by Calculated Risk on 10/15/2013 07:29:00 PM

Tuesday, October 15, 2013

Wednesday: Beige Book, Homebuilder Confidence, Tar and Feathers

Note: The action in the House today was a side show for political purposes only. The real action is in the Senate, and I expect an agreement to be reached soon.

From the NY Times: Conservatives and Moderates Close to Open Revolt

On the brink of a historic default, House Republicans on Tuesday put off a vote on their latest proposal to reopen the government and raise the debt limit, as a major credit agency warned that the United States was on the verge of a costly ratings downgrade.In addition to the highest unfavorable ratings in history, now tar and feathers are selling out in Republican congressional districts!1

Hard-line conservatives and more pragmatic Republicans were nearing open revolt Tuesday evening, after House Republican leadership rushed out a new bill in the afternoon, forcing a postponement of any vote on the measure. With the latest delay, chances increased that a resolution would not be reached before the Treasury exhausted its borrowing authority on Thursday.

...

“It’s very, very serious,” said Senator John McCain, Republican of Arizona. “Republicans have to understand we have lost this battle, as I predicted weeks ago, that we would not be able to win because we were demanding something that was not achievable.”

Wednesday:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. Look for the government shutdown to impact applications.

• DELAYED: At 8:30 AM, the Consumer Price Index for September was scheduled for release. The consensus is for a 0.2% increase in CPI in September and for core CPI to increase 0.2%.

• At 10:00 AM, the October NAHB homebuilder survey. The consensus is for a reading of 57, down from 58 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

1"Tar and feathers" is a joke, but not the record high unfavorable ratings for Republicans.

Shiller on 401K Plan Investing

by Calculated Risk on 10/15/2013 04:08:00 PM

This reminds me of when I was the Trustee for our company's retirement plan. I was amazed at the reasons some people didn't participate - even with a decent match on their contributions - and I was even more amazed at how some people invested.

From an interview of Robert Shiller by Neil Irwin at the WaPo: Robert Shiller: ‘When I look around I see a lot of foolishness, and I can’t believe it’s not important economically’. Robert Shiller said:

Here’s where the efficient markets hypothesis gets you into trouble. The idea that everyone will manage their 401k plan optimally is really not right. What was discovered by some of the behavioral finance research is people are inertial. They don’t do anything. If they have to sign up for the plan, they won’t do it. If they do sign up, they'll put their money in whatever asset seems to be recommended and leave it there the rest of their lives. You would think it’s kind of obvious, that some people aren't that interested in managing their portfolios.It was even worse than "inertia". Many people were too risk adverse and would park their money in money market funds all the time. Others would invest in money markets, and then, if the market had done well for a few quarters, they'd move the money into the market. As soon as there was any kind of sell off, they'd be back in the money market. Amazingly these people underperformed every asset class by chasing recent performance. I think there is something to this "behavioral finance"!

Zillow: 30-Year Fixed Mortgage Rates increase slightly to 4.16%

by Calculated Risk on 10/15/2013 02:34:00 PM

The Freddie Mac Weekly Primary Mortgage Market Survey® will be released on Thursday (the series I usually follow), but here is a release from Zillow today: 30-Year Fixed Mortgage Rates Rise Slightly For Second Consecutive Week; Current Rate is 4.16%

The 30-year fixed mortgage rate on Zillow® Mortgage Marketplace is currently 4.16 percent, up five basis points from 4.11 percent at this time last week. The 30-year fixed mortgage rates hovered between 4.11 and 4.14 percent for the majority of the week before rising to the current rate this morning.This is down from mid-August when 30 year fixed rates were at 4.58% (Freddie Mac survey). Last year rates averaged 3.38% in October 2012.

“Rates rose slightly last week, but remain relatively unchanged since the government shutdown began two weeks ago,” said Erin Lantz, director of mortgages at Zillow. “Despite some non-government economic data scheduled to be released next week, we expect rates to remain fairly steady until the government re-opens and releases more insightful data on the health of the economy.”

The rate for a 15-year fixed home loan is currently 3.18 percent, while the rate for a 5-1 adjustable-rate mortgage (ARM) is 2.84 percent.

FNC: House prices increased 5.3% year-over-year in August

by Calculated Risk on 10/15/2013 11:00:00 AM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: Home Prices Up 0.6% in August; Signs of Subsiding Growth Momentum

The latest FNC Residential Price Index™ (RPI) shows continued growth of home prices in August as the U.S. housing recovery remains well underway. The index moved 0.6% higher from the previous the month, making August the 18th consecutive month of rising home prices. According to the FNC RPI, August home prices have climbed to the levels attained in December 2009. ...The 100-MSA composite was up 5.3% compared to August 2012 (slightly higher YoY change than in June and July). The FNC index turned positive on a year-over-year basis in July, 2012.

In August, foreclosure sales nationwide accounted for 12.4% of total home sales, down slightly from July’s 12.7% and by more than 4.5 percentage points from a year ago. However, there are signs that the price momentum has likely subsided entering the fall/winter low season in homebuying. The latest September median sales-to-list price ratio edged lower to 96.2 – a 3.8% listing price markdown among closed sales, down from 97.2 in August. ...

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that August home prices increased from the previous month at a seasonally unadjusted rate of 0.6%. In a sign of moderating month-over-month price momentum, August’s price increase is smaller than June and July. On a year-over-year basis, home prices were up a modest 5.3% from a year ago. The two narrower indices exhibit similar month-over-month price momentums but a slightly faster year-over-year price increase.

...

FNC’s RPI is the mortgage industry’s first hedonic price index built on a comprehensive database that blends public records of residential sales prices with real-time appraisals of property and neighborhood attributes. As a gauge of underlying home values, the RPI excludes sales of foreclosed homes, which are frequently sold with large price discounts, reflecting poor property conditions.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes.

Even with the recent increase, the FNC composite 100 index is still off 26.2% from the peak.

I expect all of the housing price indexes to show lower year-over-year price gains toward the end of this year.

NY Fed: Empire State Manufacturing Activity "held steady" in October

by Calculated Risk on 10/15/2013 08:36:00 AM

From the NY Fed: Empire State Manufacturing Survey

The October 2013 Empire State Manufacturing Survey indicates that business conditions held steady for New York manufacturers. The general business conditions index fell 5 points to 1.5. The new orders index rose five points to 7.8 ...This is the first of the regional surveys for October. The general business conditions index was below the consensus forecast of a reading of 7.0, but shows continued modest expansion.

Labor market conditions were also steady, with the index for number of employees falling four points to 3.6 and the average workweek index inching up to 3.6. Indexes for the six month outlook continued to convey a strong degree of optimism about future business conditions. The future general business conditions index held near last month’s year-and-a-half high, at 40.8. The indexes for expected new orders and expected shipments also remained at strong levels.

emphasis added

Monday, October 14, 2013

Tuesday: NY Fed Manufacturing Survey

by Calculated Risk on 10/14/2013 09:31:00 PM

From the NY Times: Senators Near Fiscal Deal, but the House Is Uncertain

Senate leaders neared the completion Monday night of a bipartisan deal to raise the debt ceiling and end the government shutdown ... Negotiators talked into the evening as senators from both parties coalesced around a plan that would lift the debt limit through Feb. 7, pass a resolution to finance the government through Jan. 15 and conclude formal discussions on a long-term tax and spending plan no later than Dec. 13 ...Unfortunately this is the reference week for the BLS - the week the data is gathered for the October employment report -so the data might not be gathered with the government still shutdown.

As they drafted their deal, Senate negotiators in both parties were hoping that House Republican leaders would have no choice but to let a bipartisan agreement come to a vote, even if it could pass only with votes from Democrats and a minority of the Republican majority.

Tuesday:

• At 8:30 AM ET, the NY Fed Empire State Manufacturing Survey for October will be released. The consensus is for a reading of 7.0, up from 6.3 in September (above zero is expansion).

WSJ: More Homes for Sales, Fewer Sales, Slowing Price Increases in Certain Areas

by Calculated Risk on 10/14/2013 05:46:00 PM

From Nick Timiraos at the WSJ: Home Sales, Prices Slowing in Bust-and-Boom Markets

The sharp home-price rally in some of the hardest-hit housing markets is likely to fade in the coming months amid a pullback in investor purchases and steady increases in the number of homes listed for sale.Timiraos presents some data for Phoenix, Sacramento and Las Vegas. The increase in inventory, and decline in all-cash buyers in these areas is something Tom Lawler has been tracking too. This suggests price increases in these areas should slow.

...

The rally began in early 2012 after investors aggressively bought up cheap foreclosed homes that can be rehabbed and flipped to end users or rented out to those who aren’t ready or able to buy, clearing an overhang of distressed properties. Meanwhile, many traditional buyers couldn’t sell their properties because they owed more than their homes were worth, keeping inventories very lean. As home prices warmed up and interest rates fell to rock-bottom levels, traditional buyers got in on the game, releasing pent-up demand.

Now, housing data is showing that the brakes could soon hit such sharp gains

Weekly Update: Existing Home Inventory down only 1.0% year-over-year on Oct 14th

by Calculated Risk on 10/14/2013 03:13:00 PM

Here is another weekly update on housing inventory: One of key questions for 2013 is Will Housing inventory bottom this year? Since this is a very important question, I'm tracking inventory weekly in 2013.

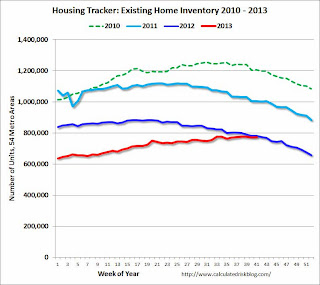

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for August). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012 and 2013.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2013 is increasing, although still 1.0% below the same week in 2012.

This strongly suggests inventory bottomed early this year, and I expect inventory to be up year-over-year very soon, and I also expect the seasonal decline to be less than usual at the end of the year. Inventory is still very low, but this increase in inventory should slow house price increases.

The Agreement: What I'd like to see

by Calculated Risk on 10/14/2013 12:10:00 PM

This is what I'd like to see (and many other analysts and economists would too):

• Eliminate the "debt ceiling". It is superfluous. As former Fed Chairman Alan Greenspan and others have said, the "debt ceiling" is just arithmetic. We have approved expenditures. We have revenue. The shortfall is borrowed. If we don't get rid of the debt ceiling, increase the level through 2014.

• Pass a Continuing Resolution (CR) for fiscal 2014 that reduces the impact of the sequester. As Republican advisor Mark Zandi said last week:

As part of any budget deal, lawmakers should reverse the sequester. The second year of budget sequestration will likely have greater consequences than the first, affecting many government programs in ways that nearly all agree are not desirable. A sizable share of the sequestration cuts to date has involved one-off adjustments, but future cuts will have to come from lasting reductions in operational budgets.• In the long run (not this decade), the US will be challenged by health care costs. This requires some adjustments to both spending and revenue. As Mark Zandi said last week:

It would of course also be desirable for lawmakers to address the nation’s long-term fiscal challenges. ... Both cuts in government spending and increases in tax revenues will be necessary to reasonably solve these long-term fiscal problems.As I noted last week, perhaps another super-committee with long term consequences if the committee fails (not more short term cuts like the sequester). The consequences should be distasteful to both parties - and both cut spending and raise revenue in the long term so there is some motivation for the committee to reach agreement.

• It is important to note that the deficit is declining, and declining rapidly. Over the next few years (the short run), the deficit will not be a problem (great news!), as long as the economy continues to grow (government shutdowns and threats to not "pay the bills" hurt the short run).

Final comment: It is sad, but predictable, that this shutdown and threat to not "pay-the-bills" is happening now. As Goldman Sachs chief economist Jan Hatzius wrote in April:

The federal budget deficit is shrinking rapidly. ... [T]here is still a great deal of room for the economic recovery to reduce the deficit for cyclical reasons. ... In our view, the most important implication from the reduction in the budget deficit for the near-term economic outlook is reduced pressure for further fiscal retrenchment.In another year, the House will have lost the short term deficit as an argument (actually for those paying attention, the short term deficit is no longer a serious concern). However this doesn't mean we shouldn't pay attention to the long term issues, and maybe we could find some common ground on moving forward on those issues - without hurting the short term.

Update: Real Estate Agent Boom and Bust

by Calculated Risk on 10/14/2013 08:48:00 AM

Way back in 2005, I posted a graph of the Real Estate Agent Boom. Here is another update to the graph.

Below is another update to the long term graph of the number of real estate licensees in California.

The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

The number of salesperson's licenses is off 32.5% from the peak, and is still declining (down 3.7% year-over-year). The number of salesperson's licenses has fallen to May 2004 levels.

Brokers' licenses are only off 8.3% and have only fallen to late 2006 levels - but are still slowly declining (down 1.3% year-over-year).

Click on graph for larger image.

Click on graph for larger image.

So far there is no sign of a new bubble in real estate agents!