by Calculated Risk on 12/18/2013 10:00:00 AM

Wednesday, December 18, 2013

AIA: "Slight Contraction for Architecture Billings Index" in November

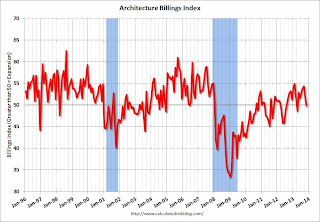

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Slight Contraction for Architecture Billings Index

After six months of steadily increasing demand for design services, the Architecture Billings Index (ABI) paused in November. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the November ABI score was 49.8, down from a mark of 51.6 in October. This score reflects a slight decrease in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 57.8, down from the reading of 61.5 the previous month.

“Architecture firms continue to report widely varying views of business conditions across the country. This slight dip is likely just a minor, and hopefully temporary, lull in the progress of current design projects,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “But there is a continued uneasiness in the marketplace as businesses attempt to determine the future direction of demand for commercial, industrial, and institutional buildings.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 49.8 in November, down from 51.6. Anything below 50 indicates contraction in demand for architects' services. This index has indicated expansion in 14 of the last 16 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index is not as strong as during the '90s - or during the bubble years of 2004 through 2006 - but the readings this year suggest some increase in CRE investment in 2014.

Housing Starts at 1.09 million Annual Rate in November

by Calculated Risk on 12/18/2013 08:38:00 AM

This report is for three months due to the government shutdown; September, October and November.

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in November were at a seasonally adjusted annual rate of 1,091,000. This is 22.7 percent above the revised October estimate of 889,000 and is 29.6 percent above the November 2012 rate of 842,000.

Single-family housing starts in November were at a rate of 727,000; this is 20.8 percent above the revised October figure of 602,000. The November rate for units in buildings with five units or more was 354,000.

Building Permits:

Privately-owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 1,007,000. This is 3.1 percent below the revised October rate of 1,039,000, but is 7.9 percent above the November 2012 estimate of 933,000.

Single-family authorizations in November were at a rate of 634,000; this is 2.1 percent above the revised October figure of 621,000. Authorizations of units in buildings with five units or more were at a rate of 346,000 in November.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in November (Multi-family is volatile month-to-month).

Single-family starts (blue) increased sharply to 727,000 SAAR in November.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was well above expectations of 952 thousand starts in November. I'll have more later ... but this was a solid report.

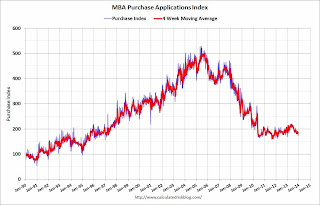

MBA: Mortgage Applications Decrease in Latest Survey

by Calculated Risk on 12/18/2013 07:01:00 AM

From the MBA: Mortgage Applications Fall During Holiday-Shortened Week

Mortgage applications decreased 5.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 13, 2013. ...

The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier to the lowest level since December 2012....

...

"Mortgage applications fell further last week, with the market index falling to its lowest level in more than a dozen years,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Both purchase and refinance applications fell as interest rates increased going into today's Federal Open Market Committee meeting."

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.62 percent, the highest level since September 2013, from 4.61 percent, with points increasing to 0.38 from 0.26 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down sharply - and down 70% from the levels in early May.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 11% from a year ago.

Tuesday, December 17, 2013

Wednesday: Fed Day, Housing Starts

by Calculated Risk on 12/17/2013 08:21:00 PM

The long delayed housing starts report will be released tomorrow for September, October and November.

Starts are a key report, but the big story for the day will be the FOMC announcement, projections, and press briefing. The consensus is the FOMC will wait until early 2014 to start to reduce asset purchases, but it is possible that they will start the "taper" at this meeting.

Wednesday:

• 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Census Bureau will release Housing Starts for September, October and November. Total housing starts were at 891 thousand (SAAR) in August. Single family starts were at 628 thousand SAAR in August. The consensus is for total housing starts to increase to 952 thousand (SAAR) in November.

• During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

• At 2:00 PM, the FOMC Meeting Announcement will be released. It is possible the FOMC will start to reduce QE purchases following this meeting.

• Also at 2:00 PM, the FOMC projections will be released. This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chairman Ben Bernanke will hold a press briefing following the FOMC announcement.

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in November

by Calculated Risk on 12/17/2013 05:41:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in November.

From CR: This is just a few markets, but total "distressed" share is down significantly, foreclosure are down in most areas, and short sales are off sharply year-over-year.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back in markets (like Vegas and Phoenix) the share of all cash buyers will probably decline.

Note: Existing home sales for November will be released on Thursday, and Tom Lawler is projecting the NAR will report sales of 4.98 million on a seasonally adjusted annual rate basis. The consensus is for sales to decline to a 5.05 million SAAR, down from 5.12 SAAR in October.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Nov-13 | Nov-12 | Nov-13 | Nov-12 | Nov-13 | Nov-12 | Nov-13 | Nov-12 | |

| Las Vegas | 21.0% | 41.2% | 7.0% | 10.7% | 28.0% | 51.9% | 43.7% | 52.7% |

| Reno | 17.0% | 41.0% | 6.0% | 9.0% | 23.0% | 50.0% | ||

| Phoenix | 7.8% | 23.2% | 8.0% | 12.9% | 15.8% | 36.1% | 34.0% | 43.2% |

| Sacramento | 11.0% | 36.1% | 4.6% | 11.5% | 15.6% | 47.6% | 25.0% | 37.1% |

| Minneapolis | 5.0% | 11.1% | 17.0% | 24.5% | 22.0% | 35.6% | ||

| Mid-Atlantic | 7.5% | 11.9% | 8.1% | 8.7% | 15.7% | 20.6% | 19.6% | 20.0% |

| Orlando | 13.5% | 29.4% | 20.3% | 21.1% | 33.8% | 50.5% | 46.5% | 54.2% |

| California* | 12.3% | 26.2% | 6.8% | 16.9% | 19.1% | 43.1% | ||

| Bay Area CA* | 9.1% | 23.2% | 3.7% | 12.5% | 12.8% | 35.7% | 22.0% | 28.9% |

| So. California* | 12.7% | 26.6% | 6.3% | 15.4% | 19.0% | 42.0% | 27.2% | 34.0% |

| Hampton Roads | 26.9% | 28.3% | ||||||

| Northeast Florida | 36.4% | 41.8% | ||||||

| Chicago | 35.0% | 43.0% | ||||||

| Tucson | 32.2% | 0.338 | ||||||

| Toledo | 37.2% | 0.409 | ||||||

| Des Moines | 19.9% | 22.1% | ||||||

| Peoria | 21.8% | 21.2% | ||||||

| Omaha | 21.6% | 19.8% | ||||||

| Spokane | 16.0% | 9.1% | ||||||

| Houston | 7.7% | 15.0% | ||||||

| Memphis* | 20.4% | 24.4% | ||||||

| Birmingham AL | 21.0% | 26.5% | ||||||

| Springfield IL | 17.0% | 15.8% | ||||||

| *share of existing home sales, based on property records | ||||||||

Sacramento Housing: Total Sales down 29% Year-over-year in November, Conventional Sales up 14%, Active Inventory increases 57%

by Calculated Risk on 12/17/2013 03:51:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For a long time, not much changed. But over the last 2 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In November 2013, 15.5% of all resales (single family homes) were distressed sales. This was down from 16.7% last month, and down from 47.6% in November 2012.

The percentage of REOs was at 4.4%, and the percentage of short sales decreased to 11.0%. (the lowest percentage of distressed sales since the Sacramento Realtors started tracking the data).

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently (blue).

Active Listing Inventory for single family homes increased 56.8% year-over-year in November. This is the seventh consecutive month with a year-over-year increase in inventory.

Cash buyers accounted for 25.0% of all sales, down from 37.1% a year ago (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 29% from November 2012, but conventional sales were up 14% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

As I've noted before, we are seeing a similar pattern in other distressed areas. This suggests what will happen in other areas: 1) Flat or declining overall existing home sales, 2) but increasing conventional sales, 3) Less investor buying, 4) more inventory, and 5) slower price increases.

Key Measures Shows Low Inflation in November

by Calculated Risk on 12/17/2013 12:49:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.2% annualized rate) in November. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for November here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was unchanged (with annualized rate of 0.4%) in November. The CPI less food and energy increased 0.2% (1.9% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.0%, the trimmed-mean CPI rose 1.6%, the CPI rose 1.2%, and the CPI less food and energy rose 1.7%. Core PCE is for October and increased just 1.1% year-over-year.

On a monthly basis, median CPI was at 2.2% annualized, trimmed-mean CPI was at 1.2% annualized, and core CPI increased 1.9% annualized.

These measures indicate inflation remains below the Fed's target.

NAHB: Builder Confidence increases to 58 in December

by Calculated Risk on 12/17/2013 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 58 in December, up from 54 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Rises Four Points in December

Builder confidence in the market for newly built, single-family homes improved four points to a 58 reading on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for December, released today. This gain reflected improvement in all three index components – current sales conditions, sales expectations and traffic of prospective buyers.

...

All three HMI components posted gains in December. The index gauging current sales conditions jumped six points to 64, while the index gauging expectations for future sales rose two points to 62. The index gauging traffic of prospective buyers gained three points to 44.

Looking at the three-month moving averages for regional HMI scores, the South edged one point higher to 57 while the Northeast, Midwest and West each fell a single point to 38, 59 and 59, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

“This is definitely an encouraging sign as we move into 2014,” said National Association of Home Builders (NAHB) Chairman Rick Judson, a home builder from Charlotte, N.C. “The HMI is up 11 points since December of 2012 and has been above 50 for the past seven months. This indicates that an increasing number of builders have a positive view on where the industry is going.”

CoreLogic: Almost 800,000 Properties returned to positive Equity during Q3 2013

by Calculated Risk on 12/17/2013 08:57:00 AM

From CoreLogic: CoreLogic reports 791,000 More Residential Properties Return to Positive Equity in Second Quarter

CoreLogic ... today released new analysis showing approximately 791,000 more residential properties returned to a state of positive equity during the third quarter of 2013, and the total number of mortgaged residential properties with equity currently stands at 42.6 million. The analysis indicates that nearly 6.4 million homes, or 13 percent of all residential properties with a mortgage, were still in negative equity at the end of the third quarter of 2013. This figure is down from 7.2 million homes, or 14.7 percent of all residential properties with a mortgage, at the end of the second quarter of 2013.

... Of the 42.6 million residential properties with positive equity, 10 million have less than 20 percent equity. Borrowers with less than 20 percent equity, referred to as “under-equitied,” may have a more difficult time obtaining new financing for their homes due to underwriting constraints. Under-equitied mortgages accounted for 20.4 percent of all residential properties with a mortgage nationwide in the third quarter of 2013, with more than 1.5 million residential properties at less than 5 percent equity, referred to as near-negative equity. Properties that are near negative equity are considered at risk should home prices fall. ...

“Rising home prices continued to help homeowners regain their lost equity in the third quarter of 2013,” said Mark Fleming, chief economist for CoreLogic. “Fewer than 7 million homeowners are underwater, with a total mortgage debt of $1.6 trillion. Negative equity will decline even further in the coming quarters as the housing market continues to improve.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 32.2 percent, followed by Florida (28.8 percent), Arizona (22.5 percent), Ohio (18.0 percent) and Georgia (17.8 percent). These top five states combined accounted for 36.4 percent of negative equity in the U.S."

The second graph shows the distribution of home equity in Q3 compared to Q2. Close to 5% of residential properties have 25% or more negative equity, down from around 6% in Q2 and 8% in Q1.

The second graph shows the distribution of home equity in Q3 compared to Q2. Close to 5% of residential properties have 25% or more negative equity, down from around 6% in Q2 and 8% in Q1.In Q3 2012, there were 10.5 million properties with negative equity - now there are 6.4 million. A significant change.

CPI unchanged in November, Core CPI increases 0.2%

by Calculated Risk on 12/17/2013 08:36:00 AM

From the Bureau of Labor Statistics (BLS): Consumer Price Index - November 2013

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in November on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.2 percent before seasonal adjustment.On a year-over-year basis, CPI is up 1.2 percent, and core CPI is up also up 1.7 percent. Both are below the Fed's target. This was close to the consensus forecast of no change for CPI, and above the consensus for a 0.1% increase in core CPI.

...

The index for all items less food and energy rose 0.2 percent in November. ... The 12-month increase in the index for all items less food and energy remained at 1.7 percent for the third month in a row.

emphasis added

I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This is the last inflation data before the FOMC decision tomorrow.