by Calculated Risk on 7/25/2013 05:43:00 PM

Thursday, July 25, 2013

Larry Summers and the Pivot to Austerity

Just a thought, I haven't seen any discussion on this ... the pivot to austerity in early 2010 is widely viewed as a major mistake (as opposed to staying focused on employment). Larry Summers was the Director of the National Economic Council until December 2010, so he probably played a key role in the austerity pivot.

In 2010, Fed Chairman Ben Bernanke was already warning about premature tightening:

"Economic conditions provide little scope for reducing deficits significantly further over the next year or two; indeed, premature fiscal tightening could put the recovery at risk. Over the medium- and long-term, however, the story is quite different."This has been a familiar comment from Bernanke over the last few years: less austerity now, and put the long run deficit on a sustainable path. Unfortunately this advice has fallen on deaf ears.

A key question for Mr. Summers is what role he played in the premature pivot to austerity.

Also, from FT Alphaville: Larry Summers on QE

Lawrence Summers made dismissive remarks about the effectiveness of quantitative easing at a conference in April, raising the possibility of a big shift in US monetary policy if he becomes chairman of the Federal Reserve.

... the people who have discussed policy with him say Mr Summers regards fiscal policy as a more effective tool than monetary policy. “More of what will determine things going forward will have to do with fiscal policy and that there is less efficacy from quantitative easing than is supposed,” he said in his Santa Monica remarks.

Freddie Mac: 30 Mortgage Rate declines to 4.31% in Latest Survey

by Calculated Risk on 7/25/2013 02:21:00 PM

From Freddie Mac today: Mortgage Rates Calm Further

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates easing for the second consecutive week helping to alleviate concerns over a slowdown in the housing market and amid recent strong homes sales data for June. ...The 30 year mortgage rate hit 4.51% in the Freddie Mac survey two weeks ago, and is now down to 4.31%. This is still up sharply from 3.35% in early May.

30-year fixed-rate mortgage (FRM) averaged 4.31 percent with an average 0.8 point for the week ending July 25, 2013, down from last week when it averaged 4.37 percent. Last year at this time, the 30-year FRM averaged 3.49 percent.

15-year FRM this week averaged 3.39 percent with an average 0.8 point, down from last week when it averaged 3.41 percent. A year ago at this time, the 15-year FRM averaged 2.80 percent.

Kansas City Fed: Regional Manufacturing expanded in July

by Calculated Risk on 7/25/2013 11:05:00 AM

From the Kansas City Fed: Tenth District Manufacturing Survey Rose Moderately

The Federal Reserve Bank of Kansas City released the July Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity rose moderately, although producers' expectations for future activity eased somewhat.So far all of the regional surveys - except Richmond - showed improvement in July. The Dallas Fed regional survey will be released next Monday, and the ISM index for July will be released Thursday, August 1st.

“We saw several positive things in this month's survey. Production and shipments rebounded after being disrupted by storms last month," said Wilkerson. "And while some firms remain hesitant to expand, overall capital spending and hiring plans remain positive.”

The month-over-month composite index was 6 in July, up from -5 in June and 2 in May ... Most other month-over-month indexes also improved. The production index increased from -17 to 21, its highest level since June 2011, and the shipments and new orders indexes also rose markedly. ... In contrast, the order backlog index edged lower from -4 to -7, and the employment index also eased slightly

Most of the regional surveys (and the Markit Flash PMI) suggest stronger expansion in the ISM index for July.

LPS: Mortgage Delinquency Rate increases in June

by Calculated Risk on 7/25/2013 10:15:00 AM

According to the First Look report for June to be released today by Lender Processing Services (LPS), the percent of loans delinquent increased in June compared to May, and declined about 8% year-over-year. Also the percent of loans in the foreclosure process declined further in June and were down 29%% over the last year.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 6.68% from 6.08% in May. Note: Some of the increase in short term delinquencies in June is seasonal, although the uptick this year was larger than normal. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 2.93% in June from 3.05% in May.

The number of delinquent properties, but not in foreclosure, is down about 8% year-over-year (274,000 fewer properties delinquent), and the number of properties in the foreclosure process is down 29% or 903,000 properties year-over-year.

LPS will release the complete mortgage monitor for June in early August.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| June 2013 | May 2013 | June 2012 | |

| Delinquent | 6.68% | 6.08% | 7.14% |

| In Foreclosure | 2.93% | 3.05% | 4.09% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,983,000 | 1,708,000 | 2,012,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,345,000 | 1,335,000 | 1,590,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,458,000 | 1,525,000 | 2,061,000 |

| Total Properties | 4,785,000 | 4,569,000 | 5,663,000 |

Weekly Initial Unemployment Claims increase to 343,000

by Calculated Risk on 7/25/2013 08:34:00 AM

The DOL reports:

In the week ending July 20, the advance figure for seasonally adjusted initial claims was 343,000, an increase of 7,000 from the previous week's revised figure of 336,000. The 4-week moving average was 345,250, a decrease of 1,250 from the previous week's revised average of 346,500.The previous week was revised up from 334,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 345,250.

The 4-week average has mostly moved sideways over the last few months. Claims were close to the 341,000 consensus forecast.

Wednesday, July 24, 2013

Comments on Janet Yellen; Thursday: Durable Goods, Initial Unemployment Claims

by Calculated Risk on 7/24/2013 09:36:00 PM

All aboard the Janet Yellen express! There were several articles about Yellen (and Larry Summers) over the last couple of days, but what really stands out is Yellen's depth of knowledge on monetary policy and Federal Reserve regulatory issues. She has strong leadership skills, and is admired by just about everyone. She clearly follows the data, and was well ahead of most other FOMC members (and other candidates) on understanding the housing bust and possible consequences.

A few articles, from Cardiff Garcia at the Financial Times: Why Yellen should be the next Fed chair, from Professor Richard Green writing at Forbes: Janet Yellen Would Be A Better Pick For Fed Chair Than Larry Summers, Tim Duy Fed Watch: Shock and Awe(ful), Mike Konczal at Next New Deal: Yellen, Summers and Rebuilding After the Fire, Felix Salmon at Reuters: Don’t send Summers to the Fed and Jon Hilsenrath at the WSJ: Fed Chief Choice Shapes Up as Race Between Summers, Yellen

And from former FDIC Chairwoman Sheila Bair writing at Fortune: Why Janet Yellen should succeed Ben Bernanke

[T]here is no better qualified candidate to fill Bernanke's shoes when he steps down in January. A noted economist, Yellen headed the Council of Economic Advisors for two years; led the San Francisco Federal Reserve Bank for six years; and has served ably as Bernanke's Vice Chairman since 2010. Unlike Larry Summers ... she was not part of the deregulatory cabal that got us into the 2008 financial crisis. In fact, she had a solid record as a bank regulator at the San Francisco Fed and was one of the few in the Fed system to sound the alarm on the risks of subprime mortgages in 2007.If you read all those pieces - and ignore the criticism of Larry Summers - you'll understand why Janet Yellen is such an outstanding choice for Fed Chair. She has all the skills, leadership ability, communications skills (she won teaching accolades as a professor), and she pays attention to developing trends (data guys really respect Yellen).

None of the other candidates was paying attention in 2005 and 2006 like Yellen, as an example here is her '"ghost towns" of the West' comment in 2006:

According to some of our contacts elsewhere in this Federal Reserve District, data like these are actually "behind the curve," and they're willing to bet that things will get worse before they get better. For example, a major home builder has told me that the share of unsold homes has topped 80 percent in some of the new subdivisions around Phoenix and Las Vegas, which he labeled the new "ghost towns" of the West.And Menzie Chinn points out a speech she gave in 2007 and writes:

Having coauthored an entire book on the financial crisis of 2008 (Lost Decades, with Jeffry Frieden) I think that one of the most important qualities for a policymaker is the ability to look forward, and assess potential dangers and understand why those dangers arise. ... Keeping in mind how carefully one must tread as a public official (as opposed to someone pontificating on a blog), [Yellen's] comments [in 2007] strike me as quite prescient, and with the benefit of hindsight, correct in diagnosis.Yellen was correct, but she has no crystal ball - she just paid close attention to the data and drew the correct conclusions. Other candidates can only point to general warnings during that period.

The bottom line is on monetary policy experience, regulatory experience, leadership and communications skills, and the ability to analyze the data - and draw the correct conclusions - Yellen stands head and shoulders above all the other candidates. She is the right person at the right time.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for an increase to 341 thousand from 334 thousand last week.

• Also at 8:30 AM, the Durable Goods Orders for June from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

• At 11:00 AM, the Kansas City Fed Survey of Manufacturing Activity for July. The consensus is for a reading of 0 for this survey, up from minus 5 in June (Above zero is expansion).

NMHC Survey: Apartment Market Conditions Tighten slightly in July

by Calculated Risk on 7/24/2013 04:03:00 PM

From the National Multi Housing Council (NMHC): Second Quarter Apartment Markets Mixed in Latest NMHC Survey

While demand for apartment homes remained strong, rising interest rates exerted negative pressure on the industry’s ability to secure debt financing according to the National Multi Housing Council’s (NMHC) July Quarterly Survey of Apartment Market Conditions. Only the Market Tightness Index (55) remained above the breakeven line of 50 this quarter. Sales Volume (46) and Equity Financing (49) dipped, with Debt Financing dropping sharply to 20.

“Debt costs for apartment firms have been rising. In addition to the 90 basis point increase in interest rates from the April survey, spreads over Treasuries have also gone up, likely dampening transactions somewhat. Rates are still low by historical standards, however, and at current levels should not put too big a crimp in apartment activity going forward,” said Mark Obrinsky, NMHC’s Senior Vice President for Research and Chief Economist. “Underlying demand trends remain strong, and we are approaching the cusp of a meaningful increase in supply that will hopefully be enough to meet the current need for apartment homes.”

...

Market Tightness Index edged up to 55 from 54. Just 14 percent noted looser conditions in the markets they were familiar with. This represents the 13th time in the last 14 quarters in which the index was over 50.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. The quarterly increase was small, but indicates tighter market conditions.

On supply: Even though multifamily starts have been increasing, completions lag starts by about a year - so the builders are still trying to catch up. There will be many more completions in 2013 and in 2014, than in 2012, increasing the supply. As Obrinsky noted: "we are approaching the cusp of a meaningful increase in supply".

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. This survey now suggests vacancy rates might be nearing a bottom, although apartment markets are still tight, so rents will probably continue to increase.

AIA: "Architecture Billings Index Stays in Growth Mode" in June

by Calculated Risk on 7/24/2013 01:38:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Stays in Growth Mode

The Architecture Billings Index (ABI) remained positive again in June after the first decline in ten months in April. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the June ABI score was 51.6, down from a mark of 52.9 in May. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 62.6, up sharply from the reading of 59.1 the previous month.

“With steady demand for design work in all major nonresidential building categories, the construction sector seems to be stabilizing,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “Threats to a sustained recovery include construction costs and labor availability, inability to access financing for real estate projects, and possible adverse effects in the coming months from sequestration and the looming federal debt ceiling debate.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.6 in June, down from 52.9 in May. Anything above 50 indicates expansion in demand for architects' services. This index has indicated expansion in 10 of the last 11 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. The increases in this index over the past 11 months suggest some increase in CRE investment in the second half of 2013.

A Few Comments on New Home Sales

by Calculated Risk on 7/24/2013 11:28:00 AM

As I noted over the weekend, the key number in the existing home sales report is not sales, but inventory. It is mostly visible inventory that impacts prices. When we look at sales for existing homes, the focus should be on the composition between conventional and distressed, not total sales. So, for those who follow housing closely, the existing home sales report on Monday was solid even though sales were down.

However, for the new home sales report, the key number IS sales! An increase in sales adds to both GDP and employment (completed inventory is at record lows, so any increase in sales will translate to more single family starts). So sales in June at 497 thousand SAAR were very solid (the highest sales rate since May 2008). The housing recovery is ongoing.

Earlier: New Home Sales at 497,000 Annual Rate in June

Looking at the first half of 2013, there has been a significant increase in sales this year. The Census Bureau reported that there were 244 new homes sold in the first half of 2013, up 28.4% from the 190 thousand sold during the same period in 2012. This was the highest sales for the first half of the year since 2008.

And even though there has been a large increase in the sales rate, sales are just above the lows for previous recessions. This suggests significant upside over the next few years. Based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years - substantially higher than the current sales rate.

And an important point worth repeating every month: Housing is historically the best leading indicator for the economy, and this is one of the reasons I think The future's so bright, I gotta wear shades.

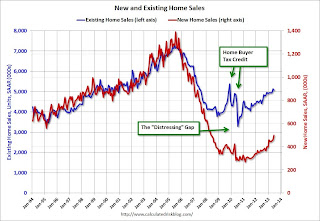

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through June 2013. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to continue to close - mostly from an increase in new home sales.

Another way to look at this is a ratio of existing to new home sales.

Another way to look at this is a ratio of existing to new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down - and is currently at the lowest level since November 2008. I expect this ratio to continue to trend down over the next several years as the number of distressed sales declines and new home sales increase.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 497,000 Annual Rate in June

by Calculated Risk on 7/24/2013 10:00:00 AM

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 497 thousand. This was up from 459 thousand SAAR in May (May sales were revised down from 476 thousand).

March sales were revised down from 451 thousand to 443 thousand, and April sales were revised down from 466 thousand to 453 thousand.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in June 2013 were at a seasonally adjusted annual rate of 497,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 8.3 percent above the revised May rate of 459,000 and is 38.1 percent above the June 2012 estimate of 360,000."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply decreased in June to 3.9 months from 4.2 months in May.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of June was 161,000. This represents a supply of 3.9 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is at a record low. The combined total of completed and under construction is also just above the record low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In June 2013 (red column), 48 thousand new homes were sold (NSA). Last year 34 thousand homes were sold in June. The high for June was 115 thousand in 2005, and the low for June was 28 thousand in 2010 and 2011.

This was above expectations of 481,000 sales in June, and a solid report even with the downward revisions to previous months. I'll have more later today.