by Calculated Risk on 7/09/2013 03:54:00 PM

Tuesday, July 09, 2013

Zillow: 30-Year Fixed Mortgage Rates Surge to Highest Level in 2 Years

The Freddie Mac Weekly Primary Mortgage Market Survey® will be released on Thursday (the series I usually follow), but since everyone is curious about mortgage rates, here is a release from Zillow today: 30-Year Fixed Mortgage Rates Surge to Highest Level in 2 Years

Mortgage rates for 30-year fixed mortgages rose this week, with the current rate borrowers were quoted on Zillow Mortgage Marketplace at 4.41 percent, up from 4.17 percent at this same time last week.The ten year Treasury yield closed at 2.71% on Friday, but has fallen to 2.63% today.

The 30-year fixed mortgage rate hovered between 4.2 and 4.3 percent early last week and spiked at 4.6 percent on Friday before declining near the current rate early this week. The last time rates exceeded 4.4 percent was July 26, 2011.

“Rates surged on Friday after a stronger-than-expected jobs report and upward revisions to prior months’ unemployment levels,” said Erin Lantz, director of Zillow Mortgage Marketplace. “This week, rate movement will depend on whether Wednesday’s release of the Federal Open Market Committee meeting minutes and Fed Chairman Ben Bernanke’s speech reinforce or depress market expectations of a September start of easing federal stimulus.”

BLS: Job Openings little changed in May

by Calculated Risk on 7/09/2013 11:21:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 3.8 million job openings on the last business day of May, little changed from April, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.3 percent) and separations rate (3.2 percent) also were little changed in May. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ...The number of quits (not seasonally adjusted) was little changed over the 12 months ending in May for total nonfarm, total private, government, and in all four regions.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent employment report was for June.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in May to 3.828 million, up from 3.800 million in April. The number of job openings (yellow) has generally been trending up, but openings are only up 1% year-over-year compared to May 2012.

Quits were up in May, and quits are up about 2% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market.

Reis: Apartment Vacancy Rate unchanged at 4.3% in Q2 2013

by Calculated Risk on 7/09/2013 09:50:00 AM

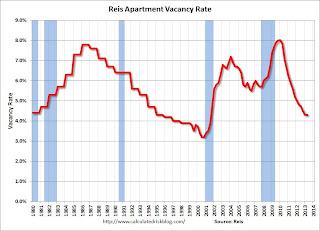

Reis reported that the apartment vacancy rate was unchanged in Q2. The vacancy rate was at 4.8% in Q2 2012 (a year ago) and peaked at 8.0% at the end of 2009.

Some data and comments from Reis Senior Economist Ryan Severino:

Vacancy was unchanged during first quarter at 4.3%. While the rate of vacancy compression has been slowing in recent quarters, this marks the first time that the quarterly vacancy rate has not fallen since the first quarter of 2010. Over the last four quarters national vacancies have declined by 50 basis points, a bit slower than last quarter's year‐over‐year decline in vacancy of 70 basis points. This dynamic is somewhat to be expected ‐ as the market gets tighter and tighter, it becomes increasingly difficult for vacancy to continue falling at a high rate as vacant units, or at least palatable vacant units, disappear from the market.

The aforementioned stalling in vacancy decline is more a function of increasingly supply than decreasing demand. On the demand side, the sector absorbed 31,973 units in the second quarter, about on par with absorption from one year ago during 2Q2012 and down slightly from the 39,319 units that were absorbed during the first quarter of 2013. Year‐to‐date, the sector has absorbed more units in 2013 than were absorbed through this point in 2012. However, new construction is finally starting to pick up a bit. Completions during the second quarter were 26,584 units, an increase relative to last quarter's 16,578 units and slightly below the 29,523 units that were delivered during the fourth quarter of 2012. This appears to be the front end of the relatively large wave of new supply that is estimated to come online over the next few years.

Asking and effective rents grew by 0.6% and 0.7%, respectively, during the second quarter. This is a slight increase relative to the first quarter when asking and effective rents grew by 0.5% and 0.6%, respectively. However, during the last few quarters rent growth has slowed relative to the mini‐spike that was observed during mid‐2012

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

New supply is finally coming on the market and the vacancy rate has stopped falling (at least for one quarter).

Apartment vacancy data courtesy of Reis.

NFIB: Small Business Optimism Index declines in June

by Calculated Risk on 7/09/2013 08:19:00 AM

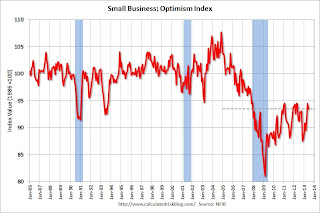

From the National Federation of Independent Business (NFIB): Small Business Optimism Drops in June, Ends 2 Months of Increases

Small-business optimism remained in tepid territory in June, as NFIB’s monthly economic Index dropped just under a point (0.9) and landed at 93.5 ...In a little sign of good news, only 18% of owners reported weak sales as the top problem (lack of demand). During good times, small business owners usually complain about taxes and regulations - and those are now the top problems again.

Job creation plans rose 2 points to a net 7% planning to increase total employment, better, but still a weak reading.

...

Five percent of the owners reported that all their credit needs were not met, unchanged and the lowest reading since February 2008.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index decreased to 93.5 in June from 94.4 in May. This is still low, but just below the post-recession high.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

Monday, July 08, 2013

Tuesday: Apartment Vacancy Survey, Job Openings

by Calculated Risk on 7/08/2013 08:57:00 PM

From Nick Timiraos at the WSJ: Why Home-Price Gains Will Slow Amid Higher Mortgage Rates. Timiraos suggests seven areas to watch, here are a few:

4. What does this mean for investors? If anyone gains, it could be investors that have been buying up cheap homes as rental properties. “I see investors licking their chops,” said Redfin’s Mr. Kelman. “Investors were really getting frustrated this spring trying to compete against all this funny money” from low rates. Also, to the extent that rising rates freeze would-be buyers out of the market, that should help increase rental demand.Tuesday:

There have been signs, however, that higher home prices have prompted investors to dial back their purchases because it’s become more difficult to dig up bargains, even before rates began to rise.

[CR: I disagree that this is good for investors. I think higher rates will slow investor buying because of competing returns on other investments.]

5. How fast will inventory rise? Even before rates increased, the number of homes offered for sale was rising at a slightly faster pace than it normally does during the spring, even though inventory in May was still around 10% below last year’s level. One sign that inventory has picked up is that competitive offer situations are dropping. The share of offers written by Redfin agents that faced a competing offer fell to 69.5% of offers in May, down from 73.3% in April. One year ago, some 69.3% of offers faced at least one competing bid.

Markets that have seen larger increases in listings have seen even bigger declines in multiple-bid situations. In Orange County, Calif., where the inventory of homes for sale is up by more than one third since March, some 84% of homes where Redfin agents wrote an offer in May had competing bids, compared to 94% in April. In San Diego, some 73% of offers in May had multiple offers, compared to 87% in April.

[CR: I think inventory is key]

6. Is this the end of the housing rebound? [CR short answer: no]

• Early: Reis Q2 2013 Apartment Survey of rents and vacancy rates.

• At 7:30 AM ET, NFIB Small Business Optimism Index for June. The consensus is for an increase to 94.7 from 94.4 in May.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for May from the BLS. The number of job openings has generally been trending up.

Duy on Tapering in September

by Calculated Risk on 7/08/2013 06:24:00 PM

From Tim Duy at Economist's View: On That September Tapering. A few excerpts:

I think September is the date to begin tapering, and the data flow would need to turn notably downward to forestall a policy shift at that time. I think it is important to recognize that the Federal Reserve is treating quantitative easing and interest rates as two very separate policies, and each has its own relevant data. ...Duy makes a strong argument, and he is correct that market participants frequently seem to confuse the two Fed tools (it doesn't seem confusing to me).

...

[Q]uantitative easing has always been primarily about the job market and mitigating downside risks, essentially putting a floor under the economy.

...

More to the point, however, is that they are not entirely comfortable with quantitative easing and want to quickly bring the program to a conclusion. Hence the bar to ending quantitative easing is relative low now. They are more comfortable with zero interest rates, and thus have a relatively high bar for changing interest rates.

In short, to accept a September tapering as a data dependent decision, you need to accept that the data threshold is relatively low and differs from the threshold for interest rate policy. They are two separate policies. Consequently, we don't need to see substantially better data to forestall a September taper, but instead substantially worse data.

...

Bottom Line: The Federal Reserve is having a difficult time convincing market participants that quantitative easing and interest rates represent two separate policy tools. They want to severe the perception that the two are connected - a reduction in the pace of asset purchases thus does not signal a change in the expected lift-off from the zero bound. Understanding that the two policies are different is, I think, key to understanding why the Fed is heading toward a September tapering despite what many view as an overall subpar economic environment.

However, Bernanke stated:

"If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year."I guess it depends on what "broadly consistent" means. Clearly the economy is already under performing the Fed's forecast, and if "broadly consistent" means the lower bound of their forecasts, the economy would have to pickup significantly in July and August to taper in September. Of course "broadly consistent" could mean a fairly large miss ...

Weekly Update: Existing Home Inventory is up 16.3% year-to-date on July 8th

by Calculated Risk on 7/08/2013 02:10:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for May). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 16.3%, and I expect some further increases over the next couple of months.

Inventory is well above the peak percentage increases for 2011 and 2012 and this suggests to me that inventory is near the bottom. It now seems likely - at least by this measure - that inventory bottomed early this year.

It is important to remember that inventory is still very low, and is down 12.4% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), I expect price increases to slow.

Reis: Office Vacancy Rate unchanged in Q2 at 17.0%

by Calculated Risk on 7/08/2013 11:03:00 AM

Reis released their Q2 2013 Office Vacancy survey this morning. Reis reported that the office vacancy rate was unchanged at 17.0% in Q2.

From Reis Senior Economist Ryan Severino:

Vacancy was unchanged during the second quarter at 17.0%. This is a nominal slowdown from the prior quarter's 10 basis point decline in vacancy. However, the reality of the situation is that the decline in vacancy on a quarterly basis since the market began to recover in mid‐2011 has been unable to exceed just 10 basis points. So calling this quarter a slowdown, while technically true, is a bit hyperbolic. On a year‐over‐year basis, the vacancy rate fell by a scant 30 basis points. With the labor market unable to generate significant office‐using employment, demand for space remains enervated. Without even modest demand, the decline in the national vacancy rate will not accelerate. National vacancies remain elevated at 450 basis points above the sector's cyclical low, recorded in the third quarter of 2007 before the recession began that December.On new construction:

emphasis added

Occupied stock increased by 7.230 million SF in the second quarter. While this is technically an increase versus last quarter's 3.933 million SF of net absorption, it originates from the 7.594 million SF that were completed during the quarter. Sans this construction‐related absorption, there is little to no demand for space in existing buildings in the market. Clearly, the market is favoring new space at the expense of old space at this juncture. Nonetheless, it is somewhat heartening to see a bit of an increase in new construction activity. The market has not delivered as much new space since the second quarter of 2010 when many projects were completed only because they had been started before anyone fully grasped the magnitude of the Great Recession. Auspiciously, this quarter's mini‐spike in construction activity comes hot on the heels of last quarter's scant 2.191 million SF of new office space, the lowest quarterly figure for new completions since Reis began publishing quarterly data in 1999.On rents:

Asking and effective rents both grew by 0.4% during the second quarter. This is now the second quarter in a row that both asking and effective rent growth have slowed. 0.4% for both metrics is about on par with the quarterly average growth rate since rents began rising consistently in the fourth quarter of 2010. Asking and effective rents have now risen for eleven consecutive quarters. Yet, the cumulative growth in asking and effective rents during this 11‐quarter recovery period is only 4.7% and 5.4%, respectively. For comparison's sake, the office market is able to produce that kind of rent growth in typical calendar‐year periods. Rents remain below peak levels set in 2008. Without stronger demand, it will take years to return to those levels.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was unchanged in Q2 at 17.0%, and down from 17.3% in Q2 2012. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010, and Q1 2011.

As Severino noted, construction picked up in Q2 (more office space was delivered) and this kept the vacancy rate from falling.

Office vacancy data courtesy of Reis.

LPS: Large Decline in Mortgage Delinquencies, U.S. Negative Equity Share Falls Below 15 Percent

by Calculated Risk on 7/08/2013 08:35:00 AM

LPS released their Mortgage Monitor report for May today. According to LPS, 6.08% of mortgages were delinquent in May, down from 6.21% in April.

LPS reports that 3.05% of mortgages were in the foreclosure process, down from 4.12% in May 2012.

This gives a total of 9.13% delinquent or in foreclosure. It breaks down as:

• 1,708,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,335,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,525,000 loans in foreclosure process.

For a total of 4,469,000 loans delinquent or in foreclosure in May. This is down from 5,605,000 in May 2012.

Click on graph for larger image.

Click on graph for larger image.

The first graph from LPS shows percent of loans delinquent and in the foreclosure process over time.

From LPS:

The May Mortgage Monitor report released by Lender Processing Services found that the national delinquency rate continued to fall in May, marking the largest year-to-date drop since 2002. Delinquencies are down more than 15 percent since the end of December 2012, coming in at 6.08 percent for the month. As LPS Applied Analytics Senior Vice President Herb Blecher explained, much of this improvement is supported by the fact that new problem loan rates are approaching the pre-crisis average.

“Though they are still approximately 1.4 times what they were, on average, during the 1995 to 2005 period, delinquencies have come down significantly from their January 2010 peak,” Blecher said. “In large part, this is due to the continuing decline in new problem loans -- as fewer problem loans are coming into the system, the existing inventories are working their way through the pipeline. New problem loan rates are now at just 0.73 percent, which is right about on par with the annual averages during 2005 and 2006, and extremely close to the 0.55 percent average for the 2000-2004 period preceding.

The second graph shows the percent of loans with negative equity. From LPS:

The second graph shows the percent of loans with negative equity. From LPS:“As we’ve noted before,” Blecher continued, “negative equity appears to still be one of the strongest drivers of new problem loans, and -- primarily buoyed by home price increases nationwide -- that situation also continues to improve. We looked once again at the number of ‘underwater’ loans in the U.S., and found that the total share of mortgages with LTVs of greater than 100 percent had declined to just 7.3 million loans as of the end of the first quarter of 2013. This accounts for less than 15 percent of all currently active loans and represents a nearly 50 percent year-over-year decline.”There is much more in the mortgage monitor.

Sunday, July 07, 2013

Sunday Night Futures

by Calculated Risk on 7/07/2013 09:00:00 PM

Monday:

• Early: The LPS May Mortgage Monitor report. This is a monthly report of mortgage delinquencies and other mortgage data.

• Early: Reis Q2 2013 Office Survey of rents and vacancy rates.

• At 3:00 PM ET, Consumer Credit for May from the Federal Reserve. The consensus is for credit to increase $13.0 billion in May.

Weekend:

• Schedule for Week of July 7th

Over in Europe from Reuters: Greece, foreign lenders close in on deal to unlock aid

Greece is likely to reach a deal with foreign lenders on its latest bailout review before a meeting of euro zone finance ministers on Monday to decide on further aid, EU and Greek officials said on Sunday.The Asian markets are green tonight with the Nikkei up 1.1%.

...

Greece hopes euro zone finance ministers will free up its next 8.1 billion-euro ($10.4 billion) tranche of aid when they meet on Monday ...

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 6 and DOW futures are up 53 (fair value).

Oil prices have increased recently with WTI futures at $103.91 per barrel and Brent at $108.00 per barrel. The spread between WTI and Brent has narrowed significantly.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices have fallen 15 cents per gallon over the last three weeks to almost $3.49 per gallon. Based on Brent prices and the calculator at Econbrowser, I expect gasoline prices to move up a 5 cents if oil prices stay steady.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |