by Calculated Risk on 9/27/2013 06:12:00 PM

Friday, September 27, 2013

Report: Employment Report to be delayed if Government Shutdown

A week ago I was wondering about this ...

From Reuters: Labor Dept says U.S. jobs report would be delayed by shutdown

The U.S. Labor Department said in a memo on Friday it would not issue its closely-watched monthly employment report next week should the government shut down on Monday.A partial shutdown is dumb, disruptive and costs money (no money is saved). A shutdown is very possible (it would start on Tuesday Oct 1st). But even with a shutdown, I'm confident Congress will pay the bills (aka raise "debt ceiling").

"All survey and other program operations will cease and the public website will not be updated," Erica Groshen, the commissioner of the Bureau of Labor Statistics, said in a memo published on the department's website.

...

A separate memo from the Labor Department said the government's weekly jobless claims report, which is due on Thursday, would not be affected.

Vehicle Sales: Likely Weaker Sales in September

by Calculated Risk on 9/27/2013 03:01:00 PM

Note: The automakers will report September vehicle sales Tuesday, Oct 1st.

According the Bureau of Economic Analysis (BEA), light vehicle sales in August were at a 16.0 million rate, on a seasonally adjusted annual rate (SAAR) basis. It looks like September sales will be somewhat softer.

Here are a few forecasts:

From Kelley Blue Book: September Auto Sales Expected To Dip 2 Percent, According To Kelley Blue Book

"September 2013 new-vehicle sales represent the first year-over-year drop since May 2011, due to slower retail sales, two fewer sales days in the month, and this year's Labor Day sales included in August 2013 totals," said Alec Gutierrez, senior analyst at Kelley Blue Book. ...From JD Power: Strong Labor Day Weekend Sales Pull Deliveries from September

The seasonally adjusted annual rate (SAAR) for September 2013 is estimated to be 15.7 million, up from 14.7 million in September 2012 and down from 16.0 million in August 2013.

Based on analysis of sales during the first two weeks of the month, new-vehicle sales are likely to reach nearly 1.33 million units, but may be weaker than in recent months due to strong Labor Day weekend sales that were tallied with August's robust sales totals.From TrueCar: September 2013 New Car Sales Expected to Be Down 4.4 Percent According to TrueCar; September 2013 SAAR at 15.4M

"Although the year-over-year sales gain in September is smaller than has been observed in recent months, it's important to recognize that September reported sales are being heavily influenced by the [Labor Day weekend] quirk in the sales calendar," said John Humphrey, senior vice president of the global automotive practice at J.D. Power.

For September 2013, new light vehicle sales in the U.S. (including fleet) is expected to be 1,131,333 units, down 4.4 percent from September 2012 and also down 24.5% percent from August 2013 (on an unadjusted basis – September 2013 had 23 sales days, compared to 25 in September 2012).The analyst consensus is for sales of 16.0 million SAAR in September.

The September 2013 forecast translates into a Seasonally Adjusted Annualized Rate ("SAAR") of 15.4 million new car sales, down about four percent from August 2013 and up about four percent over September 2012.

Chemical Activity Barometer for September Suggests Economic Activity Increasing

by Calculated Risk on 9/27/2013 12:09:00 PM

This is a new indicator that I'm following that appears to be a leading indicator for the economy.

From the American Chemistry Council: Leading Economic Indicator at Highest Since June 2008; Hints at Potential Upside Surprises for U.S. Economy

The U.S. economy continues to improve, with forecasts now suggesting economic expansion into 2015, according to the American Chemistry Council’s (ACC) monthly Chemical Activity Barometer (CAB), released today. The Chemical Activity Barometer is a leading economic indicator, shown to lead U.S. business cycles by an average of eight months at cycle peaks, and four months at cycle troughs. The barometer increased 0.4 percent over August on a three-month moving average (3MMA) basis. The barometer is up 3.3 percent over a year ago, with the index itself at its highest point since June 2008. Prior CAB readings for April through August were all revised.

“This 0.4 percent jump is a real improvement in growth dynamics from the smaller, yet steady, increases we saw from March through August,” said Dr. Kevin Swift, chief economist at the American Chemistry Council. “The Chemical Activity Barometer is showing a strengthening of some fundamentals, with forecasts remaining positive. Indeed, there is potential for upside surprises in the U.S. economy,” he added.

emphasis added

Click on graph for larger image.

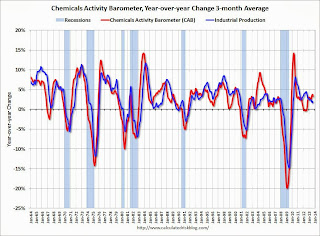

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

And this suggests that economic activity is increasing.

Final September Consumer Sentiment at 77.5

by Calculated Risk on 9/27/2013 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for September was at 77.5, down from the August reading of 82.1, but up from the preliminary September reading of 76.8.

This was below the consensus forecast of 78.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011. Unfortunately Congress is once again threatening to "not pay the bills" and that might impact sentiment (and consumer spending) in October.

Personal Income increased 0.4% in August, Spending increased 0.3%

by Calculated Risk on 9/27/2013 08:30:00 AM

The BEA released the Personal Income and Outlays report for August:

Personal income increased $57.2 billion, or 0.4 percent ... in August, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $34.5 billion, or 0.3 percent.On inflation, the PCE price index increased at a 1.7% annual rate in August, and core PCE prices increased at a 1.9% annual rate.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in August, compared with an increase of 0.1 percent in July. ... The price index for PCE increased 0.1 percent in August, the same increase as in July. The PCE price index, excluding food and energy, increased 0.2 percent in August, compared with an increase of 0.1 percent in July.

The following graph shows real Personal Consumption Expenditures (PCE) through August (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q3 PCE growth (first two months of the quarter), PCE was increasing at a 1.5% annual rate in Q3 2013 (using mid-month method, PCE was increasing at 1.6% rate). This suggests sluggish PCE (and GDP) growth in Q3.

Thursday, September 26, 2013

Friday: Personal Income and Outlays for August, Consumer Sentiment

by Calculated Risk on 9/26/2013 09:49:00 PM

From the LA Times: Downtown San Diego condo market's long drought may be ending

The Great Recession slammed the door on condominium construction in the 2.2-square-mile area. Projects were scrapped or converted to rentals. From 2001 through 2009, builders finished nearly 8,300 units, according to Civic San Diego, which oversees new construction planning downtown.Downtown San Diego was one of the areas that was crushed during the downturn.

They haven't finished one since.

[Canadian developer Nat] Bosa's ritzy project, which he plans to break ground on during the first half of next year, would change that.

Along the same lines, I drove by "Central Park West" in Irvine today. That was the project that was built by Lennar and mothballed in 2007. There are several new buildings going up right now!

Friday:

• 8:30 AM ET, the Personal Income and Outlays for August. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 78.0, up from the preliminary reading of 76.8, but down from the August reading of 82.1.

Commentary: Congress will "Pay the Bills"

by Calculated Risk on 9/26/2013 05:09:00 PM

It seems more and more likely that there will be a partial government shutdown starting next Tuesday. This is expensive, dumb and inconvenient (for me, the delayed data releases will be frustrating). But the scary issue is the so-called "debt ceiling". Unfortunately "debt ceiling" sounds virtuous, but it isn't - it is actually a question of "paying the bills".

Sometimes we see articles like this in the NY Times: House G.O.P. Leaders List Conditions for Raising Debt Ceiling

[B]ehind closed doors in the Capitol, House Republican leaders laid out their demands for a debt-ceiling increase to the Republican rank and file.That is foolish. Just tell the "rank and file" the truth - it has to be a clean bill (as Reagan, Greenspan and many other Republicans have said before). As I pointed out in early January, a poker analogy is that the GOP is bluffing into the best possible hand - and everyone knows it. They will have to fold, and everything they say is just political posturing.

They include a one-year delay of the president’s health care law, fast-track authority to overhaul the tax code, construction of the Keystone XL oil pipeline, offshore oil and gas production, more permitting of energy exploration on federal lands, a rollback of regulations on coal ash, blocking new Environmental Protection Agency regulations on greenhouse gas production, eliminating a $23 billion fund to ensure the orderly dissolution of failed major banks, eliminating mandatory contributions to the new Consumer Financial Protection Bureau, limits on medical malpractice lawsuits and an increase in means testing for Medicare, among other provisions.

As Republican Senator Mitch McConnell said in 2011, if the debt ceiling isn't raised the "Republican brand" would become toxic and synonymous with fiscal irresponsibility. Analysts are debating what will happen in the next election if Congress shuts down the government; I think the impact on the election will be minimal if the shutdown doesn't last very long. But if Congress stopped paying the bills - for the first time in 237 years (except some minor glitches) - people will remember. So it won't happen; Congress will pay the bills.

Now if we could just avoid a shutdown ...

Note: I said the thing in 2011, and again at the end of last year. The goods news is the eventual agreement will take the government through 2014 (so it will not be an election issue).

Kansas City Fed: Manufacturing Survey "Moderated Somewhat"

by Calculated Risk on 9/26/2013 12:52:00 PM

From the Kansas City Fed: Tenth District Manufacturing Survey Moderated Somewhat

According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity moderated somewhat but remained positive, and producers’ expectations for future activity increased markedly.On Tuesday, the Richmond Fed reported:

“We saw slightly slower growth this month, but firms were much more optimistic about industry activity in early 2014” said Wilkerson. “Worker shortages remained a problem at many firms.”

...

The month-over-month composite index was 2 in September, down from 8 in August and 6 in July ... The employment index eased after rising last month

emphasis added

The composite index of manufacturing activity was flat in September, at a reading of 0 following last month's 14, as the component indexes cooled this month. ... The index for the number of employees fell twelve points from last month to settle at −6.In aggregate the regional surveys have suggested moderate growth in September. The last of the regional Fed manufacturing surveys for September will be released on Monday (Dallas Fed).

The overall outlook of producers for the next six months was for stronger business conditions. The gauge for expected shipments added three points to end at 39, and the index for the volume of new orders rose two points to 35 this month.

Employment: Preliminary annual benchmark revision shows upward adjustment of 345,000 jobs

by Calculated Risk on 9/26/2013 10:22:00 AM

This morning the BLS released the preliminary annual benchmark revision showing an additional 345,000 payroll jobs as of March 2013. The final revision will be published next February when the January 2014 employment report is released in February 2014. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

In accordance with usual practice, the Bureau of Labor Statistics (BLS) is announcing the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. The final benchmark revision will be issued in February 2014, with the publication of the January 2014 Employment Situation news release.Using the preliminary benchmark estimate, this means that payroll employment in March 2013 was 345,000 higher than originally estimated. In February 2014, the payroll numbers will be revised up to reflect this estimate. The number is then "wedged back" to the previous revision (March 2012).

Each year, employment estimates from the Current Employment Statistics (CES) survey are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from State Unemployment Insurance (UI) tax records that nearly all employers are required to file. For National CES employment series, the annual benchmark revisions over the last 10 years have averaged plus or minus three-tenths of one percent of Total nonfarm employment. The preliminary estimate of the benchmark revision indicates an upward adjustment to March 2013 Total nonfarm employment of 345,000 (0.3 percent). This revision is impacted by a large non-economic code change in the Quarterly Census of Employment and Wages (QCEW) that moves approximately 469,000 in employment from Private households, which is out-of-scope for CES, to the Education and health care services industry, which is in scope. After accounting for this movement, the estimate of the revision to the over-the-year change in CES from March 2012 to March 2013 is a downward revision of 124,000. ...

This preliminary estimate showed an additional 333,000 private sector jobs, and 12,000 government jobs (as of March 2013). Note: The revision would have been negative except for the reclassification of certain jobs (that weren't previously included in the payroll report).

Pending Home Sales Index declines 1.6% in August

by Calculated Risk on 9/26/2013 10:00:00 AM

From the NAR: Pending Home Sales Decline in August

The Pending Home Sales Index, a forward-looking indicator based on contract signings, eased 1.6 percent to 107.7 in August from a downwardly revised 109.4 in July, but remains 5.8 percent above August 2012 when it was 101.8; the data reflect contracts but not closings. Pending sales have been above year-ago levels for the past 28 months.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in September and October.

...

The PHSI in the Northeast rose 4.0 percent to 84.8 in August, and is 5.1 percent above a year ago. In the Midwest the index declined 1.4 percent to 111.6 in August, but is 13.8 percent higher than August 2012. Pending home sales in the South fell 3.5 percent to an index of 116.9 in August, but are 3.7 percent above a year ago. The index in the West declined 1.6 percent in August to 106.9, but is 1.7 percent higher than August 2012.