by Calculated Risk on 9/13/2013 07:52:00 PM

Friday, September 13, 2013

Bank Failure #22 in 2013: First National Bank, Edinburg, Texas

From the FDIC: PlainsCapital Bank, Dallas, Texas, Assumes All of the Deposits of First National Bank, Edinburg, Texas

As of June 30, 2013, First National Bank had approximately $3.1 billion in total assets and $2.3 billion in total deposits. In addition to assuming all of the deposits of First National Bank, PlainsCapital Bank agreed to purchase approximately $2.7 billion of First National Bank's assets. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $637.5 million. ... First National Bank is the 22nd FDIC-insured institution to fail in the nation this year, and the first in Texas. The last FDIC-insured institution closed in the state was First International Bank, Plano, on September 30, 2011.The FDIC is still at work. First National Bank was bigger than most recent failures.

Bank Failure #21 in 2013: The Community's Bank, Bridgeport, Connecticut

by Calculated Risk on 9/13/2013 05:28:00 PM

From the FDIC: FDIC Approves the Payout of the Insured Deposits of The Community's Bank, Bridgeport, Connecticut

The FDIC was unable to find another financial institution to take over the banking operations of The Community's Bank. The FDIC will mail checks directly to depositors of The Community's Bank for the amount of their insured money. ...No one wanted this one - and it sounds like there might be some accounts over the insured limit.

Beginning Monday, depositors of The Community's Bank with more than $250,000 at the bank may visit the FDIC's Web page "Is My Account Fully Insured?" at http://www2.fdic.gov/dip/Index.asp to determine their insurance coverage.

As of June 30, 2013, The Community's Bank had approximately $26.3 million in total assets and $25.7 million in total deposits. The amount of uninsured deposits will be determined once the FDIC obtains additional information from those customers.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $7.8 million. The Community's Bank is the 21st FDIC-insured institution to fail in the nation this year, and the first in Connecticut. The last FDIC-insured institution closed in the state was Connecticut Bank of Commerce, Stamford, on June, 26, 2002.

DataQuick on California Bay Area: Sales "Dip" in August, Distressed Sales Down

by Calculated Risk on 9/13/2013 04:57:00 PM

From DataQuick: Bay Area August Home Sales Dip; Median Price Eases Back From July

A total of 8,616 new and resale houses and condos were sold in the nine-county Bay Area last month. That was down 7.7 percent from 9,339 in July and down 0.6 percent from 8,670 in August last year, according to San Diego-based DataQuick.The key in this report is the decline in distressed sales (foreclosures and short sales). Distressed sales are now down to 14.6% from 37.8% in August 2012.

Last month’s sales were 10.3 percent behind the long-term August average of 9,601. August sales have ranged from 6,688 in 1992 to 13,940 in 2004. DataQuick’s statistics begin in 1988 and the Bay Area has had below-average sales every month since the fall of 2006.

...

Foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 4.6 percent of resales in August, the same as July’s revised percentage, and down from 14.5 percent a year ago. The July and August level is the lowest since 4.4 percent in August 2007. Foreclosure resales peaked at 52.0 percent in February 2009. The monthly average for foreclosure resales over the past 17 years is about 10 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 10.0 percent of Bay Area resales last month. That was down from an estimated 10.6 percent in July and down from 23.3 percent a year earlier.

Hotels: Occupancy Rate tracking pre-recession levels

by Calculated Risk on 9/13/2013 12:49:00 PM

NOTE: Calculated Risk blog is loading slowly for some readers. This is apparently a problem with either Google or Amazon hosting, and is currently being investigated.

Another update on hotels from HotelNewsNow.com: STR: US results for week ending 7 September

In year-over-year comparisons, occupancy fell 1.9 percent to 56.5 percent, average daily rate was down 0.4 percent to US$102.58, and revenue per available room decreased 2.3 percent to US$57.98.The 4-week average of the occupancy rate is close to normal levels.

"Rosh Hashanah and Labor Day had an adverse effect on hotel performance last week,” said Jan Freitag, senior VP of strategic development at STR. “RevPAR declined as both ADR and occupancy dropped from the same week last year. Of all the Chain Scales, only Economy properties reported a very slight lift in RevPAR. The last end of summer vacation rush lifted resort RevPAR by 3.9 percent, driven by a 5.8-percent increase in ADR."

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2013, yellow is for 2012, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Through September 7th, the 4-week average of the occupancy rate is slightly higher than the same period last year and is tracking the pre-recession levels. The 4-week average of the occupancy rate will decrease over the next few weeks, before increasing again in the Fall. Overall, this has been a decent year for the hotel industry.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Preliminary September Consumer Sentiment decreases to 76.8

by Calculated Risk on 9/13/2013 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for September was at 76.8, down from the August reading of 82.1.

This was below the consensus forecast of 82.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011. This decline could be related to the situation in Syria ... it is probably too early to see the impact of the threats by Congress to "not pay the bills" in October.

Retail Sales increased 0.2% in August

by Calculated Risk on 9/13/2013 08:53:00 AM

On a monthly basis, retail sales increased 0.2% from July to August (seasonally adjusted), and sales were up 4.7% from August 2012. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for August, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $426.6 billion, an increase of 0.2 percent from the previous month, and 4.7 percent above August 2012. ... The June to July 2013 percent change was revised from +0.2 percent to +0.4 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 28.7% from the bottom, and now 12.8% above the pre-recession peak (not inflation adjusted)

Retail sales ex-autos increased 0.1%.

Excluding gasoline, retail sales are up 25.8% from the bottom, and now 13.3% above the pre-recession peak (not inflation adjusted).

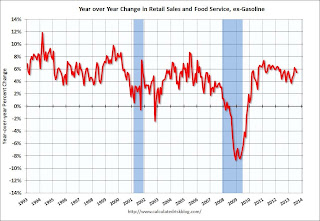

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.Retail sales ex-gasoline increased by 5.4% on a YoY basis (4.7% for all retail sales).

This was below the consensus forecast of 0.5% increase in retail sales, however sales for July were revised up.

Thursday, September 12, 2013

Friday: Retail Sales, PPI, Consumer sentiment

by Calculated Risk on 9/12/2013 08:30:00 PM

Off topic: Elvis has left the building ... from the LA Times: NASA confirms Voyager 1 has left the solar system

NASA confirmed Thursday that after 36 years of space travel and months of heated debate among scientists, Voyager 1 has indeed left our solar system and had entered interstellar space more than a year ago.A small step on to the future colonization of the Milky Way.

"Voyager has boldly gone where no probe has gone before, marking one of the most significant technological achievements in the annals of the history of science," said John Grunsfeld, NASA's associate administrator for the Science Mission Directorate.

At a Thursday news conference in Washington, D.C., officials said the belated confirmation was based on new "key" evidence involving space plasma density. The evidence was outlined in a paper published online Thursday in the journal Science.

Lead author Don Gurnett, a University of Iowa plasma physicist and a Voyager project scientist, said the data showed conclusively that Voyager 1 had exited the heliopause — the bubble of hot, energetic particles that surrounds our sun and planets — and entered into a region of cold, dark space called the interstellar medium.

Friday:

• At 8:30 AM ET, the Retail sales report for August will be released. The consensus is for retail sales to increase 0.5% in August, and to increase 0.3% ex-autos.

• Also at 8:30 AM, the Producer Price Index for August. The consensus is for a 0.2% increase in producer prices (0.1% increase in core).

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for a reading of 82.0, down from 82.1 in August.

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales (business inventories) report for July. The consensus is for a 0.3% increase in inventories.

Freddie Mac: Mortgage Rates Hold Steady near Highs for Year

by Calculated Risk on 9/12/2013 06:10:00 PM

From Freddie Mac today: Mortgage Rates Hold Steady

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates relatively unchanged from last week following a mixed employment report, and holding steady near their highs for the year. ...The high this year for 30 year rates in the Freddie Mac survey was 4.58%, and the high for 15 year rates was 3.60%.

30-year fixed-rate mortgage (FRM) averaged 4.57 percent with an average 0.8 point for the week ending September 12, 2013, unchanged from last week. A year ago at this time, the 30-year FRM averaged 3.55 percent.

15-year FRM this week averaged 3.59 percent with an average 0.7 point, unchanged from last week. A year ago at this time, the 15-year FRM averaged 2.85 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The refinance index has dropped sharply recently (down 71% since early May) and will probably decline further if rates stay at this level.

DataQuick: August SoCal Home Sales down slightly from July, Up 2.8% year-over-year, Distressed Sales down

by Calculated Risk on 9/12/2013 01:34:00 PM

From DataQuick: Southland Median Sale Price Steady Month-to-Month, Up Sharply Year-Over-Year

A total of 23,057 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 0.8 percent from a revised 23,253 sales in July, and up 2.8 percent from 22,438 sales in August 2012, according to San Diego-based DataQuick.This is moving in the right direction (fewer distressed sales, fewer absentee buyers).

Last month’s sales were 12.8 percent below the average number of sales – 26,452 – in the month of August since 1988, when DataQuick’s statistics begin. Southland sales haven’t been above average for any particular month in more than seven years. August sales have ranged from 16,379 in August 1992 to 39,562 in August 2003.

In a sign of continued market confidence, Southern California home buyers continue to put near-record amounts of their own money into residential real estate. In August they paid a total of $4.68 billion out of their own pockets in the form of down payments or cash purchases. That was down from a revised $5.18 billion in July and up from $4.24 billion a year ago. The out-of-pocket total peaked this May at $5.41 billion.

“There’s something for everyone in today’s housing data. Sellers have seen an amazing price jump from just a year ago, allowing many to finally sell at a profit. Home shoppers have more properties to choose as we begin to see a ‘supply response’ to higher values. Price pressures appear to be easing, though, amid higher mortgage rates, more supply and fewer cash and investor purchases. As we head into fall and winter, a slower time of year, we’ll probably see year-over-year price gains continue to taper,” said John Walsh, DataQuick president.

In August, foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 7.1 percent of the Southland resale market. That was down from a revised 7.7 percent the month before and down from 19.2 percent a year earlier. Last month’s foreclosure resale rate was the lowest since it was 5.5 percent in June 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 13.6 percent of Southland resales last month. That was the lowest level since it was also 13.6 percent in April 2009. Last month’s short sale figure was down from an estimated 14.6 percent the month before and down from 26.6 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 26.3 percent of the Southland homes sold last month, which is the lowest share for any month since it was 25.1 percent in November 2011. Last month’s level was down from 27.4 percent the month before and down from 27.2 percent a year earlier.

emphasis added

Report: Homes Listed For Sales increased in August, Down only 2.5% year-over-year

by Calculated Risk on 9/12/2013 10:27:00 AM

From Nick Timiraos at the WSJ: Sellers Test Housing Market Amid Rising Prices

Housing inventories increased in August and stood just 2.5% below their levels of a year ago, offering the latest sign that more sellers are testing the market after swift home-price gains over the past year.Note: Here is the realtor.com site (not updated with August data yet at posting time). The year-over-year decline is getting smaller each month. As an example, Realtor.com reported that the year-over-year decline was 16% in February, 7.3% in June, 5.2% in July - and is now down to just 2.5% (August 2013 inventory is 2.5% below August 2012 inventory).

Nationally, there were 1.98 million homes listed for sale in August, according to a report released Thursday by Realtor.com. That was up by more than 24% from the low point in February and up 1% from July. Inventories have increased for six straight months.

While the overall level of homes for sale remains relatively depressed, the report suggests that inventory may have hit a bottom earlier this year after an extended two-year decline.

emphasis added

This was the smallest year-over-year (YoY) decrease since 2011, and it appears the YoY change will turn positive soon. My guess is the YoY change for inventory will probably turn positive in September and that inventory bottomed in early 2013.