by Calculated Risk on 12/03/2013 04:17:00 PM

Tuesday, December 03, 2013

Lawler: Single Family Inventory Down Again, But Pace of Decline Slowed in Q3

From housing economist Tom Lawler:

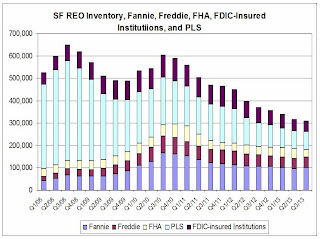

The overall SF REO inventory appears to have declined again last quarter, though the pace of decline slowed. Both Fannie and Freddie reported slight increases last quarter, reflecting modest increases in acquisitions (mainly in judicial foreclosure states) and declines in dispositions in part reflecting “market conditions. FHA’s SF REO inventory, in contrast, declined last quarter following increases in the previous two quarters.

REO inventory both held by private-label securities and at FDIC-insured institutions also fell last quarter, though at a slower pace than the previous few quarters. (Note: I get my PLS inventory estimates from Barclays Capital, but only have data through August. For FDIC-insured institutions, I assume that the average carrying value is 50% higher than that at Fannie and Freddie).

Click on graph for larger image.

Click on graph for larger image.

CR Note: This is most, but not all, of the lender owner foreclosure inventory, aka "Real Estate Owned" (REO). There is also REO for the VA, and some other non-FDIC insured institutions - but this is probably close to 90% of all REOs.

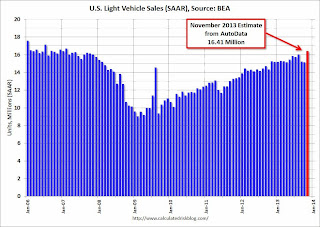

U.S. Light Vehicle Sales increase to 16.4 million annual rate in November, Highest since Feb 2007

by Calculated Risk on 12/03/2013 02:03:00 PM

Based on an estimate from AutoData, light vehicle sales were at a 16.41 million SAAR in November. That is up 7.6% from November 2012, and up 8.3% from the sales rate last month. Some of the sales in November might be a bounce back from the weakness in October related to the government shutdown.

This was above the consensus forecast of 15.7 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for November (red, light vehicle sales of 16.41 million SAAR from AutoData).

Click on graph for larger image.

Click on graph for larger image.

This was the highest sales rate since February 2007, and was probably due to some bounce back buying following the government shutdown.

The growth rate will probably slow in 2013 - compared to the previous three years - but this will still be another solid year for the auto industry.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and are still a key driver of the recovery. Looking forward, growth will slow for auto sales. If sales average the recent pace for the entire year, total sales will be up almost 9% from 2012, not quite double digit but still strong.

Fannie, Freddie, FHA REO inventory declined slightly in Q3

by Calculated Risk on 12/03/2013 11:06:00 AM

The FHA has stopped releasing REO inventory as part of their monthly report, however they provided me the most recent data today (for October).

In their Q3 SEC filing, Fannie reported their Real Estate Owned (REO) increased to 100,941 single family properties, up from 96,920 at the end of Q2. Freddie reported their REO increased to 47,119 in Q3, up from 44,623 at the end of Q2.

The FHA reported their REO decreased to 32,226 (as of October), down from 41,838 in Q2. This reverses a recent trend of increasing REO inventory at the FHA.

The combined Real Estate Owned (REO) for Fannie, Freddie and the FHA declined to 180,286, down from 183,381 at the end of Q2 2013. The peak for the combined REO of the F's was 295,307 in Q4 2010.

This following graph shows the REO inventory for Fannie, Freddie and the FHA.

Click on graph for larger image.

Click on graph for larger image.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions, VA and more. REO has been declining for those categories too.

Although REO was up for Fannie and Freddie in Q3 from Q2, REO decreased for the FHA - and overall REO was down for the twelfth consecutive quarter.

CoreLogic: House Prices up 12.5% Year-over-year in October

by Calculated Risk on 12/03/2013 08:58:00 AM

Notes: This CoreLogic House Price Index report is for October. The recent Case-Shiller index release was for September. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Increased by Less Than 1 Percent Month Over Month in October

On a month-over-month basis, including distressed sales, home prices increased by only 0.2 percent in October 2013 compared to September 2013. Year over year, home prices nationwide, including distressed sales, increased 12.5 percent in October 2013 compared to October 2012. This change represents the 20th consecutive monthly year-over-year increase in home prices nationally.

Excluding distressed sales, home prices increased 0.4 percent month over month in October 2013 compared to September 2013. On a year-over-year basis, excluding distressed sales, home prices increased by 11 percent in October 2013 compared to October 2012. Distressed sales include short sales and real-estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that November 2013 home prices, including distressed sales, are expected to remain at the same level month over month as October 2013, with a projected increase of 12.2 percent on a year-over-year basis from November 2012.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.2% in October, and is up 12.5% over the last year. This index is not seasonally adjusted, and the month-to-month changes will be smaller for next several months.

The index is off 17.5% from the peak - and is up 22.9% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

I expect the year-over-year price increases to slow in the coming months.

Monday, December 02, 2013

Tuesday: Vehicle Sales

by Calculated Risk on 12/02/2013 08:45:00 PM

From Joe Weisenthal at Business Insider: Here's Wall Street's Big Idea For 2014

[I]t's clear what the big idea for 2014 is: The final return to a normal non-crisis environment and the search for growth.It is fun to make out of consensus calls, but I also think growth will pickup in 2014.

This theme was stated with the most flair by Japanese investment bank Nomura, which titled its 2014 outlook the "End Of The End Of The World." ...

Morgan Stanley's outlook for 2014 incorporate similar ideas. They lay out 5 big things that need to happen for sustained global growth, and what's key is that each pillar is region specific and not crisis related. ...

Meanwhile, Citi's top economist Willem Buiter goes so far as to call 2014 a potentially "revolutionary" year for the global economy, precisely because of the end of the age of crisis.

Yet what is revolutionary about 2014 is that the likelihood of severe downside tail events, which could paralyze the global economy, seems to have diminished significantly (though not disappeared). Granted, the euro-area is still work in progress, China presents meaningful question marks, Congressional gridlock in the US could still throw sand in the federal fiscal wheels and geopolitics can always surprise. But, enough progress has been made that all of these issues seem less threatening today than 12 months ago.

Tuesday:

• All Day: Light vehicle sales for November. The consensus is for light vehicle sales to increase to 15.7 million SAAR in November (Seasonally Adjusted Annual Rate) from 15.2 million SAAR in October.

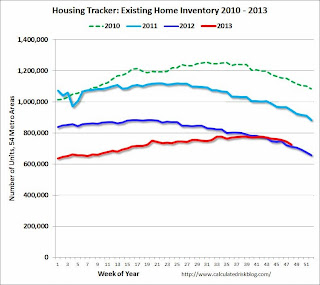

Weekly Update: Housing Tracker Existing Home Inventory up 1.7% year-over-year on Nov Dec 2nd

by Calculated Risk on 12/02/2013 04:38:00 PM

Here is another weekly update on housing inventory ... for the seventh consecutive week, housing inventory is up year-over-year. This suggests inventory bottomed early in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for October). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012 and 2013.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2013 is now 1.7% above the same week in 2012 (red is 2013, blue is 2012).

We can be pretty confident that inventory bottomed early this year. Inventory is still very low, but this increase in inventory should slow house price increases. One of the key questions for 2014 will be: How much will inventory increase? I'll post some thoughts on inventory at the end of the year.

Restaurant Performance Index increases in October

by Calculated Risk on 12/02/2013 01:59:00 PM

From the National Restaurant Association: Restaurant Performance Index Hit a Four-Month High in October

Fueled by stronger same-store sales and traffic and a more optimistic outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) rose to a four-month high in October. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.9 in October, up 0.7 percent from September and the strongest level since June. In addition, the RPI stood above 100 for the eighth consecutive month, which signifies expansion in the index of key industry indicators.

“The RPI’s October gain was driven by broad-based gains in the index components, most notably solid improvements in same-store sales and customer traffic,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association.

...

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 100.9 in October – up 1.0 percent from a level of 99.9 in September and the highest level in five months.

A majority of restaurant operators reported higher same-store sales in October, and the results were a solid improvement over September’s performance. ... Restaurant operators also reported stronger customer traffic levels in October.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index increased to 100.9 in October, up from 100.2 in September. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

Construction Spending increased in October

by Calculated Risk on 12/02/2013 11:31:00 AM

Note: The release today was for both September and October. Construction spending decreased in September and increased in October (October was up from August).

The Census Bureau reported that overall construction spending increased in October:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during October 2013 was estimated at a seasonally adjusted annual rate of $908.4 billion, 0.8 percent above the September estimate of $901.2 billion. The October figure is 5.3 percent above the October 2012 estimate of $863.1 billion.

...

Spending on private construction was at a seasonally adjusted annual rate of $625.7 billion, 0.5 percent below the September estimate of $629.0 billion. ...

In October, the estimated seasonally adjusted annual rate of public construction spending was $282.7 billion, 3.9 percent above the September estimate of $272.2 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

There has been a "pause" in residential construction spending, but the level is still very low and I expect residential spending to continue to increase. Private residential spending is 52% below the peak in early 2006, and up 43% from the post-bubble low.

Non-residential spending is 28% below the peak in January 2008, and up about 33% from the recent low.

Public construction spending is now 13% below the peak in March 2009 and up about 7% from the recent low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 17%. Non-residential spending is down 3% year-over-year. Public spending is up 2% year-over-year.

To repeat a few key themes:

1) Private residential construction is usually the largest category for construction spending, and is now the largest category once again. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time for a couple of years - mostly related to energy and power - but the key sectors of office, retail and hotels are still at very low levels. Based on the architecture billings index, I expect private non-residential to start to increase.

3) Public construction spending increased in October and is now 7% above the low in April. It appears that the drag from public construction spending is over. Public spending has declined to 2006 levels (not adjusted for inflation) and was a drag on the economy for 4 years. In real terms, public construction spending has declined to 2001 levels.

Looking forward, construction spending should continue to increase. Residential spending is still very low, non-residential should start to pickup, and public spending appears to have bottomed.

ISM Manufacturing index increases in November to 57.3

by Calculated Risk on 12/02/2013 10:00:00 AM

The ISM manufacturing index indicated faster expansion in November. The PMI was at 57.3% in November, up from 56.4% in October. The employment index was at 56.5%, up from 53.2%, and the new orders index was at 63.6%, up from 60.6% in October.

From the Institute for Supply Management: November 2013 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in November for the sixth consecutive month, and the overall economy grew for the 54th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI™ registered 57.3 percent, an increase of 0.9 percentage point from October's reading of 56.4 percent. The PMI™ has increased progressively each month since June, with November's reading reflecting the highest PMI™ in 2013. The New Orders Index increased in November by 3 percentage points to 63.6 percent, and the Production Index increased by 2 percentage points to 62.8 percent. The Employment Index registered 56.5 percent, an increase of 3.3 percentage points compared to October's reading of 53.2 percent. This reflects the highest reading since April 2012 when the Employment Index registered 56.8 percent. With 15 of 18 manufacturing industries reporting growth in November relative to October, the positive growth trend characterizing the second half of 2013 is continuing."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 55.2% and suggests manufacturing expanded at a faster pace in November.

Markit PMI shows stronger expansion for manufacturing in November

by Calculated Risk on 12/02/2013 09:00:00 AM

The Markit PMI is at 54.7 (above 50 is expansion). This was up from 51.8 in October, and up from the November flash reading of 54.3.

From Markit: PMI jumps to highest reading since January

The final Markit U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) registered 54.7 in November, signalling the strongest improvement in manufacturing business conditions since January. The headline index was up sharply from 51.8 in October (a one-year low) and above the earlier flash estimate of 54.3.The ISM PMI for November will be released at 10 AM ET today.

...

Firms linked the marked rise in output to a stronger increase in new work intakes. Notably, new order growth was strong and accelerated to one of the fastest rates for over one-and-a-half years. [New orders were at 56.2 up from 52.7]

...

Employment in the U.S. manufacturing sector increased for the fifth consecutive month in November. However, the rate of job creation slowed to a modest pace that was weaker than the average for 2013 so far.

“The U.S. manufacturing sector has shown surprising resilience in the face of the government shutdown. The average PMI reading so far in the fourth quarter is unchanged on the average seen in the third quarter and the survey is consistent with production growing at an annualised rate of approximately 2.5%." [said Chris Williamson, Chief Economist at Markit]

“One of the most encouraging trends we are seeing, however, is a surge in the production of capital goods such as plant and machinery, which is growing at the fastest rate since the financial crisis, fuelled by rising domestic demand. This is a great sign that companies are feeling sufficiently confident to be boosting investment.”

emphasis added