by Calculated Risk on 9/28/2013 10:32:00 PM

Saturday, September 28, 2013

Unofficial Problem Bank list declines to 690 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for September 27, 2013.

Changes and comments from surferdude808:

The FDIC broke its reporting pattern by not releasing its enforcement action activity for the previous month on the last Friday of the current month. Guess we will get it next week. Otherwise, there two removals during the week that leave the Unofficial Problem Bank list with 690 institutions and $240.5 billion of assets. A year ago, the list held 874 institutions with $335 billion of assets. During the month of September 2013, the list dropped by a net 17 institutions after 14 action terminations, two unassisted mergers, two failures, and one addition. Assets fell by $10.2 billion, which made was the third consecutive month for the list to shrink by more than $10 billion. It may be challenging for the monthly asset removal rate to stay above $10 billion as the average size of institutions on the list has fallen to $349 million. Thus, about 28 institutions would need removal while the average monthly removal rate for the past year is 23 institutions.

The removals this week were Seacoast National Bank, Stuart, FL ($2.2 billion Ticker: SBCF) and A J Smith Federal Savings Bank, Midlothian, IL ($216 million).

During the month, the Treasury Department issued its five-year update report on TARP. A total of 119 institutions still have not repaid capital infused under TARP including 57 institutions on the Unofficial Problem Bank List. Of the institutions on the Unofficial Problem bank List, there are 50 that have missed 10 or more quarterly payments. See the table for additional details (excel file).

Supposedly, only healthy banks were eligible for an infusion of capital through the various TARP programs. This week, the Wall Street Journal (Some Smaller Banks Still Owe TARP Money) highlighted the difficulties of many banks to exit TARP and this "undercut the insistence of government officials at the height of the crisis that taxpayer dollars would only be steered toward healthy, viable banks." More than 25 banking organizations that received TARP have failed or filed for bankruptcy protection. After five years, the dividend rate on TARP preferred shares rises from 5% to 9%. In the fourth quarter of 2013, the dividend rate will increase for 13 institutions on the Unofficial Problem Bank List. Most likely, the dividend increase will accelerate the resolution status of these institutions.

Next week, we look for the FDIC to release its actions through August 2013. If so, we will update the quarterly transition matrix. There is nothing new to pass along on Capitol Bancorp, Ltd.

Freddie Mac: Mortgage Serious Delinquency rate declined in August, Lowest since April 2009

by Calculated Risk on 9/28/2013 03:37:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in August to 2.64% from 2.70% in July. Freddie's rate is down from 3.36% in August 2012, and this is the lowest level since April 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

I'm frequently asked when the distressed sales will be back to normal levels, and that will happen when the percent of seriously delinquent loans (and in foreclosure) is closer to normal. Since very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for August next week.

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%.

At the recent rate of improvement, the serious delinquency rate will not be under 1% until 2016 or so. Therefore I expect a fairly high level of distressed sales for 2 to 3 more years (mostly in judicial states).

Schedule for Week of September 29th

by Calculated Risk on 9/28/2013 08:39:00 AM

Special Note: If Congress partially shuts down the government on Tuesday, some economic data will be delayed including the employment report.

The key report this week is the September employment report on Friday.

Other key reports include the ISM manufacturing report on Tuesday, September auto sales also on Tuesday, and the ISM non-manufacturing report on Thursday.

Also Reis is scheduled to release their Q3 surveys for apartments, offices and malls.

9:45 AM ET: Chicago Purchasing Managers Index for September. The consensus is for an increase to 54.4, up from 53.0 in August.

10:30 AM: Dallas Fed Manufacturing Survey for September. This is the last of the regional manufacturing surveys for September. The consensus is a reading of 6.0, up from the reading of 5.0 in August (above zero is expansion).

Early: Reis Q3 2013 Apartment Survey of rents and vacancy rates.

9:00 AM: The Markit US PMI Manufacturing Index for September. The consensus is for the index to decrease to 52.9 from 53.1 in August.

10:00 AM ET: ISM Manufacturing Index for September. The consensus is for a decrease to 55.0 from 55.7 in August.

10:00 AM ET: ISM Manufacturing Index for September. The consensus is for a decrease to 55.0 from 55.7 in August. Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index was at 55.7% in August. The employment index was at 53.3%, and the new orders index was at 63.2%.

10:00 AM: Construction Spending for August. The consensus is for a 0.4% increase in construction spending.

All day: Light vehicle sales for September. The consensus is for light vehicle sales to decrease to 15.8 million SAAR in August (Seasonally Adjusted Annual Rate) from 16.0 million SAAR in August.

All day: Light vehicle sales for September. The consensus is for light vehicle sales to decrease to 15.8 million SAAR in August (Seasonally Adjusted Annual Rate) from 16.0 million SAAR in August.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the August sales rate.

Early: Reis Q3 2013 Office Survey of rents and vacancy rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 175,000 payroll jobs added in September, down from 176,000 in August.

3:30 PM: Speech by Fed Chairman Ben S. Bernanke, Brief Welcoming Remarks, At the Federal Reserve/Conference of State Bank Supervisors Community Banking Research Conference, Federal Reserve Bank of St. Louis

Early: Reis Q3 2013 Mall Survey of rents and vacancy rates.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 313 thousand from 305 thousand last week.

10:00 AM: ISM non-Manufacturing Index for September. The consensus is for a reading of 57.0, down from 58.6 in August. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for August. The consensus is for a 0.2% increase in orders.

10:00 AM: Trulia Price Rent Monitors for September. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

8:30 AM: Employment Report for September. The consensus is for an increase of 178,000 non-farm payroll jobs in September; the economy added 169,000 non-farm payroll jobs in August.

The consensus is for the unemployment rate to be unchanged at 7.3% in September.

The following graph shows the percentage of payroll jobs lost during post WWII recessions through July.

The economy has added 7.5 million private sector jobs since employment bottomed in February 2010 (6.8 million total jobs added including all the public sector layoffs).

The economy has added 7.5 million private sector jobs since employment bottomed in February 2010 (6.8 million total jobs added including all the public sector layoffs).There are still 1.4 million fewer private sector jobs now than when the recession started in 2007.

Friday, September 27, 2013

Report: Employment Report to be delayed if Government Shutdown

by Calculated Risk on 9/27/2013 06:12:00 PM

A week ago I was wondering about this ...

From Reuters: Labor Dept says U.S. jobs report would be delayed by shutdown

The U.S. Labor Department said in a memo on Friday it would not issue its closely-watched monthly employment report next week should the government shut down on Monday.A partial shutdown is dumb, disruptive and costs money (no money is saved). A shutdown is very possible (it would start on Tuesday Oct 1st). But even with a shutdown, I'm confident Congress will pay the bills (aka raise "debt ceiling").

"All survey and other program operations will cease and the public website will not be updated," Erica Groshen, the commissioner of the Bureau of Labor Statistics, said in a memo published on the department's website.

...

A separate memo from the Labor Department said the government's weekly jobless claims report, which is due on Thursday, would not be affected.

Vehicle Sales: Likely Weaker Sales in September

by Calculated Risk on 9/27/2013 03:01:00 PM

Note: The automakers will report September vehicle sales Tuesday, Oct 1st.

According the Bureau of Economic Analysis (BEA), light vehicle sales in August were at a 16.0 million rate, on a seasonally adjusted annual rate (SAAR) basis. It looks like September sales will be somewhat softer.

Here are a few forecasts:

From Kelley Blue Book: September Auto Sales Expected To Dip 2 Percent, According To Kelley Blue Book

"September 2013 new-vehicle sales represent the first year-over-year drop since May 2011, due to slower retail sales, two fewer sales days in the month, and this year's Labor Day sales included in August 2013 totals," said Alec Gutierrez, senior analyst at Kelley Blue Book. ...From JD Power: Strong Labor Day Weekend Sales Pull Deliveries from September

The seasonally adjusted annual rate (SAAR) for September 2013 is estimated to be 15.7 million, up from 14.7 million in September 2012 and down from 16.0 million in August 2013.

Based on analysis of sales during the first two weeks of the month, new-vehicle sales are likely to reach nearly 1.33 million units, but may be weaker than in recent months due to strong Labor Day weekend sales that were tallied with August's robust sales totals.From TrueCar: September 2013 New Car Sales Expected to Be Down 4.4 Percent According to TrueCar; September 2013 SAAR at 15.4M

"Although the year-over-year sales gain in September is smaller than has been observed in recent months, it's important to recognize that September reported sales are being heavily influenced by the [Labor Day weekend] quirk in the sales calendar," said John Humphrey, senior vice president of the global automotive practice at J.D. Power.

For September 2013, new light vehicle sales in the U.S. (including fleet) is expected to be 1,131,333 units, down 4.4 percent from September 2012 and also down 24.5% percent from August 2013 (on an unadjusted basis – September 2013 had 23 sales days, compared to 25 in September 2012).The analyst consensus is for sales of 16.0 million SAAR in September.

The September 2013 forecast translates into a Seasonally Adjusted Annualized Rate ("SAAR") of 15.4 million new car sales, down about four percent from August 2013 and up about four percent over September 2012.

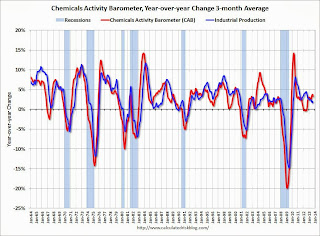

Chemical Activity Barometer for September Suggests Economic Activity Increasing

by Calculated Risk on 9/27/2013 12:09:00 PM

This is a new indicator that I'm following that appears to be a leading indicator for the economy.

From the American Chemistry Council: Leading Economic Indicator at Highest Since June 2008; Hints at Potential Upside Surprises for U.S. Economy

The U.S. economy continues to improve, with forecasts now suggesting economic expansion into 2015, according to the American Chemistry Council’s (ACC) monthly Chemical Activity Barometer (CAB), released today. The Chemical Activity Barometer is a leading economic indicator, shown to lead U.S. business cycles by an average of eight months at cycle peaks, and four months at cycle troughs. The barometer increased 0.4 percent over August on a three-month moving average (3MMA) basis. The barometer is up 3.3 percent over a year ago, with the index itself at its highest point since June 2008. Prior CAB readings for April through August were all revised.

“This 0.4 percent jump is a real improvement in growth dynamics from the smaller, yet steady, increases we saw from March through August,” said Dr. Kevin Swift, chief economist at the American Chemistry Council. “The Chemical Activity Barometer is showing a strengthening of some fundamentals, with forecasts remaining positive. Indeed, there is potential for upside surprises in the U.S. economy,” he added.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

And this suggests that economic activity is increasing.

Final September Consumer Sentiment at 77.5

by Calculated Risk on 9/27/2013 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for September was at 77.5, down from the August reading of 82.1, but up from the preliminary September reading of 76.8.

This was below the consensus forecast of 78.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011. Unfortunately Congress is once again threatening to "not pay the bills" and that might impact sentiment (and consumer spending) in October.

Personal Income increased 0.4% in August, Spending increased 0.3%

by Calculated Risk on 9/27/2013 08:30:00 AM

The BEA released the Personal Income and Outlays report for August:

Personal income increased $57.2 billion, or 0.4 percent ... in August, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $34.5 billion, or 0.3 percent.On inflation, the PCE price index increased at a 1.7% annual rate in August, and core PCE prices increased at a 1.9% annual rate.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in August, compared with an increase of 0.1 percent in July. ... The price index for PCE increased 0.1 percent in August, the same increase as in July. The PCE price index, excluding food and energy, increased 0.2 percent in August, compared with an increase of 0.1 percent in July.

The following graph shows real Personal Consumption Expenditures (PCE) through August (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q3 PCE growth (first two months of the quarter), PCE was increasing at a 1.5% annual rate in Q3 2013 (using mid-month method, PCE was increasing at 1.6% rate). This suggests sluggish PCE (and GDP) growth in Q3.

Thursday, September 26, 2013

Friday: Personal Income and Outlays for August, Consumer Sentiment

by Calculated Risk on 9/26/2013 09:49:00 PM

From the LA Times: Downtown San Diego condo market's long drought may be ending

The Great Recession slammed the door on condominium construction in the 2.2-square-mile area. Projects were scrapped or converted to rentals. From 2001 through 2009, builders finished nearly 8,300 units, according to Civic San Diego, which oversees new construction planning downtown.Downtown San Diego was one of the areas that was crushed during the downturn.

They haven't finished one since.

[Canadian developer Nat] Bosa's ritzy project, which he plans to break ground on during the first half of next year, would change that.

Along the same lines, I drove by "Central Park West" in Irvine today. That was the project that was built by Lennar and mothballed in 2007. There are several new buildings going up right now!

Friday:

• 8:30 AM ET, the Personal Income and Outlays for August. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 78.0, up from the preliminary reading of 76.8, but down from the August reading of 82.1.

Commentary: Congress will "Pay the Bills"

by Calculated Risk on 9/26/2013 05:09:00 PM

It seems more and more likely that there will be a partial government shutdown starting next Tuesday. This is expensive, dumb and inconvenient (for me, the delayed data releases will be frustrating). But the scary issue is the so-called "debt ceiling". Unfortunately "debt ceiling" sounds virtuous, but it isn't - it is actually a question of "paying the bills".

Sometimes we see articles like this in the NY Times: House G.O.P. Leaders List Conditions for Raising Debt Ceiling

[B]ehind closed doors in the Capitol, House Republican leaders laid out their demands for a debt-ceiling increase to the Republican rank and file.That is foolish. Just tell the "rank and file" the truth - it has to be a clean bill (as Reagan, Greenspan and many other Republicans have said before). As I pointed out in early January, a poker analogy is that the GOP is bluffing into the best possible hand - and everyone knows it. They will have to fold, and everything they say is just political posturing.

They include a one-year delay of the president’s health care law, fast-track authority to overhaul the tax code, construction of the Keystone XL oil pipeline, offshore oil and gas production, more permitting of energy exploration on federal lands, a rollback of regulations on coal ash, blocking new Environmental Protection Agency regulations on greenhouse gas production, eliminating a $23 billion fund to ensure the orderly dissolution of failed major banks, eliminating mandatory contributions to the new Consumer Financial Protection Bureau, limits on medical malpractice lawsuits and an increase in means testing for Medicare, among other provisions.

As Republican Senator Mitch McConnell said in 2011, if the debt ceiling isn't raised the "Republican brand" would become toxic and synonymous with fiscal irresponsibility. Analysts are debating what will happen in the next election if Congress shuts down the government; I think the impact on the election will be minimal if the shutdown doesn't last very long. But if Congress stopped paying the bills - for the first time in 237 years (except some minor glitches) - people will remember. So it won't happen; Congress will pay the bills.

Now if we could just avoid a shutdown ...

Note: I said the thing in 2011, and again at the end of last year. The goods news is the eventual agreement will take the government through 2014 (so it will not be an election issue).