by Calculated Risk on 10/18/2013 08:44:00 AM

Friday, October 18, 2013

Zillow: Home Value Appreciation slows in Q3

From Zillow: Housing Market Shows Welcome Signs of Cooling in Q3

The pace of home value appreciation nationwide is slowing, and has even turned negative in some areas. But rather than being a bad sign for housing, this slowdown was expected and is, in fact, welcome in a handful of markets, according to the third quarter Zillow Real Estate Market Reports.With a little more inventory, and somewhat higher mortgage rates, a slowdown in house price appreciation makes sense.

The U.S. Zillow Home Value Index stood at $163,000 as of the end of the third quarter, up 6.4 percent year-over-year and 1.2 percent from the end of the second quarter. But national home values in September remained the same as in August, and the pace of monthly home value growth has fallen in each of the past three months. Among the top 30 largest metro areas covered by Zillow, half showed negative monthly appreciation at the end of the third quarter. As recently as July, all of the top 30 metro areas showed positive monthly appreciation, with none exhibiting a monthly pace slower than 1 percent month-over-month.

...

"Far from being a negative sign, we’re relieved to see more noticeable signs of cooling in the market. If home values continued to rise as they have, relatively unchecked, we would almost certainly be headed into another bubble cycle, and nobody wants that,” said Zillow Chief Economist Dr. Stan Humphries. “This is more proof that the market recovery is entering a new phase, transitioning away from the bounce off the bottom we’ve been experiencing and finding a more sustainable level. This moderation should help consumers feel more at ease in their decisions to buy and sell, and will help keep the market balanced.”

The Zillow Home Value Forecast calls for annual appreciation rates to slow markedly over the next 12 months as moderation spreads, to an annual pace of 3.8 percent nationwide by September 2014.

emphasis added

Thursday, October 17, 2013

WSJ: "Shutdown Upends Timing" of Taper

by Calculated Risk on 10/17/2013 08:36:00 PM

From Jon Hilsenrath at the WSJ: Fed Unlikely to Trim Bond Buying in October

The Fed is unlikely to start curtailing its bond buying at its next policy meeting Oct. 29-30. Fed officials have said the decision depends on how the economic data evolve, but the data won't be very illuminating into November because the partial government shutdown closed the agencies that collect them.We've been flying blind, and it will take some until all "instruments" are working again. Plus the shutdown probably slowed growth in Q4 - and the Fed will want to understand the economic impact of the shutdown before changing course.

"For those who really look at the data, it is going to basically delay thought of changing course," Richard Fisher, president of the Federal Reserve Bank of Dallas, said Thursday in an interview.

...

Fed officials could act at one of the following two meetings—Dec. 17-18 or Jan. 28-29. Their decision will turn on the strength of an economy that would still be a bit harder to read ...

Lawler: Early Look at Existing Home Sales in September

by Calculated Risk on 10/17/2013 05:27:00 PM

From housing economist Tom Lawler:

Based on local realtor association/board/MLS reports I’ve seen so far, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.26 million in September, down 4% from

August’s seasonally-adjusted pace. While unadjusted sales this September showed faster YOY growth than was the case in August, business-day related seasonal factor differences, combined with a lower year-ago “comp” for September relative to August, are the reasons why the faster YOY growth translates into a lower monthly SA sales pace.

[CR Note: on adjustments, see table below]

On the inventory front, data from various local listings trackers, combined with local realtor association/board/MLS reports, would suggest that the number of existing homes for sale at the end of September was down only slightly from August. However, NAR inventory estimates typically show larger monthly declines in September than listings data and publicly-available realtor reports would suggest, for reasons that aren’t clear. For example, NAR estimates suggest that the number of existing homes for sale fell by 9.6% from the end of last August to the end of last September, a drop that vastly exceeded both what available listings data and local realtor reports would have suggested. If the NAR’s inventory estimate for this September were down 3.56% from August’s estimate, then this September’s inventory estimate would be unchanged from last September’s. Such a result is quite possible.

Finally, local realtor/MLS/board reports suggest that the NAR’s median home sales estimate will show significantly slower YOY growth for September than for August My best estimate is that the NAR’s estimate for the median existing SF home sales price in September will be around $198,800, up 11.1% from last September.

CR Note: The NAR is scheduled to report September existing home sales on Monday, October 21st.

As Lawler noted, there is a chance that the NAR will report inventory flat year-over-year for September (although it will probably be down slightly).

| YOY Growth, Existing Home Sales, 2013 vs. 2012 | ||||

|---|---|---|---|---|

| Unadjusted | Seasonally Adjusted | Difference | % Difference, Business Days | |

| Jan-13 | 11.9% | 9.5% | 2.4% | 5.0% |

| Feb-13 | 5.9% | 9.5% | -3.6% | -5.0% |

| Mar-13 | 7.5% | 10.8% | -3.3% | -4.5% |

| Apr-13 | 13.5% | 9.7% | 3.8% | 4.8% |

| May-13 | 14.7% | 12.0% | 2.7% | 0.0% |

| Jun-13 | 8.0% | 14.7% | -6.7% | -4.8% |

| Jul-13 | 20.7% | 17.2% | 3.5% | 4.8% |

| Aug-13 | 10.5% | 13.2% | -2.7% | -4.3% |

| Sep-13proj | 14.0% | 10.0% | 3.9% | 5.3% |

BLS: September Employment Report to be released Tuesday, October 22nd

by Calculated Risk on 10/17/2013 04:38:00 PM

From the BLS: Updated Schedule of BLS News Releases

See the table below for some of the updated dates.

There will be concerns about the data for some time (this is the October employment report reference week). As an example, from the Cleveland Fed: Implications of the Government Shutdown on Inflation Estimates

Each month, the Bureau of Labor Statistics (BLS) releases estimates of the Consumer Price Index (CPI) and the Producer Price Index (PPI). The government shutdown, which ended late on October 16, caused a delay in the release of these statistics and many of the statistics and data products that rely on them. But the shutdown will also affect the accuracy of these statistics for months to come. This article outlines the impact of the shutdown, particularly on the accuracy of the CPI.Here are a few of the schedule changes:

The repercussions on CPI estimates will continue for at least seven months. Some of these repercussions will occur later this month, but the majority of the influence will occur the next month, in November, when the monthly overall inflation estimates derived from the CPI will be subject to significant error.

emphasis added

| Release | Reference Period | Previously Scheduled Release Date | Revised Release Date |

|---|---|---|---|

| Metropolitan Area Employment and Unemployment | Aug-13 | Wednesday, October 02, 2013 | Monday, October 21, 2013 |

| Employment Situation | Sep-13 | Friday, October 04, 2013 | Tuesday, October 22, 2013 |

| U.S. Import and Export Price Indexes | Sep-13 | Thursday, October 10, 2013 | Wednesday, October 23, 2013 |

| Job Openings and Labor Turnover Survey | Aug-13 | Tuesday, October 08, 2013 | Thursday, October 24, 2013 |

| Producer Price Index | Sep-13 | Friday, October 11, 2013 | Tuesday, October 29, 2013 |

| Consumer Price Index | Sep-13 | Wednesday, October 16, 2013 | Wednesday, October 30, 2013 |

| Real Earnings | Sep-13 | Wednesday, October 16, 2013 | Wednesday, October 30, 2013 |

| Employment Situation | Oct-13 | Friday, November 01, 2013 | Friday, November 08, 2013 |

Sacramento: Conventional Sales up Sharply Year-over-year in September, Active Inventory increases 77% year-over-year

by Calculated Risk on 10/17/2013 01:24:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For a long time, not much changed. But over the last 2 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In September 2013, 16.0% of all resales (single family homes) were distressed sales. This was down from 19.0% last month, and down from 50.8% in September 2012. This is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs was at 3.9% (the lowest since the data was tracked), and the percentage of short sales decreased to 12.1%. (the lowest percentage for short sales since Sacramento started tracking short sales in June 2009).

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently (blue).

Active Listing Inventory for single family homes increased 77.3% year-over-year in September. This is the fifth consecutive month with a year-over-year increase in inventory - clearly inventory has bottomed in Sacramento.

Cash buyers accounted for 23.6% of all sales, down from 25.4% last month (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 11% from September 2012, but conventional sales were up 51% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

As I've noted before, we are seeing a similar pattern in other distressed areas. This suggests what will happen in other areas: 1) Flat or declining overall existing home sales, 2) but increasing conventional sales, 3) Less investor buying, 4) more inventory, and 5) slower price increases.

Philly Fed Manufacturing Survey indicates Solid Expansion in October

by Calculated Risk on 10/17/2013 10:00:00 AM

From the Philly Fed: October Manufacturing Survey

Manufacturing growth in the region continued in October, according to firms responding to this month’s Business Outlook Survey. The survey’s broadest indicators for general activity, new orders, shipments, and employment were positive, signifying growth. The survey's indicators of future activity suggest continued optimism about growth over the next six months.This was above the consensus forecast of a reading of 15.0 for October.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, edged down from 22.3 in September to 19.8 this month. The index has now been positive for five consecutive months. ... The demand for manufactured goods, as measured by the current new orders index, increased 6 points, to 27.5, its highest reading since March 2011.

Labor market indicators showed improvement this month. The current employment index increased 5 points, to 15.4, its highest reading since May 2011.

emphasis added

Click on graph for larger image.

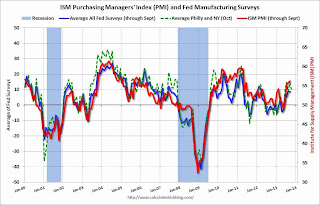

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through October. The ISM and total Fed surveys are through September.

The average of the Empire State and Philly Fed surveys has been positive for five consecutive months. This was a solid report and suggests further solid expansion in the ISM report for October.

Weekly Initial Unemployment Claims decline to 358,000

by Calculated Risk on 10/17/2013 08:30:00 AM

The DOL reports:

In the week ending October 12, the advance figure for seasonally adjusted initial claims was 358,000, a decrease of 15,000 from the previous week's revised figure of 373,000. The 4-week moving average was 336,500, an increase of 11,750 from the previous week's revised average of 324,750.The previous week was revised down from 374,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 336,500.

Some of this recent increase in the four-week average was related to the government shutdown (and some related to processing issues in California).

Note: This information is collected by the states and was not delayed by the shutdown.

Wednesday, October 16, 2013

Senate Approves Deal 81 to 18, House to Vote Later

by Calculated Risk on 10/16/2013 08:12:00 PM

The Senate approved the deal to open the government and pay-the-bills 81 to 18, and the House will vote later. Here is the CSPAN feed. There was never any doubt (in my mind) that the debt ceiling would be raised. And it is good news that the shutdown will be over (it was very expensive).

Thursday:

• 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 374 thousand last week. This data is gathered by the states and will continue to be released.

• DELAYED: the Housing Starts for September. The consensus is for total housing starts to increase to 913 thousand (SAAR) in September.

• DELAYED: the Fed was scheduled to release Industrial Production and Capacity Utilization for September. From the Fed:

The industrial production indexes that are published in the G.17 Statistical Release on Industrial Production and Capacity Utilization incorporate a range of data from other government agencies, the publication of which has been delayed as a result of the federal government shutdown. Consequently, the G.17 release will not be published as scheduled on October 17, 2013. After the reopening of the federal government, the Federal Reserve will announce a publication date for the G.17 release.The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 78.1%.

• At 10:00 AM, the Philly Fed manufacturing survey for October. The consensus is for a reading of 15.0, down from 22.3 last month (above zero indicates expansion).

DataQuick on SoCal: September Home Sales Up 7.0% year-over-year, Foreclosure Resales lowest since May 2007

by Calculated Risk on 10/16/2013 03:29:00 PM

From DataQuick: Southland Median Sale Price Dips Month-to-Month, Still Up Sharply From Yr Ago

Southern California home sales in September fell more than usual from August but rose modestly above a year earlier as sales gains for mid- to high-priced properties compensated for declines in sub-$300,000 activity. ... A total of 19,112 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 17.1 percent from 23,057 sales in August, and up 7.0 percent from 17,859 sales in September 2012, according to San Diego-based DataQuick.This continues to move in the right direction (fewer distressed sales, fewer absentee buyers).

Last month’s sales were 19.9 percent below the average number of sales – 23,862 – in the month of September. Southland sales haven’t been above average for any particular month in more than seven years. September sales have ranged from a low of 12,455 in September 2007 to high of 37,771 in September 2003.

In September, foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 6.3 percent of the Southland resale market. That was down from a revised 6.9 percent the month before and down from 16.6 percent a year earlier. Last month’s foreclosure resale rate was the lowest since it was 5.5 percent in May 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 13.1 percent of Southland resales last month. That was the lowest level since it was 12.9 percent in May 2009. Last month’s short sale figure was down from an estimated 13.3 percent the month before and down from 28.0 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 26.3 percent of the Southland homes sold last month, which is the lowest share for any month since it was 25.1 percent in November 2011. Last month’s level was down from a revised 26.7 percent the month before and down from 27.7 percent a year earlier. The absentee share has ratcheted down gradually each month this year since hitting a record 32.4 percent in January.

emphasis added

Fed's Beige Book: Economic activity increased "at a modest to moderate pace"

by Calculated Risk on 10/16/2013 02:03:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Chicago and based on information collected on or before October 7, 2013. This document summarizes comments received from business and other contacts outside the Federal Reserve and is not a commentary on the views of Federal Reserve officials. "

Reports from the twelve Federal Reserve Districts suggest that national economic activity continued to expand at a modest to moderate pace during the reporting period of September through early October. Eight Districts reported similar growth rates in economic activity as during the previous reporting period, while growth slowed some in the Philadelphia, Richmond, Chicago, and Kansas City Districts. Contacts across Districts generally remained cautiously optimistic in their outlook for future economic activity, although many also noted an increase in uncertainty due largely to the federal government shutdown and debt ceiling debate.And on real estate:

Construction and real estate activity continued to improve in September. Residential construction increased moderately on balance, growing at a stronger pace in the Minneapolis and Dallas Districts but only slightly in Richmond and Philadelphia. Multifamily construction remained stronger than single-family construction in a number of Districts. Residential real estate activity continued to improve at a moderate pace in most Districts, as home sales and prices continued to rise and inventories remained low. Home sales in the New York and Dallas Districts were strong, with the exception of the Jersey Shore, which is still recovering from Hurricane Sandy. The Philadelphia, Atlanta, and Chicago Districts experienced a more modest improvement in home sales. A number of Districts reported concerns from homebuilders and realtors over rising mortgage rates. However, contacts in the Dallas District indicated that rising interest rates were not hurting affordability and contacts in the Boston District suggested some boost to activity by homebuyers entering the market in anticipation of future increases in rates. Nonresidential construction activity remained modest, but varied by market and District. Growth was strong in the Minneapolis District, but up only slightly in Richmond, Atlanta, and Philadelphia. The Cleveland, Chicago, and St. Louis Districts reported increased activity for industrial building, Cleveland noted strong demand from the healthcare sector, and redevelopment of vacant retail space picked up in Boston. Leasing activity continued to improve modestly in most Districts, but was particularly strong in the Dallas District. A number of Districts reported that vacancy rates continued to fall, rents rose, and the outlook for commercial real estate was generally positive.Overall this was similar to the previous beige book with economic activity increasing at a "modest to moderate" pace.

emphasis added