by Calculated Risk on 9/20/2013 07:03:00 PM

Friday, September 20, 2013

Yellen Speech Next Week Canceled, Nomination as Fed Chair Expected Very Soon

From the WSJ: Yellen Speech Canceled as White House Weighs Fed Pick

The Economic Club of New York has canceled a coming speech by Fed Vice Chairwoman Janet Yellen as the White House moves closer to selecting a new head of the central bank.My guess is the nomination will be announced Monday.

The group said Friday that the Oct. 1 speech by Ms. Yellen had been called off but gave no reason.

LA area Port Traffic: Import and Export Traffic Increases in August

by Calculated Risk on 9/20/2013 01:39:00 PM

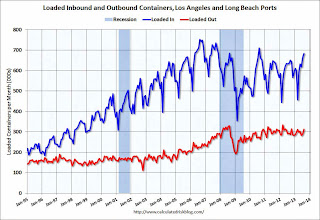

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for August since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 0.7% in August compared to the rolling 12 months ending in July. Outbound traffic increased 0.6% compared to July.

In general, inbound traffic has been increasing slowly, and outbound traffic had been declining slightly (but picked up in August).

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

This suggests an increase in the trade deficit with Asia for August - and possibly fairly strong retailer buying for the holiday season.

BLS: State unemployment rates were "little changed" in August

by Calculated Risk on 9/20/2013 11:24:00 AM

From the BLS: Regional and state unemployment rates were little changed in August

Regional and state unemployment rates were little changed in August. Eighteen states and the District of Columbia had unemployment rate increases, 17 states had decreases, and 15 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada had the highest unemployment rate among the states in August, 9.5 percent. The next highest rate was in Illinois, 9.2 percent. North Dakota continued to have the lowest jobless rate, 3.0 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Nevada have seen the largest declines and many other states have seen significant declines (California, Florida and more).

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at or above 9% in four states: Nevada, Illinois, Rhode Island and Michigan.

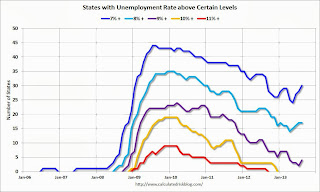

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).Currently four states have an unemployment rate above 9% (purple), seventeen states above 8% (light blue), and 30 states above 7% - the most in a year (blue).

Will the BLS release an employment report for September?

by Calculated Risk on 9/20/2013 09:04:00 AM

A quick note: Currently the BLS is scheduled to release the September employment report on Friday October 4th. However, if there is a partial shut down of the government by Congressional Republicans, the employment report will be delayed.

Back in 1996, following the partial government shutdown from December 16, 1995 through January 6, 1996, the BLS finally released the December 1995 employment report on January 19, 1996. A similar delay would happen this time if the government is shutdown on October 1st (the fiscal year begins on October 1st).

During a "government shutdown", most of the government keeps running and a shutdown doesn't save any money (it is a political stunt). The impact on the economy would probably be minor, but it would be disruptive - and extremely annoying for those of us who use and follow government economic data. Private data would still be released (ISM surveys, ADP employment report, etc), but all government data would stop (employment, GDP, housing starts, etc.).

Note: If the government stopped paying the bills in mid-October (doesn't raise the "debt ceiling"), the consequences would be serious - but I doubt anyone is that crazy. The good news is these threats and stunts only happen in off years to give voters time to forget before the next election!

Thursday, September 19, 2013

AAR: Rail Traffic increased in August

by Calculated Risk on 9/19/2013 08:59:00 PM

From the Association of American Railroads (AAR): AAR Reports Increased Intermodal, Carload Rail Traffic for August

The Association of American Railroads (AAR) ... reported increased total U.S. rail traffic for the month of August 2013, with intermodal setting a new record and carload volume increasing overall compared with August 2012.

Intermodal traffic in August 2013 totaled 1,031,179 containers and trailers, up 4.4 percent (43,398 units) compared with August 2012. The weekly average of 257,795 units in August 2013 was the highest weekly average for any month in history. Carloads originated in August totaled 1,178,619, up 0.5 percent or 5,285 carloads compared with the same month last year.

...

“In terms of average weekly volumes, August was the best intermodal month in history for both U.S. and Canadian railroads,” said AAR Senior Vice President John T. Gray. “Because the fall is typically the peak season for intermodal traffic, it wouldn’t be surprising to see new records set in September and October. Intermodal’s strength is a testament to the massive private investments railroads have made in their intermodal operations and the tremendous effort they’ve put forth in improving the reliability, responsiveness, and cost effectiveness of their intermodal service.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Green is 2013.

U.S. railroads averaged 294,655 carloads per week in August 2013, up 0.5% over August 2012 and the highest weekly average for any month since November 2011. August is just the second month in 2013 in which year-over-year total carloads were higher than in 2012. For the past seven months, carloads have deviated only very slightly from the same periods in 2012 ...Note that lumber was up only up 2.7% from a year ago.

The commodity category with the largest year-over-year increase in August 2013 was petroleum and petroleum products, with carloads up 18.5% (8,148 carloads) over August 2012 ... [C]oal and grain led the way for carload declines in August 2013, just as they have for many months now. Coal carloads were down 9,915 (2.0%) in August 2013 compared with August 2012, while grain carloads were down 6,570 (9.0%).

Graphs and excerpts reprinted with permission.

Graphs and excerpts reprinted with permission.The second graph is for intermodal traffic (using intermodal or shipping containers):

Intermodal traffic is on track for a record year in 2013.

Intermodal volume on U.S. railroads averaged 257,795 containers and trailers per week in August 2013, easily the highest weekly average for any month in history. The old record was 252,347 units per week, set in June of this year; before that, the record was 251,703 in October 2006. The four weeks of August 2013 were the second, fourth, sixth, and seventh highest volume intermodal weeks in history for U.S. railroads. Moreover, because the fall is typically the peak season for intermodal traffic, it wouldn’t be surprising to see new records set in September and/or October. August 2013 was the 45th-straight year-over-year monthly increase for U.S. rail intermodal traffic.

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in August

by Calculated Risk on 9/19/2013 05:24:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in August.

From CR: Look at the two columns in the table for Total "Distressed" Share. In every area that has reported distressed sales so far, the share of distressed sales is down year-over-year.

Also there has been a decline in foreclosure sales in all of these cities.

And now short sales are declining year-over-year too. This is a recent change - short sales had been increasing year-over-year, but it looks like both categories of distressed sales are now declining.

The All Cash Share is mostly declining. When investors pull back in markets like Phoenix (already declining), the share of all cash buyers will probably decline.

In general it appears the housing market is slowly moving back to normal.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Aug-13 | Aug-12 | Aug-13 | Aug-12 | Aug-13 | Aug-12 | Aug-13 | Aug-12 | |

| Las Vegas | 25.0% | 43.7% | 8.0% | 16.9% | 33.0% | 60.6% | 52.5% | 52.5% |

| Reno | 21.0% | 38.0% | 7.0% | 15.0% | 28.0% | 53.0% | ||

| Phoenix | 10.3% | 29.4% | 8.9% | 14.0% | 19.3% | 43.4% | 34.1% | 44.7% |

| Sacramento | 14.6% | 35.4% | 4.8% | 16.6% | 19.4% | 52.0% | 25.4% | 33.1% |

| Minneapolis | 5.5% | 10.7% | 15.1% | 25.2% | 20.6% | 35.9% | ||

| Mid-Atlantic | 7.6% | 11.8% | 7.0% | 8.7% | 14.6% | 20.6% | 17.5% | 17.9% |

| Orlando | 16.8% | 28.7% | 16.7% | 23.4% | 33.5% | 52.1% | 45.9% | 53.0% |

| California * | 13.2% | 26.4% | 7.8% | 20.0% | 21.0% | 46.4% | ||

| Bay Area CA * | 10.0% | 23.6% | 4.6% | 14.5% | 14.6% | 38.1% | 22.4% | 27.9% |

| So. California * | 13.6% | 26.6% | 7.1% | 19.2% | 20.7% | 45.8% | 27.6% | 32.3% |

| Florida SF | 12.4% | 22.2% | 17.1% | 17.2% | 29.5% | 39.4% | 41.6% | 42.5% |

| Florida C/TH | 9.9% | 19.8% | 15.7% | 16.5% | 25.5% | 36.3% | 68.1% | 73.4% |

| Hampton Roads | 21.0% | 24.4% | ||||||

| Northeast Florida | 35.7% | 40.7% | ||||||

| Toledo | 30.1% | 35.9% | ||||||

| Des Moines | 16.6% | 21.9% | ||||||

| Tucson | 29.1% | 33.3% | ||||||

| Peoria | 20.8% | 20.5% | ||||||

| Pensacola | 33.7% | 30.7% | ||||||

| Akron | 33.0% | 29.7% | ||||||

| Houston | 7.7% | 16.8% | ||||||

| Memphis* | 16.4% | 28.8% | ||||||

| Birmingham AL | 21.2% | 27.8% | ||||||

| Springfield IL | 10.4% | 12.5% | ||||||

| *share of existing home sales, based on property records | ||||||||

Comments on Existing Home Sales

by Calculated Risk on 9/19/2013 02:27:00 PM

First, the higher than consensus headline sales number was not surprising, although this was even above Lawler's estimate (see Lawler: Early Look at Existing Home Sales in August).

Second, the strong sales rate in August is not a sign that higher mortgage rates have had no impact on sales. The NAR reports CLOSED sales, and the usual escrow period is 45 to 60 days. Mortgage rates didn't start increasing until the 2nd half of May, and were still below 4% in mid-June (see Freddie Mac Weekly Primary Mortgage Market Survey®), so buyers could have locked in rates in early June - and pushed to close in August.

I expect sales to decline in September, and a further decline in a couple of months. From CNBC:

"We are getting early signals from lock boxes that show a significant change in direction in August," said Lawrence Yun, chief economist for the National Association of Realtors, referring to the small key boxes that hang on the doors of for-sale homes. The number of times they were opened in August dropped dramatically, signaling a big drop in potential buyer traffic.But that doesn't mean the housing recovery is over. What matters for jobs and the economy are new home sales, not existing home sales. And I expect the housing recovery to continue.

The key number in the existing home sales report is inventory (not sales), and the NAR reported that inventory increased slightly in August from July, and is only down 6.3% from August 2012. This is the smallest year-over-year decline since March 2011.

The key points are: 1) inventory is very low, but 2) the year-over-year inventory decline will probably end soon. With the low level of inventory, there is still upward pressure on prices - but as inventory starts to increase, buyer urgency will wane, and price increases will slow.

When will the NAR report a year-over-year increase in inventory? Soon. Inventory usually declines seasonally in September from August, but I think the decline will be less than usual this year. Last year, the NAR reported September inventory at 2.17 million. For August 2013, the NAR reported 2.25 million. So inventory could decline a little in September and still be up year-over-year. I'm guessing inventory will be up year-over-year in the September report (or maybe October).

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were up 13.2% from August 2012, but conventional sales are probably up close to 30% from August 2012, and distressed sales down. The NAR reported (from a survey):

Distressed homes – foreclosures and short sales – accounted for 12 percent of August sales, down from 15 percent in July, and is the lowest share since monthly tracking began in October 2008; they were 23 percent in August 2012.Although this survey isn't perfect, if total sales were up 13.2% from August 2012, and distressed sales declined to 12% of total sales (12% of 5.48 million) from 23% (23% of 4.84 million in August 2012), this suggests conventional sales were up sharply year-over-year - a good sign.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in August (red column) are above the sales for 2007 through 2012, however sales are well below the bubble years of 2005 and 2006.

The bottom line is this was a solid report, but it is still too early to tell about the impact of higher mortgage rates on sales. Inventory is still low, but the year-over-year decline in inventory is decreasing - and will turn positive soon (indicating inventory bottomed earlier this year).

Earlier:

• Existing Home Sales in August: 5.48 million SAAR, 4.9 months of supply

Philly Fed Manufacturing Survey indicates Solid Expansion in September

by Calculated Risk on 9/19/2013 12:05:00 PM

Note: I'll have more on existing home sales later. This was released earlier this morning ...

From the Philly Fed: September Manufacturing Survey

Manufacturing activity picked up in September, according to firms responding to this month’s Business Outlook Survey. The survey’s broadest indicators for general activity, new orders, shipments, and employment were all positive and higher than in August. The survey's indicators of future activity were significantly higher, suggesting improved optimism about growth over the next six months.This was above the consensus forecast of a reading of 10.0 for September.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from 9.3 in August to 22.3 this month. The index has now been positive for four consecutive months and is at its highest reading since March 2011. ... The demand for manufactured goods, as measured by the current new orders index, increased 16 points, to 21.2.

Labor market indicators showed improvement this month. The current employment index increased 7 points, to 10.3, its highest reading since April of last year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through September. The ISM and total Fed surveys are through August.

The average of the Empire State and Philly Fed surveys has been positive for four consecutive months and near the high for the last 2+ years. This suggests further solid expansion in the ISM report for September.

Existing Home Sales in August: 5.48 million SAAR, 4.9 months of supply

by Calculated Risk on 9/19/2013 10:00:00 AM

The NAR reports: August Existing-Home Sales Rise, Limited Inventory Continues to Push Prices

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 1.7 percent to a seasonally adjusted annual rate of 5.48 million in August from 5.39 million in July, and are 13.2 percent higher than the 4.84 million-unit level in August 2012.

Total housing inventory at the end of August increased 0.4 percent to 2.25 million existing homes available for sale, which represents a 4.9-month supply at the current sales pace, down from a 5.0-month supply in July. Unsold inventory is 6.3 percent below a year ago, when there was a 6.0-month supply.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August 2013 (5.48 million SAAR) were 1.7% higher than last month, and were 13.2% above the August 2012 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.25 million in August up from 2.24 million in July. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.25 million in August up from 2.24 million in July. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 6.25% year-over-year in August compared to August 2012. This is the 30th consecutive month with a YoY decrease in inventory, and the smallest YoY decrease since early 2011 (I expect the YoY change in inventory to turn positive soon).

Inventory decreased 6.25% year-over-year in August compared to August 2012. This is the 30th consecutive month with a YoY decrease in inventory, and the smallest YoY decrease since early 2011 (I expect the YoY change in inventory to turn positive soon).Months of supply was at 4.9 months in August.

This was above expectations of sales of 5.25 million (economist Tom Lawler's forecast was closer than the consensus). For existing home sales, the key number is inventory - and inventory is still down year-over-year, although the declines are slowing. This was another solid report. I'll have more later ...

Weekly Initial Unemployment Claims increase to 309,000, Four Week Average lowest since October 2007

by Calculated Risk on 9/19/2013 08:30:00 AM

The DOL reports:

In the week ending September 14, the advance figure for seasonally adjusted initial claims was 309,000, an increase of 15,000 from the previous week's revised figure of 294,000. The 4-week moving average was 314,750, a decrease of 7,000 from the previous week's revised average of 321,750.The previous week was revised up from 292,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 314,750.

The 4-week average is at the lowest level since October 2007 (before the recession started). Claims were below the 341,000 consensus forecast.

Here is a long term graph of the 4-week average of weekly unemployment claims back to 1971.

Here is a long term graph of the 4-week average of weekly unemployment claims back to 1971.