by Calculated Risk on 7/16/2013 04:44:00 PM

Tuesday, July 16, 2013

LA area Port Traffic: More Export Weakness in June

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for June since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 1% in June, and outbound traffic down 3%, compared to the rolling 12 months ending in May.

In general, inbound traffic has been increasing slightly, and outbound traffic has been declining slightly.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

This suggests an increase in the trade deficit with Asia for June.

Key Measures show low inflation in June

by Calculated Risk on 7/16/2013 12:29:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in June. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for June here. Motor fuel increased at a 104% annualized rate in June.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.5% (5.9% annualized rate) in June. The CPI less food and energy increased 0.2% (2.0% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.7%, the CPI rose 1.8%, and the CPI less food and energy rose 1.6%. Core PCE is for May and increased just 1.1% year-over-year.

On a monthly basis, median CPI was at 2.0% annualized, trimmed-mean CPI was at 1.6% annualized, and core CPI increased 2.0% annualized. Also core PCE for May increased 1.3% annualized.

Inflation is mostly below the Fed's target, although the Fed expects inflation to pick up a little in the 2nd half of 2013.

NAHB: Builder Confidence increases in July to 57, Highest in 7 Years

by Calculated Risk on 7/16/2013 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 6 points in July to 57. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Rises Six Points in July

Builder confidence in the market for newly built, single-family homes rose six points to 57 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for July, released today. This is the index’s third consecutive monthly gain and its strongest reading since January of 2006.

“Builders are seeing more motivated buyers coming through their doors as the inventory of existing homes for sale continues to tighten,” noted NAHB Chief Economist David Crowe. “Meanwhile, as the infrastructure that supplies home building returns, some previously skyrocketing building material costs have begun to soften.”

...

All three HMI components posted gains in July. The component gauging current sales conditions rose five points to 60 – its highest level since early 2006. Meanwhile, the component gauging sales expectations in the next six months gained seven points to 67 and the component gauging traffic of prospective buyers rose five points to 45 – marking the strongest readings for each since late 2005.

All four regions also posted gains in their HMI scores’ three-month moving averages. The Northeast showed a four-point gain to 40 while the Midwest reported an eight-point gain to 54, the South posted a five-point gain to 50 and the West measured a three-point gain to 51.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the July release for the HMI and the May data for starts (June housing starts will be released tomorrow). This was well above the consensus estimate of a reading of 52.

Fed: Industrial Production increased 0.3% in June

by Calculated Risk on 7/16/2013 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.3 percent in June after having been unchanged in May. For the second quarter as a whole, industrial production moved up at an annual rate of 0.6 percent. In June, manufacturing production rose 0.3 percent following an increase of 0.2 percent in May. The output at mines advanced 0.8 percent in June, while the output of utilities decreased 0.1 percent. At 99.1 percent of its 2007 average, total industrial production was 2.0 percent above its year-earlier level. The rate of capacity utilization for total industry edged up 0.1 percentage point to 77.8 percent, a rate that was 0.1 percentage point above its level of a year earlier but 2.4 percentage points below its long-run (1972–2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.9 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.4 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increase 0.3% in June to 99.1 . This is 18.2% above the recession low, but still 1.8% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were slightly above expectations. The consensus was for a 0.2% increase in Industrial Production in June, and for Capacity Utilization to increases to 77.7%.

CPI increases 0.5% in June, Core CPI 0.2%

by Calculated Risk on 7/16/2013 08:40:00 AM

From the Bureau of Labor Statistics (BLS): Consumer Price Index - June 2013

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.8 percent before seasonal adjustment. The gasoline index rose sharply in June and accounted for about two thirds of the seasonally adjusted all items change.On a year-over-year basis, CPI is up 1.8 percent, and core CPI is up also up 1.6 percent. Both are below the Fed's target. This was close to the consensus forecast of a 0.4% increase for CPI (due to gasoline prices), and a 0.2% increase in core CPI.

...

The index for all items less food and energy increased 0.2 percent in June, the same increase as in May.

emphasis added

Note: CPI-W (used for cost of living adjustment, COLA) is also up 1.8% year-over-year in June. The COLA is calculated using the average Q3 data (July, August, and September).

I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Monday, July 15, 2013

Tuesday: CPI, Industrial Production, Homebuilder Confidence

by Calculated Risk on 7/15/2013 08:57:00 PM

And the Q2 GDP forecasts are lowered again following the weaker than expected retail sales report ...

Via the WSJ:

RBS lowered its forecast for the nation's economic growth rate in the second quarter to a weak 0.5% from 0.8%Steve Lisman via CNBC:

[W]e just calculated using about eight estimates that have been changed today. The current GDP forecast for the second quarter, it's now below 1% ... 0.9%. it should actually be a bit lower in there because one guy in there, UBS, up there 1.12%, that's the prior, and that is now down below 1, with the low being 0.3%Tuesday:

• At 8:30 AM ET, the Consumer Price Index for June will be released. The consensus is for a 0.4% increase in CPI in June and for core CPI to increase 0.2%.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for June. The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 77.7%.

• At 10:00 AM, the July NAHB homebuilder survey will be released. The consensus is for a reading of 52, the same as in June. Any number above 50 indicates that more builders view sales conditions as good than poor.

Weekly Update: Existing Home Inventory is up 18.1% year-to-date on July 15th

by Calculated Risk on 7/15/2013 05:25:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for May). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 18.1%, and I expect some further increases over the next month or two.

It now seems likely that inventory bottomed early this year.

It is important to remember that inventory is still very low, and is down 10.7% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), I expect price increases to slow.

Report: Home Listed For Sales up 4.3% in June from May, Down 7.3% year-over-year

by Calculated Risk on 7/15/2013 01:01:00 PM

From Nick Timiraos at the WSJ: Housing Listings Multiply in June

The number of homes listed for sale increased by 4.3% in June to 1.9 million homes, the highest level in the last year, according to data released Monday by Realtor.com. ... Listings typically climb heading into the spring and summer, when housing activity hits a seasonal peak. But inventories appear to be posting larger-than-usual gains in many markets right now as they rise from their lowest levels in at least a decade. ...Note: Here is the realtor.com site (not updated with June data yet at posting time).

Nationally, the number of homes listed for sale stood 7.3% below their levels of one year earlier. The year-over-year decline stood at 18.6% in February, by contrast.

...

The question now is whether higher inventory will lead to higher sales volumes, and whether it will also slow the pace of home-price gains.

emphasis added

Last month, the NAR reported inventory was down 10.1% from May 2012. That was the smallest year-over-year (YoY) decrease since 2011, and it appears the YoY decrease will be in single digits for June (the NAR reports June sales and inventory next Monday). Tom Lawler's initial estimate is that the NAR will report a 6.3% YoY decline in inventory in June.

My guess is the YoY change for inventory will probably turn positive in September and that inventory bottomed in early 2013.

FNC: House prices increased 4.0% year-over-year in May

by Calculated Risk on 7/15/2013 10:22:00 AM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: Home Prices Continue to Rise Steadily; Up 0.5% in May

The latest FNC Residential Price Index™ (RPI) shows that U.S. home prices continue to steadily improve, climbing another 0.5% in May in conjunction with continued improvement in housing market fundamentals. Notably, the FNC RPI shows that the pace at which home prices are rising is rather modest, averaging 0.4% per month in the last six months. Similarly, the rate of annual price appreciation appears to be much slower and sustainable than reported by a number of other closely watched price indices.Note: This increase is partially seasonal. This year prices were up 0.5% in May (from April). Last year, in May 2012, prices were up 1.0% - so this is slower seasonal price appreciation this year.

... Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that May home prices rose from the previous month at a seasonally unadjusted rate of 0.5%. The two narrower indices (30-MSA and 10-MSA composites) recoded a 0.4% increase. On a year-over-year basis, home prices were up a modest 4.0% from a year ago.

The year-over-year change slowed in May, with the 100-MSA composite up 4.0% compared to May 2012. The FNC index turned positive on a year-over-year basis in July, 2012.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Even with the recent increase, the FNC composite 100 index is still off 28.3% from the peak.

Retail Sales increased 0.4% in June

by Calculated Risk on 7/15/2013 08:43:00 AM

On a monthly basis, retail sales increased 0.4% from May to June (seasonally adjusted), and sales were up 5.7% from June 2012. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for June, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $422.8 billion, an increase of 0.4 percent from the previous month, and 5.7 percent above June 2012.

Click on graph for larger image.

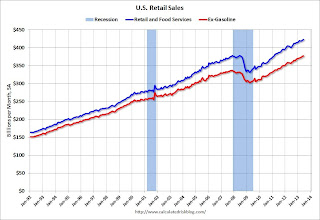

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 27.5% from the bottom, and now 11.8% above the pre-recession peak (not inflation adjusted)

Retail sales ex-autos increased slightly. Retail sales ex-gasoline increased 0.3%.

Excluding gasoline, retail sales are up 24.6% from the bottom, and now 12.2% above the pre-recession peak (not inflation adjusted).

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.Retail sales ex-gasoline increased by 5.9% on a YoY basis (5.7% for all retail sales).

This was below the consensus forecast of 0.8% increase in retail sales.