by Calculated Risk on 10/25/2013 09:55:00 AM

Friday, October 25, 2013

Final October Consumer Sentiment declines to 73.2

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for October was at 73.2, down from the September reading of 77.5, and down from the preliminary October reading of 75.2.

This was below the consensus forecast of 74.8. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011.

Unfortunately Congress shut down the government, and once again threatened to "not pay the bills", and this impacted sentiment (and possibly consumer spending) in October. The spike down wasn't as large this time, probably because many people realized the House was bluffing with a losing hand.

Thursday, October 24, 2013

Friday: Durable Goods, Consumer Sentiment

by Calculated Risk on 10/24/2013 09:21:00 PM

It is time to play "small ball"!

From the WSJ: Both Parties Seek Small Budget Deal

Republicans and Democrats will use budget talks that start next week to try to minimize or reorder broad spending cuts that began in March, with both sides Thursday playing down the possibility of a "grand bargain" that would address the nation's long-term fiscal problems.I think "small ball" is the correct approach at this time. Hopefully the "grand bargain" talk will subside - it is Not Gonna Happen during the next few months. Besides no one wants another shutdown since that was expensive and just plain dumb.

In de-emphasizing the likelihood of a larger deal, both parties appeared to be looking for limited areas of agreement in order to bypass the next round of the automatic spending cuts known as the sequester and buy time to deal with tax reform, entitlement cuts and other big-ticket items next year.

Friday:

• At 8:30 AM ET, the Durable Goods Orders for September from the Census Bureau. The consensus is for a 2.5% increase in durable goods orders.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 74.8, down from the preliminary reading of 75.2, and down from the September reading of 77.5.

FHFA: No Change in Conforming Loan Limits for at least Six Months

by Calculated Risk on 10/24/2013 05:21:00 PM

From Nick Timiraos at the WSJ: DeMarco: No Mortgage Limit Declines Before Spring 2014 (ht Soylent Green is People)

Federal officials will delay any reduction in the maximum size of home-mortgage loans eligible for backing by Fannie Mae and Freddie Mac until next spring at the earliest amid heavy resistance from the real-estate industry and many lawmakers in Congress.It will be politically difficult to lower these limits, and the limits probably wouldn't be adjusted down very much. The conforming loan limit was $252,700 in 2000. Using the FHFA Purchase Only index, the national conforming loan limit might be lowered to $360,000 or so.

Currently, Fannie and Freddie can guarantee mortgages that have balances as high as $417,000 in most of the country and up to $625,500 in expensive housing markets, including parts of California and New York. Loans within the limits, called “conforming” loans ...

Potential loan-limit changes will be announced six months ahead of their implementation date, [DeMarco] said, and such changes wouldn’t be announced until November at the earliest. “Anything we do would have a long lead time and would be gradual and measured,” said Mr. DeMarco.

When the agency does move ahead with loan limit declines, the declines will apply to both the national limit and the high-cost limits, which were enacted on an emergency and temporary basis by Congress in 2008

Using the CoreLogic or Case-Shiller Comp 20 indexes, the conforming loan limit might be lowered to $380,000 to $395,000. Not a large downward adjustment for the national limit.

Lawler on Homebuilders: Rising mortgage rates, Higher home prices, Resulted in a material slowdown in net home orders last quarter

by Calculated Risk on 10/24/2013 01:59:00 PM

Some comments from housing economist Tom Lawler:

• PulteGroup, the nation’s second largest home builder, reported that net home orders in the quarter ended September 30, 2013 totaled 3,781, down 16.8% from the comparable quarter of 2012. The company’s community count at the end of last quarter was down 15% from a year ago. Home closings totaled 4,817 last quarter, up 9.0% from the comparable quarter of 2012, at an average sales price of $310,000, up 11.1% from a year ago. The company’s order backlog as of September 30, 2013 was 7,522, down 2.1% from last September.

In its press release, the company noted that “consumers have recently slowed home purchases due to higher home prices, a rapid rise in mortgage rates, and political and economic uncertainty,” though the company said it expects the slowdown will be “short lived.”

On the home price front, the company said that “(t)he higher average selling price realized in the quarter reflects price increases implemented by the Company and a continued shift in the mix of homes closed toward more move-up and active adult homes which typically carry higher selling prices.”

• M/I Homes, the nation’s 16th largest home builder, reported that net home orders in the quarter ended September 30, 2013 totaled 869, up 14.8% from the comparable quarter of 2012. The company’s average community county last quarter was up 14.3% from a year ago. Home deliveries totaled 937 last quarter, up 25.6% from the comparable quarter of 2012, at an average sales price of $284,000, up 6.8% from a year ago. The company’s order backlog as of September 30, 2013 was 1,607, up 36.3% from last September.

At the end of September the company owned or controlled 18,133 lots, up 61.9% from last September.

• NVR: Net Home Orders Fell Last Quarter; WAY Below “Consensus”. NVR, Inc, the nation’s fourth largest home builder, reported that net home orders in the quarter ended September 30, 2013 totaled 2,381, down 6.9% from the comparable quarter of 2012. The company’s sales cancellation rate, expressed as a % of gross orders, was 19%, up from 17% a year ago. Home settlements totaled 3,342 last quarter, up 25,8% from the comparable quarter of 2012, at an average sales price of $349,200, up 8.5% from a year ago. The company’s order backlog at the end of September was 5,656, up 14.3% from last September. The decline in net orders last quarter occurred despite a YOY increase in the company’s average community count of 10.0%. NVR is heavily concentrated in the Mid-Atlantic region, where net orders last quarter were down 9.7% from a year ago.

• Meritage Homes reported that net home orders in the quarter ended September 30, 2013 totaled 1,300, up 8.0% from the comparable quarter of 2012. The company’s sales cancellation rate, expressed as a % of gross orders, was 14% last quarter, up from 13% a year ago. Home deliveries last quarter totaled 1,418, up 18.5% from the comparable quarter of 2012, at an average sales price of $341,000, up 21.8% from a year ago. The company’s order backlog on September 30, 2013 was 2,190, up 35.4% from last September. The company noted that average orders per community were down 4% from a year ago. In its press release, a company official attributed last quarter’s slowdown in net home orders to the earlier jump in mortgage rates and to the company’s aggressive increase in home prices.

The company noted that net home orders in the “West Region” (Arizona, California, and Colorado) were down 16% YOY, and net orders per community were down 19%, in part reflecting the company’s aggressive hiking of home prices in the West.

The company’s revenues, gross margins, and overall income exceeded “consensus,” but net orders were well below consensus.

As with many other large builders, Meritage began to add aggressively to the number of lots it owns or controls over the last year, and as of the end of September it owned or controlled 25,046 lots, up about 41% from last September.

Here is a summary of selected results reported by publicly-traded builders for last quarter and compared to the same quarter of 2012.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/30/13 | 9/30/12 | % Chg | 9/30/13 | 9/30/12 | % Chg | 9/30/13 | 9/30/12 | % Chg |

| Pulte Group | 3,781 | 4,544 | -16.8% | 4,817 | 4,418 | 9.0% | $310,000 | $279,000 | 11.1% |

| NVR | 2,381 | 2,558 | -6.9% | 3,342 | 2,656 | 25.8% | $349,200 | $321,700 | 8.5% |

| Meritage Homes | 1,300 | 1,204 | 8.0% | 1,418 | 1,197 | 18.5% | $341,000 | $280,000 | 21.8% |

| M/I Homes | 869 | 757 | 14.8% | 937 | 746 | 25.6% | $284,000 | $266,000 | 6.8% |

| Total | 8,331 | 9,063 | -8.1% | 10,514 | 9,017 | 16.6% | $324,324 | $290,635 | 11.6% |

There appears to be little doubt that rising mortgage rates, combined with higher home prices, resulted in a material slowdown in net home orders last quarter. Mortgage rates, of course, have fallen considerably since early September, though they remain well above levels since during the first five months of the year.

BLS: Job Openings "little changed" in August

by Calculated Risk on 10/24/2013 11:15:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 3.9 million job openings on the last business day of August, little changed from July, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.3 percent) and separations rate (3.2 percent) also were little changed in August. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. Layoffs and discharges are involuntary separations initiated by the employer. ... The quits rate (not seasonally adjusted) rose over the 12 months ending in August for total nonfarm and total private but was unchanged for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for August, the most recent employment report was for September.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in August to 3.883 million from 3.808 million in July (revised up from 3.689 million). The number of job openings (yellow) is up 6.9% year-over-year compared to August 2012.

Quits were up in August, and quits are up about 10.5% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market.

Trade Deficit in August at $38.8 Billion

by Calculated Risk on 10/24/2013 08:55:00 AM

The Department of Commerce reported this morning:

[T]otal August exports of $189.2 billion and imports of $228.0 billion resulted in a goods and services deficit of $38.8 billion, up from $38.6 billion in July, revised. August exports were $0.1 billion less than July exports of $189.3 billion. August imports were virtually unchanged at $228.0 billion.The trade deficit was below the consensus forecast of $40.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through August 2013.

Click on graph for larger image.

Click on graph for larger image.Imports and export were mostly unchanged in August.

Exports are 14% above the pre-recession peak and up 4% compared to August 2012; imports are 1% below the pre-recession peak, and up about 1% compared to August 2012 (mostly moving sideways).

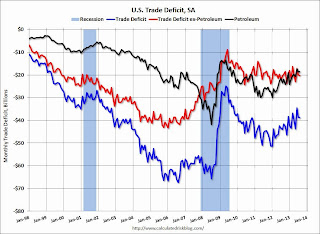

The second graph shows the U.S. trade deficit, with and without petroleum, through August.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $100.26 in August, up from $97.07 in July, and up from $94.48 in August 2012. The petroleum deficit has been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $29.9 billion in August, up from $28.7 billion in August 2012. The trade deficit is mostly due to oil and China.

Weekly Initial Unemployment Claims decline to 350,000

by Calculated Risk on 10/24/2013 08:30:00 AM

The DOL reports:

In the week ending October 19, the advance figure for seasonally adjusted initial claims was 350,000, a decrease of 12,000 from the previous week's revised figure of 362,000. The 4-week moving average was 348,250, an increase of 10,750 from the previous week's revised average of 337,500.The previous week was revised up from 358,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 348,250 - the highest level since July.

Some of this recent increase in the four-week average was related to the government shutdown and some related to processing issues in California.

Wednesday, October 23, 2013

Thursday: Unemployment Claims, Job Openings

by Calculated Risk on 10/23/2013 10:03:00 PM

From Neil Irwin at the WaPo: Another billionaire is predicting doom. Ignore him.

Hedge fund billionaire Stanley Druckenmiller is really, really worried about the future of the United States. He is doing an event at Georgetown next week making the case that entitlement spending will form the next mega-financial crisis, and not for the first time.I've read Druckenmiller's comments and Irwin is far too kind.

This kind of quasi-apocalyptic talk is breathtakingly common. His is of a thread with a lot of commentary that suggests that the whole world economy is just a shell game being propped up by profligate government spending and central bank money-printing, that it’s all a scam that will implode soon enough.

...

[T]here are Druckenmiller’s arguments on Social Security obligations as the trigger of the next global financial crisis. The poster advertising Druckenmiller's speech last week argues that the "true national debt" is more than $200 trillion. What the sponsor seems to be doing is looking at the liabilities side of the balance sheet, but not the asset side. Yes, Social Security and Medicare are on the hook to pay out a lot of money in the future. But they are also on track to collect many trillions in tax revenue in the future.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 358 thousand last week.

• At 9:30 AM, the Markit US PMI Manufacturing Index Flash for October. The consensus is for a decrease to 52.7 from 52.8 in September.

• At 10:00 AM, Job Openings and Labor Turnover Survey for August from the BLS.

• At 11:00 AM, the Kansas City Fed Survey of Manufacturing Activity for August. The consensus is for a reading of 9 for this survey, up from 8 in August (Above zero is expansion).

Note: New Home sales for September - originally scheduled for tomorrow - will be released on December 4th

LA area Port Traffic in September

by Calculated Risk on 10/23/2013 03:45:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for September since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 0.4% in September compared to the rolling 12 months ending in August. Outbound traffic decreased slightly compared to August.

In general, inbound traffic has been increasing and outbound traffic had been declining slightly.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

This suggests an increase in the trade deficit with Asia for September - and possibly a fairly strong retailer buying for the holiday season.

AIA: Architecture Billings Index Increases in September

by Calculated Risk on 10/23/2013 11:36:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Surges Higher

Showing a steady increase in the demand for design services, the Architecture Billings Index (ABI) continues to accelerate, as it reached its second highest level of the year. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the September ABI score was 54.3, up from a mark of 53.8 in August. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.6, down from the reading of 63.0 the previous month.

• Regional averages: West (60.6), South (54.1), Midwest (51.0), Northeast (50.7)

• Sector index breakdown: commercial / industrial (57.9), multi-family residential (55.6), mixed practice (55.4), institutional (50.4)

• Project inquiries index: 58.6

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 54.3 in September, up from 53.8 in August. Anything above 50 indicates expansion in demand for architects' services. This index has indicated expansion in 12 of the last 13 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index is not as strong as during the '90s - or during the bubble years of 2004 through 2006 - but the increases in this index over the past year suggest some increase in CRE investment in 2014.