by Calculated Risk on 9/22/2013 02:20:00 PM

Sunday, September 22, 2013

Preliminary annual Employment benchmark revision to be released Thursday

On Thursday the BLS will release the preliminary annual Benchmark Revision for the Current Employment Statistics. The final revision will be published next February when the January 2012 employment report is released. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

Each year, the Current Employment Statistics (CES) survey estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW) for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. On September 26, 2013 at 10:00 a.m. the Bureau of Labor Statistics (BLS) will release the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series.With the release of the final benchmark estimate in February, total payroll employment in March 2013 will changed by the amount of the revision. The number is then "wedged back" to the previous revision (March 2012).

For details on the benchmark revision process, see from the BLS Benchmark Article.

The following table shows the benchmark revisions since 1979. The BLS employment estimate tends to miss turning points - as an example the benchmark revisions were down in 2007 through 2010, and have been up for the last two years. We see a similar pattern for previous recessions (like in the early '80s and early '90s). My guess is the revision will be small this year.

A few months ago Josh Lehner looked at state level data and he thinks the revision will be positive again this year. Although he thinks the revision for government employees may be larger than normal due to the sequester. According to MarketWatch, economists at BNP Paribas expect a negative revision.

| Year | Percent benchmark revision | Benchmark revision (in thousands) |

|---|---|---|

| 1979 | 0.5 | 447 |

| 1980 | -0.1 | -63 |

| 1981 | -0.4 | -349 |

| 1982 | -0.1 | -113 |

| 1983 | * | 36 |

| 1984 | 0.4 | 353 |

| 1985 | * | -3 |

| 1986 | -0.5 | -467 |

| 1987 | * | -35 |

| 1988 | -0.3 | -326 |

| 1989 | * | 47 |

| 1990 | -0.2 | -229 |

| 1991 | -0.6 | -640 |

| 1992 | -0.1 | -59 |

| 1993 | 0.2 | 263 |

| 1994 | 0.7 | 747 |

| 1995 | 0.5 | 542 |

| 1996 | * | 57 |

| 1997 | 0.4 | 431 |

| 1998 | * | 44 |

| 1999 | 0.2 | 258 |

| 2000 | 0.4 | 468 |

| 2001 | -0.1 | -123 |

| 2002 | -0.2 | -313 |

| 2003 | -0.2 | -122 |

| 2004 | 0.2 | 203 |

| 2005 | -0.1 | -158 |

| 2006 | 0.6 | 752 |

| 2007 | -0.2 | -293 |

| 2008 | -0.1 | -89 |

| 2009 | -0.7 | -902 |

| 2010 | -0.3 | -378 |

| 2011 | 0.1 | 162 |

| 2012 | 0.3 | 424 |

| 2013 | NA | NA |

| * less than 0.05% | ||

Mortgages, Eminent domain and Richmond

by Calculated Risk on 9/22/2013 10:21:00 AM

I was hoping to avoid writing about this dumb idea, but readers keep asking ...

Mike Konczal writes in the WaPo: Is Richmond’s mortgage seizure scheme even legal?

The short answer is No (Although Konczal apparently disagrees).

There are some confusing passages in Konczal's piece. The key issue is if there is a public interest for the city of Richmond to use eminent domain. Konczal writes:

It is very likely Richmond will argue that preventing blight is a major, legitimate public purpose, and the courts agree. Abandoned homes result in increased crime and significant public costs, in addition to destabilizing neighborhoods. ... The banks argue that the loans are performing (more on their argument about this in a minute), and as such don’t serve a public purpose. But there’s also a public purpose in solving problems in the coordination of mortgage servicers to writedown and deal with failing mortgages. There’s also the public purpose of allowing people to move as well as refinance allowing for the movement of individuals as well as the ability to refinance. These are all legitimate purposes of eminent domain ...First, blight is a legitimate issue for eminent domain, but blight doesn't apply in the Richmond case. Most of these homes are owner occupied and the owners are current on their mortgages. The "abandoned homes" is mostly irrelevant in this case (there might be a few abandoned). Drive down any street in Richmond with one of the houses in question, and there is no evidence of "blight". Note: For any house that is not maintained, the city has alternatives to eminent domain - so we can rule this one out.

Konczal also writes "there’s also a public purpose in solving problems in the coordination of mortgage servicers to writedown and deal with failing mortgages". But once again, most of these loans are current and the mortgages are not "failing". (I don't buy the public interest argument for a city with coordination).

Konczal also writes: "There’s also the public purpose of allowing people to move as well as refinance allowing for the movement of individuals as well as the ability to refinance." A public purpose in "allowing people to move"? Clearly Konczal is suggesting that someone underwater on their mortgage will have difficulty moving for employment. That may be true - they may have to lose their home in foreclosure or do a short sale to move from say Richmond to Texas - but helping someone move might be in the national public interest, but not in the interest of the city of Richmond. And a public purpose to "refinance"? That is a stretch.

Also even if there is a little public interest, most of the benefits accrue to individual homeowners - and that violates the spirit of eminent domain.

I think there is no clearly stated public purpose for using eminent domain. And this is how I expect the courts to rule.

Konczal writes about valuation.

One way to evaluate these mortgages would be to compare them to bonds of mortgages containing similar instruments and see what discount is used. Given the still high levels of foreclosures, this would generate a significant discount. This is a common technique to evaluate risk and valuations when markets aren’t available, say for understanding the credit risk of a brand new company, as they aren’t in high foreclosure areas.I won't discuss the difference between the mortgage and the promissory note, but the first key here is that the valuation is for the note, not the underlying property.

The banks also argue that the fact that a majority of homeowners are current on their loans means that they aren’t relevant to either public purpose or subject to a steep discount.

Pop quiz: Say someone with excellent credit buys a new car for $30,000 with 100% financing. They drive the car home, and the car is now "used" and only worth $25,000 (I'm making up numbers for this example). What is the value of the note (the loan)? Of course the value is $30,000 even though the car is now only worth $25,000.

The same idea applies to loans on houses. If the outstanding principal balance is $400,000, but the house is only worth $250,000, the starting point for the value of the note is $400,000. As Konczal writes the value could be discounted because of the possibility of foreclosure, but these loans are current and well seasoned (the borrowers have been paying for eight years or so). The value might be less than $400,000, but the value is clearly more than $250,000 - so the scheme doesn't work since the intention is to "seize the mortgage" and refinance at less than the current property value - but that will be far below fair value for the note.

The bottom line is I expect the courts to rule against this scheme (little or no public interest) - and it wouldn't work anyway (can't pay fair value).

Saturday, September 21, 2013

Schedule for Week of September 22nd

by Calculated Risk on 9/21/2013 11:47:00 AM

The key reports this week are August New Home sales on Wednesday, Case-Shiller house prices for July on Tuesday, the third estimate of Q2 GDP on Thursday, and the August Personal Income and Outlays report on Friday.

Also the Fed will release the Q2 Flow of Funds report this week, and the Pending Home Sales index for August might show a sharp decline.

For manufacturing, the Richmond and Kansas City regional manufacturing surveys for September will be released this week.

Note: My guess is Janet Yellen will be nominated as Fed Chair this week, perhaps on Monday.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

9:00 AM: The Markit US PMI Manufacturing Index Flash for September. The consensus is for an increase to 54.0 from 53.9 in August.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average for closings in May, June and July.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average for closings in May, June and July. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through June 2012 (the Composite 20 was started in January 2000).

The consensus is for a 12.4% year-over-year increase in the Composite 20 index (NSA). The Zillow forecast is for the Composite 20 to increase 12.5% year-over-year, and for prices to increase 1.2% month-to-month seasonally adjusted.

9:00 AM: FHFA House Price Index for July 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase.

10:00 AM: Conference Board's consumer confidence index for September. The consensus is for the index to decrease to 80.0 from 81.5.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for September. The consensus is for a reading of 10.5 for this survey, down from 14 in August (Above zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 0.5% decline in durable goods orders.

10:00 AM: New Home Sales for August from the Census Bureau.

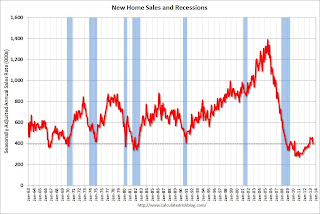

10:00 AM: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the July sales rate.

The consensus is for an increase in sales to 425 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 394 thousand in July. Based on the various reports, sales were probably weak again in August.

12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 330 thousand from 309 thousand last week.

8:30 AM: Q2 GDP (third estimate). This is the second estimate of Q2 GDP from the BEA. The consensus is that real GDP increased 2.6% annualized in Q2, revised up from the second estimate of 2.5% in Q2.

10:00 AM ET: Pending Home Sales Index for August. The consensus is for a 1.0% decrease in the index. Economist Tom Lawler is estimating the NAR will report a decline of "about 5%" in this index.

10:00 AM: 2013 Current Employment Statistics (CES) Preliminary Benchmark Revision. From the BLS: "[T]he Current Employment Statistics (CES) survey estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW) for the month of March. ... The final benchmark revision will be issued with the publication of the January 2014 Employment Situation news release in February."

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for August. The consensus is for a reading of 9 for this survey, up from 8 in August (Above zero is expansion).

8:30 AM ET: Personal Income and Outlays for August. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 78.0, up from the preliminary reading of 76.8, but down from the August reading of 82.1.

Unofficial Problem Bank list declines to 692 Institutions

by Calculated Risk on 9/21/2013 09:33:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for September 20, 2013.

Changes and comments from surferdude808:

As anticipated, the OCC released its actions through mid-August this week, which led to many changes to the Unofficial Problem Bank List. In all, there were nine removals and one addition that leave the list with 692 institutions and assets of $242.9 billion. It is the first time the list has under 700 institutions since April 2010. A year ago, the list held 878 institutions with assets of $327.4 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. Less than two years later the list peaked at 1,002 institutions. Now, more than two years after the peak, the list is down to 692 (the list increased faster than it is decreasing - but it is steadily decreasing as regulators terminate actions and close a few banks).

Bank of St. Augustine, Saint Augustine, FL ($164 million), found its way off the list by finding a merger partner. Actions were terminated against Far East National Bank, Los Angeles, CA ($1.2 billion); First Community Bank, Santa Rosa, CA ($678 million); CBC National Bank, Fernandina Beach, FL ($399 million); MidSouth Bank, N. A., Dothan, AL ($372 million); First National Bank South, Alma, GA ($309 million); The Camden National Bank, Camden, AL ($110 million); Peoples Community National Bank, Bremen , GA ($73 million); and The National Bank of Harvey, Harvey, ND ($46 million). The banking regulators have picked-up the pace on action terminations this quarter, which are now above any prior quarter in total or removal rate since publication of the first list in 2009. More info will be included in an updated transition matrix next week.

The First National Bank of Russell Springs, Russell Springs, KY ($192 million) was added to the list this week.

Next week, we anticipate the FDIC will release its enforcement action activity through August 2013. There is nothing new to report on the status of banks controlled by Capitol Bancorp, Ltd.

Friday, September 20, 2013

Yellen Speech Next Week Canceled, Nomination as Fed Chair Expected Very Soon

by Calculated Risk on 9/20/2013 07:03:00 PM

From the WSJ: Yellen Speech Canceled as White House Weighs Fed Pick

The Economic Club of New York has canceled a coming speech by Fed Vice Chairwoman Janet Yellen as the White House moves closer to selecting a new head of the central bank.My guess is the nomination will be announced Monday.

The group said Friday that the Oct. 1 speech by Ms. Yellen had been called off but gave no reason.

LA area Port Traffic: Import and Export Traffic Increases in August

by Calculated Risk on 9/20/2013 01:39:00 PM

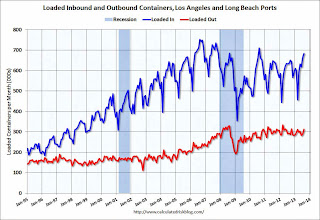

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for August since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 0.7% in August compared to the rolling 12 months ending in July. Outbound traffic increased 0.6% compared to July.

In general, inbound traffic has been increasing slowly, and outbound traffic had been declining slightly (but picked up in August).

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

This suggests an increase in the trade deficit with Asia for August - and possibly fairly strong retailer buying for the holiday season.

BLS: State unemployment rates were "little changed" in August

by Calculated Risk on 9/20/2013 11:24:00 AM

From the BLS: Regional and state unemployment rates were little changed in August

Regional and state unemployment rates were little changed in August. Eighteen states and the District of Columbia had unemployment rate increases, 17 states had decreases, and 15 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada had the highest unemployment rate among the states in August, 9.5 percent. The next highest rate was in Illinois, 9.2 percent. North Dakota continued to have the lowest jobless rate, 3.0 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Nevada have seen the largest declines and many other states have seen significant declines (California, Florida and more).

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at or above 9% in four states: Nevada, Illinois, Rhode Island and Michigan.

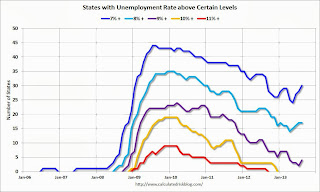

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).Currently four states have an unemployment rate above 9% (purple), seventeen states above 8% (light blue), and 30 states above 7% - the most in a year (blue).

Will the BLS release an employment report for September?

by Calculated Risk on 9/20/2013 09:04:00 AM

A quick note: Currently the BLS is scheduled to release the September employment report on Friday October 4th. However, if there is a partial shut down of the government by Congressional Republicans, the employment report will be delayed.

Back in 1996, following the partial government shutdown from December 16, 1995 through January 6, 1996, the BLS finally released the December 1995 employment report on January 19, 1996. A similar delay would happen this time if the government is shutdown on October 1st (the fiscal year begins on October 1st).

During a "government shutdown", most of the government keeps running and a shutdown doesn't save any money (it is a political stunt). The impact on the economy would probably be minor, but it would be disruptive - and extremely annoying for those of us who use and follow government economic data. Private data would still be released (ISM surveys, ADP employment report, etc), but all government data would stop (employment, GDP, housing starts, etc.).

Note: If the government stopped paying the bills in mid-October (doesn't raise the "debt ceiling"), the consequences would be serious - but I doubt anyone is that crazy. The good news is these threats and stunts only happen in off years to give voters time to forget before the next election!

Thursday, September 19, 2013

AAR: Rail Traffic increased in August

by Calculated Risk on 9/19/2013 08:59:00 PM

From the Association of American Railroads (AAR): AAR Reports Increased Intermodal, Carload Rail Traffic for August

The Association of American Railroads (AAR) ... reported increased total U.S. rail traffic for the month of August 2013, with intermodal setting a new record and carload volume increasing overall compared with August 2012.

Intermodal traffic in August 2013 totaled 1,031,179 containers and trailers, up 4.4 percent (43,398 units) compared with August 2012. The weekly average of 257,795 units in August 2013 was the highest weekly average for any month in history. Carloads originated in August totaled 1,178,619, up 0.5 percent or 5,285 carloads compared with the same month last year.

...

“In terms of average weekly volumes, August was the best intermodal month in history for both U.S. and Canadian railroads,” said AAR Senior Vice President John T. Gray. “Because the fall is typically the peak season for intermodal traffic, it wouldn’t be surprising to see new records set in September and October. Intermodal’s strength is a testament to the massive private investments railroads have made in their intermodal operations and the tremendous effort they’ve put forth in improving the reliability, responsiveness, and cost effectiveness of their intermodal service.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Green is 2013.

U.S. railroads averaged 294,655 carloads per week in August 2013, up 0.5% over August 2012 and the highest weekly average for any month since November 2011. August is just the second month in 2013 in which year-over-year total carloads were higher than in 2012. For the past seven months, carloads have deviated only very slightly from the same periods in 2012 ...Note that lumber was up only up 2.7% from a year ago.

The commodity category with the largest year-over-year increase in August 2013 was petroleum and petroleum products, with carloads up 18.5% (8,148 carloads) over August 2012 ... [C]oal and grain led the way for carload declines in August 2013, just as they have for many months now. Coal carloads were down 9,915 (2.0%) in August 2013 compared with August 2012, while grain carloads were down 6,570 (9.0%).

Graphs and excerpts reprinted with permission.

Graphs and excerpts reprinted with permission.The second graph is for intermodal traffic (using intermodal or shipping containers):

Intermodal traffic is on track for a record year in 2013.

Intermodal volume on U.S. railroads averaged 257,795 containers and trailers per week in August 2013, easily the highest weekly average for any month in history. The old record was 252,347 units per week, set in June of this year; before that, the record was 251,703 in October 2006. The four weeks of August 2013 were the second, fourth, sixth, and seventh highest volume intermodal weeks in history for U.S. railroads. Moreover, because the fall is typically the peak season for intermodal traffic, it wouldn’t be surprising to see new records set in September and/or October. August 2013 was the 45th-straight year-over-year monthly increase for U.S. rail intermodal traffic.

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in August

by Calculated Risk on 9/19/2013 05:24:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in August.

From CR: Look at the two columns in the table for Total "Distressed" Share. In every area that has reported distressed sales so far, the share of distressed sales is down year-over-year.

Also there has been a decline in foreclosure sales in all of these cities.

And now short sales are declining year-over-year too. This is a recent change - short sales had been increasing year-over-year, but it looks like both categories of distressed sales are now declining.

The All Cash Share is mostly declining. When investors pull back in markets like Phoenix (already declining), the share of all cash buyers will probably decline.

In general it appears the housing market is slowly moving back to normal.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Aug-13 | Aug-12 | Aug-13 | Aug-12 | Aug-13 | Aug-12 | Aug-13 | Aug-12 | |

| Las Vegas | 25.0% | 43.7% | 8.0% | 16.9% | 33.0% | 60.6% | 52.5% | 52.5% |

| Reno | 21.0% | 38.0% | 7.0% | 15.0% | 28.0% | 53.0% | ||

| Phoenix | 10.3% | 29.4% | 8.9% | 14.0% | 19.3% | 43.4% | 34.1% | 44.7% |

| Sacramento | 14.6% | 35.4% | 4.8% | 16.6% | 19.4% | 52.0% | 25.4% | 33.1% |

| Minneapolis | 5.5% | 10.7% | 15.1% | 25.2% | 20.6% | 35.9% | ||

| Mid-Atlantic | 7.6% | 11.8% | 7.0% | 8.7% | 14.6% | 20.6% | 17.5% | 17.9% |

| Orlando | 16.8% | 28.7% | 16.7% | 23.4% | 33.5% | 52.1% | 45.9% | 53.0% |

| California * | 13.2% | 26.4% | 7.8% | 20.0% | 21.0% | 46.4% | ||

| Bay Area CA * | 10.0% | 23.6% | 4.6% | 14.5% | 14.6% | 38.1% | 22.4% | 27.9% |

| So. California * | 13.6% | 26.6% | 7.1% | 19.2% | 20.7% | 45.8% | 27.6% | 32.3% |

| Florida SF | 12.4% | 22.2% | 17.1% | 17.2% | 29.5% | 39.4% | 41.6% | 42.5% |

| Florida C/TH | 9.9% | 19.8% | 15.7% | 16.5% | 25.5% | 36.3% | 68.1% | 73.4% |

| Hampton Roads | 21.0% | 24.4% | ||||||

| Northeast Florida | 35.7% | 40.7% | ||||||

| Toledo | 30.1% | 35.9% | ||||||

| Des Moines | 16.6% | 21.9% | ||||||

| Tucson | 29.1% | 33.3% | ||||||

| Peoria | 20.8% | 20.5% | ||||||

| Pensacola | 33.7% | 30.7% | ||||||

| Akron | 33.0% | 29.7% | ||||||

| Houston | 7.7% | 16.8% | ||||||

| Memphis* | 16.4% | 28.8% | ||||||

| Birmingham AL | 21.2% | 27.8% | ||||||

| Springfield IL | 10.4% | 12.5% | ||||||

| *share of existing home sales, based on property records | ||||||||