by Calculated Risk on 10/31/2013 09:48:00 AM

Thursday, October 31, 2013

Chicago PMI increases sharply to 65.9

From the Chicago ISM:

October 2013:

The October Chicago Business Barometer rose to 65.9 in October from 55.7 in September, led by double digit gains in New Orders, Production and Order Backlogs. October’s gain placed the Barometer at the highest level since March 2011 with companies seemingly unaffected by the government shutdown.This was well above the consensus estimate of 55.0.

New Orders soared to their highest level in nine years, adding to two prior months of gains while Production expanded to its highest level since February 2011.

Order Backlogs leapt out of a contractionary phase to the highest since March 2011. In line with expansion in New Orders and Production, Employment rose to its highest since June 2013, but remained well below the level of New Orders and Production.

Commenting on the MNI Chicago Report, Philip Uglow, Chief Economist at MNI Indicators said, “The government might have shut down but Chicago area companies powered ahead in October as orders and production surged.”

“While it is a little surprising to see such a large rise in activity, the consistent increase in the Barometer over the past four months suggests the recovery is gaining traction,” he added.

Weekly Initial Unemployment Claims decline to 340,000

by Calculated Risk on 10/31/2013 08:34:00 AM

The DOL reports:

In the week ending October 26, the advance figure for seasonally adjusted initial claims was 340,000, a decrease of 10,000 from the previous week's unrevised figure of 350,000. The 4-week moving average was 356,250, an increase of 8,000 from the previous week's unrevised average of 348,250.The previous week was unrevised at 350,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 356,250 - the highest level since April.

Some of the recent increase was due to processing problems in California (now resolved) and some probably related to the government shutdown. The four-week average will probably decline next week.

Wednesday, October 30, 2013

Report: Budget Deficit Declines Sharply in Fiscal 2013

by Calculated Risk on 10/30/2013 08:49:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 350 thousand last week.

• At 9:45 AM, the Chicago Purchasing Managers Index for October. The consensus is for a decrease to 55.0, down from 55.7 in September.

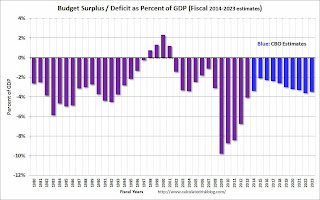

The Treasury released the Fiscal 2013 Final Monthly Treasury Statement. As expected, the Government ran a $75 billion surplus in September (end of fiscal year), and the budget deficit in 2013 declined sharply to 4.1% of GDP from 6.8% of GDP in fiscal 2012.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next nine years based on estimates from the CBO. NOTE: This includes updated GDP estimates from the BEA.

The deficit should decline further over the next couple of years (I think the CBO is pessimistic on 2014).

After 2015, the deficit will start to increase again according to the CBO, but there is no urgent need to reduce the deficit over the next few years.

Bank Failure #23 in 2013: Bank of Jackson County, Graceville, Florida

by Calculated Risk on 10/30/2013 06:15:00 PM

From the FDIC: First Federal Bank of Florida, Lake City, Florida, Assumes All of the Deposits of Bank of Jackson County, Graceville, Florida

As of June 30, 2013 Bank of Jackson County had approximately $25.5 million in total assets and $25.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $5.1 million. ... Bank of Jackson County is the 23rd FDIC-insured institution to fail in the nation this year, and the fourth in Florida.Is it Friday? No, just an unusual mid-week bank failure.

Cost of Living Adjustment: 1.5%, Contribution Base for 2014: $117,000

by Calculated Risk on 10/30/2013 04:41:00 PM

With the release of the CPI report this morning, we now know the Cost of Living Adjustment (COLA), and the contribution base for 2014.

Currently CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is a discussion from Social Security on the current calculation (1.5% increase) and a list of previous Cost-of-Living Adjustments. Note: this is not the headline CPI-U.

The contribution and benefit base will be $117,000 in 2014.

SPECIAL NOTE on CPI-chained: There has been some discussion of switching from CPI-W to CPI-chained for COLA. This will not happen this year, but could happen in the next year or two, and the switch would impact future Cost-of-living adjustments, see: Cost of Living and CPI-Chained.

If CPI-chained was used instead of CPI-W, the increase would be 1.45% (probably rounded up to 1.5%). CPI-chained would have minimal impact on any one year, but would reduce benefits over time.

FOMC Statement: No Taper

by Calculated Risk on 10/30/2013 02:00:00 PM

About as expected ...

FOMC Statement:

Information received since the Federal Open Market Committee met in September generally suggests that economic activity has continued to expand at a moderate pace. Indicators of labor market conditions have shown some further improvement, but the unemployment rate remains elevated. Available data suggest that household spending and business fixed investment advanced, while the recovery in the housing sector slowed somewhat in recent months. Fiscal policy is restraining economic growth. Apart from fluctuations due to changes in energy prices, inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic growth will pick up from its recent pace and the unemployment rate will gradually decline toward levels the Committee judges consistent with its dual mandate. The Committee sees the downside risks to the outlook for the economy and the labor market as having diminished, on net, since last fall. The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, but it anticipates that inflation will move back toward its objective over the medium term.

Taking into account the extent of federal fiscal retrenchment over the past year, the Committee sees the improvement in economic activity and labor market conditions since it began its asset purchase program as consistent with growing underlying strength in the broader economy. However, the Committee decided to await more evidence that progress will be sustained before adjusting the pace of its purchases. Accordingly, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee's dual mandate.

The Committee will closely monitor incoming information on economic and financial developments in coming months and will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. In judging when to moderate the pace of asset purchases, the Committee will, at its coming meetings, assess whether incoming information continues to support the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective. Asset purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on the Committee's economic outlook as well as its assessment of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Charles L. Evans; Jerome H. Powell; Eric S. Rosengren; Jeremy C. Stein; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action was Esther L. George, who was concerned that the continued high level of monetary accommodation increased the risks of future economic and financial imbalances and, over time, could cause an increase in long-term inflation expectations.

emphasis added

Key Measures Shows Low Inflation in September

by Calculated Risk on 10/30/2013 11:19:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in September. The 16% trimmed-mean Consumer Price Index also increased 0.2% (2.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for September here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.2% annualized rate) in September. The CPI less food and energy increased 0.1% (1.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.0%, the trimmed-mean CPI rose 1.7%, the CPI rose 1.2%, and the CPI less food and energy rose 1.7%. Core PCE is for August and increased just 1.2% year-over-year.

On a monthly basis, median CPI was at 2.1% annualized, trimmed-mean CPI was at 2.2% annualized, and core CPI increased 1.5% annualized.

These measures indicate inflation remains below the Fed's target.

ADP: Private Employment increased 130,000 in October

by Calculated Risk on 10/30/2013 08:15:00 AM

Private sector employment increased by 130,000 jobs from September to October, according to the October ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis. September’s job gain was revised down from 166,000 to 145,000.This was a little below the consensus forecast for 138,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "The government shutdown and debt limit brinksmanship hurt the already softening job market in October. Average monthly growth has fallen below 150,000. Any further weakening would signal rising unemployment. The weaker job growth is evident across most industries and company sizes.”

Note: ADP hasn't been very useful in predicting the BLS report on a monthly basis. The BLS report for October will be delayed until next Friday, November 8th, due to the government shutdown.

MBA: Mortgage Applications increase 6% in Latest Weekly Survey

by Calculated Risk on 10/30/2013 07:02:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 6.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 25, 2013. ...

The Refinance Index increased 9 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.33 percent, the lowest rate since June 2013, from 4.39 percent, with points decreasing to 0.26 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

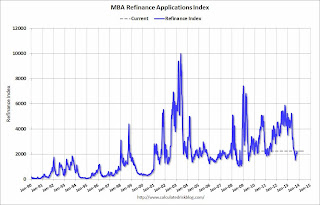

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is up over the last seven weeks as rates have declined from the August levels.

However the index is still down 57% from the levels in early May.

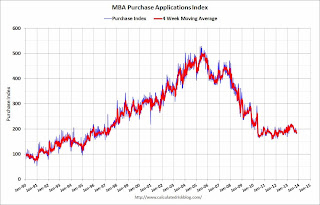

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has fallen since early May, and the 4-week average of the purchase index is now down about 4% from a year ago.

Tuesday, October 29, 2013

Wednesday: FOMC Statement, ADP Employment, CPI

by Calculated Risk on 10/29/2013 08:11:00 PM

A little good news via MarketWatch: Retail gas prices hit lowest level of 2013: AAA

The average U.S. price for a gallon of regular unleaded gasoline stood at $3.28 on Monday, the lowest price of 2013, according to AAA. The motorist and leisure travel group also said it expects gas prices to fall even further, approaching the end of the year "as sufficient, flat demand, the shift to cheaper winter-blend gasoline and falling crude-oil prices likely mean cheaper prices at the pump."Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the weekly mortgage purchase applications index.

• At 8:30 AM, the ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 138,000 payroll jobs added in October, down from 166,000 in September.

• At 8:30 AM, the Consumer Price Index for September. The consensus is for a 0.2% increase in CPI in September and for core CPI to increase 0.2%.

• At 2:00 PM, the FOMC Meeting Announcement. No change to interest rates or QE purchases is expected at this meeting.