by Calculated Risk on 9/18/2013 07:02:00 AM

Wednesday, September 18, 2013

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 11.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 13, 2013. The previous week’s results included an adjustment for the Labor Day holiday. ...

The Refinance Index increased 18 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier and is close to the same level as two weeks ago, before the holiday.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.75 percent from 4.80 percent, with points decreasing to 0.39 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

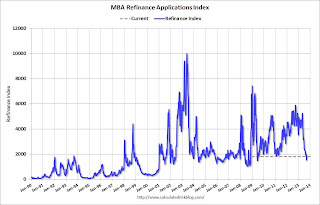

Click on graph for larger image.The first graph shows the refinance index.

The refinance index bounced around the last two weeks due to the holiday week.

But the key is the refinance index is down 65% since early May, we will probably see the refinance index back to 2000 levels soon.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index was generally been trending up over the last year (but down over the last few months), and the 4-week average of the purchase index is up about 3% from a year ago.

Tuesday, September 17, 2013

Wednesday: Housing Starts, FOMC Announcement, Bernanke Press Conference

by Calculated Risk on 9/17/2013 08:59:00 PM

Here is my FOMC preview from Sunday: FOMC Projections Preview: Some Modest Tapering is Possible. I think some modest tapering is likely (but not certain), and I expect the GDP forecast to be revised down.

Wednesday:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for August. The consensus is for total housing starts to increase to 915 thousand (SAAR) in August.

• During the day, the AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Meeting Announcement. It is likely the FOMC will start to reduce QE purchases following this meeting.

• Also at 2:00 PM: the FOMC Forecasts will be released. This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

August Update: Early Look at 2014 Cost-Of-Living Adjustments suggests 1.5% increase

by Calculated Risk on 9/17/2013 05:41:00 PM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.5 percent over the last 12 months to an index level of 230.359 (1982-84=100). For the month, the index increased 0.1 percent prior to seasonal adjustment.SPECIAL NOTE on CPI-chained: There has been some discussion of switching from CPI-W to CPI-chained for COLA. This will not happen this year, but could happen in the next year or two, and the switch would impact future Cost-of-living adjustments, see: Cost of Living and CPI-Chained

The Chained Consumer Price Index for All Urban Consumers (C-CPI-U) increased 1.4 percent over the last 12 months. For the month, the index increased 0.1 percent on a not seasonally adjusted basis.

Currently CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

Since the highest Q3 average was last year (2012), at 226.936, we only have to compare to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Currently CPI-W is above the Q3 2012 average. If the current level holds (average of July and August), COLA would be around 1.5% for next year.

Last year gasoline prices increased sharply in August and September - pushing up CPI-W for those months, and this year gasoline prices are down a little in September. So CPI-W will probably not increase as much this year in September as in September 2012.

This is early - we need the data for September - but my current guess is COLA will be a little lower than the 1.7% increase last year.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2012 yet, but wages probably increased again in 2012. If wages increased the same as last year, then the contribution base next year will be increased to around $117,000 from the current $113,700.

This is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).

Lawler: Table of Distressed Sales and Cash buyers for Selected Cities in August

by Calculated Risk on 9/17/2013 02:36:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and cash buyers for several selected cities in August. Note: The Sacramento distressed sales shares are SF only,

while the all-cash share is for total residential sales. Earlier this year the Sacramento Association

of Realtors stopped showing distressed sales for condos/townhomes, though it

reported such data in its press release.

The August press release was not yet available on its website.

From CR: Look at the two columns in the table for Total "Distressed" Share. In every area that has reported distressed sales so far, the share of distressed sales is down year-over-year.

Also there has been a decline in foreclosure sales in all of these cities.

And now short sales are declining year-over-year too! This is a recent change - short sales had been increasing year-over-year, but it looks like both categories of distressed sales are now declining.

The All Cash Share is mostly declining. When investors pull back in markets like Phoenix (already declining), the share of all cash buyers will probably decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Aug-13 | Aug-12 | Aug-13 | Aug-12 | Aug-13 | Aug-12 | Aug-13 | Aug-12 | |

| Las Vegas | 25.0% | 43.7% | 8.0% | 16.9% | 33.0% | 60.6% | 52.5% | 52.5% |

| Reno | 21.0% | 38.0% | 7.0% | 15.0% | 28.0% | 53.0% | ||

| Phoenix | 10.3% | 29.4% | 8.9% | 14.0% | 19.3% | 43.4% | 34.1% | 44.7% |

| Sacramento** | 14.4% | 34.9% | 4.6% | 16.6% | 19.0% | 51.5% | 25.4% | 33.1% |

| Minneapolis | 5.5% | 10.7% | 15.1% | 25.2% | 20.6% | 35.9% | ||

| Mid-Atlantic | 7.6% | 11.8% | 7.0% | 8.7% | 14.6% | 20.6% | 17.5% | 17.9% |

| Orlando | 16.8% | 28.7% | 16.7% | 23.4% | 33.5% | 52.1% | 45.9% | 53.0% |

| California * | 13.2% | 26.4% | 7.8% | 20.0% | 21.0% | 46.4% | ||

| Bay Area CA* | 10.0% | 23.6% | 4.6% | 14.5% | 14.6% | 38.1% | 22.4% | 27.9% |

| So. California* | 13.6% | 26.6% | 7.1% | 19.2% | 20.7% | 45.8% | 27.6% | 32.3% |

| Hampton Roads | 21.0% | 24.4% | ||||||

| Northeast Florida | 35.7% | 40.7% | ||||||

| Toledo | 30.1% | 35.9% | ||||||

| Tucson | 29.1% | 33.3% | ||||||

| Omaha | 17.0% | 15.4% | ||||||

| Pensacola | 33.7% | 30.7% | ||||||

| Memphis* | 16.4% | 28.8% | ||||||

| Birmingham AL | 21.2% | 27.8% | ||||||

| Springfield IL | 10.4% | 12.5% | ||||||

| *share of existing home sales, based on property records | ||||||||

| **Single Family Only | ||||||||

Key Measures Show Low Inflation in August

by Calculated Risk on 9/17/2013 12:14:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.0% annualized rate) in August. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.5% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for August here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.1% annualized rate) in August. The CPI less food and energy increased 0.1% (1.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.7%, the CPI rose 1.5%, and the CPI less food and energy rose 1.8%. Core PCE is for July and increased just 1.2% year-over-year.

On a monthly basis, median CPI was at 2.1% annualized, trimmed-mean CPI was at 1.5% annualized, and core CPI increased 1.5% annualized. Also core PCE for July increased 0.9% annualized.

These measures indicate inflation is below the Fed's target.

NAHB: Builder Confidence unchanged in September at 58

by Calculated Risk on 9/17/2013 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was unchanged in September at 58. Any number above 50 indicates that more builders view sales conditions as good than poor. (August was revised down from 59 to 58).

From the NAHB: Builder Confidence Unchanged in September

Following four consecutive months of improvement, builder confidence in the market for newly built, single-family homes held unchanged in September with a reading of 58 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

“Following a solid run up in builder confidence over the past year, we are seeing a pause in the momentum as consumers wait to see where interest rates settle and as the headwinds of tight credit, shrinking supplies of lots for development and increasing labor costs continue,” noted NAHB Chief Economist David Crowe.

...

HMI component indexes were mixed in September. While the component gauging current sales conditions held unchanged at 62, the component gauging sales expectations in the next six months declined three points to 65 and the component gauging traffic of prospective buyers increased one point, to 47.

All four regions posted gains in their three-month moving average HMI scores in September, including a two-point gain to 41 in the Northeast, a four-point gain to 64 in the Midwest, a two-point gain to 56 in the South and a four-point gain to 61 in the West, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the September release for the HMI and the July data for starts (August housing starts will be released tomorrow). This was just below the consensus estimate of a reading of 59.

CPI increases 0.1% in August, Core CPI 0.1%

by Calculated Risk on 9/17/2013 08:30:00 AM

From the Bureau of Labor Statistics (BLS): Consumer Price Index - June 2013

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in August on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.5 percent before seasonal adjustment.On a year-over-year basis, CPI is up 1.5 percent, and core CPI is up also up 1.8 percent. Both are below the Fed's target. This was close to the consensus forecast of a 0.2% increase for CPI, and a 0.1% increase in core CPI.

...

The index for all items less food and energy increased 0.1 percent in August after increasing 0.2 percent in each of the three previous months. ... The index for all items less food and energy increased 1.8 percent for the 12 months ending August.

emphasis added

Note: CPI-W (used for cost of living adjustment, COLA) is also up 1.5% year-over-year in August. The COLA is calculated using the average Q3 data (July, August, and September).

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.5 percent over the last 12 months to an index level of 230.359 (1982-84=100). For the month, the index increased 0.1 percent prior to seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Monday, September 16, 2013

Tuesday: CPI, Homebuilder Confidence

by Calculated Risk on 9/16/2013 10:50:00 PM

From the NY Times: Push for Yellen To Lead at Fed Gathers Steam

Janet L. Yellen told friends in recent weeks that she did not expect to be nominated as the next chairman of the Federal Reserve. Although she had been the Fed’s vice chairman since 2010 and would make history as the first woman to hold the job, President Obama’s aides made clear throughout the summer that he wanted Lawrence H. Summers, his former chief economic adviser.I expect Yellen to be nominated for Fed Chair, probably next week.

... the president’s advisers insisted throughout the summer that Mr. Obama was not averse to Ms. Yellen but simply more comfortable with Mr. Summers, a former Treasury secretary to President Bill Clinton who was Mr. Obama’s chief White House economic adviser through the height of the financial crisis and recession in 2009 and 2010. ...

Tuesday:

• 8:30 AM ET, the Consumer Price Index for August will be released. The consensus is for a 0.1% increase in CPI in August and for core CPI to increase 0.2%.

• At 10:00 AM, The September NAHB homebuilder survey. The consensus is for a reading of 59, the same as in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

Weekly Update: Existing Home Inventory is up 21.1% year-to-date on Sept 16th

by Calculated Risk on 9/16/2013 06:55:00 PM

Here is another weekly update on housing inventory: One of key questions for 2013 is Will Housing inventory bottom this year? Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for July). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 21.1%. There might be some further increases over the next few weeks, but then inventory should start declining seasonally.

It is important to remember that inventory is still very low, and is down 3.6% from the same week last year according to Housing Tracker.

The second graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2012 and 2013.

Inventory in 2013 is still 3.6% below the same week in 2012, but the inventory level is getting close to last year.

Inventory in 2013 is still 3.6% below the same week in 2012, but the inventory level is getting close to last year.

This strongly suggests inventory bottomed early this year, and I expect inventory to be up year-over-year very soon, and I also expect the seasonal decline to be less than usual at the end of the year. This increase in inventory should slow house price increases.

Lawler: Early Look at Existing Home Sales in August

by Calculated Risk on 9/16/2013 04:58:00 PM

From housing economist Tom Lawler:

Based on publicly-released reports from various regional realtor associations/MLS, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.35 million in August, down 0.7% from July’s pace. Folks who track local realtor reports but just focus on YOY trends might find this estimate surprisingly high, as the raw data suggest a sizable slowdown in YOY home sales growth in August compared to July (about 9 1/2% for August, compared to 20.7% for July). However, one must recall that (1) last August seasonally adjusted existing home sales were 5.2% higher than last July’s pace; and (2) there was one fewer business day this August compared to last August, while this July had one more business day than last July.

While not enough local realtors/MLS report new pending home sales to the public for me to derive an accurate estimate for national pending sales, many (though not all) that do reported significant (and larger than seasonal) declines in pending sales last month. My “gut” based on the data I’ve seen is that the NAR’s pending home sales index in August will be down about 5% from July.

On the inventory front, based on data from listings trackers and, local realtor association/MLS reports I estimate that the NAR’s estimate of the number of existing homes for sale at the end of August will be 2.31 million, up 1.5% from July and down 3.75% from last August.

CR Note: The NAR is scheduled to report August existing home sales on Thursday, Sept 19th. The consensus is for sales of 5.25 million on seasonally adjusted annual rate (SAAR) basis.

Based on Tom's estimates of a 5.35 million sales rate, and inventory at around 2.31 million for August, months-of-supply will be around 5.2 (up from 5.1 months in July). This would still be a very low level of inventory - probably the lowest for August since 2003 or so - also a 3.8% year-over-year decline in inventory would be the smallest year-over-year decline since March 2011. Note: In July inventory was down 5.0% compared to July 2012. These smaller year-over-year declines suggest inventory bottomed earlier this year.