by Calculated Risk on 11/15/2013 08:30:00 AM

Friday, November 15, 2013

NY Fed: Empire State Manufacturing Activity declines in November

From the NY Fed: Empire State Manufacturing Survey

The November 2013 Empire State Manufacturing Survey indicates that manufacturing conditions weakened somewhat for New York manufacturers. The general business conditions index fell four points to -2.2, its first negative reading since May. The new orders index also entered negative territory, falling thirteen points to -5.5 ...This is the first of the regional surveys for November. The general business conditions index was below the consensus forecast of a reading of 5.5, and shows contraction for the first time since May.

The prices received index fell to -4.0; the negative reading was a sign that selling prices had declined—their first retreat in two years. Labor market conditions were also weak, with the index for number of employees falling four points to 0.0, while the average workweek index dropped to -5.3. Despite the negative readings registered by many of the indexes for current activity, indexes for the six-month outlook continued to convey a strong degree of optimism about future business conditions. emphasis added

Thursday, November 14, 2013

Friday: Tanta's Birthday, Industrial Production, Empire State Mfg Survey

by Calculated Risk on 11/14/2013 09:39:00 PM

November 15th is my former co-blogger's birthday. Hard to believe it has been five years since she left us ... Happy Birthday Tanta!

Oh, Fed Chair nominee Janet Yellen was outstanding today (as expected). From the WSJ: Yellen Stands by Fed Strategy

The committee plans to vote on Ms. Yellen's nomination as soon as next week. She is expected to then win confirmation from the full Senate ...I expect an easy confirmation.

Friday:

• At 8:30 AM ET, the NY Fed Empire State Manufacturing Survey for November. The consensus is for a reading of 5.5, up from 1.5 in October (above zero is expansion).

• At 9:15 AM, the Fed is scheduled to release Industrial Production and Capacity Utilization for October. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.3%.

• At 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories for September. The consensus is for a 0.4% increase in inventories.

Freddie Mac: Fixed Mortgage Rates Climbing

by Calculated Risk on 11/14/2013 05:59:00 PM

From Freddie Mac today: Fixed Mortgage Rates Climbing

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving higher for the second consecutive week on stronger than expected data releases including the employment report for October. The 30-year fixed-rate mortgage is at its highest level since September 19, 2013, when it averaged 4.50 percent. ...The high this year for 30 year rates in the Freddie Mac survey was 4.58%, and the high for 15 year rates was 3.60%.

30-year fixed-rate mortgage (FRM) averaged 4.35 percent with an average 0.7 point for the week ending November 14, 2013, up from last week when it averaged 4.16 percent. A year ago at this time, the 30-year FRM averaged 3.34 percent.

15-year FRM this week averaged 3.35 percent with an average 0.7 point, up from last week when it averaged 3.27 percent. A year ago at this time, the 15-year FRM averaged 2.65 percent.

Click on graph for larger image.

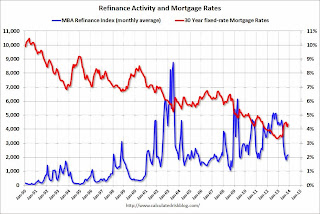

Click on graph for larger image.This graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The refinance index dropped sharply earlier this year, and then rebounded a little (down 59% from early May).

FNC: House prices increased 6.2% year-over-year in September

by Calculated Risk on 11/14/2013 02:48:00 PM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: Home Prices Show Fastest Quarterly Growth Since Recovery Began

TThe latest FNC Residential Price Index™ (RPI) shows strong growth of home prices during the third quarter of 2013 as the housing recovery continues to broaden across the country. The index, constructed to gauge the price movement among the underlying non-distressed home sales, increased 2.5% between the second and third quarters, making the third-quarter growth the fastest in the current recovery.The 100-MSA composite was up 6.2% compared to September 2012 (slightly higher YoY change than in July and August). The FNC index turned positive on a year-over-year basis in July, 2012.

Rising home sales and relatively low foreclosure sales are the key drivers of continued increases in home prices. As of September, foreclosure sales nationwide accounted for 13.4% of total home sales, up slightly from August’s 12.7% but down from 16.6% a year ago. Home prices are expected to grow at a more moderate pace in the coming months because housing demand tapers off in the winter. ...

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that September home prices increased from the previous month at a seasonally unadjusted rate of 0.5%. In a sign of moderating month-over-month price momentum, September’s price increase has tapered off compared to July and August. On a year-over-year basis, home prices were up a modest 6.2% from a year ago, or 5.7% if measured quarterly. The 30-MSA and 10-MSA composites exhibit similar month-over-month price momentum but faster accelerations in year-over-year growth at 6.7% and 6.8%, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes.

Even with the recent increase, the FNC composite 100 index is still off 25.4% from the peak.

I expect all of the housing price indexes to show lower year-over-year price gains soon.

NY Fed: Household Debt increased in Q3, Delinquency Rates Improve

by Calculated Risk on 11/14/2013 11:00:00 AM

Here is the Q3 report: Household Debt and Credit Report

Aggregate consumer debt increased in the third quarter by $127 billion, the largest increase seen since the first quarter of 2008. As of September 30, 2013, total consumer indebtedness was $11.28 trillion, up by 1.1% from its level in the second quarter of 2013. Overall consumer debt remains 11% below its peak of $12.68 trillion in 2008Q3.

Mortgages, the largest component of household debt, increased by 0.7% in the third quarter of 2013. Mortgage balances shown on consumer credit reports stand at $7.90 trillion, up by $56 billion from their level in the second quarter. Balances on home equity lines of credit (HELOC) dropped by $5 billion (0.9%) and now stand at $535 billion. Household non-housing debt balances increased by 2.7%, with gains of $31 billion in auto loan balances, $33 billion in student loan balances, and $4 billion in credit card balances.

...

About 355,000 consumers had a bankruptcy notation added to their credit reports in 2013Q3, roughly flat compared to the same quarter last year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q3.

This suggests households (in the aggregate) may be near the end of deleveraging. If so, this is a significant change.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). From the NY Fed:

Delinquency rates improved for most loan types in 2013Q3. As of September 30, 7.4% of outstanding debt was in some stage of delinquency, compared with 7.6% in 2013Q2. About $831 billion of debt is delinquent, with $600 billion seriously delinquent (at least 90 days late or “severely derogatory”).Here is the press release from the NY Fed: New York Fed Report Shows Household Debt Rises in Third Quarter

Delinquency transition rates for current mortgage accounts are near pre-crisis levels, with 1.6% of current mortgage balances transitioning into delinquency.

There are a number of credit graphs at the NY Fed site.

Trade Deficit increased in September to $41.8 Billion

by Calculated Risk on 11/14/2013 09:03:00 AM

The Department of Commerce reported this morning:

[T]otal September exports of $188.9 billion and imports of $230.7 billion resulted in a goods and services deficit of $41.8 billion, up from $38.7 billion in August, revised. September exports were $0.4 billion less than August exports of $189.3 billion. September imports were $2.7 billion more than August imports of $228.0 billion.The trade deficit was larger than the consensus forecast of $38.9 billion.

The first graph shows the monthly U.S. exports and imports in dollars through September 2013.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased slightly in September.

Exports are 14% above the pre-recession peak and up 1% compared to September 2012; imports are just below the pre-recession peak, and up about 1% compared to September 2012 (mostly moving sideways).

The second graph shows the U.S. trade deficit, with and without petroleum, through September.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $102.00 in September, up from $100.26 in July, and up from $98.90 in September 2012. Prices will probably decline in October and November. The petroleum deficit increased in September, but has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $30.5 billion in September, up from $29.1 billion in September 2012. A majority of the trade deficit is due to China.

Weekly Initial Unemployment Claims decline to 339,000

by Calculated Risk on 11/14/2013 08:30:00 AM

The DOL reports:

In the week ending November 9, the advance figure for seasonally adjusted initial claims was 339,000, a decrease of 2,000 from the previous week's revised figure of 341,000. The 4-week moving average was 344,000, a decrease of 5,750 from the previous week's revised average of 349,750.The previous week was up from 336,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 344,000.

Some of the recent increase was due to processing problems in California (now resolved) and the four-week average will probably decline further.

Wednesday, November 13, 2013

Thursday: Trade Deficit, Unemployment Claims, Yellen Confirmation Hearing

by Calculated Risk on 11/13/2013 09:41:00 PM

From Jon Hilsenrath at the WSJ: Fed Debates Low-Rate Peg

The Fed has said for months it won't raise short-term interest rates from near zero until the unemployment rate, which was 7.3% in October, falls below 6.5%, as long as inflation doesn't move above 2.5%. Fed officials believe the promise, known as "forward guidance," helps hold down long-term borrowing rates, which in turn encourages borrowing, investment and spending.

There are several ways they could strengthen their message. One idea under discussion is to lower that unemployment threshold from 6.5%, which could mean keeping rates down longer. Fed staff research suggests the economy and job market might grow faster, without much additional risk of inflation, if the Fed promised to keep rates near zero until the unemployment rate gets as low as 5.5%. Goldman Sachs economists predict the Fed will lower the threshold to 6% as early as December and reduce the bond-buying program at the same time.

Minutes of recent Fed meetings show officials have been debating the idea for several months and recent comments by officials show it is in the mix of discussions ahead of the Fed's next policy meeting on Dec. 17 and 18, though such a move may or may not happen then.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 336 thousand last week.

• Also at 8:30 AM, the Trade Balance report for September from the Census Bureau. The consensus is for the U.S. trade deficit to increase to $39.1 billion in September from $38.8 billion in August.

• At 10:00 AM, the Confirmation Hearing for Fed Chair nominee Janet Yellen.

• At 11:00 AM, the Q3 2013 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York.

DataQuick on California Bay Area: Home Sales decline year-over-year in October, Conventional Sales up 26%

by Calculated Risk on 11/13/2013 03:39:00 PM

From DataQuick: Bay Area Home Sales Ease Back; Median Sale Price Edges Higher

A total of 7,595 new and resale houses and condos sold in the nine-county Bay Area in October. That was up 6.4 percent from 7,141 the month before, and down 3.9 percent from 7,902 for October a year ago, according to San Diego-based DataQuick.The key in this report is the decline in distressed sales (foreclosures and short sales). Distressed sales are now down to 13.9% from 34.6% in October 2012.

...

Foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 3.6 percent of resales in October, the same as the month before, and down from 11.7 percent a year ago. Last month’s level is the lowest since 3.5 percent in June 2007. Foreclosure resales peaked at 52.0 percent in February 2009, while the monthly average over the past 17 years is 10 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 10.3 percent of Bay Area resales last month. That was up from an estimated 10.2 percent in September and down from 22.9 percent a year earlier.

A little arithmetic: In October 2012, there were 7,902 sales with 34.6% distressed (foreclosure resale or short sale). That means 5,168 sales were conventional. In October 2013, there were 7,595 sales with 13.9% distressed. That means 6,539 were conventional - an increase of 26% year-over-year.

This is a reminder that those who focus on the decline in overall sales are missing the key story of an improving market. We see this same pattern in most areas of the country.

EIA Forecast: Gasoline Prices expected to average $3.39 per gallon in 2014

by Calculated Risk on 11/13/2013 01:27:00 PM

The EIA expects gasoline prices to decline further in 2014 according to the Short Term Energy and Winters Fuel Outlook released today:

• The weekly U.S. average regular gasoline retail price has fallen by more than 40 cents per gallon since the beginning of September. EIA's forecast for the regular gasoline retail price averages $3.24 per gallon in the fourth quarter of 2013, $0.10 per gallon less than forecast in last month's STEO. The annual average regular gasoline retail price, which was $3.63 per gallon in 2012, is expected to average $3.50 per gallon in 2013 and $3.39 per gallon in 2014.Gasoline prices are down to around $3.20 per gallon nationally according to the Gasbuddy.com. Gasoline prices averaged $3.52 for the same week in 2012.

• The North Sea Brent crude oil spot price averaged nearly $110 per barrel for the fourth consecutive month in October. EIA expects the Brent crude oil price to decline gradually, averaging $106 per barrel in December and $103 per barrel in 2014. Projected West Texas Intermediate (WTI) crude oil prices average $95 per barrel during 2014.

emphasis added

Brad Plumer at the Wonkblog writes: The surprising reasons why gas prices are falling sharply. Plumer discusses seasonality, the rising supply of gasoline, fewer refinery disruptions, less demand and more. Whatever the reasons, this is definitely a plus for drivers!

The following graph is from Gasbuddy.com. Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |