by Calculated Risk on 8/19/2013 05:20:00 PM

Monday, August 19, 2013

Weekly Update: Existing Home Inventory is up 21.7% year-to-date on Aug 19th

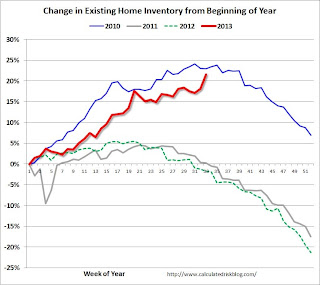

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for June). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 21.7%, and there might be some further increases over the next few weeks. It is important to remember that inventory is still very low, and is down 5.7% from the same week last year according to Housing Tracker.

This strongly suggests inventory bottomed early this year. I expect inventory to be up year-over-year very soon (maybe in September), and I also expect the seasonal decline to be less than usual at the end of the year. This increase in inventory also means price increases will slow.

Research: Drop in Jobless Claims suggests pickup in Wage Growth

by Calculated Risk on 8/19/2013 01:10:00 PM

Fast FT has an excerpt from a Deutsche Bank research note: US jobless claims hold signs for the second half

So far, rises in wages and salaries have barely been able to outpace the combined effect of inflation and the higher payroll tax introduced at the start of the year.The following graph is from the research note. This shows that the year-over-year change in weekly unemployment claims (inverted) typically leads wage growth. However, I think wage growth will remain sluggish with the high unemployment rate.

Deutsche expects that could change:

If the recent four-week average (332,000) on claims is sustained over the entirety of the third quarter, this should be consistent with an acceleration in wages and salary income toward 5.7% by yearend—which would significantly outpace the drag from inflation and the payroll taxexcerpt with permission

BLS: State unemployment rates were "little changed" in July

by Calculated Risk on 8/19/2013 10:16:00 AM

From the BLS: Jobless rates up in 28 states, down in 8 in July; payroll jobs up in 32 states, down in 17

Regional and state unemployment rates were little changed in July. Twenty-eight states and the District of Columbia had unemployment rate increases, 8 states had decreases, and 14 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

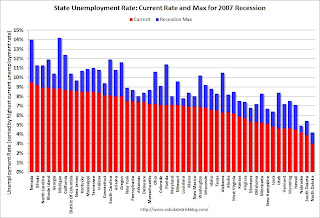

Nevada had the highest unemployment rate among the states in July, 9.5 percent. The next highest rate was in Illinois, 9.2 percent. North Dakota continued to have the lowest jobless rate, 3.0 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Nevada have seen the largest declines and many other states have seen significant declines (California, Florida and more).

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at or above 9% in only two states: Nevada and Illinois, and Mississippi. This is the fewest states with 9% unemployment since 2008.

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).Currently only two states have an unemployment rate above 9% (purple), seventeen states above 8% (light blue), and 28 states above 7% (blue).

Sunday, August 18, 2013

San Francisco: Apartments converting back to condos

by Calculated Risk on 8/18/2013 07:57:00 PM

From Carolyn Said at the San Francisco Chronicle: Bay Area rental pendulum swings to condos

Some condominium complexes opened at the worst possible time - in the depths of the real estate downturn when home buyers were few and far between. They coped by becoming for-rent apartment buildings instead. But now, as the housing recovery accelerates, several East Bay and South Bay developments are switching back to for-sale condos.The conversion of these condo projects to apartments was an interesting story during the housing bust (and a way to take excess "for sale" inventory off the market) - and now they are converting back to condos (taking advantage of the lack of "for sale" inventory). This is similar to a story by Cale Ottens at the LA Times last week: Condo conversions inch up in Los Angeles.

...

For instance, the 125-unit Broadway Grand in Oakland, developed by Signature Properties, first opened as a condo complex, sold 17 units, and then switched to rentals as the market tanked ... Last year it went condo again, and now has sold all but 11 of its units.

Similarly, the Skyline in San Jose with 121 units is now switching to condos after opening as rentals during the downturn. In Emeryville, the 424-unit Bridgewater is switching from rentals to condos. The current phase II, which started in June with 174 homes ranging from $185,000 to $450,000, is finding a receptive audience, said Alan Mark, president of the Mark Co., which is marketing the complex.

Hotels: Occupancy Rate tracking pre-recession levels

by Calculated Risk on 8/18/2013 03:11:00 PM

Another update on hotels from HotelNewsNow.com: STR: US results for week ending 10 August

In year-over-year comparisons, occupancy rose 1.9 percent to 72.7 percent, average daily rate increased 4.8 percent to US$112.48 and revenue per available room grew 6.8 percent to US$81.74.The 4-week average of the occupancy rate is close to normal levels.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2013, yellow is for 2012, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Through August 10th, the 4-week average of the occupancy rate is slightly higher than the same period last year and is tracking the pre-recession levels. This is probably the high for the 4-week average of the occupancy rate. The occupancy rate will decrease over the next several weeks as the summer travel season ends - however, overall, this has been a decent year for the hotel industry.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Percent of Population in Prime Working Age

by Calculated Risk on 8/18/2013 09:45:00 AM

Last week I posted an animation of the age and distribution of the U.S. population over time. The animations used actual data from 1900 to 2010, and Census Bureau projection from 2015 through 2060.

I mentioned that the ratio of total Americans in the prime working age will be about the same in 2060 as in 1900. The graph below shows the percent of population in the prime working age from 1900 to 2060 (I used two definitions of prime working age "25 to 54" and "25 to 59". Over time, the prime working age has expanded to included the "55 to 59" age group (red line).

Of course in the 1900s, the non-prime working age was mostly children, and in the 2000s, the non-prime working age will be more evenly split between children and the elderly. This table shows the percent of the population under 25, 25 to 54, and over 55.

| Percent of U.S. Population by Age selected Decades | |||

|---|---|---|---|

| 1900 | 2000 | 2060 | |

| Under 25 Years Old | 54.0% | 35.3% | 29.6% |

| Percent 25 to 54 Years Old | 36.6% | 43.6% | 37.3% |

| Percent 55+ Years Old | 9.4% | 21.1% | 33.1% |

Click on graph for larger image.

Click on graph for larger image.

The blue line is the percent of the total population in the 25 to 54 age group. The red line is for 25 to 60.

The prime working age has shifted over time. In 1900, the prime working age probably included the 20 to 24 age group, and maybe even many people in the 16 to 19 age group. By 2060, the prime working age may expand to 25 to 64.

Saturday, August 17, 2013

Unofficial Problem Bank list declines to 717 Institutions

by Calculated Risk on 8/17/2013 01:41:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for August 16, 2013.

Changes and comments from surferdude808:

The OCC was busy this past month mostly terminating a number of enforcement actions. They were responsible for five of the seven terminations this week and the sole addition. After these changes, the Unofficial Problem Bank List holds 717 institutions with assets of $253.9 billion. A year ago, the list held 899 institutions with assets of $347.5 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now back down to 717.

Actions were terminated against Citizens Union Bank of Shelbyville, Shelbyville, KY ($547 million); First Federal Savings and Loan Association of McMinnville, McMinnville, OR ($352 million); First National Bank of the Rockies, Grand Junction, CO ($318 million); Bank of Virginia, Midlothian, VA ($230 million Ticker: BOVA); Franklin Community Bank, National Association, Rocky Mount, VA ($179 million); The First National Bank of Polk County, Cedartown, GA ($156 million Ticker: SCSG); and Ripley Federal Savings Bank, Ripley, OH ($67 million).

The addition this week was Ponce de Leon Federal Bank, Bronx, NY ($760 million).

There is no news to pass along on Capitol Bancorp, Ltd. and the remaining banks they control. Next week the FDIC may release industry quarterly performance for the second quarter and the Official Problem Bank figures. At the first quarter release, the difference between the official and unofficial count was 149 but it has been narrowing after peaking at 185 a year ago. This quarter, it is estimated the difference has narrowed further to around 135. With there being two more Fridays in the month, it is likely the FDIC will wait until the second Friday to release their enforcement action activity through July 2013.

Schedule for Week of August 18th

by Calculated Risk on 8/17/2013 08:51:00 AM

The key reports this week are July existing home sales on Wednesday, and July new home sales on Friday.

The Kansas City Fed will host the annual Jackson Hole symposium from Thursday through Saturday. Fed Chairman Ben Bernanke will not be attending, although the likely next Fed Chair Janet Yellen will be attending but not speaking.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for July 2013

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for sales of 5.13 million on seasonally adjusted annual rate (SAAR) basis. Sales in June were at a 5.08 million SAAR. Economist Tom Lawler is estimating the NAR will report a July sales rate of 5.33 million.

A key will be inventory and months-of-supply.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes for Meeting of July 30-31, 2013.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 329 thousand from 320 thousand last week.

9:00 AM: The Markit US PMI Manufacturing Index Flash for August. The consensus is for an increase to 53.5 from 53.2 in July.

9:00 AM: FHFA House Price Index for June 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.6% increase

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for July. The consensus is for a reading of 5 for this survey, down from 6 in July (Above zero is expansion).

10:00 AM: New Home Sales for July from the Census Bureau.

10:00 AM: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the June sales rate.

The consensus is for a decrease in sales to 487 thousand Seasonally Adjusted Annual Rate (SAAR) in July from 497 thousand in June. Based on the homebuilder reports, there will probably be some downward revisions to sales for previous months.

Friday, August 16, 2013

LA area Port Traffic: Import Traffic Increases in July

by Calculated Risk on 8/16/2013 10:04:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for June since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 0.5% in July, and outbound traffic flat, compared to the rolling 12 months ending in June (percentage change corrected).

In general, inbound traffic has been increasing slightly, and outbound traffic has been declining slightly.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

This suggests an increase in the trade deficit with Asia for July.

Lawler: Early Look at Existing Home Sales in July

by Calculated Risk on 8/16/2013 03:35:00 PM

From housing economist Tom Lawler:

Based on local realtor association/board/MLS reports I have seen across the country, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.33 million in July, up 4.9% from June’s disappointing pace.

Local data indicate that existing home sales on an unadjusted basis almost certainly showed substantially faster YOY growth in July than in June. Some acceleration was to be expected, as there were more business days this July than last July, while there were fewer business days this June than last June. However, most regional home sales reports showed YOY growth rates well in excess of any “business-day” effects.

On the inventory front, the vast bulk of realtor reports showed a monthly gain in listings. Other “listings trackers” also point to a monthly increase in the number of homes for sale. While NAR inventory estimates don’t always match reported changes in listings, I estimate that the NAR’s estimate of the inventory of existing home sales in July will be 2.26 million, up 3.2% from June and down 5.8% from last July.

It is worth noting that a faster home sales pace in July does not mean that the jump in mortgage rates has had little or no effect on home sales. Existing home sales are closed sales, and many folks who settled in July locked in rates a few months ago. In addition, there is evidence that when interest rates first started moving higher – just not by a boatload – there was an increase in contracted sales reflecting home buyers’ fears of rates rising further. And, some closings may have been accelerated to beat rate-lock expirations.

CR Note: The NAR is scheduled to report July existing home sales on Wednesday, August 21st.

Based on Tom's estimates of a 5.33 million sales rate, and inventory at around 2.26 million for July, and months-of-supply around 5.1 (down from 5.2 months in June). This would still be a very low level of inventory - probably the lowest for July since 2002 or so - also a 5.8% year-over-year decline in inventory would be the smallest year-over-year decline since early 2011 (when inventory started to decline sharply). Note: In June, inventory was down 7.6% compared to June 2012. These smaller year-over-year declines suggest inventory bottomed earlier this year.

Note: Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 3 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer (the "consensus" for July is 5.13 million) .

Note: The consensus average miss was 170 thousand with a standard deviation of 190 thousand. Lawler's average miss was 70 thousand with a standard deviation of 50 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | NA | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | --- |

| 1NAR initially reported before revisions. | |||