by Calculated Risk on 11/01/2013 09:11:00 PM

Friday, November 01, 2013

Public and Private Sector Payroll Jobs: Reagan, Bush, Clinton, Bush, Obama

By request, here is an update on an earlier post through the September employment report.

In April, I posted two graphs comparing changes in public and private sector payrolls during the Bush and Obama presidencies. Several readers asked if I could add Presidents Reagan and Clinton (I've also added the single term of President George H.W. Bush). Below are updates through the September report.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a better comparison might be to look at the percentage change, but this gives an overall view of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the first year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.

The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was very sluggish, and private employment was down 946,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 665,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,490,000 private sector jobs added.

Private sector employment increased by 20,864,000 under President Clinton (light blue) and 14,688,000 under President Reagan (yellow).

There were only 1,933,000 more private sector jobs at the end of Mr. Obama's first term. At this early point in Mr. Obama's second term, there are now 3,362,000 more private sector jobs than when he initially took office.

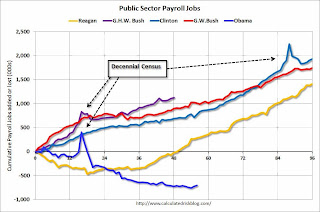

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

The public sector grew during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,748,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 703,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are mostly over at the state and local levels, but there are ongoing cutbacks at the Federal level.

Lawler on Homebuilders: Home Orders Off Significantly Last Quarter

by Calculated Risk on 11/01/2013 05:12:00 PM

From housing economist Tom Lawler:

The Ryland Group reported that net home orders in the quarter ended September 30, 2013 totaled 1,592, up 5.6% from the comparable quarter of 2012 (which included 7 net orders in areas where operations had been discontinued). The company’s sales cancellation rate, expressed as a % of gross orders, was 23.0% last quarter, compared to 19.9% a year ago. The company’s community count at the end of September was up 20.9% from a year ago, and the company’s average sales absorption rate per community last quarter was down about 13% from the comparable quarter of 2012. Home closings totaled 1,883 last quarter, up 42.4% from the comparable quarter of 2012, at an average sales price of $298,000, up 12.9% from a year ago. The company’s order backlog at the end of September was 3,376, up 36.5% from last September. Ryland said that its controlled lots at the end of September totaled 39,698, up 49.1% from last September.

Standard Pacific Homes reported that net home orders (ex jvs) in the quarter ended September 30, 2013 totaled 1,110, up 12.2% from the comparable quarter of 2012. The company’s sales cancellation rate, expressed as a % of gross orders, was 19.7% last quarter, compared to 14.0% a year ago. The company’s average community count last quarter was up 7.7% from a year ago. Home deliveries last quarter totaled 1,217, up 41.3% from the comparable quarter of 2012, at an average sales price of $420,000, up 13.8% from a year ago. The company’s order backlog at the end of September was 2,165, up 55.3% from last September. The company controlled 35,643 lots (including jvs) at the end of September, up 18.2% from a year ago.

Here is a summary of selected stats released so far by large, publicly-traded builders.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/30/13 | 9/30/12 | % Chg | 9/30/13 | 9/30/12 | % Chg | 9/30/13 | 9/30/12 | % Chg |

| Pulte Group | 3,781 | 4,544 | -16.8% | 4,817 | 4,418 | 9.0% | $310,000 | $279,000 | 11.1% |

| NVR | 2,381 | 2,558 | -6.9% | 3,342 | 2,656 | 25.8% | $349,200 | $321,700 | 8.5% |

| The Ryland Group | 1,592 | 1,507 | 5.6% | 1,883 | 1,322 | 42.4% | $298,000 | $264,000 | 12.9% |

| Standard Pacific | 1,110 | 989 | 12.2% | 1,217 | 861 | 41.3% | $420,000 | $369,000 | 13.8% |

| Meritage Homes | 1,300 | 1,204 | 8.0% | 1,418 | 1,197 | 18.5% | $341,000 | $280,000 | 21.8% |

| MDC Holdings | 924 | 1,008 | -8.3% | 1,257 | 1,039 | 21.0% | $345,000 | $320,647 | 7.6% |

| M/I Homes | 869 | 757 | 14.8% | 937 | 746 | 25.6% | $284,000 | $266,000 | 6.8% |

| Total | 11,957 | 12,567 | -4.9% | 14,871 | 12,239 | 21.5% | $330,568 | $295,818 | 11.7% |

The YOY % change in net orders for the above seven builders for the quarter ended June 30, 2013 was +11.5%. Net orders for the latest quarter were down 25.0% from the previous quarter, compared to a sequential quarterly decline of 12.1% a year ago.

Builder results so far strongly indicate that the combination of higher mortgage rates and aggressive home price increases resulted in a significant slowdown in new home sales last quarter. While the relationship between large builder results and Census estimates for new home sales is far from perfect (partly reflecting market-share changes but also reflecting methodological and timing differences), these builder results suggest that Census estimates for new SF home sales for September (re-scheduled for release, along with estimates for October, on December 4th), could be down sharply from August.

emphasis added

U.S. Light Vehicle Sales decline to 15.17 million annual rate in October

by Calculated Risk on 11/01/2013 02:59:00 PM

Based on an estimate from WardsAuto, light vehicle sales were at a 15.17 million SAAR in October. That is up 5.9% from October 2012, and down slightly from the sales rate last month. Some of the weakness in October was related to the government shutdown.

This was below the consensus forecast of 15.4 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for October (red, light vehicle sales of 15.17 million SAAR from WardsAuto).

Click on graph for larger image.

Click on graph for larger image.

This was the lowest sales rate since April, and was probably related to the government shutdown.

The growth rate will probably slow in 2013 - compared to the previous three years - but this will still be another solid year for the auto industry.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and are still a key driver of the recovery. Looking forward, growth will slow for auto sales. If sales average the recent pace for the entire year, total sales will be up almost 9% from 2012, not quite double digit but still strong.

Comment: Looking for Stronger Economic Growth in 2014

by Calculated Risk on 11/01/2013 12:40:00 PM

Back in January I wrote: The Future's so Bright .... I started by writing that "It looks like economic growth will pickup over the next few years", although for 2013, I was expecting "another year of sluggish growth" due to fiscal policy.

My guess was "we can expect another year of sluggish growth in 2013 probably in the 2% range again". Fiscal austerity probably subtracted 1.5% to 2.0% from GDP growth in 2013, and the foolish government shutdown probably subtracted a little more.

But even with contractionary fiscal policy, it looks like the US economy will grow in the 2% range this year. Ex-austerity (and ex-shutdown), we'd probably be looking at a decent year - maybe this would have been the best year since Clinton was President!

Right now it looks like 2014 will be a better than 2013 for a number of reasons:

1) The housing recovery should continue.

2) Household balance sheets are in much better shape. See: NY Fed: Household Debt declined in Q2 as Deleveraging Continues and Fed: Household Debt Service Ratio near lowest level in 30+ years

3) State and local government austerity is over (in the aggregate).

4) There will be less Federal austerity in 2014 (hopefully the sequester cuts will be minimized). And a government shutdown is unlikely. From Ethan Harris at Merrill Lynch:

There was also a major silver lining with the shutdown: it gave the general public and moderate politicians a chance to clearly state their views on using a shutdown as a negotiating tactic. Public opinion polls strongly rejected the shutdown as a way to force changes in the Affordable Care Act (ACA) and the favorability rating of the Republican Party fell sharply.5) And demographics are favorable going forward.

...

All of this makes a shutdown next year unlikely. Our hope and expectation is that business and household confidence will slowly rebound as Washington falls off the radar screen. Of course, some headwinds remain, including uncertainty about the rollout of the Affordable Care Act, but with no new austerity and no major brinkmanship moments, the economy should improve.

We will still some disappointing numbers related to the shutdown (I expect the unemployment rate to spike higher for October, but to be reversed in the November report). But right now, 2014 is looking solid.

ISM Manufacturing index increases in October to 56.4

by Calculated Risk on 11/01/2013 10:00:00 AM

The ISM manufacturing index indicated faster expansion in October. The PMI was at 56.4% in October, up from 56.2% in September. The employment index was at 53.2%, down from 55.4%, and the new orders index was at 60.6%, up from 60.5% in September.

From the Institute for Supply Management: October 2013 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in October for the fifth consecutive month, and the overall economy grew for the 53rd consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI™ registered 56.4 percent, an increase of 0.2 percentage point from September's reading of 56.2 percent. The PMI™ has increased progressively each month since June, with October's reading reflecting the highest PMI™ in 2013. The New Orders Index increased slightly in October by 0.1 percentage point to 60.6 percent, while the Production Index decreased by 1.8 percentage points to 60.8 percent. Both the New Orders and Production Indexes have registered above 60 percent for three consecutive months. The Employment Index registered 53.2 percent, a decrease of 2.2 percentage points compared to September's reading of 55.4 percent. The panel's comments are generally positive about the current business climate; however, there are mixed responses on whether the government shutdown and potential default have had any effect on October's results."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 55.0% and suggests manufacturing expanded at a faster pace in October.

Markit PMI shows "modest" manufacturing expansion in October

by Calculated Risk on 11/01/2013 09:00:00 AM

The Markit PMI is at 51.8 (above 50 is expansion). This was down from 52.8 in September, and up from the October flash reading of 51.1.

From MarkIt: PMI at one-year low, as output growth eases sharply

The U.S. manufacturing sector grew at its slowest rate for a year in October, according to the final Markit U.S. Manufacturing Purchasing Managers’ Index™ (PMI™). At 51.8, down from 52.8 in September, but above the earlier flash estimate of 51.1, the PMI suggested that the rate of expansion was only modest.The ISM PMI for October will be released at 10 AM ET today.

...

Manufacturing employment in the U.S. rose for the fourth consecutive month in October. Overall, the rate of job creation accelerated to a moderate pace, but was nonetheless weaker than at the start of the year.

“While better than the earlier flash reading, the final PMI data indicate that the U.S. manufacturing sector ground to a near standstill in October. [said Chris Williamson, Chief Economist at Markit]

“Encouragingly, it looks like companies are expecting the slowdown to be temporary, most likely linked to the government shutdown, as indicated by an upturn in the rate of job creation."

emphasis added

Thursday, October 31, 2013

Friday: Vehicle Sales, ISM Manufacturing Index

by Calculated Risk on 10/31/2013 09:08:00 PM

From Freddie Mac: Fixed Mortgage Rates Decline for Second Consecutive Week

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates declining for the second consecutive week amid recent data showing softening in the housing market. Fixed mortgage rates are at their lowest levels since June.30 year rates peaked this year at 4.58% on August 22nd in the Freddie Mac survey. This is the lowest level since late June.

30-year fixed-rate mortgage (FRM) averaged 4.10 percent with an average 0.7 point for the week ending October 31, 2013, down from last week when it averaged 4.13 percent. A year ago at this time, the 30-year FRM averaged 3.39 percent.

"Fixed mortgage rates eased further leading up to the Federal Reserve's (Fed) October 30th monetary policy announcement. The Fed saw improvement in economic activity and labor market conditions since it began its asset purchase program, but noted the recovery in the housing market slowed somewhat in recent months and unemployment remains elevated. As a result, there was no policy change which should help sustain low mortgage rates in the near future." [said Frank Nothaft, vice president and chief economist, Freddie Mac].

emphasis added

Friday:

• All day, Light vehicle sales for October. The consensus is for light vehicle sales to increase to 15.4 million SAAR in October (Seasonally Adjusted Annual Rate) from 15.2 million SAAR in September.

• At 9:00 AM, the Markit US PMI Manufacturing Index for October.

• At 10:00 AM ET, the ISM Manufacturing Index for October. The consensus is for a decrease to 55.0 from 56.2 in September. The ISM manufacturing index indicated expansion in September at 56.2%. The employment index was at 55.4%, and the new orders index was at 60.5%.

NOTE: The employment situation report for October that was originally scheduled for release on November 1st has been delayed until the following Friday, November 8th.

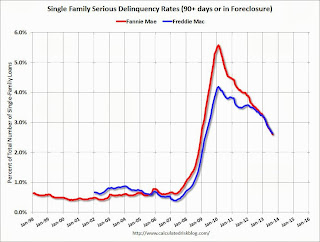

Fannie Mae: Mortgage Serious Delinquency rate declined in September, Lowest since December 2008

by Calculated Risk on 10/31/2013 05:32:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in September to 2.55% from 2.61% in August. The serious delinquency rate is down from 3.41% in September 2012, and this is the lowest level since December 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier this week, Freddie Mac reported that the Single-Family serious delinquency rate declined in September to 2.58% from 2.64% in August. Freddie's rate is down from 3.37% in September 2012, and this is at the lowest level since April 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The Fannie Mae serious delinquency rate has fallen 0.86 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in about 2 years. Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in late 2015 or 2016.

Zillow: Case-Shiller House Price Index expected to show 13.2% year-over-year increase in September

by Calculated Risk on 10/31/2013 04:09:00 PM

The Case-Shiller house price indexes for August were released Tuesday. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close. It looks like another very strong month ...

From Zillow: Sept. Case-Shiller Expected to Continue Showing Eye-Popping Annual Appreciation

The Case-Shiller data for August came out this morning, and based on this information and the September 2013 Zillow Home Value Index (ZHVI, released Oct. 17), we predict that next month’s Case-Shiller data (September 2013) will show that both the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased 13.2 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from August to September will be 0.8 percent for both the 20-City Composite and the 10-City Composite Home Price Indices (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for September will not be released until Tuesday, Nov. 26.The following table shows the Zillow forecast for the September Case-Shiller index.

...

The Zillow Home Value index showed the first signs of moderation in home value appreciation, with several of the largest metros showing month-over-month declines in September. Case-Shiller indices have also shown slowdowns in monthly appreciation but have not yet recorded monthly declines.

| Zillow September Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Sept 2012 | 158.94 | 155.66 | 146.23 | 143.20 |

| Case-Shiller (last month) | Aug 2013 | 178.75 | 174.59 | 164.53 | 160.55 |

| Zillow Forecast | YoY | 13.2% | 13.2% | 13.2% | 13.2% |

| MoM | 0.6% | 0.8% | 0.6% | 0.8% | |

| Zillow Forecasts1 | 179.9 | 176.1 | 165.5 | 162.0 | |

| Current Post Bubble Low | 146.45 | 149.63 | 134.07 | 136.87 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 22.8% | 17.7% | 23.5% | 18.3% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Goldman's Hatzius: How Much Risk to Homebuilding?

by Calculated Risk on 10/31/2013 12:59:00 PM

Goldman Sach chief economist Jan Hatzius wrote today (research note): How Much Risk to Homebuilding? A few excerpts:

The housing news has deteriorated recently across a broad set of indicators, and the FOMC accordingly downgraded its assessment of the housing market in Wednesday's post-meeting statement. How much should we worry about our forecast that residential investment will continue to grow 10-15% and directly contribute 1/2 percentage point to real GDP growth next year?Clearly housing has slowed recently. This has shown up in housing starts and new home sales, and the slowdown is also evident in home builder reports. However I think this slowdown is temporary, and I expect the housing recovery to continue in 2014.

The risks to our housing forecast are on the downside in the near term, but there are three reasons why we still take a positive view beyond the next 1-2 quarters. First, there is a clearly identifiable reason for the recent weakness, namely the sharp increase in mortgage rates. Some of this increase has reversed recently, and barring another shock the impact should be mostly complete by early 2014.

Second, the fundamental supply-demand picture for housing still looks positive. If the population grows at the rates projected by the Census Bureau and the size of the average household trends sideways to slightly lower--in line with historical trends--we estimate that household formation should climb to 1-1.3 million and steady-state housing demand to 1.3-1.6 million. This implies significant upside for housing starts from the current 900,000 level once the remaining excess supply has been eliminated

Third, while home sales and starts have disappointed recently, house prices have continued to rise at double-digit rates, with few signs of deceleration. This suggests that the supply/demand balance in the housing market still looks favorable. That said, we continue to expect that home price appreciation will slow over the next year.

Click on graph for larger image.

Click on graph for larger image.This graph shows single and total housing starts through August (the September and October reports will be both released on November 26th).

There has been a dip in housing starts recently, but I think starts are still closer to the bottom than the next cycle top. I agree with Hatzius that starts will continue to increase over the next several years - and this will be a key driver for economic growth.