by Calculated Risk on 10/10/2013 08:30:00 AM

Thursday, October 10, 2013

Weekly Initial Unemployment Claims increase sharply

The DOL reports:

In the week ending October 5, the advance figure for seasonally adjusted initial claims was 374,000, an increase of 66,000 from the previous week's unrevised figure of 308,000. The 4-week moving average was 325,000, an increase of 20,000 from the previous week's unrevised average of 305,000.The previous week was unrevised at 308,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 325,000.

Some of this sharp increase is related to the government shutdown.

Note: This information is collected by the states and will continue to be released.

Wednesday, October 09, 2013

Thursday: Unemployment Claims

by Calculated Risk on 10/09/2013 09:02:00 PM

Maybe the message will get through - from the NY Times: Business Groups Urge Congress to Reopen as Shutdown Drags On

House Republicans, facing the ninth day of a government shutdown, appeared increasingly isolated on Wednesday from even their strongest backers, with business groups demanding the immediate reopening of the government and benefactors such as Koch Industries publicly distancing themselves from the shutdown fight.From Gallup: Republican Party Favorability Sinks to Record Low

...

On Wednesday, the National Retail Federation joined other business groups like the U.S. Chamber of Commerce and the National Association of Manufacturers in asking House Republicans to relent.

[T]he Republican Party is now viewed favorably by 28% of Americans, down from 38% in September. This is the lowest favorable rating measured for either party since Gallup began asking this question in 1992.Thursday:

..

More than six in 10 Americans (62%) now view the GOP unfavorably, a record high.

• 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 308 thousand last week. This data is gathered by the states and will continue to be released

Lawler: Declining all-cash share in Vegas and Phoenix suggests slowdown in investor buying

by Calculated Risk on 10/09/2013 05:34:00 PM

From housing economist Tom Lawler:

The declining all-cash share in Vegas and (more dramatically) in Phoenix suggests slowdown in investor buying. [Here is some data]

The Arizona Regional MLS reported that residential home sales by realtors in the Greater Phoenix, Arizona area totaled 6,314 in September, down 2.5% from last September’s pace. Lender-owned properties were 8.0% of last month’s sales, down from 12.9% last September, while last month’s short-sales share was 8.8%, down from 27.0% a year ago. All-cash transactions were 33.4% last month, down from 43.9% last September. Active listings in September totaled 23,384, up 9.4% from August and up 7.3% from a year ago. The median home sales price last month was $185,000, up 23.3% from last September. Contracts signed last month were down 17.0% from a year ago.

The Greater Las Vegas Association of Realtors reported that residential home sales by realtors in the Greater Las Vegas, Nevada area totaled 3,259 in September, down 1.2% from last September’s pace. All-cash transactions were 47.2% of last month’s sales, down from 54.8% last August. Active listings in September totaled 18,253, up 1.4% from August but down 11.3% from a year ago. The median SF home sales price last month was $180,000, up 28.6% from last September.

emphasis added

CR Note: We've been seeing some decline in the "all cash share" for the last few months, and this decline looks significant. Of course not all "all cash" buyers are investors, but it is probably reasonable to use this for the trend in investor buying. I expect Tom to provide me with a table of selected cities in September (here is the data for August). This data is suggesting a slowdown in investor buying in many areas.

FOMC Minutes: "Considerable risks surrounding fiscal policy"

by Calculated Risk on 10/09/2013 02:00:00 PM

There was a significant debate on asset purchases at the last FOMC meeting. Those who didn't want to reduce asset purchases expressed several reasons including "Considerable risks surrounding fiscal policy" (no kidding!).

Even those who wanted to reduce asset purchases "indicated that they favored a relatively small reduction to signal the Committee's intention to proceed cautiously".

From the Fed: Minutes of the Federal Open Market Committee, September 17-18, 2013 . A few excerpts on asset purchases:

In their discussion of the path for monetary policy, participants debated the advantages and disadvantages of reducing the pace of the Committee's asset purchases at this meeting, focusing importantly on whether the conditions presented to the public in June for reducing the pace of asset purchases had yet been met. In general, those who preferred to maintain for now the pace of purchases viewed incoming data as having been on the disappointing side and, despite clear improvements in labor market conditions since the purchase program's inception in September 2012, were not yet adequately confident of continued progress. Many of these participants had revised down their forecasts for economic activity or pointed to near-term risks and uncertainties. For example, questions were raised about the effects on the housing sector and on the broader economy of the tightening in financial conditions in recent months, as well as about the considerable risks surrounding fiscal policy. Moreover, the announcement of a reduction in asset purchases at this meeting might trigger an additional, unwarranted tightening of financial conditions, perhaps because markets would read such an announcement as signaling the Committee's willingness, notwithstanding mixed recent data, to take an initial step toward exit from its highly accommodative policy. As a result of such concerns, a number of participants thought that risk-management considerations called for a cautious approach and that, in light of the ambiguous cast of recent readings on the economy, it would be prudent to await further evidence of progress before reducing the pace of asset purchases. Consistent with the framework discussed by the Chairman during the June press conference, asset purchases were contingent on the Committee's ongoing assessment of the economic outlook and were not on a preset course; this approach implied a need to adapt and to adjust asset purchases in response to changes in economic conditions in order to preserve the Committee's credibility. With many outside observers expecting a decision to reduce purchases at this meeting, some participants emphasized a need to clearly communicate the rationale behind any decision not to do so, in order to avoid conveying a message of pessimism regarding the economic outlook or to reinforce the distinction between decisions concerning the pace of purchases and those concerning the federal funds rate. One participant suggested that postponing the reduction in the pace of asset purchases would also allow time for the Committee to further discuss and to implement a clarification or strengthening of its forward guidance for the federal funds rate, which could temper the risk that a future downward adjustment in asset purchases would cause an undesirable tightening of financial conditions.

The participants who spoke in favor of moderating the pace of securities purchases at this meeting also cited the incoming data, but viewed those data as broadly consistent with the Committee's outlook for the labor market at the time of the June FOMC meeting when the contingent expectation that the pace of asset purchases would be reduced later in the year was first presented to the public. Moreover, they highlighted what they saw as meaningful cumulative progress in labor market conditions since the purchase program began. Those participants generally were satisfied that investors had come to understand the data-dependent nature of the Committee's thinking about asset purchases, and, because they judged that the conditions laid out in June had been met, they believed that the credibility of the Committee would best be served by announcing a downward adjustment in asset purchases at this meeting. With the markets apparently viewing a cut in purchases as the most likely outcome, it was noted that the postponement of such an announcement to later in the year or beyond could have significant implications for the effectiveness of Committee communications. In particular, concerns were expressed that a delay could potentially undermine the credibility or predictability of monetary policy by, for example, increasing uncertainty about the Committee's reaction function and about its commitment to the forward guidance for the federal funds rate, with the result of an increase in volatility in financial markets. Moreover, maintaining the pace of purchases could be perceived as a sign that the FOMC had turned more pessimistic about the economic outlook. Finally, it was noted that if the Committee did not pare back its purchases in these circumstances, it might be difficult to explain a cut in coming months, absent clearly stronger data on the economy and a swift resolution of federal fiscal uncertainties. Most of the participants leaning toward a downward adjustment in the pace of asset purchases also indicated that they favored a relatively small reduction to signal the Committee's intention to proceed cautiously.

With regard to adjustments in the pace of asset purchases, whether at this or a future meeting, a few participants expressed a preference for not cutting MBS purchases but reducing purchases only of Treasury securities initially, with the intent of continuing to support the recovery in the housing sector. However, the appeal of including both types of securities in any reduction was also mentioned. In addition, in an effort to reduce uncertainty about how the Committee might adjust its purchases in response to economic developments and to alleviate some of the related communications issues, one participant suggested an approach that would mechanically link the reduction in asset purchases to numerical values for the unemployment rate, with the goal of ending the program when the unemployment rate reached a stated level.

emphasis added

Comment: Politics, Policy, Deadbeats and Default

by Calculated Risk on 10/09/2013 10:13:00 AM

A quick comment: Politics baffles me. I know the prime directive is for politicians is to get reelected, but they do and say the damnedest things.

However if we just focus on policy, the situation is easier to analyze.

First, on the deficit. In 2000 the U.S. had a unified surplus of 2.4% of GDP. Then through a series of bad policy choices (all of which I opposed), the Federal government incurred a large structural deficit - and then with the housing bubble and bust - piled a large cyclical deficit on top of the structural deficit. In the fiscal year starting in October 2008 (Bush's last budget), the U.S. deficit had reached 10.1% of GDP.

From a 2.4% surplus to a 10.1% deficit in a few years. Ouch!!!

Since then, the deficit has declined from 10.1% to 4.0% of GDP in fiscal 2013. Congratulations! If anything, the deficit has declined too quickly (slowing economic growth).

Based on current policy, the deficit should continue to fall over the next couple of years, and remain in the 2% range for several years. Then the deficit will slowly start to increase primarily due to healthcare costs.

This suggests we don't need any more fiscal tightening right now or for the next couple of years. However we need a longer term plan to primarily address rising healthcare costs.

Shutting down the government just adds to short term costs (pushing up the short term deficit). Dumb.

Smart policy would be to eliminate the so-called "debt ceiling" (really just about paying bills already occurred), and pass the Continuing Resolution (CR) that was negotiated between both parties (and agreed to by both parties except the House added an absurd policy rider).

In addition, smart policy would be to think of ways to address the long term issues. This isn't pressing, and damaging the economy now is not the answer. Perhaps another super-committee with long term consequences if the committee fails (not more short term cuts like the sequester). The consequences should be distasteful to both parties - and both cut spending and raise revenue in the long term so there is some motivation for the committee to reach agreement.

And on deadbeats and defaults: There are certain politicians who think it is OK to not pay the bills as long as the U.S. makes interest and principal payments on the debt. This is crazy talk. There is a name for people who don't pay their bills: deadbeats. If politicians don't pay their personal bills, they are deadbeats. But if they stop the government from paying the bills, we are all deadbeats. And there will be serious economic consequences for not paying the bills on time. The consequences will build over time, but by November not "paying the bills" will ripple through the entire economy.

How does that reduce the deficit (the goal)? It doesn't.

It is time to end the shutdown and agree to pay-the-bills.

MBA: Mortgage Applications Increase in Latest Weekly Survey, Mortgage Rates Lowest since mid-June

by Calculated Risk on 10/09/2013 07:01:00 AM

From the MBA: Mortgage Refinance Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 4, 2013. ...

The Refinance Index increased 3 percent from the previous week and is at its highest level since the week ending August 9, 2013. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. ... For the second consecutive week, the unadjusted Purchase Index was lower compared to the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.42 percent, the lowest rate since mid-June, from 4.49 percent, with points increasing to 0.44 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is up over the last four weeks as rates have declined.

However the index is still down 61% from the levels in early May.

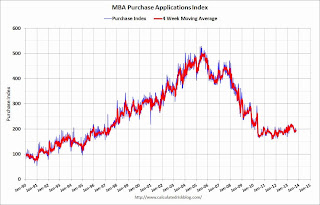

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has fallen since early May, and the 4-week average of the purchase index is only up slightly from a year ago.

Tuesday, October 08, 2013

Wednesday: FOMC Minutes, Janet Yellen

by Calculated Risk on 10/08/2013 08:26:00 PM

Some good news from the WSJ: White House to Nominate Yellen as Fed Chief

President Barack Obama plans to announce Wednesday afternoon he is nominating Federal Reserve Vice Chairwoman Janet Yellen as the central bank's new leader, a White House official said.The announcement is scheduled for 3 PM ET. An excellent choice!

...

Ms. Yellen's nomination would be subject to Senate confirmation ... The timetable for hearings and a vote is uncertain.

Ms. Yellen has been the Fed's second-in-command since 2010. From that perch, she's been a close adviser to Mr. Bernanke as he devised new easy money programs aimed at supporting economic growth.

Her nomination would mean the Fed is unlikely to make any unusual lurches in its interest-rate decisions in the near-term.

Wednesday:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• DELAYED: At 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories for August. The consensus is for a 0.4% increase in inventories.

• At 2:00 PM, the FOMC Minutes for Meeting of September 17-18, 2013.

Las Vegas Real Estate in September: Year-over-year Non-contingent Inventory up 60%

by Calculated Risk on 10/08/2013 05:26:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports end to 19-month run of rising local home prices

GLVAR said the total number of existing local homes, condominiums and townhomes sold in September was 3,259. That’s down from 3,539 in August and down from 3,298 total sales in September 2012. Compared to August, single-family home sales during September decreased by 9.2 percent, while sales of condos and townhomes decreased by 1.5 percent. Compared to one year ago, single-family home sales were up 0.3 percent, while condo and townhome sales were down 7.3 percent. ...There are several key trends that we've been following:

...

Meanwhile, GLVAR continued to report fewer foreclosures and short sales – which occur when a lender agrees to sell a home for less than what the borrower owes on the mortgage. In September, 23 percent of all existing home sales were short sales, down from 25 percent in August. Another 7.4 percent of all September sales were bank-owned properties, down from 8 percent in August. The remaining 69.6 percent of all sales were the traditional type, up from 67 percent in August. Tina said it has been several years since the local housing market has seen so few transactions being controlled by banks.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service increased in September, with 14,659 single-family homes listed for sale at the end of the month. That’s up 3.7 percent from 14,472 single-family homes listed for sale at the end of August, but down 12.6 percent from one year ago. ...

GLVAR also reported more available homes listed for sale without any sort of pending or contingent offer. By the end of September, GLVAR reported 6,330 single-family homes listed without any sort of offer. That’s up 12.8 percent from 5,612 such homes listed in August and up 60.5 percent from one year ago.

emphasis added

1) Overall sales were down slightly from August, and down about 1% year-over-year.

2) Conventional sales are up sharply. In September 2012, only 41.6% of all sales were conventional. This year, in September 2013, 69.6% were conventional. That is an increase in conventional sales of about 59% (of course there is heavy investor buying, but that is still quite an increase in non-distressed sales).

3) Most distressed sales are short sales instead of foreclosures (over 3 to 1). Both foreclosures and short sales are declining.

4) and most interesting right now is that non-contingent inventory (year-over-year) is now increasing quickly. Non-contingent inventory is up 60.5% year-over-year!

This suggests inventory has bottomed in Las Vegas (A major theme for housing in 2013). And this suggests price increases will slow.

Gallup: Sharp decline in Confidence

by Calculated Risk on 10/08/2013 02:33:00 PM

No surprise ... from Gallup: Weekly Drop in U.S. Economic Confidence Largest Since '08

Americans' confidence in the economy has deteriorated more in the past week during the partial government shutdown than in any week since Lehman Brothers collapsed on Sept. 15, 2008, which triggered a global economic crisis. Gallup's Economic Confidence Index tumbled 12 points to -34 last week, the second-largest weekly decline since Gallup began tracking economic confidence daily in January 2008.

Fiscal brinksmanship in Washington is related to many of the largest weekly drops in Americans' confidence in the economy since 2008. ... Americans' confidence in the economy fell eight points during two separate weeks in July 2011, as leaders in Washington debated over whether to raise the debt limit or default on the nation's debts. ... Similarly, economic confidence could continue to fall in the coming days and weeks as Congress and the president work to reach an agreement to raise the debt ceiling by the upcoming Oct. 17 deadline.

Still, economic confidence bounced back within several months of the 2011 debt crisis and the downgrading of the U.S. credit rating. ... This suggests that these fiscal debates may not affect consumer confidence in the same long-term negative way that hits to the economy -- like the 2008-2009 economic recession -- do.

Click on graph for larger image.

Click on graph for larger image.This graph from Gallup shows economic confidence since 2008. The recession is obvious - and so is the threat to not "pay-the-bills" in 2011.

Here we go again ... time to end the shutdown.

Weekly Update: Existing Home Inventory down only 1.3% year-over-year on Oct 7th

by Calculated Risk on 10/08/2013 10:28:00 AM

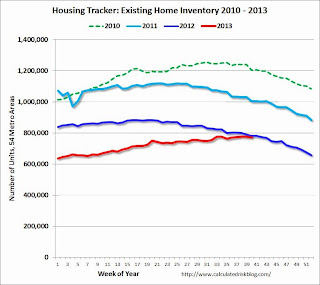

Here is another weekly update on housing inventory: One of key questions for 2013 is Will Housing inventory bottom this year? Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for August). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012 and 2013.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2013 is increasing, although still 1.3% below the same week in 2012.

This strongly suggests inventory bottomed early this year, and I expect inventory to be up year-over-year very soon, and I also expect the seasonal decline to be less than usual at the end of the year. Inventory is still very low, but this increase in inventory should slow house price increases.