to December 2013, with a projected increase of 11.5 percent on a year-over-year basis from December 2012.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.1% in November, and is up 11.8% over the last year. This index is not seasonally adjusted, and the month-to-month changes will be smaller - or even negative - for next several months.

The index is off 17.6% from the peak - and is up 22.4% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty one consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty one consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is a slightly smaller year-over-year gain than in October, and I expect the year-over-year price increases to slow in the coming months.

Trade Deficit decreased in November to $34.3 Billion

by Calculated Risk on 1/07/2014 08:44:00 AM

The Department of Commerce reported this morning:

[T]otal November exports of $194.9 billion and imports of $229.1 billion resulted in a goods and services deficit of $34.3 billion, down from $39.3 billion in October, revised. November exports were $1.7 billion more than October exports of $193.1 billion. November imports were $3.4 billion less than October imports of $232.5 billion.The trade deficit was less than the consensus forecast of $39.9 billion.

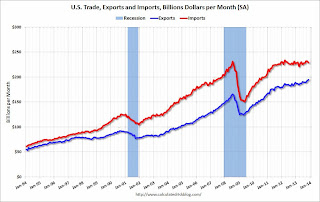

The first graph shows the monthly U.S. exports and imports in dollars through November 2013.

Click on graph for larger image.

Click on graph for larger image.Imports decreased, and exports increased in November.

Exports are 17% above the pre-recession peak and up 5% compared to November 2012; imports are just below the pre-recession peak, and down about 1% compared to November 2012.

The second graph shows the U.S. trade deficit, with and without petroleum, through November.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $94.69 in November, down from $99.96 in October, and down from $97.45 in November 2012. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China decreased to $26.9 billion in November, down from $28.9 billion in November 2012. A majority of the trade deficit is related to China.

Overall it appears exports are picking up a little again.