by Calculated Risk on 11/07/2013 08:36:00 AM

Thursday, November 07, 2013

GDP increased at 2.8% Annual Rate in Q3, Weekly Initial Unemployment Claims decline to 336,000

From the BEA: Gross Domestic Product, 3rd quarter 2013 (advance estimate)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.8 percent in the third quarter of 2013 (that is, from the second quarter to the third quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 2.5 percent.I'll have more on GDP later, but this was better than expected.

The DOL reports:

In the week ending November 2, the advance figure for seasonally adjusted initial claims was 336,000, a decrease of 9,000 from the previous week's revised figure of 345,000. The 4-week moving average was 348,250, a decrease of 9,250 from the previous week's revised average of 357,500.The previous week was up from 340,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 348,250.

Some of the recent increase was due to processing problems in California (now resolved) and the four-week average will probably decline again next week.

Wednesday, November 06, 2013

Thursday: Q3 GDP, Unemployment Claims, Q3 Mortgage Delinquency Survey

by Calculated Risk on 11/06/2013 07:48:00 PM

From Tim Duy: On Lowering the Unemployment Target. Professor Duy's conclusion:

Policymakers would like to normalize policy by moving away from asset purchases to interest rates. Emphasizing forward guidance is part of that process. Incoming research suggests not only that threshold based forward guidance is effective, but has room to be even more effective. That should be a comfort to policymakers who worry that ending asset purchases will excessively tighten financial conditions; they have a tool to change the mix of policy while leaving the level of accommodation unchanged. Whether they use it or not is another question. There has clearly been some discomfort among policymakers regarding changing the unemployment threshold. This suggests it would not necessarily be an immediate replacement for ending asset purchases. That said, it is difficult to see how the current threshold is meaningful at all if the Fed is still purchasing assets when the threshold is breached. Indeed, the current low level of unemployment relative to the threshold, combined with clear indications that the Fed has no intention of raising rates anytime soon, argues by itself that a change in the thresholds is a likely scenario in the months ahead.Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 340 thousand last week.

• Also at 8:30 AM, the advance estimate for Q3 GDP from the BEA. The consensus is that real GDP increased 2.0% annualized in Q3.

• At 10:00 AM, the Mortgage Bankers Association (MBA) Q3 2013 National Delinquency Survey (NDS).

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due through Q2 2013.

Loans 30 days delinquent decreased to 3.19% from 3.21% in Q1. This was just above the long term average. Delinquent loans in the 60 day bucket decrease to 1.12% in Q2, from 1.17% in Q1.

The 90 day bucket decreased to 2.65% from 2.88%. This is still way above normal (around 0.8% would be normal according to the MBA). The percent of loans in the foreclosure process decreased to 3.33% in Q2 from 3.55% in Q1 and was at the lowest level since 2008.

• At 3:00 PM, Consumer Credit for September from the Federal Reserve. The consensus is for credit to increase $12.0 billion in September.

California and Weekly Unemployment Claims

by Calculated Risk on 11/06/2013 04:38:00 PM

From the LA Times: Officials unaware of benefits foul-up for 2 weeks

[Following the Labor Day launch] It took two weeks for officials at California's Employment Development Department to realize there were problems with their software upgrade, according to testimony at the oversight hearing Wednesday.Here is a table of weekly claims (seasonally adjusted) from the beginning of August.

| Week Ending | Weekly Claims, SA |

|---|---|

| 8/3/13 | 335000 |

| 8/10/13 | 322000 |

| 8/17/13 | 337000 |

| 8/24/13 | 333000 |

| 8/31/13 | 323000 |

| 9/7/13 | 294000*** |

| 9/14/13 | 311000 |

| 9/21/13 | 307000 |

| 9/28/13 | 308000 |

| 10/5/13 | 373000 |

| 10/12/13 | 362000 |

| 10/19/13 | 350000 |

| 10/26/13 | 340000 |

| *** California Computer Upgrade | |

Claims averaged 330 thousand for the five weeks prior to the computer upgrade in California. Then claims dropped sharply to 294,000 and stayed low for four week. Then claims moved sharply higher as the problems in California were resolved.

Over the last eight weeks, claims have 330 thousand - the same as in August. My guess is we should just average the last eight weeks - and basically claims have been moving sideways for the last several months. In the employment preview for October, I suggested the increase in claims in October was probably not useful information this month because of the computer problems in California.

Fed's Pianalto: Tight Mortgage Credit holding back Economy

by Calculated Risk on 11/06/2013 02:12:00 PM

From Cleveland Fed President Sandra Pianalto: Housing in the National Economy: A Look Back, a Look Forward

A major reason why the economic recovery has been so slow and has required so much policy support has been the performance of the housing market. Ordinarily, deep recessions are followed by strong economic snap-backs. But an economist at my Bank and his co-author found two exceptions to that rule: the Great Depression and the recent recession. [see: Deep Recessions, Fast Recoveries, and Financial Crises: Evidence from the American Record]. In this last episode, the evidence points to the collapse of the housing market as the key explanation for the slow recovery. Most of the time, home construction and spending on household goods can be counted on to provide a big push to the recovery. Historically, residential investment has contributed about half a percentage point to GDP growth in each quarter during the two-year period immediately following a recession. During the first two years of this recent recovery, however, the contribution from residential investment to GDP growth was basically zero. Because the recent recession was caused in part by a housing crisis, the housing market was too damaged to provide its customary lift to GDP growth.Lenders are still very cautious, however lending standards are loosening - just very slowly. No one wants to go back to the almost non-existent standards of the early-to-mid 00s. I expect credit to slowly become more available, but please no NINJA loans (no income, jobs, or assets) and please no Alt-A (stated income, self-underwritten) loans.

...

So that is where we have been--a housing bust followed by a recession and sluggish economic recovery that was made all the more sluggish because of the weakened housing market. Looking ahead, tight conditions in mortgage credit markets will continue to hold the housing sector and broader economy from getting back to full strength more quickly.

Let me elaborate on that point. In a recent Federal Reserve survey of senior loan officers, bankers reported that credit standards for all categories of home mortgage loans have remained tighter than the standards that have prevailed on average since 2005. Financing companies no longer assume that houses will provide adequate collateral for borrowers with fragile credit histories. In addition, financial market regulators are standing vigilant to ensure there is no recurrence of the housing bubble that almost brought the financial system and global economy to its knees.

Moreover, access to mortgage credit has become far more restrictive. To get a mortgage today, it helps to have a very high credit score. Lenders are more likely to extend mortgage credit to consumers they perceive as very low risk. As a result, the pool of potential mortgage borrowers has shrunk. Households with low credit scores that were able to get credit before the crisis now are the least able to refinance their homes, or to obtain new mortgage loans. These are also the households who seem to be especially cautious in their spending these days. For these households, the days of extracting "free cash" from their homes are over. It is now mostly households with ample savings that spend and save as they normally would.

Another development that could lead to tighter credit conditions in the future involves the secondary mortgage market. The outlook for the government-sponsored enterprises Fannie Mae and Freddie Mac is uncertain. The GSEs, as they are known, had to be rescued after the financial crisis and Congress is weighing reforms that might greatly reduce the government's large position in housing finance. The housing market today is being heavily supported by Fannie and Freddie. Without the government guarantees on mortgage-backed securities, the amount of credit available for mortgage originations would be substantially smaller today.

To sum up my remarks, it was the housing bust that got us into this situation. And the lasting consequences of the bust continue to hold back the housing market and broader economy. The big picture is that many households are still adjusting to the large shock to their net worth that occurred during the financial crisis and are dealing with uncertainty over their future earnings prospects. For these reasons, consumer spending will likely continue at a moderate pace. But over time, I expect these effects to fade and credit conditions to improve.

emphasis added

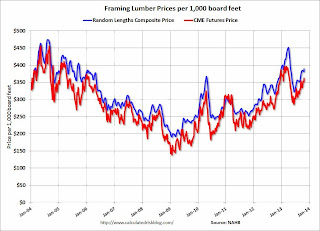

Framing Lumber Prices up 15% year-over-year

by Calculated Risk on 11/06/2013 11:59:00 AM

Here is another graph on framing lumber prices (as an indicator of building activity). Early this year I mentioned that lumber prices were nearing the housing bubble highs. Then prices started to decline sharply, with prices off over 25% from the highs by June.

The price increases early this year were due to demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices have been increasing again since June (there is some seasonality to prices).

Currently prices are up about 15% year-over-year.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through last week (via NAHB), and 2) CME framing futures.

We will probably see another surge in prices early next year.

Will the Fed "Taper" QE and Change "Thresholds" at the same time?

by Calculated Risk on 11/06/2013 08:39:00 AM

From Jeff Cox at CNBC yesterday: Fed could be about to make a major policy change

Separate papers that will be presented formally this week at an International Monetary Fund meeting suggest that the U.S. central bank should lower its target for the jobless rate before it hikes rates.Note: The Fed has made it clear that these are "thresholds", not "targets". More from Cox:

Under current Fed thinking, the unemployment rate would have to drop to just 6.5 percent—with the inflation rate rising to 2.5 percent—before making changes in the present structure, which has the policy target rate near zero.Here is more from Goldman's Hatzius:

But the research from a half-dozen Fed economists maintains the unemployment objective actually should be lowered to 6.0 percent or even 5.5 percent before it makes any moves.

...

According to an analysis from Jan Hatzius, chief economist at Goldman Sachs, the two Fed papers actually would imply an earlier reduction of QE than planned—perhaps as soon as December—while the zero-bound interest rates could remain in place until 2017 and kept below normal into "the early 2020s."

"The studies suggest that some of the most senior Fed staffers see strong arguments for a significantly greater amount of monetary stimulus than implied by either a Taylor rule or the current 6.5 percent/2.5 percent threshold guidance," Hatzius wrote. "Given the structure of the Federal Reserve Board, we believe it is likely that the most senior officials—in particular, Ben Bernanke and (Chair-elect) Janet Yellen—agree with the basic thrust of the analysis."

It is hard to overstate the importance of two new Fed staff studies that will be presented at the IMF's annual research conference on November 7-8. The lead author for the first study is William English, who is the director of the Monetary Affairs division and the Secretary and Economist of the FOMC. The lead author for the second study is David Wilcox, who is the director of the Research and Statistics division and the Economist of the FOMC. The fact that the two most senior Board staffers in the areas of monetary policy analysis and domestic macroeconomics have simultaneously published detailed research papers on central issues of the economic and monetary policy outlook is highly unusual and noteworthy in its own right. But the content and implications of these papers are even more striking.CR Note: Changing the thresholds (basically saying the FOMC will keep the Fed Funds rate exceptionally low for a longer period) could offset any negative impact from starting to taper QE3. I wouldn't be surprised if tapering - and lowering the unemployment rate threshold - happen at the same meeting. This could happen as soon as the December meeting (depending on incoming data as I noted this weekend) or sometime in 2014.

...[O]ur initial assessment is that they considerably increase the probability that the FOMC will reduce its 6.5% unemployment threshold for the first hike in the federal funds rate, either coincident with the first tapering of its QE program or before.

...

[O]ur central case is now that the FOMC will reduce the threshold from 6.5% to 6% at the March 2014 FOMC meeting, alongside the first tapering of QE; however, a move as early as the December 2013 meeting is possible, and if so, this might also increase the probability of an earlier tapering of QE.

MBA: Mortgage Applications decrease 7% in Latest Weekly Survey

by Calculated Risk on 11/06/2013 07:03:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 7.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 1, 2013. ...

The Refinance Index decreased 8 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier and is at its lowest level since the end of December 2012. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.32 percent from 4.33 percent, with points increasing to 0.42 from 0.26 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is up slightly over the last two months as rates have declined from the August levels.

However the index is still down 61% from the levels in early May.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has fallen since early May, and the 4-week average of the purchase index is now down about 3% from a year ago.

Tuesday, November 05, 2013

Lawler: Household Estimate, If True, Disturbing; Fortunately, Probably Isn’t

by Calculated Risk on 11/05/2013 07:51:00 PM

CR Note: CNBC had an article today: The housing stat you need to watch

Household formation—when a person who lives with someone else (parents, roommates, etc.) moves into another housing unit on his or her own, creating a new household—has averaged around 1 million per year historically as the U.S. population grows. In the early part of this century, when housing was just beginning its boom, it jumped by nearly 2 million. In the third quarter of this year, just 380,000 new households were formed, according to the U.S. Census.This household formation data is from the Housing Vacancies and Homeownership report and is probably not accurate.

From economist Tom Lawler: Census Residential Vacancies and Homeownership Report for Q3: Household Estimate, If True, Disturbing; Fortunately, Probably Isn’t

The Census released the Third Quarter 2013 “Residential Vacancies and Homeownership” Report this morning, which is based on the Housing Vacancy Survey supplement to the Current Population Survey. Here are some summary stats from the report, which is commonly called the Housing Vacancy Survey (HVS) report.

| Select Stats, Housing Vacancy Survey (Housing Units in thousands) | ||||

|---|---|---|---|---|

| Q3/2013 | Q2/2013 | Q3/2012 | YOY Change | |

| Rental Vacancy Rate | 8.3% | 8.2% | 8.6% | -0.3% |

| Homeowner Vacancy Rate | 1.9% | 1.9% | 1.9% | 0.0% |

| Gross Vacancy Rate | 13.61% | 13.62% | 13.66% | -0.05% |

| Homeownership Rate: NSA | 65.3% | 65.0% | 65.5% | -0.2% |

| Homeownership Rate: SA | 65.1% | 65.1% | 65.3% | -0.2% |

| Total Housing Units | 132,845 | 132,754 | 132,482 | 363 |

| Occupied Housing Units | 114,767 | 114,677 | 114,387 | 380 |

| Owner Occupied | 74,901 | 74,563 | 74,878 | 23 |

| Renter Occupied | 39,866 | 40,134 | 39,507 | 359 |

| Vacant Housing Units | 18,077 | 18,077 | 18,095 | -18 |

| Totals may not add up due to rounding | ||||

The surprising – and if true, disturbing – stat from the report is the estimate for occupied homes, which for last quarter was up just 380,000 from a year ago. That YOY increase is the lowest since the second quarter of 2010, and such anemic growth, if accurate, would be “most disturbing” from a “housing recovery” perspective. However, other estimates from a CPS-based survey earlier this year show significantly faster household growth from early 2012 to early 2013 than does the HVS, making it difficult to determine what, if anything, this latest report might mean.

Click on graph for larger image.

Click on graph for larger image.The CPS/HVS estimate for occupied housing units, or households, is “controlled” to separate estimates of the number of housing units from the Population Division, and assumes that (1) these housing units estimates are correct; and (2) the HVS estimates for the % of the housing stock that is occupied are correct. Historical estimates are “consistent” with historical estimates of the housing stock from the Population Division, but only back to 2000.

Alternative CPS estimates for the number of households are available from the CPS Annual Social and Economic Supplement for March of each year. These household estimates are “controlled” to estimates of the civilian non-institutionalized population from the Population Division, and assume that (1) the population estimates (both total and by age, sex, etc.) are correct; and (2) that the “headship” rates from the CPS/ASEC are correct. Historical estimates from the CPS/ASEC consistent with revised population estimates for last decade (based on Census 2010 results) are only available back to 2011.

The CPS/ASEC estimate for the number of US households for March, 2013 was 122.459 million, up 1.375 million from March, 2012. The HVS estimate for the number of households for March, 2013 was 114.061 million, up 373 thousand from March 2012, and the HVS estimate for the average number of households in the first half of 2013 was 114.480 million, up 575 thousand from the first half of 2012. The CPS/ASEC estimate of the number of US households increased by 2.532 million from March 2011 to March 2013, while the CPS/HVS estimate increased by only 1.306 million over that period.

| Different CPS-Based Estimates of US Households (000's) | ||||

|---|---|---|---|---|

| Mar-13 | Mar-12 | Mar-11 | Mar-13 vs. Mar-11 | |

| CPS/HVS | 114,061 | 113,688 | 112,755 | 1,306 |

| CPS/ASEC | 122,459 | 121,084 | 119,927 | 2,532 |

These shockingly different estimates both for the number of households and for recent changes in the number of households have understandably confused, baffled, and annoyed analysts and policymakers.

While both the CPS/HVS and the CPS/ASEC estimates are “controlled” to select Census 2010 results – one for the number of housing units, and the other to the number of people -- neither survey’s results are “controlled” to critical Census 2010 estimates such as the number of households (or headship rates), homeownership rates, vacancy rates, etc. -- making both of limited value to housing analysts and policymakers. Comparisons to Census 2010 results indicate that both CPS-based surveys considerably overstate homeownership rates, especially for “younger” adults, and that the CPS/HVS considerably overstates housing vacancy rates. While it is not clear whether the “bad” CPS results are based on sampling or non-sampling error – no real research has been done on this – the “sampling frame” for the CPS is incredibly outdated, and Id guess that “sampling error” is a “big deal.”

For analysts focused on the housing outlook, which is heavily dependent on the growth in households, the latest HVS estimates are “disturbing,” but the massive disparity between CPS-based household growth estimates based on “people” counts and household growth estimates based on “house” counts earlier this year makes one, I guess, “less disturbed,” though kinda pissed off.

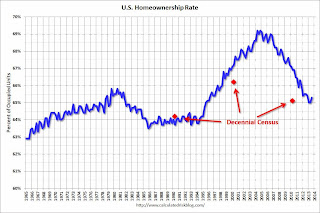

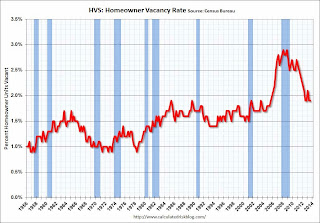

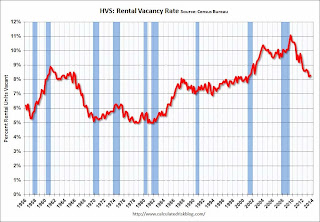

HVS: Q3 2013 Homeownership and Vacancy Rates

by Calculated Risk on 11/05/2013 04:01:00 PM

The Census Bureau released the Housing Vacancies and Homeownership report for Q3 2013 this morning.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate,except as a guide to the trend.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate was increased to 65.3% in Q3, from 65.0% in Q2.

I'd put more weight on the decennial Census numbers and that suggests the actual homeownership rate is probably in the 64% to 65% range - and given changing demographics, the homeownership rate is probably close to a bottom.

The HVS homeowner vacancy was unchanged at 1.9% in Q3.

The HVS homeowner vacancy was unchanged at 1.9% in Q3.

It isn't really clear what this means. Are these homes becoming rentals?

Once again - this probably shows that the trend is down, but I wouldn't rely on the absolute numbers.

The rental vacancy rate increased slightly in Q3 to 8.3% from 8.2% in Q2.

The rental vacancy rate increased slightly in Q3 to 8.3% from 8.2% in Q2.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate - and Reis reported that the rental vacancy rate is at the lowest level since 2001 - and might be close to a bottom.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply. However this does suggest that most of the bubble excess is behind us.

Employment Preview: Upside Payroll Surprise?

by Calculated Risk on 11/05/2013 01:09:00 PM

There will be some ugly numbers in the October employment report to be released on Friday. The unemployment rate will probably increase sharply, and the number of part time workers for economic reasons will also increase. Excerpts from the BLS on the impact of the government shutdown:

For October 2013, the household survey reference week was Sunday, October 6, through Saturday, October 12. During this period, some federal government agencies were closed or were operating at reduced staffing levels because of the lapse in their funding. The federal employees and contractors who work for those agencies may have been off work for all or part of the week. ... Workers who indicate that they were not working during the entire survey reference week and expected to be recalled to their jobs should be classified in the household survey as unemployed, on temporary layoff.These shutdown related ugly numbers should be reversed in the November report (due early December).

Workers who usually work full time but indicate that they had worked fewer than 35 hours in the reference week because of the shutdown should be classified as employed part time for economic reasons.

However the impact on the October establishment survey is less certain. The consensus forecast is for an increase of 120,000 non-farm payroll jobs in October, down from the 148,000 non-farm payroll jobs added in September.

Here is a summary of recent data:

• The ADP employment report showed an increase of 130,000 private sector payroll jobs in October. This was below expectations of 138,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month. But in general, this suggests employment growth close to expectations.

• The ISM manufacturing employment index decreased in October to 53.2% from 55.4% in September. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs were mostly unchanged in October. The ADP report indicated a 5,000 increase for manufacturing jobs in October.

The ISM non-manufacturing employment index increased in October to 56.2% from 52.7% in September. A historical correlation between the ISM non-manufacturing index and the BLS employment report for non-manufacturing, suggests that private sector BLS reported payroll jobs for non-manufacturing increased by about 235,000 in October.

Taken together, these surveys suggest around 235,000 jobs added in October - well above the consensus forecast.

• Initial weekly unemployment claims averaged close to 356,000 in October. This was up sharply from an average of 305,000 in September. However there were some computer problems in California, and claims in September were probably too low - and claims in October too high. So this might not be useful this month.

• The final October Reuters / University of Michigan consumer sentiment index decreased to 73.2 from the September reading of 77.5. This is frequently coincident with changes in the labor market, but in this case the decline was probably related to the government shutdown.

• The small business index from Intuit showed a small decrease in small business employment in October.

• Conclusion: As usual the data was mixed. The ADP report was a little lower in October than in September, however the ISM surveys suggest an increase in hiring. Weekly claims for the reference week were higher (probably mostly due to computer issues), and consumer sentiment decreased (due to the government shutdown).

There is always some randomness to the employment report - and there are reasons for pessimism (ADP, unemployment claims, consumer sentiment), however with so many questions about the data, I'll lean towards the ISM surveys and my guess is the BLS will report more than the 120,000 consensus jobs added in October.

There are many questions about this employment report because of the government shutdown, and the November report will be much more important.