by Calculated Risk on 9/11/2013 09:42:00 AM

Wednesday, September 11, 2013

Repeating myself on the "Debt Ceiling"

The bottom line is Congress is being silly (again), and they will raise the debt ceiling. It is just a matter of when. It looks like the "debt ceiling" will be reached on October 18th. Note: There is a reason Congress never threatens to default right before an election, they hope everyone will forget!

I wrote several posts about the "debt ceiling" debates in 2011 and early 2013 (only odd years, not even years because of elections). The debate clearly scared many Americans in 2011 and negatively impacted the economy. Congress folded earlier in early 2013. Hopefully this time the "debt ceiling" will be raised again in advance of the deadline.

Here are some excerpts from some previous posts ...

I prefer "default ceiling" because "debt ceiling" sounds like some sort of virtuous limit, when, in reality, the vote is about whether or not to the pay the bills - and not paying the bills is reckless and irresponsible.

A key point is that all of the talk in Congress is just a bluff. They will fold. As Republican Senator Mitch McConnell noted in 2011, if the debt ceiling isn't raised the "Republican brand" would become toxic and synonymous with fiscal irresponsibility.

I reread some of my posts from 2011, as an example Debt Ceiling Charade: The Smart Options.

Option #1: Eliminate the debt ceiling. The debt ceiling is a joke. It serves no purpose except political posturing. It is not about the deficit - it is about paying the bills, and the U.S. will pay the bills.I still prefer Option #1, but one thing is clear, the Congress will fold and the debt ceiling will be raised.

...

Option #2: Pass a "clean" bill raising the debt ceiling enough to get through the next election (so the politicians don't have to embarrass themselves again). Congress could do this at any time. That is why voters would blame the party controlling the House if the debt ceiling is not raised.

In 2011, I started writing about the debt ceiling when it became clear the threat of default was impacting the economy. A couple of old posts: Debt Ceiling Charade impacting Short-Term Credit Markets and Random Thoughts. From July 30, 2011:

"I remain confident that Congress will raise the debt ceiling; however the circus in D.C. is clearly impacting the economy. This morning I spoke to a business owner who is negotiating a new lease to expand. His lawyer told him not to sign the lease until the debt ceiling issue is resolved. I believe similar caution has gripped business owners and consumers in many places - and impacting consumer and business confidence."It is now time to start criticizing Congress again before the economy is impacted; 2011 was ridiculous and reckless.

MBA: Mortgage Refinance Activity at Lowest Level since 2009

by Calculated Risk on 9/11/2013 07:03:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 13.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 6, 2013. This week’s results included an adjustment for the Labor Day holiday. ...

The Refinance Index decreased 20 percent from the previous week. The Refinance Index has fallen 71 percent from its recent peak the week of May 3, 2013 and is at the lowest level since June 2009. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.80 percent from 4.73 percent, with points increasing to 0.46 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 71% since early May.

The last time the index declined like this was in late 2010 and early 2011 when mortgage increased sharply with the Ten Year Treasury rising from 2.5% to 3.5%. We've seen an even larger increase over the last few months with the Ten Year Treasury yield up from 1.6% to over 2.96% today. We will probably see the refinance index back to 2000 levels soon.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index was generally been trending up over the last year (but down over the last few months), and the 4-week average of the purchase index is up about 3% from a year ago.

Tuesday, September 10, 2013

Wednesday: Mortgage Applications

by Calculated Risk on 9/10/2013 10:51:00 PM

For enjoyment, from Jim the Realtor Bubbleinfo TV:Two Grandmas (at the bottom or link here).

The first house is way overpriced, and although we are seeing more inventory, some of it is OPT (Over Priced Turkeys).

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. Expect another sharp drop in refinance activity.

• At 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories for July. The consensus is for a 0.3% increase in inventories.

Lawler: Consistent with Other US Housing Reports, Negative Equity Estimates Vary Widely!

by Calculated Risk on 9/10/2013 05:42:00 PM

CR Note: This is from housing economist Tom Lawler. Lawler has been pointing out the inconsistency in US housing data; this time on negative equity.

CoreLogic released its “Equity Report” for the second quarter of 2013, in which the company estimates the distribution of equity (home value less mortgage balance) across all U.S. single-family residential properties with a mortgage. ...

Given that this report is based on US housing data, it just “wouldn’t be right” if there weren’t other reports that show significantly different “negative equity” estimates. Zillow and RealtyTrac, e.g., have negative equity reports for the second quarter, and LPS Analytics released its own estimate for the number of residential properties in a negative equity position in March, 2013 (14.7%, compared to CoreLogic’s Q1 estimate of 19.7%). Below is a table showing different estimates.

RealtyTrac’s report has three categories: “deeply underwater” (LTV >=125%); “resurfacing equity” (LTV 90% to 110%); and “equity rich” (LTV 50% or lower). RT said that its “estimates” were as of the beginning of September, but I have no clue how it derived home values as of the beginning of September.

There are two main sources of differences in negative equity estimates: the first, of course, is the value of the underlying property. The second is the current mortgage balance (including first and junior liens) on each underlying property. In many cases the only public data available are the original mortgage balances of closed-end first and second liens, and for HELOCs the total line of credit (as opposed to utilization). CoreLogic adjusts public record data on mortgages for amortization and home equity utilization to get a “true” (read "estimated”) level of the mortgage balance for each property. Zillow says that it has “partnered” with TransUnion to get “actual” current outstanding mortgage balances. I’m fairly certain RealtyTrac doesn’t make any such adjustment, and its estimate that 23.7% of homes with mortgages are “deeply underwater” is almost certainly [incorrect].

| Homes w/Mortgages (millions and percent), Latest Negative Equity Report | ||||

|---|---|---|---|---|

| CoreLogic (6/30/13) | Zillow (6/30/13) | RealtyTrac (9/1/13) | LPS (3/31/13) | |

| Homes w/ Mortgage | 48.6 | 51.4 | 46.5 | 50.0 |

| Negative Equity | 7.1 | 12.2 | 7.3 | |

| Negative Equity >25% | 2.8 | 10.7 | ||

| Negative Equity >20% | 7.0 | |||

| Negative Equity (%) | 14.6% | 23.8% | 14.7% | |

| Negative Equity >25% (%) | 5.8% | 23.0% | ||

| Negative Equity >20% (%) | 13.6% | |||

Las Vegas Real Estate in August: Year-over-year Non-contingent Inventory up 41%

by Calculated Risk on 9/10/2013 01:13:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports 19-month run of rising home prices, increased inventory

GLVAR said the total number of existing local homes, condominiums and townhomes sold in August was 3,539. That’s down from 3,633 in July and down from 3,688 total sales in August 2012. ...There are several key trends that we've been following:

...

GLVAR has also been reporting fewer foreclosures and short sales – which occur when a lender agrees to sell a home for less than what the borrower owes on the mortgage. In August, 25 percent of all existing home sales were short sales, down from 28 percent in July. Another 8 percent of all August sales were bank-owned properties, unchanged from July. The remaining 67 percent of all sales were the traditional type, up from 64 percent in July and as high as that percentage has been in several years.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service increased in August, with 14,472 single-family homes listed for sale at the end of the month. That’s up 2.4 percent from 14,133 single-family homes listed for sale at the end of July, but down 15.1 percent from last year. ...

GLVAR also reported more available homes listed for sale without any sort of pending or contingent offer. By the end of August, GLVAR reported 5,612 single-family homes listed without any sort of offer. That’s up 19.9 percent from 4,681 such homes listed in July and up 41.1 percent from one year ago.

emphasis added

1) Overall sales were down slightly from July, and down about 4% year-over-year.

2) Conventional sales are up sharply. In August 2012, only 39.4% of all sales were conventional. This year, in August 2013, 67% were conventional. That is an increase in conventional sales of about 63% (of course there is heavily investor buying, but that is still quite an increase in non-distressed sales).

3) Most distressed sales are short sales instead of foreclosures (over 3 to 1).

4) and most interesting right now is that non-contingent inventory (year-over-year) is now increasing quickly. Non-contingent inventory is up 41.1% year-over-year!

This suggests inventory has bottomed in Las Vegas (A major theme for housing in 2013). And this suggests price increases will slow.

BLS: Job Openings "little changed" in July

by Calculated Risk on 9/10/2013 10:30:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 3.7 million job openings on the last business day of July, little changed from June, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.2 percent) and separations rate (3.0 percent) also were little changed in July. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) rose over the 12 months ending in July for total nonfarm and total private but was little changed for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for July, the most recent employment report was for August.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in July to 3.689 million, down from 3.869 million in June. The number of job openings (yellow) is up 5.4% year-over-year compared to July 2012.

Quits were up in July, and quits are up about 8% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market.

CoreLogic: 2.5 Million Fewer Properties with Negative Equity in Q2 2013

by Calculated Risk on 9/10/2013 09:19:00 AM

From CoreLogic: CoreLogic reports 2.5 Million More Residential Properties Return to Positive Equity in Second Quarter

CoreLogic ... today released new analysis showing approximately 2.5 million more residential properties returned to a state of positive equity during the second quarter of 2013, and the total number of mortgaged residential properties with equity currently stands at 41.5 million. The analysis shows that 7.1 million homes, or 14.5 percent of all residential properties with a mortgage, were still in negative equity at the end of the second quarter of 2013. This figure is down from 9.6 million homes, or 19.7 percent of all residential properties with a mortgage, at the end of the first quarter of 2013

... Of the 41.5 million residential properties with positive equity, 10.3 million have less than 20 percent equity. Borrowers with less than 20 percent equity, referred to as “under-equitied,” may have a more difficult time obtaining new financing for their homes due to underwriting constraints. Under-equitied mortgages accounted for 21.1 percent of all residential properties with a mortgage nationwide in the second quarter of 2013. At the end of the second quarter of 2013, 1.7 million residential properties had less than 5 percent equity, referred to as near-negative equity. Properties that are near negative equity are at risk should home prices fall. ...

“Equity rebuilding continued in the second quarter of this year as the share of underwater mortgaged homes fell to 14.5 percent,” said Dr. Mark Fleming, chief economist for CoreLogic. “In just the first half of 2013 almost three and a half million homeowners have returned to positive equity, but the pace of improvement will likely slow as price appreciation moderates in the second half.”

emphasis added

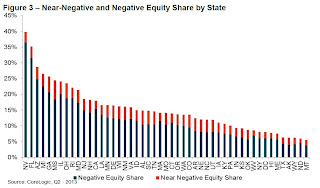

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 36.4 percent, followed by Florida (31.5 percent), Arizona (24.7 percent), Michigan (22.5 percent), and Georgia (20.7 percent). These top five states combined account for 34.9 percent of negative equity in the U.S."

The second graph shows the distribution of home equity in Q2 compared to Q1. Under 6% of residential properties have 25% or more negative equity, down from over 8% in Q1. It will be long time before those borrowers have positive equity.

The second graph shows the distribution of home equity in Q2 compared to Q1. Under 6% of residential properties have 25% or more negative equity, down from over 8% in Q1. It will be long time before those borrowers have positive equity.But many other borrowers are close (less than 10% negative equity).

NFIB: Small Business Optimism Index "flat" in August

by Calculated Risk on 9/10/2013 08:49:00 AM

From the National Federation of Independent Business (NFIB): Optimism Doesn’t Budge

Small-business optimism remained flat in August, dropping 0.1 points from July for a final reading of 94.0. While the total reading showed essentially no change over the month prior, a look at the individual indicators reveals incongruent details. Job creation plans leapt to a level not seen since before the recession and sales expectations improved; but this optimism would appear to contravene the dramatic deterioration in quarter to quarter sales and profit trends. The favorable employment plans also contrasted sharply with the increasingly negative expectations for improved general business conditions. The month’s performance proved poor, but expectations, pre-Syria, were looking up. ...Small business hiring plans increased in the August survey to a reading of 16 from 9 in July (zero is neutral). This is a very strong reading.

Job Creation. August marked the fourth consecutive month of negative job growth for small-business owners. The average increase in employment for small firms surveyed was negative 0.3 workers per firm. Dramatic employment reductions have ceased but hiring has not resumed at normal levels.

In another small sign of good news, only 17% of owners reported weak sales as the top problem (lack of demand). This was down from 20% a year ago, and half the peak of 34% during the recession. During good times, small business owners usually complain about taxes and regulations - and those are now the top problems again.

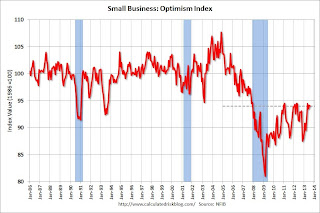

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index decreased to 94.0 in August from 94.1 in July. This is still low, but just below the post-recession high.

Monday, September 09, 2013

Tuesday: Job Openings, Small Business Confidence

by Calculated Risk on 9/09/2013 08:49:00 PM

An interesting paper from Elizabeth Laderman at the San Francisco Fed: Small Businesses Hit Hard by Weak Job Gains. An excerpt:

During the recent recession and recovery, small businesses experienced disproportionate job losses (see Burgen and Aliprantis 2012, Tasci and Burgen 2012, and Sahin et al. 2011). Between 2007 and 2012, their share of total net job losses was nearly double their 30% share of total employment. From the employment peak immediately before the recession through March 2009, the recession low point for private nonfarm employment, jobs at small businesses declined about 11%, according to the Business Employment Dynamics (BED) database of the U.S. Bureau of Labor Statistics. By contrast, payrolls at businesses with 50 or more employees shrank about 7%.Tuesday:

What explains the disparity between job losses at small and large businesses? Financial factors appear to have played a part. The financial crisis that accompanied the 2007–09 recession restrained the supply of credit to businesses. Banks severely tightened lending standards and raised interest rates for business loans during the crisis, according to evidence from the Federal Reserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices. Survey participants reported that the degree of tightening was about the same for businesses of all sizes. However, large companies can more easily tap public credit markets, while smaller companies depend more on bank credit. Indeed, Duygan-Bump et al. (2011) found empirical evidence that financing constraints for small businesses were important in explaining unemployment during the Great Recession. Other potential sources of small business finance were similarly hard hit. Small business owners often rely on personal credit for financing, such as home equity loans, especially if they are just starting out. Thus, falling house prices may have restricted their access to financing. Research has found an especially low rate of business formation during the Great Recession (see Shane 2011). Another study found that the employment decline at newer small businesses was especially large in states with sharp house price declines (Fort et al. 2013).

Weak demand for small business products and services may also have played a role in the pace of job losses. During the recession, the most important small business concern was poor sales, not limited credit availability, according to survey data from the National Federation of Independent Business (NFIB). Although sales of small and large businesses both took hits early in the recession, sales of large businesses recovered more quickly (Sahin et al. 2011). Using state-level NFIB data, Atif Mian and Amir Sufi (2013) showed that the degree of concern about poor sales among a state’s small businesses was strongly correlated with the decline of employment in that state. Mian and Sufi’s result may help explain outsized job losses among small businesses. These businesses have relatively few opportunities to benefit from geographic diversification, which means that their fortunes tend to be closely tied to economic conditions in their home states. By contrast, larger businesses typically serve broader, more diverse geographic markets.

• At 7:30 AM ET, the NFIB Small Business Optimism Index for August.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for July from the BLS. Jobs openings increased in June to 3.936 million, but openings were only up 4% year-over-year compared to June 2012.

Weekly Update: Existing Home Inventory is up 20.6% year-to-date on Sept 9th

by Calculated Risk on 9/09/2013 04:49:00 PM

Here is another weekly update on housing inventory: One of key questions for 2013 is Will Housing inventory bottom this year? Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for July). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 20.6%. There might be some further increases over the next few weeks, but then inventory should start declining seasonally.

It is important to remember that inventory is still very low, and is down 4.0% from the same week last year according to Housing Tracker.

The second graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2012 and 2013.

Inventory in 2013 is still 4.0% below the same week in 2012, but the inventory level is getting close to last year.

Inventory in 2013 is still 4.0% below the same week in 2012, but the inventory level is getting close to last year.

This strongly suggests inventory bottomed early this year, and I expect inventory to be up year-over-year very soon, and I also expect the seasonal decline to be less than usual at the end of the year. This increase in inventory should mean price increases will slow.