by Calculated Risk on 8/30/2013 08:30:00 AM

Friday, August 30, 2013

Personal Income increased 0.1% in July, Spending increased 0.1%

The BEA released the Personal Income and Outlays report for July:

Personal income increased $14.1 billion, or 0.1 percent, ... in July, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $16.3 billion, or 0.1 percent.Core PCE increased at a 2.6% annual rate in July, but only a 1.2% annual rate in Q2.

...

Real PCE -- PCE adjusted to remove price changes -- increased less than 0.1 percent in July, compared with an increase of 0.2 percent in June. ... The price index for PCE increased 0.1 percent in July, compared with an increase of 0.4 percent in June. The PCE price index, excluding food and energy, increased 0.1 percent, compared with an increase of 0.2 percent.

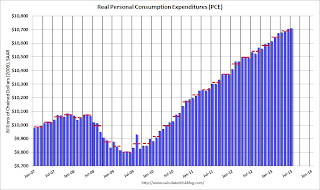

The following graph shows real Personal Consumption Expenditures (PCE) through July (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

This is a slow start to Q3.

On inflation, the PCE price index increased at a 1.1% annual rate in July, and core PCE prices increased only at a 0.9% annual rate.

Thursday, August 29, 2013

Friday: July Personal Income and Outlays, Chicago PMI, Consumer Sentiment

by Calculated Risk on 8/29/2013 07:52:00 PM

Back in June I posted four charts that I'm using to track when the Fed will start tapering the QE3 purchases.

Here is an update to the GDP chart including the 2nd estimate of GDP released this morning (Q2 GDP growth was revised up to annual rate of 2.5% from the 1.7% advance estimate). Note: Here are the most recent updates to the four charts. I'll update two more charts tomorrow (PCE and core inflation).

At the June FOMC press conference, Fed Chairman Ben Bernanke said:

"If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear. In this scenario, when asset purchases ultimately come to an end, the unemployment rate would likely be in the vicinity of 7%, with solid economic growth supporting further job gains, a substantial improvement from the 8.1% unemployment rate that prevailed when the committee announced this program."

Click on graph for larger image.

Click on graph for larger image.The current forecast is for GDP to increase between 2.3% and 2.6% from Q4 2012 to Q4 2013.

Combined the first and second quarter were below the FOMC projections. GDP would have to increase at a 2.8% annual rate in the 2nd half to reach the FOMC lower projection, and at a 3.3% rate to reach the higher projection.

Friday:

• 8:30 AM ET, Personal Income and Outlays for July. The consensus is for a 0.2% increase in personal income in June, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, the Chicago Purchasing Managers Index for August. The consensus is for an increase to 53.0, up from 52.3 in July.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 80.0.

Lawler: Regulators “Caving” on QRM

by Calculated Risk on 8/29/2013 04:09:00 PM

From housing economist Tom Lawler:

Six federal agencies on Wednesday issued a notice revising a proposed rule requiring sponsors of securitization transactions to retain risk in those transactions. The new proposal revises a proposed rule the agencies issued in 2011 to implement the risk retention requirement in the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) .

After intense lobbying and political pressure, the agencies have reluctantly agreed “to define QRMs to have the same meaning as the term qualified mortgages as defined by the Consumer Financial Protection Bureau.” The agencies also changed its original proposal that risk-retention requirements would be based on the par value of securities issued and included a “premium recapture provision; the new proposal has risk retention based on “fair value measurements without a premium capture provision.”

The agencies requested comments on whether an alternative definition of QRM should include “certain underwriting standards in addition to the qualified mortgage criteria.” With the exception of the DTI and verification requirements, the QM doesn’t really have underwriting “standards related to risk.

The “Dodd-Frank Act” had, among other things, two “definitions” of mortgages: “qualified mortgages,” to be defined by the CFPB and focusing on a borrower’s “ability to pay;” and “qualified residential mortgages,” to be defined by six regulatory agencies, focusing on mortgages with underwriting and product features related to the probability of default. A “qualified mortgage” would give lenders something of a “safe harbor” against future litigation, while a “qualified residential mortgage” would be exempt from risk-retention requirements associated with issuing mortgage-backed securities.

In setting the “qualified mortgage” definition, the CFPB focused on (1) product features); (2) up-front fees charged; (3) verification of relevant borrower information; and (4) a maximum backend debt-to-income ratio (and implicitly a maximum front-end ratio) of 43% (with some exceptions). While the CFPB gave a list of factors creditors must consider in determining a borrower’s ability to pay, it did not dictate that creditors follow any particular underwriting model. In defining a “QM” the CFPB did not take into account many extremely important variables/factors that impact the probability that a mortgagor will default.

The original intent of the Dodd-Frank “risk retention” rule was to make sure that issuers/originators had “skin in the game,” which it was hoped would better align the interests of issuers/originators and investors. Mortgage and real-estate industry lobbyists argued that “low-risk” mortgages should be exempt from the risk-retention requirement. While this exemption didn’t make any sense – after all, the proposed legislation required a 5% retention of “risk,” meaning that issuers/originators of “low-risk” mortgages backing a private-label MBS would have to retain 5% of a “low” amount of risk -- legislators succumbed to the lobbying and introduced the “QRM” concept into the final Dodd-Frank bill – relegating the definition to regulatory agencies, but requiring that QRMs be mortgages with “underwriting and product features that historical loan performance data indicate result in a lower risk of default.”

In their preliminary proposed definition of a “QRM,” regulators tried to define a QRM as a mortgage with so little risk that risk-retention to ensure mortgage players would have “skin in the game” was “unimportant.” Not surprisingly, the original proposed definition of a QRM included a hefty (20% down) down payment, a DTI no greater than 36%, had restrictions on a borrower’s credit, and excluded most of the loan features excluded from a QM.

The real estate and mortgage industry lobbyists who had argued for a QRM exemption were stunned, even though the regulators’ “framework” of (1) assuming that risk-retention was a “good thing” (and should be applied to the bulk of mortgages backing private-label RMBS), and (2) only “extremely” low risk mortgages should be exempted from this requirement made perfect sense.

Real estate and mortgage industry folks started lobbying hard against this QRM proposal, and (1) massively inflated the “costs” to issuers/originators of the risk-retention requirement – which would be based on to consumers; (2) argued that many potential borrowers would be excluded from getting mortgage credit; and (3) argued that having a QM definition that differed from a QRM definition would add to the growing regulatory burden being placed on mortgage lenders, and lobbied extremely hard to make the two definitions the same – even though the legislation explicitly differentiated between the two. This latter argument was mildly humorous, in that the only reason the legislation HAD both a QM and a QRM was because of real estate and mortgage industry lobbyists!

An alternative and more logical approach would have been for regulators to decide that there simply WAS no mortgage that was so inherently low risk that it made sense to exempt such a mortgage from the risk-retention requirement, which would effectively have eliminated the concept of a QRM. If they had done so, then the “burden” on the industry of having both a QM and a QRM would have been lifted.

Making the QM and the QRM essentially the same pretty much violates the intent of the Dodd-Frank law, in that the QM definition has very little to do with risk, while the QRM was explicitly supposed to be related to risk. E.g., a 30-year fully amortizing loan with no down payment to a borrower with a FICO score of 580, no current debt outstanding but also hardly any assets, and a front-end debt-to-income ratio of 43% would be deemed a qualified mortgage, even though by any standard such a mortgage would be viewed as extremely risky! An interest-only loan to an extremely wealthy borrower with an 800 credit score who made a 40% down payment would not be a QM.

If the current proposal is finalized as is, then the risk-retention requirement for private-label RMBS, which was very explicitly designed to better align the interests of issuers/originators and investors, will effectively be gone.

That may not be bad, in that it was not clear if a 5% risk-retention requirement would really alter behavior. However, risk retention was a clear INTENT of legislators in Dodd-Frank, and real-estate and mortgage lobbyists have effectively eliminated it for the vast bulk of mortgages that will be originated.

FDIC reports $42.2 Billion Earnings for Insured Institutions, Fewer Problem banks, Residential REO Declines in Q2

by Calculated Risk on 8/29/2013 01:02:00 PM

The FDIC reported FDIC-Insured Institutions Earned $42.2 Billion in the Second Quarter of 2013

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $42.2 billion in the second quarter of 2013, a $7.8 billion (22.6 percent) increase from the $34.4 billion in profits that the industry reported a year earlier. This is the 16th consecutive quarter that earnings have registered a year-over-year increase. Increased noninterest income, lower noninterest expenses, and reduced provisions for loan losses accounted for the increase in earnings from a year ago.The FDIC reported the number of problem banks declined:

The number of problem banks continued to decline. The number of banks on the FDIC's "Problem List" declined from 612 to 553 during the quarter. The number of "problem" banks is down nearly 40 percent from the recent high of 888 institutions at the end of first quarter 2011. Twelve FDIC-insured institutions failed in the second quarter of 2013, up from four failures in the first quarter. Thus far in 2013, there have been 20 failures, compared to 40 during the same period in 2012.

Click on graph for larger image.

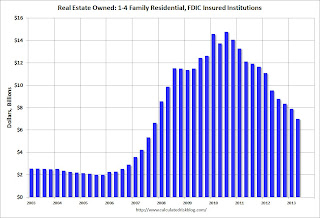

Click on graph for larger image.This graph shows the dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $7.89 billion in Q1 to $6.98 Billion in Q2. This is the lowest level of REOs since Q4 2007. The dollar value of FDIC insured REO peaked at $14.8 Billion in Q3 2010.

Even in good times, the FDIC insured institutions have about $2.5 billion in residential REO, so the FDIC insured institutions are about two-thirds of the way back to normal levels.

Zillow: Negative Equity declines in Q2

by Calculated Risk on 8/29/2013 10:53:00 AM

Note: CoreLogic will release their Q2 negative equity report in the next couple of weeks. For Q1, CoreLogic reported there were 9.7 million properties with negative equity, and that will be down further in Q2.

From Zillow: Negative Equity Rate Falls for 5th Straight Quarter in Q2

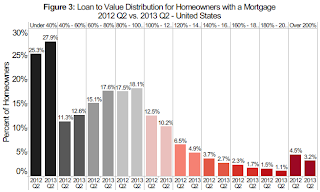

According to the second quarter Zillow Negative Equity Report, the national negative equity rate continued to fall in the second quarter, dropping to 23.8% of all homeowners with a mortgage from 25.4% in the first quarter of 2013. The negative equity rate has been continually falling for the past five quarters, with the second quarter of 2013 being down significantly from the second quarter of 2012 at 30.9% – a decrease of more than 7 percentage points. In the second quarter of 2013, more than 805,000 American homeowners were freed from negative equity. However, more than 12 million homeowners with a mortgage remain underwater ... Of all homeowners – roughly one-third of homeowners do not have a mortgage and own their homes free and clear – 16.7% are underwater.The following graph from Zillow shows negative equity by Loan-to-Value (LTV) in Q2 2013 compared to Q2 2012.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From Zillow:

Figure 3 shows the loan-to-value (LTV) distribution for homeowners with a mortgage in the nation in 2013 Q2 vs. 2012 Q2. Even though many homeowners are still underwater and haven’t crossed the 100% LTV threshold to enter into positive equity, they are moving in the right direction. ... On average, a U.S. homeowner in negative equity owes $74,700 more than what their house is worth, or 42.3% more than the home’s value. While roughly a quarter of homeowners with a mortgage are underwater, 92% of these homeowners are current on their mortgages and continue to make payments.Almost half of the borrowers with negative equity have a LTV of 100% to 120% (the light red columns). Most of these borrowers are current on their mortgages - and they have probably either refinanced with HARP or the loans are well seasoned (most of these properties were purchased in the 2004 through 2006 period, so borrowers have been current for eight years or so). In a few years, these borrowers will have positive equity.

The key concern is all those borrowers with LTVs above 140% (about 8.7% of properties with a mortgage according to Zillow). It will take many years to return to positive equity ... and a large percentage of these properties will eventually be distressed sales (short sales or foreclosures).

Q2 GDP Revised up to 2.5%, Weekly Initial Unemployment Claims decline to 331,000

by Calculated Risk on 8/29/2013 08:30:00 AM

• From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.5 percent in the second quarter of 2013 (that is, from the first quarter to the second quarter), according to the "second" estimate released by the Bureau of Economic Analysis. ... In the advance estimate, the increase in real GDP was 1.7 percent.• The DOL reports:

The upward revision to the percent change in real GDP primarily reflected an upward revision to exports, a downward revision to imports, and an upward revision to private inventory investment that were partly offset by a downward revision to state and local government spending.

In the week ending August 24, the advance figure for seasonally adjusted initial claims was 331,000, a decrease of 6,000 from the previous week's revised figure of 337,000. The 4-week moving average was 331,250, an increase of 750 from the previous week's unrevised average of 330,500.The previous week was revised up from 336,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 331,250.

The 4-week average is near the lowest level since November 2007 (before the recession started). Claims were close to the 330,000 consensus forecast.

Wednesday, August 28, 2013

Thursday: Q2 GDP (second estimate), Unemployment Claims

by Calculated Risk on 8/28/2013 07:52:00 PM

An interesting article from Shaila Dewan at the NY Times: Tensions on the Cul-de-Sac

Across the country, a growing number of single-family rentals provide an option for many who lost their homes in the housing crash through foreclosure and for those who cannot obtain a mortgage under today’s tougher credit conditions. But the decline in homeownership is also changing many neighborhoods in profound ways, including reduced home values, lower voter turnout and political influence, less social stability and higher crime.Thursday:

“When there are fewer homeowners, there is less ‘self-help,’ like park and neighborhood cleanup, neighborhood watch,” said William M. Rohe, a professor at the University of North Carolina at Chapel Hill who has just completed a review of current research on homeownership’s effects.

Even conscientious landlords and tenants invest less in their property than owner-occupants, he said. “Who’s going to paint the outside of a rental house? You’d almost have to be crazy.”

• 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 336 thousand last week.

• Also at 8:30 AM, Q2 GDP (second estimate). This is the second estimate of Q2 GDP from the BEA. The consensus is that real GDP increased 2.2% annualized in Q2, revised up from the advance estimate of 1.7% in Q2

• Note: The FDIC Q2 Quarterly Banking Profile could be released tomorrow or Friday.

Freddie Mac: Mortgage Serious Delinquency rate declined in July, Lowest since April 2009

by Calculated Risk on 8/28/2013 04:35:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in July to 2.70% from 2.79% in June. Freddie's rate is down from 3.42% in July 2012, and this is the lowest level since April 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

I'm frequently asked when the distressed sales will be back to normal levels, and that will happen when the percent of seriously delinquent loans (and in foreclosure) is back to normal.

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for July next week.

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%.

At the recent rate of improvement, the serious delinquency rate will not be under 1% until 2016 or so. Therefore I expect a fairly high level of distressed sales for 2 to 3 more years (mostly in judicial states).

Dean Baker: "Rising Mortgage Rates Did Not Affect June Case-Shiller Data"

by Calculated Risk on 8/28/2013 02:22:00 PM

Dean Baker beat me to this: Rising Mortgage Rates Did Not Affect June Case-Shiller Data

The Washington Post ... article today on the Case-Shiller June price index attributed the slower price growth in part to higher interest rates. This makes no sense.One addition: we will not see any impact of higher mortgage rates until at least the "August" Case-Shiller report is released (see earlier post), and - as Baker notes - the impact will not be fully apparent in the Case-Shiller index until the "October" report is released because of the 3 month average. However other prices indexes - like Zillow and LPS - will pick up any impact sooner.

The Case-Shiller index is an average of three months data. The June release is based on the price of houses that were closed in April, May, and June. Since there is typically 6-8 weeks between when a contract is signed and when a sale is completed these houses would have come under contract in the period from February to May. This is a period before there was any real rise in interest rates.

... We will first begin to see a limited impact of higher interest rates in the Case Shilller index in the July data and the impact of the rise will not be fully apparent until the October index is released.

Zillow: Case-Shiller House Price Index expected to show 12.5% year-over-year increase in July

by Calculated Risk on 8/28/2013 11:41:00 AM

The Case-Shiller house price indexes for June were released yesterday. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close. Note: Zillow makes a strong argument that the Case-Shiller index is currently overstating national house price appreciation.

Another 12% Hike Predicted for July Case-Shiller Indices

The Case-Shiller data for June (2013 Q2) came out [yesterday] and, based on this information and the July 2013 Zillow Home Value Index (released last week), we predict that next month’s Case-Shiller data (July 2013) will show that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]), as well as the 10-City Composite Home Price Index (NSA) increased 12.5 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from June to July will be 1.0 percent for the 20-City Composite and 1.2 percent for the 10-City Composite Home Price Indices (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for June will not be released until Tuesday, September 24.The following table shows the Zillow forecast for the July Case-Shiller index.

...

As home value appreciation is beginning to moderate, the Case-Shiller indices will continue to show an inflated sense of national home value appreciation. First signs of a slowdown in monthly appreciation are present, although these slowdowns are fairly timid. The Case-Shiller indices are biased toward the large, coastal metros currently seeing enormous home value gains, and they include foreclosure resales. The inclusion of foreclosure resales disproportionately boosts the index when these properties sell again for much higher prices — not just because of market improvements, but also because the sales are no longer distressed. In contrast, the ZHVI does not include foreclosure resales and shows home values for July 2013 up 6 percent from year-ago levels. We expect home value appreciation to continue to moderate through the end of 2013 and into 2014, rising 4.8 percent between July 2013 and July 2014. The main drivers of this moderation include rising mortgage rates, less investor participation – decreasing demand – and increasing for-sale inventory supply. Further details on our forecast of home values can be found here, and more on Zillow’s full July 2013 report can be found here.

...

To forecast the Case-Shiller indices, we use the June Case-Shiller index level, as well as the July Zillow Home Value Index (ZHVI), which is available more than a month in advance of the Case-Shiller index, paired with July foreclosure resale numbers, which Zillow also publishes more than a month prior to the release of the Case-Shiller index. Together, these data points enable us to reliably forecast the Case-Shiller 10-City and 20-City Composite indices.

| Zillow July Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | July 2012 | 157.21 | 154.35 | 144.58 | 141.81 |

| Case-Shiller (last month) | June 2013 | 173.37 | 172.25 | 159.54 | 158.32 |

| Zillow Forecast | YoY | 12.5% | 12.5% | 12.5% | 12.5% |

| MoM | 2.0% | 1.2% | 1.9% | 1.2% | |

| Zillow Forecasts1 | 176.8 | 174.0 | 162.6 | 159.9 | |

| Current Post Bubble Low | 146.46 | 149.62 | 134.07 | 136.88 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 20.7% | 16.3% | 21.3% | 16.8% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||