by Calculated Risk on 9/18/2013 08:29:00 PM

Wednesday, September 18, 2013

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg Survey

From Mark Thoma at Economist'sView: Why Didn't the Fed Begin Tapering?

Here's why I think they delayed: ... 1. Fiscal policy. ... 2. Inflation and unemployment. ... 3. The Fed is gun shy. ...4. Capital flight from developing markets.From Tim Duy at Economist'sView: No Taper - Yet

Two significant factors that held the FOMC in check were fiscal policy and higher interest rates.And from Binyamin Appelbaum at the NY Times: In Surprise, Fed Decides Not to Curtail Stimulus Effort

[T]he Fed said Wednesday that it would postpone any retreat from its monetary stimulus campaign for at least another month and quite possibly until next year. The Fed’s chairman, Ben S. Bernanke, emphasized that economic conditions were improving. But he said the Fed still feared a turn for the worse.The fiscal policy deadlines will have passed - and the issues probably resolved - by the time the Fed meets in late October.

He noted that Congressional Republicans and the White House were hurtling toward an impasse over government spending. ... And the Fed undermined its own efforts when it declared in June that it intended to begin a retreat by the end of the year, causing investors to begin immediately demanding higher interest rates on mortgage loans and other financial products, a trend that the Fed said Wednesday was threatening to slow the economy.

Thursday:

• 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 341 thousand from 292 thousand last week.

• At 10:00 AM, Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for sales of 5.25 million on seasonally adjusted annual rate (SAAR) basis. Economist Tom Lawler estimates the NAR will report sales at a 5.35 million annual rate (SAAR).

• Also at 10:00 AM, the Philly Fed manufacturing survey for September will be released. The consensus is for a reading of 10.0, up from 9.3 last month (above zero indicates expansion).

A Few Comments on Bernanke Press Conference and Fed Policy

by Calculated Risk on 9/18/2013 03:49:00 PM

• At the June FOMC press conference, Fed Chairman Ben Bernanke said (emphasis added):

"If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear. In this scenario, when asset purchases ultimately come to an end, the unemployment rate would likely be in the vicinity of 7%, with solid economic growth supporting further job gains, a substantial improvement from the 8.1% unemployment rate that prevailed when the committee announced this program."• At the press conference today, Bernanke said the data was "close" to being consistent with their forecasts, but that the committee would like further confirmation before starting to reduce asset purchases. Bernanke said it is still “possible” to start reducing asset purchase this year, but that “there is no fixed calendar schedule". This seems a little less certain of starting to taper this year than Bernanke's comments in June.

• Bernanke made it clear that the committee considers all FOMC meetings important, not just meetings with a scheduled press conference. He said a conference call (or briefing) could be arranged if the press needed to ask questions following a meeting with no scheduled press briefing. Bernanke said: "We certainly could arrange a public, on-the-record conference call or some other way of answering the media's questions." This suggests that the FOMC could start to taper at the October meeting even though there is no scheduled press conference (Oct 29th and 30th), or wait until December - or even next year - depending on the incoming data.

• It seems one of the reasons the Fed didn't taper was because they wanted to see the results of the current budget negotiations. It is possible that Congress will shut down the government (not catastrophic if it lasts a few days). However, as Bernanke noted, "failing to pay the bills" could have "very serious consequences". Both of these fiscal issues should be resolved prior to the October FOMC meeting. Note: I'm not concerned about Congress not "paying the bills" (aka Debt Ceiling), because failure to pay the bills would be the end of the Republican party - so it won't happen (several leaders in the GOP have acknowledged this). However there is some possibility of shutting down the government (probably just a threat, but not impossible).

• Inflation below target remains a key issue, and it is possible the Fed will wait on tapering if inflation doesn't move up a little.

• Bernanke hopes to comment on his future soon. I expect Fed Vice Chair Janet Yellen to be nominated by President Obama for Fed Chair next week (asking Bernanke to stay is a remote possibility).

FOMC Projections and Press Conference

by Calculated Risk on 9/18/2013 02:13:00 PM

The key sentence in the announcement was: "the Committee decided to await more evidence that progress will be sustained before adjusting the pace of its purchases".

With the downgrade to GDP and inflation (for 2014), it makes sense that the Fed decided to wait for more data.

As far as the "Appropriate timing of policy firming", the participants moved out a little with two participants now seeing the first increase in 2016.

Bernanke press conference here or watch below.

Free desktop streaming application by Ustream

On the projections, GDP was revised down for 2013 and 2014, the unemployment rate was revised down slightly, and inflation was revised down for 2014.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2013 | 2014 | 2015 | 2016 |

| Sept 2013 Meeting Projections | 2.0 to 2.3 | 2.9 to 3.1 | 3.0 to 3.5 | 2.5 to 3.3 |

| June 2013 Meeting Projections | 2.3 to 2.6 | 3.0 to 3.5 | 2.9 to 3.6 | |

| Mar 2013 Meeting Projections | 2.3 to 2.8 | 2.9 to 3.4 | 2.9 to 3.7 | |

The unemployment rate was at 7.3% in August.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2013 | 2014 | 2015 | 2016 |

| Sept 2013 Meeting Projections | 7.1 to 7.3 | 6.4 to 6.8 | 5.9 to 6.2 | 5.4 to 5.9 |

| June 2013 Meeting Projections | 7.2 to 7.3 | 6.5 to 6.8 | 5.8 to 6.2 | |

| Mar 2013 Meeting Projections | 7.3 to 7.5 | 6.7 to 7.0 | 6.0 to 6.5 | |

The FOMC believes inflation will stay significantly below target.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2013 | 2014 | 2015 | 2016 |

| Sept 2013 Meeting Projections | 1.1. to 1.2 | 1.3 to 1.8 | 1.6 to 2.0 | 1.7 to 2.0 |

| June 2013 Meeting Projections | 0.8 to 1.2 | 1.4 to 2.0 | 1.6 to 2.0 | |

| Mar 2013 Meeting Projections | 1.3 to 1.7 | 1.5 to 2.0 | 1.7 to 2.0 | |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2013 | 2014 | 2015 | 2016 |

| Sept 2013 Meeting Projections | 1.2 to 1.3 | 1.5 to 1.7 | 1.7 to 2.0 | 1.9 to 2.0 |

| June 2013 Meeting Projections | 1.2 to 1.3 | 1.5 to 1.8 | 1.7 to 2.0 | |

| Mar 2013 Meeting Projections | 1.5 to 1.6 | 1.7 to 2.0 | 1.8 to 2.0 | |

FOMC Statement: No Taper

by Calculated Risk on 9/18/2013 02:00:00 PM

Information received since the Federal Open Market Committee met in July suggests that economic activity has been expanding at a moderate pace. Some indicators of labor market conditions have shown further improvement in recent months, but the unemployment rate remains elevated. Household spending and business fixed investment advanced, and the housing sector has been strengthening, but mortgage rates have risen further and fiscal policy is restraining economic growth. Apart from fluctuations due to changes in energy prices, inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic growth will pick up from its recent pace and the unemployment rate will gradually decline toward levels the Committee judges consistent with its dual mandate. The Committee sees the downside risks to the outlook for the economy and the labor market as having diminished, on net, since last fall, but the tightening of financial conditions observed in recent months, if sustained, could slow the pace of improvement in the economy and labor market. The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, but it anticipates that inflation will move back toward its objective over the medium term.

Taking into account the extent of federal fiscal retrenchment, the Committee sees the improvement in economic activity and labor market conditions since it began its asset purchase program a year ago as consistent with growing underlying strength in the broader economy. However, the Committee decided to await more evidence that progress will be sustained before adjusting the pace of its purchases. Accordingly, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee's dual mandate.

The Committee will closely monitor incoming information on economic and financial developments in coming months and will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. In judging when to moderate the pace of asset purchases, the Committee will, at its coming meetings, assess whether incoming information continues to support the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective. Asset purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on the Committee's economic outlook as well as its assessment of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Charles L. Evans; Jerome H. Powell; Eric S. Rosengren; Jeremy C. Stein; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action was Esther L. George, who was concerned that the continued high level of monetary accommodation increased the risks of future economic and financial imbalances and, over time, could cause an increase in long-term inflation expectations.

emphasis added

AIA: Architecture Billings Index increases in August

by Calculated Risk on 9/18/2013 10:19:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Strong Conditions Revealed in Architecture Billings Index

The Architecture Billings Index (ABI) showed more acceleration in the growth of design activity nationally. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the August ABI score was 53.8, up from a mark of 52.7 in July. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 63.0, down from the reading of 66.4 the previous month.

“As business conditions at architecture firms have improved eleven out of the past twelve months, it is fair to say that the design professions are in a recovery mode,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “This upturn signals an impending turnaround in nonresidential construction activity, but a key component to maintaining this momentum is the ability of businesses to obtain financing for real estate projects, and for a resolution to the federal government budget and debt ceiling impasse.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.8 in August, up from 52.7 in July. Anything above 50 indicates expansion in demand for architects' services. This index has indicated expansion in 11 of the last 12 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index is not as strong as during the '90s - or during the bubble years of 2004 through 2006 - but the increases in this index over the past year suggest some increase in CRE investment in the second half of 2013.

Housing Starts increased in August to 891,000 SAAR

by Calculated Risk on 9/18/2013 08:41:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 891,000. This is 0.9 percent above the revised July estimate of 883,000 and is 19.0 percent above the August 2012 rate of 749,000.

Single-family housing starts in August were at a rate of 628,000; this is 7.0 percent above the revised July figure of 587,000. The August rate for units in buildings with five units or more was 252,000.

Building Permits:

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 918,000. This is 3.8 percent below the revised July rate of 954,000, but is 11.0 percent above the August 2012 estimate of 827,000.

Single-family authorizations in August were at a rate of 627,000; this is 3.0 percent above the revised July figure of 609,000. Authorizations of units in buildings with five units or more were at a rate of 268,000 in August.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in August (Multi-family is volatile month-to-month).

Single-family starts (blue) increased to 628,000 SAAR in August (Note: July was revised down from 591 thousand to 587 thousand).

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been generally increasing after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that housing starts have been generally increasing after moving sideways for about two years and a half years. This was below expectations of 915 thousand starts in August. I'll have more later ...

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 9/18/2013 07:02:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 11.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 13, 2013. The previous week’s results included an adjustment for the Labor Day holiday. ...

The Refinance Index increased 18 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier and is close to the same level as two weeks ago, before the holiday.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.75 percent from 4.80 percent, with points decreasing to 0.39 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

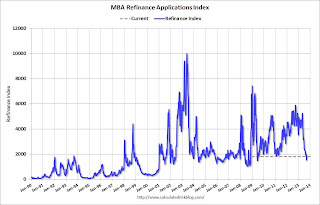

Click on graph for larger image.The first graph shows the refinance index.

The refinance index bounced around the last two weeks due to the holiday week.

But the key is the refinance index is down 65% since early May, we will probably see the refinance index back to 2000 levels soon.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index was generally been trending up over the last year (but down over the last few months), and the 4-week average of the purchase index is up about 3% from a year ago.

Tuesday, September 17, 2013

Wednesday: Housing Starts, FOMC Announcement, Bernanke Press Conference

by Calculated Risk on 9/17/2013 08:59:00 PM

Here is my FOMC preview from Sunday: FOMC Projections Preview: Some Modest Tapering is Possible. I think some modest tapering is likely (but not certain), and I expect the GDP forecast to be revised down.

Wednesday:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for August. The consensus is for total housing starts to increase to 915 thousand (SAAR) in August.

• During the day, the AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Meeting Announcement. It is likely the FOMC will start to reduce QE purchases following this meeting.

• Also at 2:00 PM: the FOMC Forecasts will be released. This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

August Update: Early Look at 2014 Cost-Of-Living Adjustments suggests 1.5% increase

by Calculated Risk on 9/17/2013 05:41:00 PM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.5 percent over the last 12 months to an index level of 230.359 (1982-84=100). For the month, the index increased 0.1 percent prior to seasonal adjustment.SPECIAL NOTE on CPI-chained: There has been some discussion of switching from CPI-W to CPI-chained for COLA. This will not happen this year, but could happen in the next year or two, and the switch would impact future Cost-of-living adjustments, see: Cost of Living and CPI-Chained

The Chained Consumer Price Index for All Urban Consumers (C-CPI-U) increased 1.4 percent over the last 12 months. For the month, the index increased 0.1 percent on a not seasonally adjusted basis.

Currently CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

Since the highest Q3 average was last year (2012), at 226.936, we only have to compare to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Currently CPI-W is above the Q3 2012 average. If the current level holds (average of July and August), COLA would be around 1.5% for next year.

Last year gasoline prices increased sharply in August and September - pushing up CPI-W for those months, and this year gasoline prices are down a little in September. So CPI-W will probably not increase as much this year in September as in September 2012.

This is early - we need the data for September - but my current guess is COLA will be a little lower than the 1.7% increase last year.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2012 yet, but wages probably increased again in 2012. If wages increased the same as last year, then the contribution base next year will be increased to around $117,000 from the current $113,700.

This is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).

Lawler: Table of Distressed Sales and Cash buyers for Selected Cities in August

by Calculated Risk on 9/17/2013 02:36:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and cash buyers for several selected cities in August. Note: The Sacramento distressed sales shares are SF only,

while the all-cash share is for total residential sales. Earlier this year the Sacramento Association

of Realtors stopped showing distressed sales for condos/townhomes, though it

reported such data in its press release.

The August press release was not yet available on its website.

From CR: Look at the two columns in the table for Total "Distressed" Share. In every area that has reported distressed sales so far, the share of distressed sales is down year-over-year.

Also there has been a decline in foreclosure sales in all of these cities.

And now short sales are declining year-over-year too! This is a recent change - short sales had been increasing year-over-year, but it looks like both categories of distressed sales are now declining.

The All Cash Share is mostly declining. When investors pull back in markets like Phoenix (already declining), the share of all cash buyers will probably decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Aug-13 | Aug-12 | Aug-13 | Aug-12 | Aug-13 | Aug-12 | Aug-13 | Aug-12 | |

| Las Vegas | 25.0% | 43.7% | 8.0% | 16.9% | 33.0% | 60.6% | 52.5% | 52.5% |

| Reno | 21.0% | 38.0% | 7.0% | 15.0% | 28.0% | 53.0% | ||

| Phoenix | 10.3% | 29.4% | 8.9% | 14.0% | 19.3% | 43.4% | 34.1% | 44.7% |

| Sacramento** | 14.4% | 34.9% | 4.6% | 16.6% | 19.0% | 51.5% | 25.4% | 33.1% |

| Minneapolis | 5.5% | 10.7% | 15.1% | 25.2% | 20.6% | 35.9% | ||

| Mid-Atlantic | 7.6% | 11.8% | 7.0% | 8.7% | 14.6% | 20.6% | 17.5% | 17.9% |

| Orlando | 16.8% | 28.7% | 16.7% | 23.4% | 33.5% | 52.1% | 45.9% | 53.0% |

| California * | 13.2% | 26.4% | 7.8% | 20.0% | 21.0% | 46.4% | ||

| Bay Area CA* | 10.0% | 23.6% | 4.6% | 14.5% | 14.6% | 38.1% | 22.4% | 27.9% |

| So. California* | 13.6% | 26.6% | 7.1% | 19.2% | 20.7% | 45.8% | 27.6% | 32.3% |

| Hampton Roads | 21.0% | 24.4% | ||||||

| Northeast Florida | 35.7% | 40.7% | ||||||

| Toledo | 30.1% | 35.9% | ||||||

| Tucson | 29.1% | 33.3% | ||||||

| Omaha | 17.0% | 15.4% | ||||||

| Pensacola | 33.7% | 30.7% | ||||||

| Memphis* | 16.4% | 28.8% | ||||||

| Birmingham AL | 21.2% | 27.8% | ||||||

| Springfield IL | 10.4% | 12.5% | ||||||

| *share of existing home sales, based on property records | ||||||||

| **Single Family Only | ||||||||