by Calculated Risk on 10/09/2013 10:13:00 AM

Wednesday, October 09, 2013

Comment: Politics, Policy, Deadbeats and Default

A quick comment: Politics baffles me. I know the prime directive is for politicians is to get reelected, but they do and say the damnedest things.

However if we just focus on policy, the situation is easier to analyze.

First, on the deficit. In 2000 the U.S. had a unified surplus of 2.4% of GDP. Then through a series of bad policy choices (all of which I opposed), the Federal government incurred a large structural deficit - and then with the housing bubble and bust - piled a large cyclical deficit on top of the structural deficit. In the fiscal year starting in October 2008 (Bush's last budget), the U.S. deficit had reached 10.1% of GDP.

From a 2.4% surplus to a 10.1% deficit in a few years. Ouch!!!

Since then, the deficit has declined from 10.1% to 4.0% of GDP in fiscal 2013. Congratulations! If anything, the deficit has declined too quickly (slowing economic growth).

Based on current policy, the deficit should continue to fall over the next couple of years, and remain in the 2% range for several years. Then the deficit will slowly start to increase primarily due to healthcare costs.

This suggests we don't need any more fiscal tightening right now or for the next couple of years. However we need a longer term plan to primarily address rising healthcare costs.

Shutting down the government just adds to short term costs (pushing up the short term deficit). Dumb.

Smart policy would be to eliminate the so-called "debt ceiling" (really just about paying bills already occurred), and pass the Continuing Resolution (CR) that was negotiated between both parties (and agreed to by both parties except the House added an absurd policy rider).

In addition, smart policy would be to think of ways to address the long term issues. This isn't pressing, and damaging the economy now is not the answer. Perhaps another super-committee with long term consequences if the committee fails (not more short term cuts like the sequester). The consequences should be distasteful to both parties - and both cut spending and raise revenue in the long term so there is some motivation for the committee to reach agreement.

And on deadbeats and defaults: There are certain politicians who think it is OK to not pay the bills as long as the U.S. makes interest and principal payments on the debt. This is crazy talk. There is a name for people who don't pay their bills: deadbeats. If politicians don't pay their personal bills, they are deadbeats. But if they stop the government from paying the bills, we are all deadbeats. And there will be serious economic consequences for not paying the bills on time. The consequences will build over time, but by November not "paying the bills" will ripple through the entire economy.

How does that reduce the deficit (the goal)? It doesn't.

It is time to end the shutdown and agree to pay-the-bills.

MBA: Mortgage Applications Increase in Latest Weekly Survey, Mortgage Rates Lowest since mid-June

by Calculated Risk on 10/09/2013 07:01:00 AM

From the MBA: Mortgage Refinance Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 4, 2013. ...

The Refinance Index increased 3 percent from the previous week and is at its highest level since the week ending August 9, 2013. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. ... For the second consecutive week, the unadjusted Purchase Index was lower compared to the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.42 percent, the lowest rate since mid-June, from 4.49 percent, with points increasing to 0.44 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is up over the last four weeks as rates have declined.

However the index is still down 61% from the levels in early May.

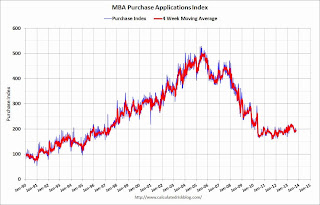

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has fallen since early May, and the 4-week average of the purchase index is only up slightly from a year ago.

Tuesday, October 08, 2013

Wednesday: FOMC Minutes, Janet Yellen

by Calculated Risk on 10/08/2013 08:26:00 PM

Some good news from the WSJ: White House to Nominate Yellen as Fed Chief

President Barack Obama plans to announce Wednesday afternoon he is nominating Federal Reserve Vice Chairwoman Janet Yellen as the central bank's new leader, a White House official said.The announcement is scheduled for 3 PM ET. An excellent choice!

...

Ms. Yellen's nomination would be subject to Senate confirmation ... The timetable for hearings and a vote is uncertain.

Ms. Yellen has been the Fed's second-in-command since 2010. From that perch, she's been a close adviser to Mr. Bernanke as he devised new easy money programs aimed at supporting economic growth.

Her nomination would mean the Fed is unlikely to make any unusual lurches in its interest-rate decisions in the near-term.

Wednesday:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• DELAYED: At 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories for August. The consensus is for a 0.4% increase in inventories.

• At 2:00 PM, the FOMC Minutes for Meeting of September 17-18, 2013.

Las Vegas Real Estate in September: Year-over-year Non-contingent Inventory up 60%

by Calculated Risk on 10/08/2013 05:26:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports end to 19-month run of rising local home prices

GLVAR said the total number of existing local homes, condominiums and townhomes sold in September was 3,259. That’s down from 3,539 in August and down from 3,298 total sales in September 2012. Compared to August, single-family home sales during September decreased by 9.2 percent, while sales of condos and townhomes decreased by 1.5 percent. Compared to one year ago, single-family home sales were up 0.3 percent, while condo and townhome sales were down 7.3 percent. ...There are several key trends that we've been following:

...

Meanwhile, GLVAR continued to report fewer foreclosures and short sales – which occur when a lender agrees to sell a home for less than what the borrower owes on the mortgage. In September, 23 percent of all existing home sales were short sales, down from 25 percent in August. Another 7.4 percent of all September sales were bank-owned properties, down from 8 percent in August. The remaining 69.6 percent of all sales were the traditional type, up from 67 percent in August. Tina said it has been several years since the local housing market has seen so few transactions being controlled by banks.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service increased in September, with 14,659 single-family homes listed for sale at the end of the month. That’s up 3.7 percent from 14,472 single-family homes listed for sale at the end of August, but down 12.6 percent from one year ago. ...

GLVAR also reported more available homes listed for sale without any sort of pending or contingent offer. By the end of September, GLVAR reported 6,330 single-family homes listed without any sort of offer. That’s up 12.8 percent from 5,612 such homes listed in August and up 60.5 percent from one year ago.

emphasis added

1) Overall sales were down slightly from August, and down about 1% year-over-year.

2) Conventional sales are up sharply. In September 2012, only 41.6% of all sales were conventional. This year, in September 2013, 69.6% were conventional. That is an increase in conventional sales of about 59% (of course there is heavy investor buying, but that is still quite an increase in non-distressed sales).

3) Most distressed sales are short sales instead of foreclosures (over 3 to 1). Both foreclosures and short sales are declining.

4) and most interesting right now is that non-contingent inventory (year-over-year) is now increasing quickly. Non-contingent inventory is up 60.5% year-over-year!

This suggests inventory has bottomed in Las Vegas (A major theme for housing in 2013). And this suggests price increases will slow.

Gallup: Sharp decline in Confidence

by Calculated Risk on 10/08/2013 02:33:00 PM

No surprise ... from Gallup: Weekly Drop in U.S. Economic Confidence Largest Since '08

Americans' confidence in the economy has deteriorated more in the past week during the partial government shutdown than in any week since Lehman Brothers collapsed on Sept. 15, 2008, which triggered a global economic crisis. Gallup's Economic Confidence Index tumbled 12 points to -34 last week, the second-largest weekly decline since Gallup began tracking economic confidence daily in January 2008.

Fiscal brinksmanship in Washington is related to many of the largest weekly drops in Americans' confidence in the economy since 2008. ... Americans' confidence in the economy fell eight points during two separate weeks in July 2011, as leaders in Washington debated over whether to raise the debt limit or default on the nation's debts. ... Similarly, economic confidence could continue to fall in the coming days and weeks as Congress and the president work to reach an agreement to raise the debt ceiling by the upcoming Oct. 17 deadline.

Still, economic confidence bounced back within several months of the 2011 debt crisis and the downgrading of the U.S. credit rating. ... This suggests that these fiscal debates may not affect consumer confidence in the same long-term negative way that hits to the economy -- like the 2008-2009 economic recession -- do.

Click on graph for larger image.

Click on graph for larger image.This graph from Gallup shows economic confidence since 2008. The recession is obvious - and so is the threat to not "pay-the-bills" in 2011.

Here we go again ... time to end the shutdown.

Weekly Update: Existing Home Inventory down only 1.3% year-over-year on Oct 7th

by Calculated Risk on 10/08/2013 10:28:00 AM

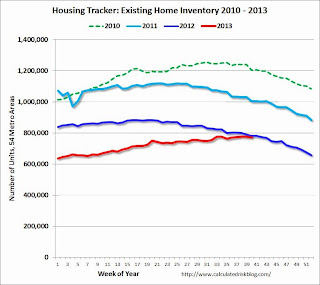

Here is another weekly update on housing inventory: One of key questions for 2013 is Will Housing inventory bottom this year? Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for August). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012 and 2013.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2013 is increasing, although still 1.3% below the same week in 2012.

This strongly suggests inventory bottomed early this year, and I expect inventory to be up year-over-year very soon, and I also expect the seasonal decline to be less than usual at the end of the year. Inventory is still very low, but this increase in inventory should slow house price increases.

NFIB: Small Business Optimism Index "Dips" in September

by Calculated Risk on 10/08/2013 07:31:00 AM

From the National Federation of Independent Business (NFIB): Small Businesses Skeptical About Future; Optimism Dips

Small-business owner optimism did not “crash “ in September, but it did fall, dropping 0.20 from August’s reading of 94.1 and landing at 93.9. The largest contributing factor to the dip was the significant increase in pessimism about future business conditions, although this was somewhat offset by a notable increase in number of small-business owners expecting higher sales. Overall, four Index components improved, four fell and two remained unchanged from August. While it is premature to measure the impact of the government shut-down on the small-business sector, it’s possible that the pending “crisis” impacted economic outlook. ...Small business hiring plans decreased slightly in the September survey to a reading of 9 from 10 in August (zero is neutral). This is a solid reading.

Job Creation. Job creation was down in September. NFIB owners reduced employment by an average of 0.1 workers per firm in September after August’s slight gain (0.08 workers added on average) following three months of negative numbers.

In another small sign of good news, only 17% of owners reported poor sales as the top problem (lack of demand). This was down from 21% a year ago, and half the peak of 34% during the recession. During good times, small business owners usually complain about taxes and regulations - and those are now the top problems again.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index decreased to 93.8 in September from 94.1 in August. This is still low, but just below the post-recession high.

However this was before the U.S. House shutdown the government, and October's reading may be grim.

Monday, October 07, 2013

Tuesday: Small Business Optimism, DELAYED: Trade Deficit, Job Openings

by Calculated Risk on 10/07/2013 08:50:00 PM

There are now deniers who claim there will not be serious economic damage if the country doesn't pay the bills (aka raise the "debt ceiling"). That is crazy talk. It would probably take a few weeks before the economy completely tanked - but it would tank.

Interesting - it seems the "debt ceiling" deniers (like Larry Kudlow) are many of the same people who said there was no housing bubble! Note: I still believe - no matter how crazy Congressmen talk - that Congress will pay the bills (raise the debt ceiling).

From the WSJ: Debt Limit Taking Center Stage in Impasse

Senate Democrats this week are planning a vote to extend the nation's borrowing authority through 2014, the latest sign that the focus of the budget impasse is shifting toward preventing a U.S. debt default.From the WaPo: Obama, Senate Dems hope to break logjam soon with debt ceiling bill

President Obama and Senate Democrats tried Monday to break a political logjam that could threaten the U.S. economy, advancing legislation that would raise the federal debt ceiling as soon as possible.Unfortunately voters will forget the shutdown of the government.

Democrats said they will attempt to force Republicans to agree to a $1 trillion debt-limit increase to ensure that the government does not reach a point this month where it may be unable to pay its bills, risking its first default. They said they also may accept a short-term bill, perhaps lasting only weeks, to avoid going over the brink.

The Democratic push on the debt limit came as a partial government shutdown entered its second week with no solution in sight. New polling showed that the fiscal standoff is hurting Republicans far more than it is Obama, although no party is faring particularly well.

Tuesday:

• 7:30 AM ET, the NFIB Small Business Optimism Index for September.

• DELAYED: At 8:30 AM, the Trade Balance report for August from the Census Bureau. The consensus is for the U.S. trade deficit to increase to $40.0 billion in August from $39.1 billion in July.

• DELAYED 10:00 AM, the Job Openings and Labor Turnover Survey for August from the BLS.

Lawler: Fannie Mae on Government Shutdown and Government Verifications

by Calculated Risk on 10/07/2013 05:08:00 PM

From housing economist Tom Lawler: Fannie Mae on Government Shutdown and Government Verifications

“In some instances, Fannie Mae requires validation through a government agency, such as the Internal Revenue Service (IRS) and the Social Security Administration (SSA) for certain documentation or information provided by the borrower. During the government shutdown, these requests may not be processed. Fannie Mae is implementing the following temporary policies with regard to these two agencies.

“IRS Transcripts: Fannie Mae requires lenders to have each borrower (regardless of income source) complete and sign a separate IRS Request for Transcript of Tax Return (Form 4506-T) at or before closing. Lenders are only required to execute the Form 4506-T prior to closing for loans originated and underwritten with the policies pertaining to borrowers with five to ten financed properties. This policy requires the lender to obtain the IRS copies of the tax returns or transcripts to validate the accuracy of the tax returns provided by the borrower prior to the loan closing.

“Because these requests may not be processed during the shutdown, Fannie Mae is temporarily revising this policy to enable lenders to obtain the transcripts and complete the validation after closing but prior to delivery of the loan. Loans originated and underwritten in accordance with the five to ten financed properties policy with tax returns that cannot be validated prior to delivery are not eligible for sale to Fannie Mae.

“Social Security Number Validation: When data integrity issues pertaining to the borrower’s Social Security number are identified, a lender may be required to validate the Social Security number with the SSA using SSA Form 89. Because these requests may not be processed during the shutdown, Fannie Mae is temporarily revising this policy to enable lenders to obtain the verification prior to the delivery of the loan. If the Social Security number cannot be validated with the SSA prior to delivery, the loan is not eligible for sale to Fannie Mae.”

Other temporary Seller and Servicing Policy changes related to the government shutdown can be found in Lender Letter LL-2013-08.

CBO Report on Fiscal 2013 Deficit

by Calculated Risk on 10/07/2013 01:41:00 PM

The CBO monthly budget report for September (and fiscal 20131) that was due today has been delayed. From the CBO: CBO's Monthly Budget Review Will Not Be Published Today

Because a lapse in appropriated funds has caused CBO to largely shut down its operations, the Monthly Budget Review, which ordinarily would be issued this morning, will not be published today or during the duration of the government shutdown.The CBO has been projecting the deficit would decline significantly this year:

emphasis added

[T]he budget deficit will shrink this year to $642 billion, the Congressional Budget Office (CBO) estimates, the smallest shortfall since 2008. Relative to the size of the economy, the deficit this year—at 4.0 percent of gross domestic product (GDP)—will be less than half as large as the shortfall in 2009, which was 10.1 percent of GDP.Flying blind. Time to end the shutdown.

1 The Federal Government fiscal year runs from Oct 1st through September 30th of each year.