by Calculated Risk on 10/01/2013 02:47:00 PM

Tuesday, October 01, 2013

U.S. Light Vehicle Sales decline to 15.2 million annual rate in September

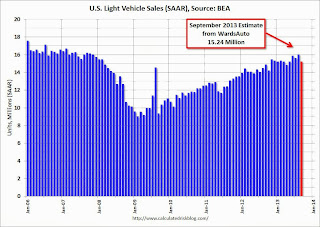

Based on an estimate from WardsAuto, light vehicle sales were at a 15.24 million SAAR in September. That is up 2.4% from September 2012, and down 4.9% from the sales rate last month. Some of the decline in September (and strong August) was related to the timing of the Labor Day holiday.

This was below the consensus forecast of 15.8 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for September (red, light vehicle sales of 15.24 million SAAR from WardsAuto).

Click on graph for larger image.

Click on graph for larger image.

This was the lowest sales rate since April, but followed a strong August - August was the first time the sales rate was over 16 million since November 2007.

The growth rate will probably slow in 2013 - compared to the previous three years - but this will still be another solid year for the auto industry.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and are still a key driver of the recovery. Looking forward, growth will slow for auto sales. If sales average the recent pace for the entire year, total sales will be up about 9% from 2012, not quite double digit but still strong.

CoreLogic: House Prices up 12.4% Year-over-year in August

by Calculated Risk on 10/01/2013 11:36:00 AM

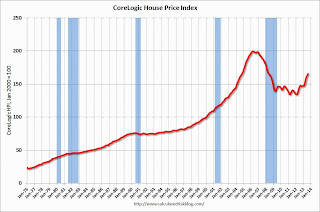

Notes: This CoreLogic House Price Index report is for August. The recent Case-Shiller index release was for July. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rise by 12.4 Percent Year Over Year in August

Home prices nationwide, including distressed sales, increased 12.4 percent on a year-over-year basis in August 2013 compared to August 2012. This change represents the 18th consecutive monthly year-over-year increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 0.9 percent in August 2013 compared to July 2013.

Excluding distressed sales, home prices increased on a year-over-year basis by 11.2 percent in August 2013 compared to August 2012. On a month-over-month basis, excluding distressed sales, home prices increased 1 percent in August 2013 compared to July 2013. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that September 2013 home prices, including distressed sales, are expected to rise by 12.7 percent on a year-over-year basis from September 2012 and rise by 0.2 percent on a month-over-month basis from August 2013. Excluding distressed sales, September 2013 home prices are poised to rise 12.2 percent year over year from September 2012 and by 0.7 percent month over month from August 2013.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.9% in August, and is up 12.4% over the last year. This index is not seasonally adjusted, and the month-to-month changes will be smaller for next several months.

The index is off 17.2% from the peak - and is up 23.4% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for eighteen consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for eighteen consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

I expect the year-over-year price increases to slow in the coming months.

ISM Manufacturing index increases in September to 56.2

by Calculated Risk on 10/01/2013 10:00:00 AM

The ISM manufacturing index indicated faster expansion in September. The PMI was at 56.2% in September, up from 55.7% in August. The employment index was at 55.4%, up from 53.3%, and the new orders index was at 60.5%, down from 63.2% in August.

From the Institute for Supply Management: August 2013 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in September for the fourth consecutive month, and the overall economy grew for the 52nd consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI™ registered 56.2 percent, an increase of 0.5 percentage point from August's reading of 55.7 percent. September's PMI™ reading is the highest of the year, leading to an average PMI™ reading of 55.8 percent for the third quarter. The New Orders Index decreased in September by 2.7 percentage points to 60.5 percent, and the Production Index increased by 0.2 percentage point to 62.6 percent. The Employment Index registered 55.4 percent, an increase of 2.1 percentage points compared to August's reading of 53.3 percent, which is the highest reading for the year. Comments from the panel are generally positive and optimistic about increasing demand and improving business conditions."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 55.0% and suggests manufacturing expanded at a faster pace in September.

Reis: Apartment Vacancy Rate declined to 4.2% in Q3 2013

by Calculated Risk on 10/01/2013 08:31:00 AM

Reis reported that the apartment vacancy rate declined in Q3 to 4.2% from 4.3% in Q2. In Q3 2012 (a year ago) the vacancy rate was at 4.7%, and the rate peaked at 8.0% at the end of 2009.

Some data and comments from Reis Senior Economist Ryan Severino:

Vacancy declined by 10 basis points during third quarter to 4.2%. Although vacancy compression has clearly slowed over the last few years, the decline of 10 basis points is an improvement versus last quarter when vacancy was unchanged. Over the last four quarters national vacancies have declined by 50 basis points, on par with last quarter's year‐over‐year decline in vacancy. More so than the magnitude of the vacancy compression, the simple fact that vacancy continues to compress despite such low vacancy rates speaks volumes about the ongoing demand for apartments. The national vacancy rate now stands 380 basis points below the cyclical peak of 8.0% observed right after the recession concluded in late 2009.

Almost four years removed from the advent of the apartment market recovery, demand for apartment units remains robust. The sector absorbed 40,392 units in the third quarter, well outpacing absorption from one year ago during 3Q2012 and up from the 33,634 units that were absorbed during the second quarter of 2013. Year to date, the sector has absorbed more units in 2013 than were absorbed through this point in 2012, but is well below the pace of net absorption during the early stages of the recovery in 2010 and 2011. Conversely, construction activity continues to increase. Completions during the third quarter were 34,834 units, an increase relative to last quarter's 28,891 units and the 21,237 units that were delivered during the third quarter of 2012. This is the highest level of quarterly completions since the fourth quarter of 2009. As we mentioned last quarter, it appears as if we are on the precipice of the relatively large surge in new supply that the market has been anticipating (though not seeing) for the last few years. ... Nonetheless, despite the increase in construction activity, robust demand continues to outpace new completions, intimating that most new units are being rapidly absorbed.

Asking and effective rents both by 0.9% and 1.0%, respectively, during the third quarter. ... Accelerating supply growth is not yet much of a factor in restraining rent growth, but that could change as construction activity surges over the next year. Nevertheless, even with tepid rent growth during the recovery period, national asking and effective rents once again reached all‐time high levels, at least on a nominal basis.

...

Despite supply growth accelerating, we do not expect there to be much change in the national vacancy rate during the fourth quarter due to continued strong demand. However, we anticipate that vacancy will slowly drift upward beginning in 2014, eventually reaching 4.9% by the end of 2017. This primarily should be a function of increased construction activity, not a fall off in demand, which should remain fairly robust.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

New supply is finally coming on the market and the decline in the vacancy rate has slowed.

Apartment vacancy data courtesy of Reis.

Monday, September 30, 2013

Calculated Risk is Open on Tuesday: Vehicle Sales, ISM Mfg Index, Construction Spending

by Calculated Risk on 9/30/2013 08:15:00 PM

If there is a government shutdown, the August construction spending report might not be released on Tuesday (it is probably already prepared, so it might be released even with a shutdown). The remaining reports Tuesday are all from private sources.

Tuesday:

• Early, Reis Q3 2013 Apartment Survey of rents and vacancy rates.

• At 9:00 AM ET, the Markit US PMI Manufacturing Index for September. The consensus is for the index to decrease to 52.9 from 53.1 in August.

• At 10:00 AM, the ISM Manufacturing Index for September. The consensus is for a decrease to 55.0 from 55.7 in August. The ISM manufacturing index was at 55.7% in August. The employment index was at 53.3%, and the new orders index was at 63.2%.

• Also at 10:00 AM, Construction Spending for August. The consensus is for a 0.4% increase in construction spending.

• At around 2:00 PM ET, Light vehicle sales for September will be released all day. The consensus is for light vehicle sales to decrease to 15.8 million SAAR in September (Seasonally Adjusted Annual Rate) from 16.0 million SAAR in August. I will post an estimate of September SAAR around 2 PM ET.

Fannie Mae: Mortgage Serious Delinquency rate declined in August, Lowest since December 2008

by Calculated Risk on 9/30/2013 06:17:00 PM

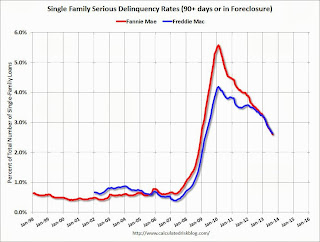

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in August to 2.61% from 2.70% in July. The serious delinquency rate is down from 3.44% in August 2012, and this is the lowest level since December 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier Freddie Mac reported that the Single-Family serious delinquency rate declined in August to 2.64% from 2.70% in July. Freddie's rate is down from 3.36% in August 2012, and this is the lowest level since April 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The Fannie Mae serious delinquency rate has fallen 0.83 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in about 2 years. Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in late 2015 or 2016.

Preparing for the Partial Shutdown

by Calculated Risk on 9/30/2013 05:20:00 PM

From the WSJ: Agencies Prepare to Send Workers Home as Shutdown Looms

With the clock ticking and no budget deal in sight, federal agencies prepared to send more than 800,000 workers home without pay, and large swaths of the government were set to temporarily close.Bad policy, but the impact on the economy will be minimal if the shutdown is short.

...

Absent an agreement, workers who are furloughed will have to report to their agencies Tuesday morning for a half-day of preparations for the shutdown. Most will have up to four hours to wrap things up, and then be sent home until further notice.

Those who are deemed essential, or—in the language of government, "excepted"—will be guaranteed back pay after the fact. In past shutdowns, Congress has agreed to pay those furloughed as well, but given the cost-cutting zeitgeist of 2013, that was hardly guaranteed this time.

...

A Wall Street Journal review of agencies' shutdown plans found that more than 800,000 workers would be furloughed. In all, the federal government employs just under 2.9 million civilian employees.

As we've discussed for some time, the deficit is declining rapidly (more short term cuts are bad policy right now) and public employment has fallen sharply over the last 4+ years (a significant drag). This is not helpful.

Restaurant Performance Index declines in August

by Calculated Risk on 9/30/2013 01:06:00 PM

From the National Restaurant Association: Restaurant Performance Index Edged Down in August Amid Fading Operator Expectations

Due to a softer outlook among restaurant operators for sales growth and the economy, the National Restaurant Association’s Restaurant Performance Index (RPI) declined for the third consecutive month. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.5 in August, down 0.2 percent from July’s level of 100.7. Despite the recent declines, the RPI remained above 100 for the sixth consecutive month, which signifies expansion in the index of key industry indicators.

“The August decline in the RPI was due almost entirely to a dip in the expectations indicators, with restaurant operators becoming less bullish about sales growth and the economy in the months ahead,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association.

“In contrast, operators reported positive same-store sales and customer traffic levels in August, and a majority of operators reported capital expenditures for the fourth consecutive month,” Riehle added.

...

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 100.7 in August – up 0.6 percent from July and the first increase in three months. In addition, the Current Situation Index stood above 100 for the fifth consecutive month, which signifies expansion in the current situation indicators.

A majority of restaurant operators reported positive same-store sales in August, and the overall results were an improvement over July’s performance. ... Restaurant operators also reported stronger customer traffic levels in August.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index declined to 100.5 in August from 100.7 in July. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

Dallas Fed: "Texas Manufacturing Activity Picks Up"

by Calculated Risk on 9/30/2013 10:38:00 AM

From the Dallas Fed: Texas Manufacturing Activity Picks Up

Texas factory activity expanded in September, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 7.3 to 11.5, suggesting output increased at a slightly faster pace than in August. ... Perceptions of broader business conditions improved further in September. The general business activity index jumped nearly 8 points to 12.8, its highest reading in a year and a half.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The new orders index was 5, largely unchanged from its August level. ... Labor market indicators reflected continued employment growth but flat workweeks. The September employment index was 10, its third reading in a row in solidly positive territory.

...

Expectations regarding future business conditions remained optimistic in September. The indexes of future general business activity and future company outlook showed mixed movements but remained in strongly positive territory. Indexes for future manufacturing activity also remained solidly positive, and the index for future employment spiked 10 points to 21.9.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through September), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

Most of the regional surveys showed expansion in September (Richmond was at zero), and overall at about the same pace as in August. The ISM index for September will be released tomorrow, October 1st.

Chicago PMI increases to 55.7

by Calculated Risk on 9/30/2013 06:45:00 AM

From the Chicago ISM:

September 2013:

Led by gains in Production, New Orders and Supplier Deliveries, the Chicago Business BarometerTM gained 2.7 points in September to 55.7.This was above the consensus estimate of 54.0.

The Barometer has gained in each of the past three months, the longest run of monthly increases for more than three years. Activity has recovered from April’s three year low of 49.0, although is still only consistent with modest economic growth.

...

New Orders were up for the second consecutive month to the highest level since February. ...Employment softened for the third consecutive month and was the only barometer component to fall in September. Inventories continued to contract and Prices Paid fell substantially after rising in the past four months.

Commenting on the MNI Chicago Report, Philip Uglow, Chief Economist at MNI Indicators said, “Activity picked-up again in September close to trend supported by New Orders and Production.”

“While the pick-up is welcomed, growth is far from solid. The easing in the employment component is a notable setback this month, underlying the fragility of the recovery,” he added.