by Calculated Risk on 8/09/2013 08:29:00 PM

Friday, August 09, 2013

Merle Hazard: "Great Unwind" with commentary from several economists

A new song from Merle Hazard called the "The Great Unwind". This was debuted on PBS this week and several economists have commented on the song:

Yesterday from PBS: Art Laffer, John Taylor, Simon Johnson Respond to the Fed's 'Great Unwind' Problem

From John Taylor:

I've been writing about the costs of unwinding unconventional monetary policy since the Fed started its massive bond buying four years ago. Now, just in time for the actual unwinding, we have the online debut of Merle Hazard's funny and informative "The Great Unwind," a country and western song about the Fed's current predicament. Like Merle's earlier numbers -- such as "Inflation or Deflation" and "Bailout" -- his new song tells you a lot about monetary policy. Full disclosure: I'm a real fan of Merle Hazard as I said in this promotional video Merle Hazard Meets John Taylor for "Inflation or Deflation."And today: Is the Fed's 'Great Unwind' a Nonevent or the Chickens Finally Coming Home to Roost? (with comments from Ken Rogoff, Justin Wolfers, James Galbraith, and Greg Mankiw) From Rogoff:

Another great performance from Merle Hazard. However, I would worry more about the long-term effects of lingering unemployment and growing income inequality than the risks of quantitative easing (QE). ... the real risk is that there will be a sharp rise in interest rates making it very expensive to roll over growing issuance of short-term debt. As long as that doesn't happen, the "great unwind" will be a non-event.From Wolfers:

Country music star Merle's Hazard's latest turns to a far more important theme than the usual fare of unrequited love, dead dogs, old trucks and 'merica, worrying instead about how the Fed will unwind it's balance sheet. Is Ben Bernanke a monetary outlaw or the trusted sheriff who'll restore order? I'm betting on the latter, but either way, I tip my (ten-gallon) hat to the strumming balladeer and dismal scientist.From CR: Rogoff argues that the concern is "a sharp rise in interest rates" - I'd say the concern is an eventual sharp increase in inflation that forces the Fed to unwind quicker than planned. I'm not that worried though - I'm more in the "non-event" / "restore order" group - but it does require a Fed Chairman with good judgment and an understanding of what is happening. Enjoy!

Bank Failure #18 in 2013: Bank of Wausau, Wausau, Wisconsin

by Calculated Risk on 8/09/2013 06:14:00 PM

From the FDIC: Nicolet National Bank, Green Bay, Wisconsin, Assumes All of the Deposits of Bank of Wausau, Wausau, Wisconsin

As of June 30, 2013, Bank of Wausau had approximately $43.6 million in total assets and $40.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $13.5 million. ... Bank of Wausau is the 18th FDIC-insured institution to fail in the nation this year, and the second in Wisconsin.It is Friday!

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in July

by Calculated Risk on 8/09/2013 03:49:00 PM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for several selected cities in July.

From CR: Look at the two columns in the table for Total "Distressed" Share. In every area that has reported distressed sales so far, the share of distressed sales is down significantly year-over-year.

Also there has been a sharp decline in foreclosure sales in all of these cities.

And now short sales are declining year-over-year too! This is a recent change - short sales had been increasing year-over-year, but it looks like both categories of distressed sales are now declining.

The All Cash Share is mostly staying steady. The all cash share will probably decline when investors pull back in markets like Las Vegas and Phoenix (already declining).

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jul-13 | Jul-12 | Jul-13 | Jul-12 | Jul-13 | Jul-12 | Jul-13 | Jul-12 | |

| Las Vegas | 28.0% | 40.0% | 8.0% | 20.7% | 36.0% | 60.7% | 54.5% | 54.8% |

| Reno | 21.0% | 38.0% | 7.0% | 15.0% | 28.0% | 53.0% | ||

| Phoenix | 11.5% | 29.5% | 9.4% | 14.6% | 20.8% | 44.1% | 35.8% | 44.9% |

| Charlotte | 9.5% | 13.8% | ||||||

| Tucson | 29.1% | 33.3% | ||||||

| Toledo | 35.0% | 36.5% | ||||||

| Omaha | 15.9% | 15.6% | ||||||

| Memphis* | 16.7% | 26.9% | ||||||

| *share of existing home sales, based on property records | ||||||||

Update: The Shrinking Deficit

by Calculated Risk on 8/09/2013 02:48:00 PM

An excerpt from a post by Cardiff Garcia at FT Alphaville: Shrinking US deficit update, and a new debt ceiling projection

From a note this morning by economists at Barclays:On Monday, the Treasury will release the monthly update of the Federal Government deficit for July. The report is expected to show that the deficit for the current calendar year will be close to the Congressional Budget Office's (CBO) projections in May. The CBO already released their Monthly Budget Review for July 2013:

The US federal budget deficit has been improving at a dramatic pace in recent months. As a percent of GDP, the deficit peaked at 10.2% of GDP in the four quarters ending in Q4 09; over the past four quarters, it has totaled 4.2% of GDP, down from 7.7% one year earlier.

The federal government incurred a deficit of $96 billion in July 2013, CBO estimates, $27 billion more than the shortfall in the same month last year. But that comparison is distorted by quirks of the calendar: Because July 1, 2012, fell on a Sunday, certain payments that ordinarily would have been made in July were made earlier, reducing outlays in July 2012 by about $36 billion. No such payment shift occurred in July 2013. Without that shift in the timing of payments in 2012, the deficit for July 2013 would have been $10 billion less than the deficit for July 2012.Watch out for reports that don't mention the timing issue!

For the current fiscal year (ends September 30th), the CBO is projecting a deficit of 4.0%. This is down sharply from 7.0% last year. And the CBO expects the deficit to fall to 2.1% of GDP in 2015.

Click on graph for larger image.

Click on graph for larger image.This graph, based on the CBO's May projections, shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

After 2015, the deficit will start to increase again according to the CBO, but as I've noted before, we really don't want to reduce the deficit much faster than this path over the next few years, because that will be too much of a drag on the economy.

Update: When will payroll employment exceed the pre-recession peak?

by Calculated Risk on 8/09/2013 12:59:00 PM

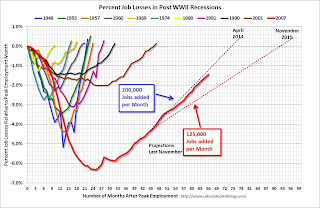

About two years ago I posted a graph with projections of when payroll employment would return to pre-recession levels (see: Sluggish Growth and Payroll Employment from November 2011).

In 2011, I argued we'd continue to see sluggish growth (back in 2011 many analysts were forecasting another US recession - those forecasts were wrong).

On the graph I posted two lines - one with payroll growth of 125,000 payroll jobs added per month (the pace in 2011), and another line with 200,000 payroll jobs per month. The following graph is an update with reported payroll growth through July 2013.

The dashed red line is 125,000 payroll jobs added per month. The dashed blue line is 200,000 payroll jobs per month. Both projections are from November 2011.

Click on graph for larger image.

Click on graph for larger image.

So far the economy has tracked fairly closely to the blue line (200,000 payroll jobs per month).

Right now it appears payrolls will exceed the pre-recession peak in early to mid-2014.

Currently there are about 2 million fewer payroll jobs than before the recession started, and at the recent pace of job growth it will take another 11 months to reach the previous peak. Note: I expect another upward adjustment when the annual benchmark revision is released in January, so we will probably reach the previous peak in fewer than 11 months.

Of course this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow).

Note: There are 1.482 million fewer private sector payroll jobs than before the recession started. At the recent pace of private sector job growth - plus a positive benchmark revision in January - we could be back at the pre-recession peak early in 2014.

LA Times: The Return of Condo Conversions

by Calculated Risk on 8/09/2013 09:59:00 AM

An interesting story from Cale Ottens at the LA Times: Condo conversions inch up in Los Angeles

Apartment building owners in Los Angeles and throughout California are once again converting to condos, but not at the torrid pace of 2007, when condo conversion peaked before the Great Recession.Right now it seems like most of the conversions from apartments to condos are buildings originally intended to be condos, but were converted to rental units during the housing bust. So far I haven't seen older apartments being converted to condos as was happening during the bubble.

...

Before the last recession, it was common for apartments to convert to condos when the market was hot. But the trend came to a screeching halt when the housing bubble burst.

At the peak in 2007, the city issued 208 permits allowing apartment complexes to be converted. But that number has declined every year since. The city issued a mere 38 permits last year.

...

The number of condo conversions, however, probably won't get anywhere near the levels they were before the economic downturn, said Chris Foley, a principal at real estate marketing firm Polaris Pacific in San Francisco.

The only conversions Foley said he expects to see throughout the state are the properties originally intended to be condos but turned into apartments when the housing market tanked and condos weren't selling.

Thursday, August 08, 2013

MBA National Delinquency Survey: Judicial vs. Non-Judicial Foreclosure States

by Calculated Risk on 8/08/2013 09:41:00 PM

Earlier I posted the MBA National Delinquency Survey press release and a graph that showed mortgage delinquencies and foreclosures by period past due. There is a clear downward trend for mortgage delinquencies, however some states are further along than others. From the press release:

States with a judicial foreclosure system continue to bear a disproportionate share of the foreclosure backlog. .... The rate of new foreclosures in New York hit an all-time high during the second quarter and is now essentially equal with Florida. The percentage of loans in foreclosure in New Jersey remains about the same as the rates in California, Arizona and Nevada combined. The foreclosure percentages in Connecticut are back to near all-time highs for that state.

Click on graph for larger image.

Click on graph for larger image.This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

The top states are Florida (10.58% in foreclosure down from 11.43% in Q1), New Jersey (8.01% down from 9.00%), New York (6.09% down from 6.18%), and Maine (5.62% down from 5.80%). Nevada is the only non-judicial state in the top 10, and this is partially due to state laws that slow foreclosures.

California (1.64% down from 1.76%) and Arizona (1.51% down from 1.77%) are now well below the national average by every measure.

For judicial foreclosure states, it appears foreclosure inventory peaked in Q2 2012 (foreclosure inventory is the number of mortgages in the foreclosure process). Foreclosure inventory in the judicial states has declined for four consecutive quarters. This was three years after the peak in foreclosure inventories for non-judicial states.

For judicial foreclosure states, it appears foreclosure inventory peaked in Q2 2012 (foreclosure inventory is the number of mortgages in the foreclosure process). Foreclosure inventory in the judicial states has declined for four consecutive quarters. This was three years after the peak in foreclosure inventories for non-judicial states.It looks like the judicial states will have a significant number of distressed sales for several more years.

Las Vegas Real Estate in July: Year-over-year Non-contingent Inventory up 9%

by Calculated Risk on 8/08/2013 05:43:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR report shows 18-month run of rising home prices

GLVAR said the total number of existing local homes, condominiums and townhomes sold in July was 3,633. That’s down slightly from 3,642 in June, but up from 3,572 total sales in July 2012. ...There are several key trends that we've been following:

...

In July, [GLVAR President Dave Tina said] “traditional” sales accounted for a recent high of 64 percent of all local home sales. ... In July, 28.0 percent of all existing home sales were short sales, down from 31.0 percent in June. Another 8.0 percent of all July sales were bank-owned properties, down from 9.0 percent of all sales in June. The remaining 64 percent of all sales were the traditional type, up from 60 percent in June.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service increased in July, with 14,133 single-family homes listed for sale at the end of the month. That’s up 2.8 percent from 13,750 single-family homes listed for sale at the end of June, but down 16.6 percent from last year. ...

By the end of July, GLVAR reported 4,681 single-family homes listed without any sort of offer. That’s up 22.3 percent from 3,828 such homes listed in June and up 9.0 percent from one year ago.

emphasis added

1) Overall sales were down slightly from June, but up slightly year-over-year.

2) Conventional sales are up sharply. In July 2012, only 39.3% of all sales were conventional. This year, in July 2013, 64% were conventional. That is an increase in conventional sales of about 65% (of course there is heavily investor buying, but that is still quite an increase in non-distressed sales).

3) Most distressed sales are short sales instead of foreclosures (over 3 to 1).

4) and probably most interesting right now is that non-contingent inventory (year-over-year) is now increasing. Non-contingent inventory is up 9.0% year-over-year.

This suggests inventory has bottomed in Las Vegas (A major theme for housing in 2013). And this suggests price increases will slow.

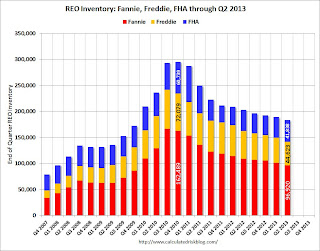

Fannie, Freddie, FHA REO inventory declines in Q2 2013

by Calculated Risk on 8/08/2013 02:24:00 PM

Fannie released their second quarter results this morning. In their SEC filing, Fannie reported their Real Estate Owned (REO) declined to 96,920 single family properties, down from 101,449 at the end of Q1.

The combined Real Estate Owned (REO) for Fannie, Freddie and the FHA declined to 183,381 at the end of Q2 2013, down 3% from Q1, and down almost 10% from 202,765 in Q2 2012. The peak for the combined REO of the F's was 295,307 in Q4 2010.

This following graph shows the REO inventory for Fannie, Freddie and the FHA.

Click on graph for larger image.

Click on graph for larger image.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions, VA and more. REO has been declining for those categories too.

Although REO was down for Fannie and Freddie in Q2 from Q1, REO increased for the FHA for the 2nd consecutive quarter - this is something to watch.

NAHB: Builder Confidence improves in the 55+ Housing Market in Q2

by Calculated Risk on 8/08/2013 12:02:00 PM

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008, so the readings have been very low. This is the first ever reading above 50.

From the NAHB: Builder Confidence in the 55+ Housing Market Shows Significant Improvement in Second Quarter

Builder confidence in the 55+ housing market for single-family homes showed strong continued improvement in the second quarter of 2013 compared to the same period a year ago, according to the National Association of Home Builders’ (NAHB) latest 55+ Housing Market Index (HMI) released today. The index increased 24 points to a level of 53, which is the highest second-quarter number since the inception of the index in 2008 and the seventh consecutive quarter of year over year improvements. [CR Note: NAHB is reporting the year-over-year increase]

...

All of the components of the 55+ single-family HMI showed major growth from a year ago: present sales climbed 24 points to 54, expected sales for the next six months increased 25 points to 60 and traffic of prospective buyers rose 26 points to 48

The 55+ multifamily condo HMI posted a substantial gain of 24 points to 43, which is the highest second-quarter reading since the inception of the index. All 55+ multifamily condo HMI components increased compared to a year ago as present sales rose 26 points to 44, expected sales for the next six months climbed 26 points to 46 and traffic of prospective buyers rose 19 points to 38.

The 55+ multifamily rental indices also showed strong gains in the second quarter as present production increased 19 points to 50, expected future production rose 20 points to 52, current demand for existing units climbed 20 points to 62 and future demand increased 21 points to 63.

“The 55+ HMI for single-family homes almost doubled from a year ago,” said NAHB Chief Economist David Crowe. “Sentiment in other segments of the 55+ market housing was strong as well. This is consistent with the increase in builder confidence we’ve seen in other NAHB surveys recently. At this point, the main challenge for builders in many parts of the country is finding enough buildable lots in desirable locations and workers with the necessary skill set to respond to the increased demand.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q2 2013. This is the first reading above 50, and this indicates that more builders view conditions as good than poor.

This is going to be a key demographic for household formation over the next couple of decades, but only if the baby boomers can sell their current homes.

There are two key drivers: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.