by Calculated Risk on 9/14/2013 06:31:00 PM

Saturday, September 14, 2013

Hedge Fund Risk and Andy Lo's "Capital Decimation Partners"

Professor Krugman writes: Heads They Win, Tails We Lose

Many years ago MIT’s Andy Lo made a simple point (weirdly, I haven’t been able to track down the paper) about the distortion of incentives inherent in financial-industry compensation. Suppose you’re a hedge fund manager, getting 2 and 20 — fees of 2 percent of investors’ money, plus 20 percent of profits. What you want to do is load up on as much leverage as possible, and make high-risk, high return investments. This more or less guarantees that your fund will eventually go bust — but in the meantime you’ll have raked in huge personal earnings, and can walk away filthy rich from the wreckage.Andy Lo's article was published in the Financial Analysts Journal in 2001: Risk Management for Hedge Funds: Introduction and Overview. An online copy is available here.

But surely, you say, investors will see through this strategy. They can’t consistently be that stupid or naive, can they?

Hahahaha.

Jim Hamilton at Econbrowser has a nice summary from 2005: Hedge fund risk

[L]et me tell you about one fund I do know about called CDP, which was described by MIT Professor Andrew Lo in an article published in Financial Analysts Journal in 2001.Of course the strategy would eventually go bust, but the managers would be rich!!!

1992-1999 was a good time to be in stocks-- a strategy of buying and holding the S&P 500 would have earned you a 16% annual return, with $100 million invested in 1992 growing to $367 million by 1999. As nice as this was, it pales in comparison to CDP's strategy, which would have turned $100 million into $2.7 billion, a 41% annual compounded return, with a positive return in every single year.

Schedule for Week of September 15th

by Calculated Risk on 9/14/2013 01:01:00 PM

The key event this week will be the FOMC statement and press conference on Wednesday. It is possible that the FOMC will start to reduce the monthly purchases of assets. I'll post a preview soon.

There are three key housing reports that will be released this week, housing starts on Wednesday, homebuilder confidence survey on Tuesday, and existing home sales on Thursday.

For manufacturing, August Industrial Production, and the NY Fed (Empire State) and Philly Fed September surveys will be released this week. For prices, CPI will be released on Tuesday.

8:30 AM: NY Fed Empire Manufacturing Survey for September. The consensus is for a reading of 9.0, up from 8.2 in August (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This graph shows industrial production since 1967.

The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

8:30 AM: Consumer Price Index for August. The consensus is for a 0.1% increase in CPI in August and for core CPI to increase 0.2%.

10:00 AM ET: The September NAHB homebuilder survey. The consensus is for a reading of 59, the same as in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. Total housing starts were at 896 thousand (SAAR) in July. Single family starts were at 591 thousand SAAR in July.

The consensus is for total housing starts to increase to 915 thousand (SAAR) in August.

During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. It is possible the FOMC will start to reduce QE purchases following this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 341 thousand from 292 thousand last week.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for sales of 5.25 million on seasonally adjusted annual rate (SAAR) basis. Sales in July were at a 5.39 million SAAR.

A key will be inventory and months-of-supply.

10:00 AM: the Philly Fed manufacturing survey for September. The consensus is for a reading of 10.0, up from 9.3 last month (above zero indicates expansion).

10:00 AM: Regional and State Employment and Unemployment (Monthly) for August 2013

Unofficial Problem Bank list declines to 700 Institutions

by Calculated Risk on 9/14/2013 08:10:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for September 13, 2013.

Changes and comments from surferdude808:

The FDIC shuttered two banks this Friday to keep things interesting. The failures and two action terminations caused the Unofficial Problem Bank List to drop to 700 institutions with assets of $246.0 billion. A year ago, the list held 866 institutions with assets of $330.5 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. Less than two years later the list peaked at 1,002 institutions. Now, more than two years after the peak, the list is down to 700 (the list increased faster than it is decreasing - but it is steadily decreasing as regulators terminate actions and close a few more banks).

Actions were terminated against Nextier Bank, National Association, Evans City, PA ($510 million) and Seattle Bank, Seattle, WA ($223 million). Failures this week were First National Bank, Edinburg, TX ($3.1 billion) and The Community's Bank, Bridgeport, CT ($26 million). The failure in Connecticut is only the second in FDIC's Boston Region since the onset of the financial crisis. In this region, proactive local supervision leadership contributed to the comparatively stellar failure performance as reflected by the low number of failed institutions and low volume of failed bank assets.

According to a report published by SNL Securities (Bankruptcy judge will not permit Capitol Bancorp's FDIC 'fishing expedition') on September 12th, the presiding bankruptcy judge denied the holding company's request to conduct discovery to determine if the FDIC has not acted in good faith by not approving cross-guarantee waivers. An FDIC attorney said the agency would reach a decision on the waivers "as quickly as it can." So the saga of Capitol Bancorp continues.

Next week, we anticipate the OCC will release its actions through mid-August.

Friday, September 13, 2013

Bank Failure #22 in 2013: First National Bank, Edinburg, Texas

by Calculated Risk on 9/13/2013 07:52:00 PM

From the FDIC: PlainsCapital Bank, Dallas, Texas, Assumes All of the Deposits of First National Bank, Edinburg, Texas

As of June 30, 2013, First National Bank had approximately $3.1 billion in total assets and $2.3 billion in total deposits. In addition to assuming all of the deposits of First National Bank, PlainsCapital Bank agreed to purchase approximately $2.7 billion of First National Bank's assets. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $637.5 million. ... First National Bank is the 22nd FDIC-insured institution to fail in the nation this year, and the first in Texas. The last FDIC-insured institution closed in the state was First International Bank, Plano, on September 30, 2011.The FDIC is still at work. First National Bank was bigger than most recent failures.

Bank Failure #21 in 2013: The Community's Bank, Bridgeport, Connecticut

by Calculated Risk on 9/13/2013 05:28:00 PM

From the FDIC: FDIC Approves the Payout of the Insured Deposits of The Community's Bank, Bridgeport, Connecticut

The FDIC was unable to find another financial institution to take over the banking operations of The Community's Bank. The FDIC will mail checks directly to depositors of The Community's Bank for the amount of their insured money. ...No one wanted this one - and it sounds like there might be some accounts over the insured limit.

Beginning Monday, depositors of The Community's Bank with more than $250,000 at the bank may visit the FDIC's Web page "Is My Account Fully Insured?" at http://www2.fdic.gov/dip/Index.asp to determine their insurance coverage.

As of June 30, 2013, The Community's Bank had approximately $26.3 million in total assets and $25.7 million in total deposits. The amount of uninsured deposits will be determined once the FDIC obtains additional information from those customers.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $7.8 million. The Community's Bank is the 21st FDIC-insured institution to fail in the nation this year, and the first in Connecticut. The last FDIC-insured institution closed in the state was Connecticut Bank of Commerce, Stamford, on June, 26, 2002.

DataQuick on California Bay Area: Sales "Dip" in August, Distressed Sales Down

by Calculated Risk on 9/13/2013 04:57:00 PM

From DataQuick: Bay Area August Home Sales Dip; Median Price Eases Back From July

A total of 8,616 new and resale houses and condos were sold in the nine-county Bay Area last month. That was down 7.7 percent from 9,339 in July and down 0.6 percent from 8,670 in August last year, according to San Diego-based DataQuick.The key in this report is the decline in distressed sales (foreclosures and short sales). Distressed sales are now down to 14.6% from 37.8% in August 2012.

Last month’s sales were 10.3 percent behind the long-term August average of 9,601. August sales have ranged from 6,688 in 1992 to 13,940 in 2004. DataQuick’s statistics begin in 1988 and the Bay Area has had below-average sales every month since the fall of 2006.

...

Foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 4.6 percent of resales in August, the same as July’s revised percentage, and down from 14.5 percent a year ago. The July and August level is the lowest since 4.4 percent in August 2007. Foreclosure resales peaked at 52.0 percent in February 2009. The monthly average for foreclosure resales over the past 17 years is about 10 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 10.0 percent of Bay Area resales last month. That was down from an estimated 10.6 percent in July and down from 23.3 percent a year earlier.

Hotels: Occupancy Rate tracking pre-recession levels

by Calculated Risk on 9/13/2013 12:49:00 PM

NOTE: Calculated Risk blog is loading slowly for some readers. This is apparently a problem with either Google or Amazon hosting, and is currently being investigated.

Another update on hotels from HotelNewsNow.com: STR: US results for week ending 7 September

In year-over-year comparisons, occupancy fell 1.9 percent to 56.5 percent, average daily rate was down 0.4 percent to US$102.58, and revenue per available room decreased 2.3 percent to US$57.98.The 4-week average of the occupancy rate is close to normal levels.

"Rosh Hashanah and Labor Day had an adverse effect on hotel performance last week,” said Jan Freitag, senior VP of strategic development at STR. “RevPAR declined as both ADR and occupancy dropped from the same week last year. Of all the Chain Scales, only Economy properties reported a very slight lift in RevPAR. The last end of summer vacation rush lifted resort RevPAR by 3.9 percent, driven by a 5.8-percent increase in ADR."

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2013, yellow is for 2012, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Through September 7th, the 4-week average of the occupancy rate is slightly higher than the same period last year and is tracking the pre-recession levels. The 4-week average of the occupancy rate will decrease over the next few weeks, before increasing again in the Fall. Overall, this has been a decent year for the hotel industry.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Preliminary September Consumer Sentiment decreases to 76.8

by Calculated Risk on 9/13/2013 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for September was at 76.8, down from the August reading of 82.1.

This was below the consensus forecast of 82.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011. This decline could be related to the situation in Syria ... it is probably too early to see the impact of the threats by Congress to "not pay the bills" in October.

Retail Sales increased 0.2% in August

by Calculated Risk on 9/13/2013 08:53:00 AM

On a monthly basis, retail sales increased 0.2% from July to August (seasonally adjusted), and sales were up 4.7% from August 2012. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for August, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $426.6 billion, an increase of 0.2 percent from the previous month, and 4.7 percent above August 2012. ... The June to July 2013 percent change was revised from +0.2 percent to +0.4 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 28.7% from the bottom, and now 12.8% above the pre-recession peak (not inflation adjusted)

Retail sales ex-autos increased 0.1%.

Excluding gasoline, retail sales are up 25.8% from the bottom, and now 13.3% above the pre-recession peak (not inflation adjusted).

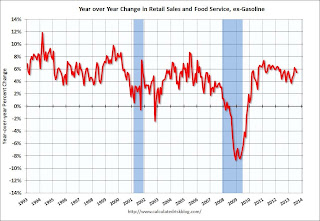

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.Retail sales ex-gasoline increased by 5.4% on a YoY basis (4.7% for all retail sales).

This was below the consensus forecast of 0.5% increase in retail sales, however sales for July were revised up.

Thursday, September 12, 2013

Friday: Retail Sales, PPI, Consumer sentiment

by Calculated Risk on 9/12/2013 08:30:00 PM

Off topic: Elvis has left the building ... from the LA Times: NASA confirms Voyager 1 has left the solar system

NASA confirmed Thursday that after 36 years of space travel and months of heated debate among scientists, Voyager 1 has indeed left our solar system and had entered interstellar space more than a year ago.A small step on to the future colonization of the Milky Way.

"Voyager has boldly gone where no probe has gone before, marking one of the most significant technological achievements in the annals of the history of science," said John Grunsfeld, NASA's associate administrator for the Science Mission Directorate.

At a Thursday news conference in Washington, D.C., officials said the belated confirmation was based on new "key" evidence involving space plasma density. The evidence was outlined in a paper published online Thursday in the journal Science.

Lead author Don Gurnett, a University of Iowa plasma physicist and a Voyager project scientist, said the data showed conclusively that Voyager 1 had exited the heliopause — the bubble of hot, energetic particles that surrounds our sun and planets — and entered into a region of cold, dark space called the interstellar medium.

Friday:

• At 8:30 AM ET, the Retail sales report for August will be released. The consensus is for retail sales to increase 0.5% in August, and to increase 0.3% ex-autos.

• Also at 8:30 AM, the Producer Price Index for August. The consensus is for a 0.2% increase in producer prices (0.1% increase in core).

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for a reading of 82.0, down from 82.1 in August.

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales (business inventories) report for July. The consensus is for a 0.3% increase in inventories.