by Calculated Risk on 11/15/2013 08:56:00 PM

Friday, November 15, 2013

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in October

Economist Tom Lawler sent me an updated table below of short sales, foreclosures and cash buyers for several selected cities in October.

On short sales from CR: Look at the first two columns in the table for Short Sales Share. Short sales are down sharply from a year ago, and will probably really decline in early 2014. It appears that the Mortgage Debt Relief Act of 2007 will not be extended again next year. Usually cancelled debt is considered income, but a provision of the 2007 Debt Relief Act allowed borrowers "to exclude certain cancelled debt on [a] principal residence from income. Debt reduced through mortgage restructuring, as well as mortgage debt forgiven in connection with a foreclosure, qualifies for the relief." (excerpt from IRS). This relief expires on Dec 31, 2013. Complete all short sales by the end of this year!

Total "Distressed" Share. In all areas that have reported distressed sales so far, the share of distressed sales is down year-over-year. Also there has been a significant decline in foreclosure sales in most of these cities.

The All Cash Share (last two columns) is mostly declining year-over-year. When investors pull back in markets like Phoenix (already declining), the share of all cash buyers will probably decline.

In general it appears the housing market is slowly moving back to normal.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Oct-13 | Oct-12 | Oct-13 | Oct-12 | Oct-13 | Oct-12 | Oct-13 | Oct-12 | |

| Las Vegas | 21.0% | 44.7% | 6.0% | 11.6% | 27.0% | 56.3% | 44.9% | 54.1% |

| Reno | 16.0% | 40.0% | 4.0% | 12.0% | 20.0% | 52.0% | ||

| Phoenix | 8.4% | 26.2% | 6.9% | 12.9% | 15.3% | 39.1% | 31.6% | 43.9% |

| Sacramento | 11.4% | 35.7% | 5.1% | 12.0% | 16.5% | 47.7% | 23.9% | 36.9% |

| Minneapolis | 5.1% | 10.4% | 16.4% | 24.9% | 21.5% | 35.3% | ||

| Mid-Atlantic | 7.9% | 9.1% | 8.2% | 13.0% | 16.1% | 22.1% | 19.9% | 20.0% |

| Orlando | 15.1% | 29.8% | 20.7% | 23.2% | 35.8% | 53.0% | 54.8% | |

| California* | 12.6% | 26.7% | 6.6% | 17.1% | 19.2% | 43.8% | ||

| Bay Area CA* | 10.3% | 22.9% | 3.6% | 11.7% | 13.9% | 34.6% | 22.8% | 29.6% |

| So. California* | 12.9% | 27.2% | 6.3% | 16.3% | 19.2% | 43.5% | 27.5% | 32.8% |

| Hampton Roads | 25.5% | 28.3% | ||||||

| Northeast Florida | 35.7% | 44.2% | ||||||

| Toledo | 37.0% | 36.0% | ||||||

| Des Moines | 20.2% | 21.7% | ||||||

| Peoria | 21.1% | 23.7% | ||||||

| Tucson | 32.9% | 31.8% | ||||||

| Omaha | 20.0% | 20.4% | ||||||

| SE Michigan | 34.5% | 44.3% | ||||||

| Spokane | 13.8% | 8.4% | ||||||

| Memphis* | 18.4% | 22.9% | ||||||

| Memphis* | 18.4% | 22.9% | ||||||

| Birmingham AL | 21.0% | 30.8% | ||||||

| *share of existing home sales, based on property records | ||||||||

Lawler: Early Read on Existing Home Sales in October

by Calculated Risk on 11/15/2013 05:03:00 PM

From housing economist Tom Lawler:

Based on local realtor/MLS reports across the country, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.08 million in October, down 4.0% from September’s seasonally adjusted pace. It’s difficult to gauge the extent to which last month’s government shutdown impacted closings last month, but weakness in contract signings prior to the shutdown suggest that last month’s decline in closings was mainly the result of higher mortgage rates and higher home prices. Weakness in closings was not uniform across the country – many Northeast markets, e.g., saw stronger YOY sales growth – but outside of the Northeast most markets saw a sales slowdown.

On the inventory front, most markets saw a “typical” seasonal decline in listings, but a number of markets actually saw an increase in listings – including many markets where the investor share of home sales has been higher than the norm over the last few years. Based on realtor/MLS reports AND on entities that track listings, I estimate that the inventory of existing homes for sale as measured by the NAR declined by 1.4% from the end of September to the end of October, which would imply that October listings would be up 3.3% from last October.

The government shutdown may have had a larger impact on contract signings, as several associations/MLS across the country reported YOY declines in new contract signings. Sadly, a large number of associations/MLS don’t report data on new contract signings to the public, and as a result it is difficult to construct “national” pending home sales measures consistent with the NAR’s pending home sales index (which I believe has some serious problems.)

CR Note: The NAR is scheduled to report October existing home sales on Wednesday, November 20th.

Hotel Occupancy Rate increases 2.5% year-over-year in latest Survey

by Calculated Risk on 11/15/2013 11:59:00 AM

From HotelNewsNow.com: STR: US results for week ending 9 November

The U.S. hotel industry posted positive results in the three key performance measurements during the week of 3-9 November, according to data from STR.The 4-week average of the occupancy rate is close to normal levels.

In year-over-year measurements, the industry’s occupancy increased 2.5 percent to 64.1 percent. Average daily rate rose 3.1 percent to finish the week at US$111.35. Revenue per available room for the week was up 5.7 percent to finish at US$71.34.

emphasis added

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average for the year 2000 through 2013.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2013 and black is for 2009 - the worst year since the Great Depression for hotels.

Note: Although 2009 was the worst year since the Depression, there was a brief period in 2001 when the occupancy rate was even lower than in 2009 due to the attacks on 9/11. In 2005, the occupancy rate was very high at the end of the year due to Hurricanes Katrina and Rita.

Through November 9th, the 4-week average of the occupancy rate is slightly higher than the same period last year and is tracking at pre-recession levels.

This has been a solid year for the hotel industry (although the government shutdown hurt for a few weeks in October).

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Fed: Industrial Production decreased 0.1% in October

by Calculated Risk on 11/15/2013 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production edged down 0.1 percent in October after having increased 0.7 percent in September. Manufacturing production rose 0.3 percent in October for its third consecutive monthly gain. The index for mining fell 1.6 percent after having risen for six consecutive months, and the output of utilities dropped 1.1 percent after having jumped 4.5 percent in September. The level of the index for total industrial production in October was equal to its 2007 average and was 3.2 percent above its year-earlier level. Capacity utilization for the industrial sector declined 0.2 percentage point in October to 78.1 percent, a rate 1.1 percentage points above its level of a year earlier and 2.1 percentage points below its long-run (1972-2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.1 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.1% is still 2.1 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.1% in October to 99.98. This is 19.4% above the recession low, but still slightly, 0.8%, below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were below expectations. The consensus was for a 0.1% increase in Industrial Production in October, and for Capacity Utilization to be at 78.3%.

NY Fed: Empire State Manufacturing Activity declines in November

by Calculated Risk on 11/15/2013 08:30:00 AM

From the NY Fed: Empire State Manufacturing Survey

The November 2013 Empire State Manufacturing Survey indicates that manufacturing conditions weakened somewhat for New York manufacturers. The general business conditions index fell four points to -2.2, its first negative reading since May. The new orders index also entered negative territory, falling thirteen points to -5.5 ...This is the first of the regional surveys for November. The general business conditions index was below the consensus forecast of a reading of 5.5, and shows contraction for the first time since May.

The prices received index fell to -4.0; the negative reading was a sign that selling prices had declined—their first retreat in two years. Labor market conditions were also weak, with the index for number of employees falling four points to 0.0, while the average workweek index dropped to -5.3. Despite the negative readings registered by many of the indexes for current activity, indexes for the six-month outlook continued to convey a strong degree of optimism about future business conditions. emphasis added

Thursday, November 14, 2013

Friday: Tanta's Birthday, Industrial Production, Empire State Mfg Survey

by Calculated Risk on 11/14/2013 09:39:00 PM

November 15th is my former co-blogger's birthday. Hard to believe it has been five years since she left us ... Happy Birthday Tanta!

Oh, Fed Chair nominee Janet Yellen was outstanding today (as expected). From the WSJ: Yellen Stands by Fed Strategy

The committee plans to vote on Ms. Yellen's nomination as soon as next week. She is expected to then win confirmation from the full Senate ...I expect an easy confirmation.

Friday:

• At 8:30 AM ET, the NY Fed Empire State Manufacturing Survey for November. The consensus is for a reading of 5.5, up from 1.5 in October (above zero is expansion).

• At 9:15 AM, the Fed is scheduled to release Industrial Production and Capacity Utilization for October. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.3%.

• At 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories for September. The consensus is for a 0.4% increase in inventories.

Freddie Mac: Fixed Mortgage Rates Climbing

by Calculated Risk on 11/14/2013 05:59:00 PM

From Freddie Mac today: Fixed Mortgage Rates Climbing

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving higher for the second consecutive week on stronger than expected data releases including the employment report for October. The 30-year fixed-rate mortgage is at its highest level since September 19, 2013, when it averaged 4.50 percent. ...The high this year for 30 year rates in the Freddie Mac survey was 4.58%, and the high for 15 year rates was 3.60%.

30-year fixed-rate mortgage (FRM) averaged 4.35 percent with an average 0.7 point for the week ending November 14, 2013, up from last week when it averaged 4.16 percent. A year ago at this time, the 30-year FRM averaged 3.34 percent.

15-year FRM this week averaged 3.35 percent with an average 0.7 point, up from last week when it averaged 3.27 percent. A year ago at this time, the 15-year FRM averaged 2.65 percent.

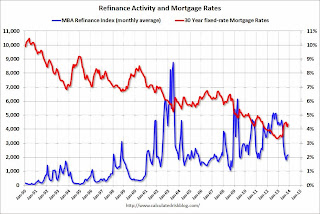

Click on graph for larger image.

Click on graph for larger image.This graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The refinance index dropped sharply earlier this year, and then rebounded a little (down 59% from early May).

FNC: House prices increased 6.2% year-over-year in September

by Calculated Risk on 11/14/2013 02:48:00 PM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: Home Prices Show Fastest Quarterly Growth Since Recovery Began

TThe latest FNC Residential Price Index™ (RPI) shows strong growth of home prices during the third quarter of 2013 as the housing recovery continues to broaden across the country. The index, constructed to gauge the price movement among the underlying non-distressed home sales, increased 2.5% between the second and third quarters, making the third-quarter growth the fastest in the current recovery.The 100-MSA composite was up 6.2% compared to September 2012 (slightly higher YoY change than in July and August). The FNC index turned positive on a year-over-year basis in July, 2012.

Rising home sales and relatively low foreclosure sales are the key drivers of continued increases in home prices. As of September, foreclosure sales nationwide accounted for 13.4% of total home sales, up slightly from August’s 12.7% but down from 16.6% a year ago. Home prices are expected to grow at a more moderate pace in the coming months because housing demand tapers off in the winter. ...

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that September home prices increased from the previous month at a seasonally unadjusted rate of 0.5%. In a sign of moderating month-over-month price momentum, September’s price increase has tapered off compared to July and August. On a year-over-year basis, home prices were up a modest 6.2% from a year ago, or 5.7% if measured quarterly. The 30-MSA and 10-MSA composites exhibit similar month-over-month price momentum but faster accelerations in year-over-year growth at 6.7% and 6.8%, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes.

Even with the recent increase, the FNC composite 100 index is still off 25.4% from the peak.

I expect all of the housing price indexes to show lower year-over-year price gains soon.

NY Fed: Household Debt increased in Q3, Delinquency Rates Improve

by Calculated Risk on 11/14/2013 11:00:00 AM

Here is the Q3 report: Household Debt and Credit Report

Aggregate consumer debt increased in the third quarter by $127 billion, the largest increase seen since the first quarter of 2008. As of September 30, 2013, total consumer indebtedness was $11.28 trillion, up by 1.1% from its level in the second quarter of 2013. Overall consumer debt remains 11% below its peak of $12.68 trillion in 2008Q3.

Mortgages, the largest component of household debt, increased by 0.7% in the third quarter of 2013. Mortgage balances shown on consumer credit reports stand at $7.90 trillion, up by $56 billion from their level in the second quarter. Balances on home equity lines of credit (HELOC) dropped by $5 billion (0.9%) and now stand at $535 billion. Household non-housing debt balances increased by 2.7%, with gains of $31 billion in auto loan balances, $33 billion in student loan balances, and $4 billion in credit card balances.

...

About 355,000 consumers had a bankruptcy notation added to their credit reports in 2013Q3, roughly flat compared to the same quarter last year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q3.

This suggests households (in the aggregate) may be near the end of deleveraging. If so, this is a significant change.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). From the NY Fed:

Delinquency rates improved for most loan types in 2013Q3. As of September 30, 7.4% of outstanding debt was in some stage of delinquency, compared with 7.6% in 2013Q2. About $831 billion of debt is delinquent, with $600 billion seriously delinquent (at least 90 days late or “severely derogatory”).Here is the press release from the NY Fed: New York Fed Report Shows Household Debt Rises in Third Quarter

Delinquency transition rates for current mortgage accounts are near pre-crisis levels, with 1.6% of current mortgage balances transitioning into delinquency.

There are a number of credit graphs at the NY Fed site.

Trade Deficit increased in September to $41.8 Billion

by Calculated Risk on 11/14/2013 09:03:00 AM

The Department of Commerce reported this morning:

[T]otal September exports of $188.9 billion and imports of $230.7 billion resulted in a goods and services deficit of $41.8 billion, up from $38.7 billion in August, revised. September exports were $0.4 billion less than August exports of $189.3 billion. September imports were $2.7 billion more than August imports of $228.0 billion.The trade deficit was larger than the consensus forecast of $38.9 billion.

The first graph shows the monthly U.S. exports and imports in dollars through September 2013.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased slightly in September.

Exports are 14% above the pre-recession peak and up 1% compared to September 2012; imports are just below the pre-recession peak, and up about 1% compared to September 2012 (mostly moving sideways).

The second graph shows the U.S. trade deficit, with and without petroleum, through September.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $102.00 in September, up from $100.26 in July, and up from $98.90 in September 2012. Prices will probably decline in October and November. The petroleum deficit increased in September, but has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $30.5 billion in September, up from $29.1 billion in September 2012. A majority of the trade deficit is due to China.