by Calculated Risk on 8/18/2013 09:45:00 AM

Sunday, August 18, 2013

Percent of Population in Prime Working Age

Last week I posted an animation of the age and distribution of the U.S. population over time. The animations used actual data from 1900 to 2010, and Census Bureau projection from 2015 through 2060.

I mentioned that the ratio of total Americans in the prime working age will be about the same in 2060 as in 1900. The graph below shows the percent of population in the prime working age from 1900 to 2060 (I used two definitions of prime working age "25 to 54" and "25 to 59". Over time, the prime working age has expanded to included the "55 to 59" age group (red line).

Of course in the 1900s, the non-prime working age was mostly children, and in the 2000s, the non-prime working age will be more evenly split between children and the elderly. This table shows the percent of the population under 25, 25 to 54, and over 55.

| Percent of U.S. Population by Age selected Decades | |||

|---|---|---|---|

| 1900 | 2000 | 2060 | |

| Under 25 Years Old | 54.0% | 35.3% | 29.6% |

| Percent 25 to 54 Years Old | 36.6% | 43.6% | 37.3% |

| Percent 55+ Years Old | 9.4% | 21.1% | 33.1% |

Click on graph for larger image.

Click on graph for larger image.

The blue line is the percent of the total population in the 25 to 54 age group. The red line is for 25 to 60.

The prime working age has shifted over time. In 1900, the prime working age probably included the 20 to 24 age group, and maybe even many people in the 16 to 19 age group. By 2060, the prime working age may expand to 25 to 64.

Saturday, August 17, 2013

Unofficial Problem Bank list declines to 717 Institutions

by Calculated Risk on 8/17/2013 01:41:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for August 16, 2013.

Changes and comments from surferdude808:

The OCC was busy this past month mostly terminating a number of enforcement actions. They were responsible for five of the seven terminations this week and the sole addition. After these changes, the Unofficial Problem Bank List holds 717 institutions with assets of $253.9 billion. A year ago, the list held 899 institutions with assets of $347.5 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now back down to 717.

Actions were terminated against Citizens Union Bank of Shelbyville, Shelbyville, KY ($547 million); First Federal Savings and Loan Association of McMinnville, McMinnville, OR ($352 million); First National Bank of the Rockies, Grand Junction, CO ($318 million); Bank of Virginia, Midlothian, VA ($230 million Ticker: BOVA); Franklin Community Bank, National Association, Rocky Mount, VA ($179 million); The First National Bank of Polk County, Cedartown, GA ($156 million Ticker: SCSG); and Ripley Federal Savings Bank, Ripley, OH ($67 million).

The addition this week was Ponce de Leon Federal Bank, Bronx, NY ($760 million).

There is no news to pass along on Capitol Bancorp, Ltd. and the remaining banks they control. Next week the FDIC may release industry quarterly performance for the second quarter and the Official Problem Bank figures. At the first quarter release, the difference between the official and unofficial count was 149 but it has been narrowing after peaking at 185 a year ago. This quarter, it is estimated the difference has narrowed further to around 135. With there being two more Fridays in the month, it is likely the FDIC will wait until the second Friday to release their enforcement action activity through July 2013.

Schedule for Week of August 18th

by Calculated Risk on 8/17/2013 08:51:00 AM

The key reports this week are July existing home sales on Wednesday, and July new home sales on Friday.

The Kansas City Fed will host the annual Jackson Hole symposium from Thursday through Saturday. Fed Chairman Ben Bernanke will not be attending, although the likely next Fed Chair Janet Yellen will be attending but not speaking.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for July 2013

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for sales of 5.13 million on seasonally adjusted annual rate (SAAR) basis. Sales in June were at a 5.08 million SAAR. Economist Tom Lawler is estimating the NAR will report a July sales rate of 5.33 million.

A key will be inventory and months-of-supply.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes for Meeting of July 30-31, 2013.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 329 thousand from 320 thousand last week.

9:00 AM: The Markit US PMI Manufacturing Index Flash for August. The consensus is for an increase to 53.5 from 53.2 in July.

9:00 AM: FHFA House Price Index for June 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.6% increase

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for July. The consensus is for a reading of 5 for this survey, down from 6 in July (Above zero is expansion).

10:00 AM: New Home Sales for July from the Census Bureau.

10:00 AM: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the June sales rate.

The consensus is for a decrease in sales to 487 thousand Seasonally Adjusted Annual Rate (SAAR) in July from 497 thousand in June. Based on the homebuilder reports, there will probably be some downward revisions to sales for previous months.

Friday, August 16, 2013

LA area Port Traffic: Import Traffic Increases in July

by Calculated Risk on 8/16/2013 10:04:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for June since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 0.5% in July, and outbound traffic flat, compared to the rolling 12 months ending in June (percentage change corrected).

In general, inbound traffic has been increasing slightly, and outbound traffic has been declining slightly.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

This suggests an increase in the trade deficit with Asia for July.

Lawler: Early Look at Existing Home Sales in July

by Calculated Risk on 8/16/2013 03:35:00 PM

From housing economist Tom Lawler:

Based on local realtor association/board/MLS reports I have seen across the country, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.33 million in July, up 4.9% from June’s disappointing pace.

Local data indicate that existing home sales on an unadjusted basis almost certainly showed substantially faster YOY growth in July than in June. Some acceleration was to be expected, as there were more business days this July than last July, while there were fewer business days this June than last June. However, most regional home sales reports showed YOY growth rates well in excess of any “business-day” effects.

On the inventory front, the vast bulk of realtor reports showed a monthly gain in listings. Other “listings trackers” also point to a monthly increase in the number of homes for sale. While NAR inventory estimates don’t always match reported changes in listings, I estimate that the NAR’s estimate of the inventory of existing home sales in July will be 2.26 million, up 3.2% from June and down 5.8% from last July.

It is worth noting that a faster home sales pace in July does not mean that the jump in mortgage rates has had little or no effect on home sales. Existing home sales are closed sales, and many folks who settled in July locked in rates a few months ago. In addition, there is evidence that when interest rates first started moving higher – just not by a boatload – there was an increase in contracted sales reflecting home buyers’ fears of rates rising further. And, some closings may have been accelerated to beat rate-lock expirations.

CR Note: The NAR is scheduled to report July existing home sales on Wednesday, August 21st.

Based on Tom's estimates of a 5.33 million sales rate, and inventory at around 2.26 million for July, and months-of-supply around 5.1 (down from 5.2 months in June). This would still be a very low level of inventory - probably the lowest for July since 2002 or so - also a 5.8% year-over-year decline in inventory would be the smallest year-over-year decline since early 2011 (when inventory started to decline sharply). Note: In June, inventory was down 7.6% compared to June 2012. These smaller year-over-year declines suggest inventory bottomed earlier this year.

Note: Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 3 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer (the "consensus" for July is 5.13 million) .

Note: The consensus average miss was 170 thousand with a standard deviation of 190 thousand. Lawler's average miss was 70 thousand with a standard deviation of 50 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | NA | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | --- |

| 1NAR initially reported before revisions. | |||

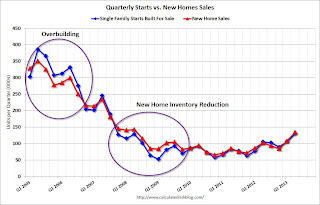

Quarterly Housing Starts by Intent compared to New Home Sales

by Calculated Risk on 8/16/2013 11:33:00 AM

In addition to housing starts for July, the Census Bureau also released the Q2 "Started and Completed by Purpose of Construction" report this morning.

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released this morning showed there were 131,000 single family starts, built for sale, in Q2 2013, and that was below the 135,000 new homes sold for the same quarter, so inventory decreased a little (Using Not Seasonally Adjusted data for both starts and sales).

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.Single family starts built for sale were up about 25% compared to Q2 2012. This is still very low, and only back to about Q2 2008 levels.

Owner built starts were up slightly year-over-year. And condos built for sale are just above the record low.

The 'units built for rent' had increased significantly, but the year-over-year growth has slowed.

The second graph shows quarterly single family starts, built for sale and new home sales (NSA).

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006. In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are starting about the same number of homes that they are selling, and the inventory of under construction and completed new home sales was just above the record low at 129,000 in Q2 2013.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control, and also suggests that the year-over-year increase in housing starts is directly related to an increase in demand and not renewed speculative building.

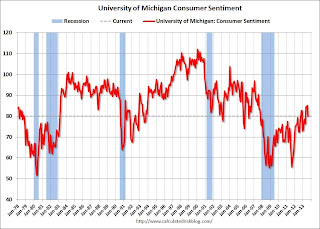

Preliminary August Consumer Sentiment decreases to 80.0

by Calculated Risk on 8/16/2013 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for August decreased to 80.0 from the final July reading of 85.1.

This was below the consensus forecast of 85.5. This is a noisy series, however sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011.

Housing Starts increased in July to 896,000 SAAR

by Calculated Risk on 8/16/2013 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 896,000. This is 5.9 percent above the revised June estimate of 846,000 and is 20.9 percent above the July 2012 rate of 741,000.

Single-family housing starts in July were at a rate of 591,000; this is 2.2 percent below the revised June figure of 604,000. The July rate for units in buildings with five units or more was 290,000.

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 943,000. This is 2.7 percent above the revised June rate of 918,000 and is 12.4 percent above the July 2012 estimate of 839,000.

Single-family authorizations in July were at a rate of 613,000; this is 1.9 percent below the revised June figure of 625,000. Authorizations of units in buildings with five units or more were at a rate of 303,000 in July.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in July (Multi-family is volatile month-to-month).

Single-family starts (blue) decreased slightly to 591,000 SAAR in July (Note: June was revised up from 591 thousand to 604 thousand).

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been generally increasing after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that housing starts have been generally increasing after moving sideways for about two years and a half years. This was slightly below expectations of 904 thousand starts in July, but Permits were strong. Total starts in July were up 21% from July 2012; single family starts were only up 15.4% year-over-year. I'll have more later ...

Thursday, August 15, 2013

Friday: Housing Starts

by Calculated Risk on 8/15/2013 09:06:00 PM

Oh my! From Nick Timiraos and Jeannette Neumann at the WSJ: Richmond’s Seizure Plan Complicated by Size of Mortgages

The city of Richmond, Calif., is seeking to acquire mortgages as large as $1.1 million under its plan to invoke powers of eminent domain to purchase and restructure underwater mortgages.It isn't true that a loss has occurred on a loan just because the value of the collateral declines. Frequently a loan will be for more than any collateral securing the loan (this happens frequently with car loans and I could give many other examples). This doesn't mean a loss has "already occurred" - in fact most of these loans are paid in full with no loss.

...

“The city will pay fair value for every loan,” said [John Vlahoplus, the chief strategy officer for MRP]. “Any loss on a loan has already occurred because of the fall in home prices.”

Friday:

• At 8:30 AM, the Census Bureau will release Housing Starts for July. The consensus is for total housing starts to increase to 904 thousand (SAAR) in July.

• At 9:55 AM: the Reuter's/University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for a reading of 85.5, up from 85.1 in July.

First Look at 2014 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 8/15/2013 05:05:00 PM

The BLS reported this morning: "The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 2.0 percent over the last 12 months to an index level of 230.084 (1982-84=100). For the month, the index was unchanged prior to seasonal adjustment."

CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

Since the highest Q3 average was last year (2012), at 226.936, we only have to compare to last year.

Click on graph for larger image.

Click on graph for larger image.

This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Currently CPI-W is above the Q3 2012 average. If the current level holds, COLA would be around 1.4% for next year (the current 230.084 divided by the Q3 2012 level of 226.936).

Even though CPI-W was up 2.0% year-over-year in July, the adjustment will probably be lower than 2.0%. Last year gasoline prices increased sharply in August and September - pushing up CPI-W for those months, and this year gasoline prices are down a little in August. So CPI-W will probably not increase as much this year in August as in Aug 2012.

This is early - we need the data for August and September - but my current guess is COLA will be a little lower than the 1.7% last year.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2012 yet, but wages probably increased again in 2012. If wages increased the same as last year, then the contribution base next year will be increased to around $117,000 from the current $113,700.

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).