by Calculated Risk on 7/08/2013 11:03:00 AM

Monday, July 08, 2013

Reis: Office Vacancy Rate unchanged in Q2 at 17.0%

Reis released their Q2 2013 Office Vacancy survey this morning. Reis reported that the office vacancy rate was unchanged at 17.0% in Q2.

From Reis Senior Economist Ryan Severino:

Vacancy was unchanged during the second quarter at 17.0%. This is a nominal slowdown from the prior quarter's 10 basis point decline in vacancy. However, the reality of the situation is that the decline in vacancy on a quarterly basis since the market began to recover in mid‐2011 has been unable to exceed just 10 basis points. So calling this quarter a slowdown, while technically true, is a bit hyperbolic. On a year‐over‐year basis, the vacancy rate fell by a scant 30 basis points. With the labor market unable to generate significant office‐using employment, demand for space remains enervated. Without even modest demand, the decline in the national vacancy rate will not accelerate. National vacancies remain elevated at 450 basis points above the sector's cyclical low, recorded in the third quarter of 2007 before the recession began that December.On new construction:

emphasis added

Occupied stock increased by 7.230 million SF in the second quarter. While this is technically an increase versus last quarter's 3.933 million SF of net absorption, it originates from the 7.594 million SF that were completed during the quarter. Sans this construction‐related absorption, there is little to no demand for space in existing buildings in the market. Clearly, the market is favoring new space at the expense of old space at this juncture. Nonetheless, it is somewhat heartening to see a bit of an increase in new construction activity. The market has not delivered as much new space since the second quarter of 2010 when many projects were completed only because they had been started before anyone fully grasped the magnitude of the Great Recession. Auspiciously, this quarter's mini‐spike in construction activity comes hot on the heels of last quarter's scant 2.191 million SF of new office space, the lowest quarterly figure for new completions since Reis began publishing quarterly data in 1999.On rents:

Asking and effective rents both grew by 0.4% during the second quarter. This is now the second quarter in a row that both asking and effective rent growth have slowed. 0.4% for both metrics is about on par with the quarterly average growth rate since rents began rising consistently in the fourth quarter of 2010. Asking and effective rents have now risen for eleven consecutive quarters. Yet, the cumulative growth in asking and effective rents during this 11‐quarter recovery period is only 4.7% and 5.4%, respectively. For comparison's sake, the office market is able to produce that kind of rent growth in typical calendar‐year periods. Rents remain below peak levels set in 2008. Without stronger demand, it will take years to return to those levels.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was unchanged in Q2 at 17.0%, and down from 17.3% in Q2 2012. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010, and Q1 2011.

As Severino noted, construction picked up in Q2 (more office space was delivered) and this kept the vacancy rate from falling.

Office vacancy data courtesy of Reis.

LPS: Large Decline in Mortgage Delinquencies, U.S. Negative Equity Share Falls Below 15 Percent

by Calculated Risk on 7/08/2013 08:35:00 AM

LPS released their Mortgage Monitor report for May today. According to LPS, 6.08% of mortgages were delinquent in May, down from 6.21% in April.

LPS reports that 3.05% of mortgages were in the foreclosure process, down from 4.12% in May 2012.

This gives a total of 9.13% delinquent or in foreclosure. It breaks down as:

• 1,708,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,335,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,525,000 loans in foreclosure process.

For a total of 4,469,000 loans delinquent or in foreclosure in May. This is down from 5,605,000 in May 2012.

Click on graph for larger image.

Click on graph for larger image.

The first graph from LPS shows percent of loans delinquent and in the foreclosure process over time.

From LPS:

The May Mortgage Monitor report released by Lender Processing Services found that the national delinquency rate continued to fall in May, marking the largest year-to-date drop since 2002. Delinquencies are down more than 15 percent since the end of December 2012, coming in at 6.08 percent for the month. As LPS Applied Analytics Senior Vice President Herb Blecher explained, much of this improvement is supported by the fact that new problem loan rates are approaching the pre-crisis average.

“Though they are still approximately 1.4 times what they were, on average, during the 1995 to 2005 period, delinquencies have come down significantly from their January 2010 peak,” Blecher said. “In large part, this is due to the continuing decline in new problem loans -- as fewer problem loans are coming into the system, the existing inventories are working their way through the pipeline. New problem loan rates are now at just 0.73 percent, which is right about on par with the annual averages during 2005 and 2006, and extremely close to the 0.55 percent average for the 2000-2004 period preceding.

The second graph shows the percent of loans with negative equity. From LPS:

The second graph shows the percent of loans with negative equity. From LPS:“As we’ve noted before,” Blecher continued, “negative equity appears to still be one of the strongest drivers of new problem loans, and -- primarily buoyed by home price increases nationwide -- that situation also continues to improve. We looked once again at the number of ‘underwater’ loans in the U.S., and found that the total share of mortgages with LTVs of greater than 100 percent had declined to just 7.3 million loans as of the end of the first quarter of 2013. This accounts for less than 15 percent of all currently active loans and represents a nearly 50 percent year-over-year decline.”There is much more in the mortgage monitor.

Sunday, July 07, 2013

Sunday Night Futures

by Calculated Risk on 7/07/2013 09:00:00 PM

Monday:

• Early: The LPS May Mortgage Monitor report. This is a monthly report of mortgage delinquencies and other mortgage data.

• Early: Reis Q2 2013 Office Survey of rents and vacancy rates.

• At 3:00 PM ET, Consumer Credit for May from the Federal Reserve. The consensus is for credit to increase $13.0 billion in May.

Weekend:

• Schedule for Week of July 7th

Over in Europe from Reuters: Greece, foreign lenders close in on deal to unlock aid

Greece is likely to reach a deal with foreign lenders on its latest bailout review before a meeting of euro zone finance ministers on Monday to decide on further aid, EU and Greek officials said on Sunday.The Asian markets are green tonight with the Nikkei up 1.1%.

...

Greece hopes euro zone finance ministers will free up its next 8.1 billion-euro ($10.4 billion) tranche of aid when they meet on Monday ...

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 6 and DOW futures are up 53 (fair value).

Oil prices have increased recently with WTI futures at $103.91 per barrel and Brent at $108.00 per barrel. The spread between WTI and Brent has narrowed significantly.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices have fallen 15 cents per gallon over the last three weeks to almost $3.49 per gallon. Based on Brent prices and the calculator at Econbrowser, I expect gasoline prices to move up a 5 cents if oil prices stay steady.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

House Prices and Mortgage Rates

by Calculated Risk on 7/07/2013 03:49:00 PM

A week ago I posted a couple of graphs comparing House Prices and Mortgage Rates. The first graph used nominal house prices and the second graph used real house prices (adjusted for inflation).

In that post I noted that historically there has been no strong correlation between interest rates and home prices (I was agreeing with a quote from Douglas Duncan, chief economist at Fannie Mae).

As a caveat, I noted that a "key difference now compared to earlier periods, is that there is more investor buying. And investors will compare their returns on different investments - and rising rates will probably slow investor demand for real estate, even if they are all cash buyers."

Overall my conclusion was that other factors (like a stronger economy) have a bigger impact on house prices than changes in mortgage rates.

Today I looked at several previous periods of sharply rising mortgage rates as summarized in the table below. (I looked for periods when rates increased significantly more than 100 bps in a short period.

During all of these periods the economy was growing as mortgage rates increased sharply. In all of the periods nominal house prices increased, and only in 1994 did real prices decline (that was during the housing bust in several key states like California in the early to mid-90s).

My view is rising rates might slow price increases but not lead to a decline in prices (other than some seasonal declines). As far as the housing recovery (residential investment such as housing starts and new home sales), I think rising mortgage rates will have a minimal impact.

| House Prices During Periods with a Sharp Increase in Mortgage Rates | |||||

|---|---|---|---|---|---|

| Date | Mortgage Rate1 | Date | Mortgage Rate | Nominal House Price Change2 | Real House Price Change3 |

| May-83 | 12.63% | Jul-84 | 14.67% | 6.6% | 1.9% |

| Mar-87 | 9.04% | Oct-87 | 11.26% | 5.2% | 2.8% |

| Oct-93 | 6.83% | Dec-94 | 9.20% | 1.2% | -1.6% |

| Apr-99 | 6.92% | May-00 | 8.52% | 10.9% | 7.5% |

| Apr-13 | 3.45% | ||||

| 1 Mortgage Rates are 30 year fixed from the Freddie Mac Primary Mortgage Market Survey® 2 House Prices are based on the CoreLogic House Price Index. 3 Real prices are adjusted for inflation. | |||||

Lumber Prices off 25% from recent peak

by Calculated Risk on 7/07/2013 11:47:00 AM

Just two months ago I mentioned that lumber prices were nearing the housing bubble highs. Since then prices have declined sharply, with prices off about 25% from the highs in early May.

Some of the decline could be related to additional supply coming on the market, and some due to less buying from China (several sources are reporting that China has pulled back significantly on buying North American lumber).

On additional supply, a few months ago the WSJ had an article about some producers increasing supply:

Georgia-Pacific, the largest U.S. producer of plywood ... plans to invest about $400 million over the next three years to boost softwood plywood and lumber capacity by 20%.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows two measures of lumber prices (not plywood): 1) Framing Lumber from Random Lengths through last week (via NAHB), and 2) CME framing futures.

Lumber prices are now about 25% off the recent highs.

Saturday, July 06, 2013

Public and Private Sector Payroll Jobs: Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 7/06/2013 07:02:00 PM

In April, I posted two graphs comparing changes in public and private sector payrolls during the Bush and Obama presidencies. Several readers asked if I could add Presidents Reagan and Clinton (I've also added the single term of President George H.W. Bush). Below are updates through the June report.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a better comparison might be to look at the percentage change, but this gives an overall view of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama has just started his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.

The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was very sluggish, and private employment was down 946,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 665,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,490,000 private sector jobs added.

Private sector employment increased by 20,864,000 under President Clinton (light blue) and 14,688,000 under President Reagan (yellow).

There were only 1,933,000 more private sector jobs at the end of Mr. Obama's first term. A few months into Mr. Obama's second term, there are now 3,003,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

The public sector grew during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,748,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 732,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are mostly over at the state and local levels, but there are ongoing cutbacks at the Federal level.

Schedule for Week of July 7th

by Calculated Risk on 7/06/2013 03:27:00 PM

The focus this week will be on the FOMC minutes for the June meeting (for further hints on QE3 tapering plans), and on the speech that follows a couple of hours later by Fed Chairman Ben Bernanke.

For prices, PPI for June will be released on Friday.

Also Reis will release their Q2 2013 Office and Apartment vacancy rate survey this week.

Early: Reis Q2 2013 Office Survey of rents and vacancy rates.

3:00 PM ET: Consumer Credit for May from the Federal Reserve. The consensus is for credit to increase $13.0 billion in May.

Early: Reis Q2 2013 Apartment Survey of rents and vacancy rates.

7:30 AM ET: NFIB Small Business Optimism Index for June. The consensus is for an increase to 94.7 from 94.4 in May.

10:00 AM: Job Openings and Labor Turnover Survey for May from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for May from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in April to 3.757 million, down from 3.875 million in March. The number of job openings (yellow) has generally been trending up, and openings are up 7% year-over-year compared to April 2012.

Quits were up in April, and quits are up about 8% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for May. The consensus is for a 0.3% increase in inventories.

2:00 PM: FOMC Minutes for Meeting of June 18-19, 2013.

4:10 PM: Speech by Fed Chairman Ben Bernanke, A Century of U.S. Central Banking: Goals, Frameworks, Accountability, At the National Bureau of Economic Research Conference: The First 100 Years of the Federal Reserve: The Policy Record, Lessons Learned, and Prospects for the Future, Cambridge, Mass.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 337 thousand from 343 thousand last week.

8:30 AM: Producer Price Index for June. The consensus is for a 0.5% increase in producer prices (0.2% increase in core).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for July). The consensus is for a reading of 84.1 unchanged from June.

Unofficial Problem Bank list declines to 743 Institutions

by Calculated Risk on 7/06/2013 08:28:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 5, 2013.

Changes and comments from surferdude808:

Not many fireworks to report with the Unofficial Problem Bank List this week. The only changes are removals through unassisted mergers. After removal, the list stands at 743 institutions with assets of $271.5 billion. A year ago, the list held 913 institutions with assets of $353.4 billion.Yesterday on the employment report:

The FDIC and the State Banking Department allowed the Metropolitan Bank Group, Inc., Chicago IL to merge its problem banks into its lead bank -- North Community Bank, Chicago, IL ($789 million), which has been operating under an enforcement action since 2011 that was recently modified in May 2013. The subsidiaries merged were Metrobank, Berwyn, IL ($622 million); Archer Bank, Chicago, IL ($469 million); Plaza Bank, Norridge, IL ($327 million); and Oswego Community Bank, Oswego, IL ($194 million). Other banks finding merger partners were The Bank of Southern Connecticut, New Haven, CT ($121 million) and Nevada National Bank, Las Vegas, NV ($52 million).

Next week will likely be quiet unless the FDIC gets back in the closing business after taking the past four weeks off.

• June Employment Report: 195,000 Jobs, 7.6% Unemployment Rate

• Employment Report: More Hiring, Wages Up, Still Weak Labor Market

Friday, July 05, 2013

Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 7/05/2013 08:31:00 PM

Earlier on the employment report:

• June Employment Report: 195,000 Jobs, 7.6% Unemployment Rate

• Employment Report: More Hiring, Wages Up, Still Weak Labor Market

A few more employment graphs by request ...

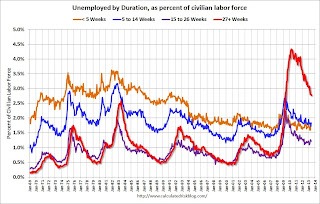

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, but only the less than 5 weeks is back to normal levels.

The long term unemployed is at 2.8% of the labor force - the lowest since May 2009 - however the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 377 thousand. Only 13 thousand construction jobs were added in June. Historically there is a lag between an increase in activity and more hiring - and it appears hiring should pickup significant in the 2nd half of 2013 (Merrill estimates 20 thousand construction jobs per month will be added this year, Goldman estimates 25 to 30 thousand jobs per month, Deutsche Bank around 50 thousand jobs per month in the 2nd half).

The BLS diffusion index for total private employment was at 58.8 in June, down from 61.8 in May.

The BLS diffusion index for total private employment was at 58.8 in June, down from 61.8 in May.For manufacturing, the diffusion index decreased to 46.3, down from 48.1 in June..

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth for total private employment was fairly widespread in June. This is a good sign for the economy. However, for manufacturing, more companies were decreasing employment than adding jobs again in June - for the third consecutive month.

Merrill Lynch on Taper Timing

by Calculated Risk on 7/05/2013 04:26:00 PM

A few excerpts from a research note by Ethan Harris and Michelle Meyer:

Fed officials must be scratching their heads in regards to the sharp reaction of markets to recent tapering talk. Every “core” member of the Committee has been saying tapering is data dependent: this assumes signs of a pick up in both growth and inflation.CR Note: My view is also that data dependent means data dependent. In the two plus weeks since the last FOMC meeting, the data has been below the Fed forecasts (see previous post). I think it will take a clear pickup in the economy during July and August for the FOMC to begin to taper in September; however the consensus is that September is a done deal. Maybe ... perhaps we will know more following the release of the June FOMC meeting minutes next week, and from Bernanke's speech next Wednesday.

In our view, both the markets and economists have not internalized the Fed’s reaction function. Even before the recent downward revisions, most economists surveyed by Bloomberg had weaker growth forecasts for this year than the Fed and yet more than half say tapering starts in September. ...

Why does data seem to matter so much to the Fed, but not to Fed forecasters? We think the Fed has convinced many forecasters that September tapering is a done deal. In May, Bernanke testified that the Fed could taper “in the next few meetings”; that is, by September. Then at his post-FOMC press conference he said he was “deputized” to lay out a specific exit plan: if our forecast is correct, he said, we will taper later this year and end QE by the middle of next year with an unemployment rate of 7%. In our view, he was describing a sensible reaction that will only be realized if their forecast is correct. By contrast, the market interpretation seems to be: “if they are being this specific and not offering any alternative paths, they must be fairly determined to start tapering.” ...

But we disagree with the market interpretation. Data dependent means data dependent. ...

Although the Fed has attempted to clarify its reaction function, we have become increasingly uncertain. The FOMC has zeroed in on the jobs market and to a lesser extent in reduced downside risks: both argue strongly for near-term tapering. However, the Fed’s mandate is to manage the overall economy and the gap between solid jobs and weakness in other growth and inflation indicators has gotten very big ...

Three scenarios seem plausible. (1) The rest of the economy quickly converges to the employment data and the Fed starts a steady move to the exit in September. (2) The Fed decides reduced downside risks make the case for a one-time dial down in QE, so they taper in September but then pause for an extended period waiting for clear broad-based improvement. In other words, subsequent moves are more data dependent than the first. (3) The Fed decides to wait for broad confirmation in data and doesn’t start tapering until December. The third option remains our base case, but clearly we are out of the consensus and September tapering is increasingly possible.