by Calculated Risk on 11/14/2013 08:30:00 AM

Thursday, November 14, 2013

Weekly Initial Unemployment Claims decline to 339,000

The DOL reports:

In the week ending November 9, the advance figure for seasonally adjusted initial claims was 339,000, a decrease of 2,000 from the previous week's revised figure of 341,000. The 4-week moving average was 344,000, a decrease of 5,750 from the previous week's revised average of 349,750.The previous week was up from 336,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 344,000.

Some of the recent increase was due to processing problems in California (now resolved) and the four-week average will probably decline further.

Wednesday, November 13, 2013

Thursday: Trade Deficit, Unemployment Claims, Yellen Confirmation Hearing

by Calculated Risk on 11/13/2013 09:41:00 PM

From Jon Hilsenrath at the WSJ: Fed Debates Low-Rate Peg

The Fed has said for months it won't raise short-term interest rates from near zero until the unemployment rate, which was 7.3% in October, falls below 6.5%, as long as inflation doesn't move above 2.5%. Fed officials believe the promise, known as "forward guidance," helps hold down long-term borrowing rates, which in turn encourages borrowing, investment and spending.

There are several ways they could strengthen their message. One idea under discussion is to lower that unemployment threshold from 6.5%, which could mean keeping rates down longer. Fed staff research suggests the economy and job market might grow faster, without much additional risk of inflation, if the Fed promised to keep rates near zero until the unemployment rate gets as low as 5.5%. Goldman Sachs economists predict the Fed will lower the threshold to 6% as early as December and reduce the bond-buying program at the same time.

Minutes of recent Fed meetings show officials have been debating the idea for several months and recent comments by officials show it is in the mix of discussions ahead of the Fed's next policy meeting on Dec. 17 and 18, though such a move may or may not happen then.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 336 thousand last week.

• Also at 8:30 AM, the Trade Balance report for September from the Census Bureau. The consensus is for the U.S. trade deficit to increase to $39.1 billion in September from $38.8 billion in August.

• At 10:00 AM, the Confirmation Hearing for Fed Chair nominee Janet Yellen.

• At 11:00 AM, the Q3 2013 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York.

DataQuick on California Bay Area: Home Sales decline year-over-year in October, Conventional Sales up 26%

by Calculated Risk on 11/13/2013 03:39:00 PM

From DataQuick: Bay Area Home Sales Ease Back; Median Sale Price Edges Higher

A total of 7,595 new and resale houses and condos sold in the nine-county Bay Area in October. That was up 6.4 percent from 7,141 the month before, and down 3.9 percent from 7,902 for October a year ago, according to San Diego-based DataQuick.The key in this report is the decline in distressed sales (foreclosures and short sales). Distressed sales are now down to 13.9% from 34.6% in October 2012.

...

Foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 3.6 percent of resales in October, the same as the month before, and down from 11.7 percent a year ago. Last month’s level is the lowest since 3.5 percent in June 2007. Foreclosure resales peaked at 52.0 percent in February 2009, while the monthly average over the past 17 years is 10 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 10.3 percent of Bay Area resales last month. That was up from an estimated 10.2 percent in September and down from 22.9 percent a year earlier.

A little arithmetic: In October 2012, there were 7,902 sales with 34.6% distressed (foreclosure resale or short sale). That means 5,168 sales were conventional. In October 2013, there were 7,595 sales with 13.9% distressed. That means 6,539 were conventional - an increase of 26% year-over-year.

This is a reminder that those who focus on the decline in overall sales are missing the key story of an improving market. We see this same pattern in most areas of the country.

EIA Forecast: Gasoline Prices expected to average $3.39 per gallon in 2014

by Calculated Risk on 11/13/2013 01:27:00 PM

The EIA expects gasoline prices to decline further in 2014 according to the Short Term Energy and Winters Fuel Outlook released today:

• The weekly U.S. average regular gasoline retail price has fallen by more than 40 cents per gallon since the beginning of September. EIA's forecast for the regular gasoline retail price averages $3.24 per gallon in the fourth quarter of 2013, $0.10 per gallon less than forecast in last month's STEO. The annual average regular gasoline retail price, which was $3.63 per gallon in 2012, is expected to average $3.50 per gallon in 2013 and $3.39 per gallon in 2014.Gasoline prices are down to around $3.20 per gallon nationally according to the Gasbuddy.com. Gasoline prices averaged $3.52 for the same week in 2012.

• The North Sea Brent crude oil spot price averaged nearly $110 per barrel for the fourth consecutive month in October. EIA expects the Brent crude oil price to decline gradually, averaging $106 per barrel in December and $103 per barrel in 2014. Projected West Texas Intermediate (WTI) crude oil prices average $95 per barrel during 2014.

emphasis added

Brad Plumer at the Wonkblog writes: The surprising reasons why gas prices are falling sharply. Plumer discusses seasonality, the rising supply of gasoline, fewer refinery disruptions, less demand and more. Whatever the reasons, this is definitely a plus for drivers!

The following graph is from Gasbuddy.com. Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in October

by Calculated Risk on 11/13/2013 10:31:00 AM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for several selected cities in October. First, from Lawler on October sales:

While I don’t yet have enough local data to produce a precise estimate of national existing home sales for October, my “best guess” right now based on the data I have is that existing home sales (as measured by the NAR) ran at a seasonally adjusted annual rate of 5.08 million in October, down 4.0% from September’s seasonally-adjusted pace.On short sales from CR: Look at the first two columns in the table for Short Sales Share. Short sales are down sharply from a year ago, and will probably really decline in early 2014. It appears that the Mortgage Debt Relief Act of 2007 will not be extended again next year. Usually cancelled debt is considered income, but a provision of the 2007 Debt Relief Act allowed borrowers "to exclude certain cancelled debt on [a] principal residence from income. Debt reduced through mortgage restructuring, as well as mortgage debt forgiven in connection with a foreclosure, qualifies for the relief." (excerpt from IRS). This relief expires on Dec 31, 2013. Complete all short sales by the end of this year!

It’s worth noting that pending sales in most areas showed substantially slower YOY growth in October compared to September, and quite a few areas showed a YOY drop – suggesting that November sales could be weak/down as well.

Total "Distressed" Share. In most areas that have reported distressed sales so far, the share of distressed sales is down year-over-year. Also there has been a significant decline in foreclosure sales in all of these cities.

The All Cash Share (last two columns) is mostly declining year-over-year. When investors pull back in markets like Phoenix (already declining), the share of all cash buyers will probably decline.

In general it appears the housing market is slowly moving back to normal.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Oct-13 | Oct-12 | Oct-13 | Oct-12 | Oct-13 | Oct-12 | Oct-13 | Oct-12 | |

| Las Vegas | 21.0% | 44.7% | 6.0% | 11.6% | 27.0% | 56.3% | 44.9% | 54.1% |

| Reno | 16.0% | 40.0% | 4.0% | 12.0% | 20.0% | 52.0% | ||

| Phoenix | 8.4% | 26.2% | 6.9% | 12.9% | 15.3% | 39.1% | 31.6% | 43.9% |

| Sacramento | 11.4% | 35.7% | 5.1% | 12.0% | 16.5% | 47.7% | 23.9% | 36.9% |

| Minneapolis | 5.1% | 10.4% | 16.4% | 24.9% | 21.5% | 35.3% | ||

| Mid-Atlantic | 7.9% | 9.1% | 8.2% | 13.0% | 16.1% | 22.1% | 19.9% | 20.0% |

| So. California* | 12.9% | 27.2% | 6.3% | 16.3% | 19.2% | 43.5% | 27.5% | 32.8% |

| Toledo | 37.0% | 38.6% | ||||||

| Tucson | 32.9% | 31.8% | ||||||

| Omaha | 20.0% | 20.4% | ||||||

| SE Michigan | 34.5% | 44.3% | ||||||

| Memphis* | 18.4% | 22.9% | ||||||

| Birmingham AL | 21.0% | 30.8% | ||||||

| *share of existing home sales, based on property records | ||||||||

MBA: Mortgage Applications decrease 1.8% in Latest Weekly Survey

by Calculated Risk on 11/13/2013 09:31:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 8, 2013. This week's results are compared to a revised level from last week. That decline, initially reported as -7.0 percent, was revised to -2.8 percent....

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.44 percent, the highest level in a month, from 4.32 percent, with points increasing to 0.44 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

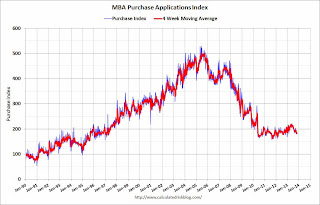

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is up slightly over the last two months as rates have declined from the August levels.

However the index is still down 59% from the levels in early May.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has fallen since early May, and the 4-week average of the purchase index is now down about 2% from a year ago.

Tuesday, November 12, 2013

The Cranes of Miami

by Calculated Risk on 11/12/2013 07:00:00 PM

Earlier I posted some photos of some new construction in California: The Return of the Cranes. Several people wrote to me about their part of the country, but I think Miami is the winner.

Here are two photos of the cranes of Miami:

Maybe we should have a "count the cranes" contest for the first photo. Wow - looks like China!

Lawler on Homebuilders: Net Orders Last Quarter Down From Year Ago

by Calculated Risk on 11/12/2013 03:22:00 PM

D.R. Horton, the nation’s largest home builder, reported that net home orders in the quarter ended September 30, 2013 totaled 5,160, down 2.2% from the comparable quarter of 2012. The company’s sales cancellation rate, expressed as a % of gross orders, was 31%, up from 27% a year ago. Home closings totaled 6,866 last quarter, up 23.2% from the comparable quarter of 2012, at an average sales price of $262,463, up 13.6% from a year ago. The company’s order backlog at the end of September was 8,205, up 13.3% from last September.

In its conference call, Horton officials attributed the increase in home prices both to increased pricing power and an increased “mix” of larger homes sold to trade-up buyers. Officials also said that the drop in sales orders reflected a “moderation” in demand that began in mid-May and continued through September, and attributed the drop in demand both to higher mortgage rates and higher home prices. The officials noted that the pace of orders had improved in October, and also said that home prices increases have “moderated.”

Officials also noted that its previous rapid increase in its land/lot inventory (see next page) meant that it had “sufficient inventories of homes and finished lots” to meet what it hoped to be improved demand over the next year, and that the company expected to reduce its land purchases next year.

Here are some summary stats for nine large, publicly-traded builders for the quarter ended September 30th.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/30/13 | 9/30/12 | % Chg | 9/30/13 | 9/30/12 | % Chg | 9/30/13 | 9/30/12 | % Chg |

| D.R. Horton | 5,160 | 5,276 | -2.2% | 6,866 | 5,575 | 23.2% | $262,453 | $231,085 | 13.6% |

| Pulte Group | 3,781 | 4,544 | -16.8% | 4,817 | 4,418 | 9.0% | $310,000 | $279,000 | 11.1% |

| NVR | 2,381 | 2,558 | -6.9% | 3,342 | 2,656 | 25.8% | $349,200 | $321,700 | 8.5% |

| The Ryland Group | 1,592 | 1,507 | 5.6% | 1,883 | 1,322 | 42.4% | $298,000 | $264,000 | 12.9% |

| Beazer Homes | 1,192 | 1,110 | 7.4% | 1,657 | 1,608 | 3.0% | $263,200 | $228,600 | 15.1% |

| Standard Pacific | 1,110 | 989 | 12.2% | 1,217 | 861 | 41.3% | $420,000 | $369,000 | 13.8% |

| Meritage Homes | 1,300 | 1,204 | 8.0% | 1,418 | 1,197 | 18.5% | $341,000 | $280,000 | 21.8% |

| MDC Holdings | 924 | 1,008 | -8.3% | 1,257 | 1,039 | 21.0% | $345,000 | $320,647 | 7.6% |

| M/I Homes | 869 | 757 | 14.8% | 937 | 746 | 25.6% | $284,000 | $266,000 | 6.8% |

| Total | 18,309 | 18,953 | -3.4% | 23,394 | 19,422 | 20.5% | $305,805 | $271,672 | 12.6% |

As the above table indicates, while overall settlements for their builders last quarter were up 20.6% from a year ago, and average sales prices were up 12.6% YOY, net sales orders were down 3.4% YOY – the first YOY drop for this group of builders since the first quarter of 2011.

These builder results indicate that the combination of higher mortgage rates and aggressive home price increases resulted in a significant slowdown in new home sales last quarter. While the relationship between large builder results and Census estimates for new home sales is far from perfect (partly reflecting market-share changes but also reflecting methodological and timing differences), these builder results suggest that Census estimates for new SF home sales for September (re-scheduled for release, along with estimates for October, on December 4th), could be down sharply from August.

Sacramento Housing: Total Sales down 25% Year-over-year in October, Conventional Sales up 19%, Active Inventory increases 93%

by Calculated Risk on 11/12/2013 01:10:00 PM

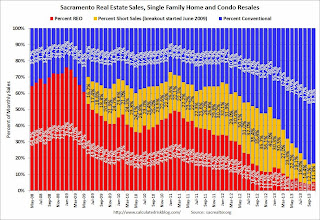

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For a long time, not much changed. But over the last 2 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In October 2013, 16.7% of all resales (single family homes) were distressed sales. This was up slightly from 16.0% last month, and down from 47.7% in October 2012.

The percentage of REOs was at 5.3%, and the percentage of short sales decreased to 11.3%. (the lowest percentage for short sales since Sacramento started tracking short sales in June 2009).

Note on Short Sales: I expect short sales will really decline next year with the expiration of Cancelled Mortgage Debt Relief provision of the Mortgage Debt Relief Act of 2007.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently (blue).

Active Listing Inventory for single family homes increased 93.2% year-over-year in October. This is the sixth consecutive month with a year-over-year increase in inventory - and inventory has now almost doubled from a year ago.

Cash buyers accounted for 23.9% of all sales, up slightly from 23.6% last month (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 25% from October 2012, but conventional sales were up 18% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

As I've noted before, we are seeing a similar pattern in other distressed areas. This suggests what will happen in other areas: 1) Flat or declining overall existing home sales, 2) but increasing conventional sales, 3) Less investor buying, 4) more inventory, and 5) slower price increases.

The Return of the Cranes

by Calculated Risk on 11/12/2013 10:56:00 AM

Back in 2009, Michael C. sent me some photos of rabbits hiding in a field of steel. The steel was intended for a construction project that was on hold. Now Michael has sent me some more photos.

The photos below are of 100 Van Ness in San Francisco, Samsung’s New Corporate HQ, the Transbay Center (Jay Paul the developer / owner for the fields of steel post is also putting a high rise on this site along with the huge office tower), and more.

Michael writes:

[In] SF and the place is on fire with 20 tower cranes across the city. [My company sent] me to Phoenix ... and they are going like gangbusters on residential housing! Also remember the Easter bunny in the field of steel? Well the are going to start on that again ... presumably there is some demand for office space in San Diego finally.Photo credits: Michael C.

[As to] the fields of steel from Easter a few years ago, this was the original project. Only one of the buildings got built and the steel for the three of the next 11 to be built was ordered and left on site. It can still be seen here on google maps. ... Looks like the bunny will be homeless by Easter.