by Calculated Risk on 7/03/2013 10:00:00 AM

Wednesday, July 03, 2013

ISM Non-Manufacturing Index indicates slower expansion in June

The June ISM Non-manufacturing index was at 52.2%, down from 53.7% in May. The employment index increased in June to 54.7%, up from 50.1% in May. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: June 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in June for the 42nd consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 52.2 percent in June, 1.5 percentage points lower than the 53.7 percent registered in May. This indicates continued growth at a slightly slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 51.7 percent, which is 4.8 percentage points lower than the 56.5 percent reported in May, reflecting growth for the 47th consecutive month. The New Orders Index decreased by 5.2 percentage points to 50.8 percent, and the Employment Index increased 4.6 percentage points to 54.7 percent, indicating growth in employment for the 11th consecutive month. The Prices Index increased 1.4 percentage points to 52.5 percent, indicating prices increased at a faster rate in June when compared to May. According to the NMI™, 14 non-manufacturing industries reported growth in June. Respondents' comments are mixed about business conditions depending upon the industry and company. The majority indicate that growth has been slow and incremental; however, it is still better year over year."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 54.5% and indicates slightly slower expansion in June than in May.

Weekly Initial Unemployment Claims decline to 343,000

by Calculated Risk on 7/03/2013 08:35:00 AM

The DOL reports:

In the week ending June 29, the advance figure for seasonally adjusted initial claims was 343,000, a decrease of 5,000 from the previous week's revised figure of 348,000. The 4-week moving average was 345,500, a decrease of 750 from the previous week's revised average of 346,250.The previous week was revised up from 346,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 345,500.

The 4-week average has mostly moved sideways over the last few months. Claims were close to the 345,000 consensus forecast.

ADP: Private Employment increased 188,000 in June

by Calculated Risk on 7/03/2013 08:19:00 AM

Private sector employment increased by 188,000 jobs from May to June, according to the June ADP National Employment Report®. ... May’s job gains were revised downward to 134,000 from 135,000.This was above the consensus forecast for 165,000 private sector jobs added in the ADP report. Note: The BLS reports on Friday, and the consensus is for an increase of 175,000 payroll jobs in June, on a seasonally adjusted (SA) basis.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "The job market continues to gracefully navigate through the strongly blowing fiscal headwinds. Health Care Reform does not appear to be significantly hampering job growth, at least not so far. Job gains are broad based across industries and businesses of all sizes."

Note: ADP hasn't been very useful in predicting the BLS report.

MBA: Mortgage Refinance Applications Decline as Mortgage Rates Increase in Latest Weekly Survey

by Calculated Risk on 7/03/2013 07:01:00 AM

From the MBA: Mortgage Applications Decrease as Rates Reach Two-year High in Latest MBA Weekly Survey

The Refinance Index decreased 16 percent from the previous week and is at its lowest level since July 2011. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier.

...

“Mortgage rates reached their highest point in two years last week. At these rates, many fewer homeowners have an incentive to refinance, and refinance application volume declined more than 15 percent. With this decline in volume, the refinance share dropped to its lowest level in more than two years. Purchase application volume also declined, but not nearly to the same extent, as affordability remains strong,” said Mike Fratantoni, MBA’s Vice President of Research and Economics

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less)increased to 4.58 percent, the highest rate since July 2011, from 4.46 percent, with points increasing to 0.43 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

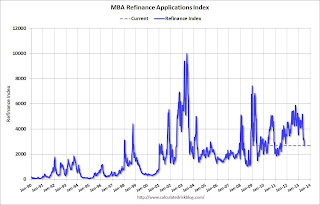

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates above 4.5%, refinance activity has fallen sharply, decreasing in 7 of the last 8 weeks.

This index is down 48% over the last eight weeks.

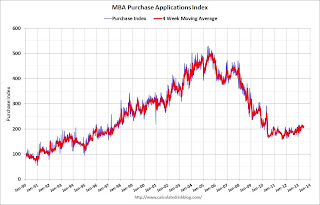

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up almost 10% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up almost 10% from a year ago.

Tuesday, July 02, 2013

Wednesday: Trade Deficit, ADP Employment, ISM Service, Q2 Mall Vacancy Rates

by Calculated Risk on 7/02/2013 08:10:00 PM

The Egyptian "deadline" is tomorrow, from CNN: Showdown? Egypt's Morsy defies military 'ultimatum'

Egyptian President Mohamed Morsy refused Tuesday to bow to a military ultimatum that he find a solution to the unrest sweeping the country or be pushed aside, setting the stage for a possible showdown.Hoping for the best for the people of Egypt.

Morsy declared he was elected president in balloting that was free and representative of the will of the people.

...

It was unclear what steps the military would take given Morsy's refusal to meet its Wednesday evening deadline. The military has previously stopped short of saying that it was suggesting a coup.

Wednesday:

• Early: the Reis Q2 2013 Mall Survey of rents and vacancy rates.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for June will be released. This report is for private payrolls only (no government). The consensus is for 165,000 payroll jobs added in June.

• At 8:30 AM, the Trade Balance report for May from the Census Bureau. The consensus is for the U.S. trade deficit to increase to $40.8 billion in May from $40.3 billion in April.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for a decrease to 345 thousand from 346 thousand last week.

• At 10:00 AM, the ISM non-Manufacturing Index for June will be released. The consensus is for a reading of 54.5, up from 53.7 in May. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, the Trulia Price Rent Monitors for June. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

U.S. Light Vehicle Sales increased to 15.9 million annual rate in June, Highest since November 2007

by Calculated Risk on 7/02/2013 03:59:00 PM

Based on an estimate from WardsAuto, light vehicle sales were at a 15.89 million SAAR in June. That is up 12% from June 2012, and up 4% from the sales rate last month.

This was above the consensus forecast of 15.5 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for June (red, light vehicle sales of 15.89 million SAAR from WardsAuto).

Click on graph for larger image.

Click on graph for larger image.

This is highest level for auto sales since November 2007.

After three consecutive years of double digit auto sales growth, the growth rate will probably slow in 2013 - but this will still be another solid year for the auto industry.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and had been a key driver of the recovery. Looking forward, growth will slow for auto sales. If sales average the recent pace for the entire year, total sales will be up about 8% from 2012.

June Vehicle Sales: Preliminary Reports suggests highest sales rate since 2007

by Calculated Risk on 7/02/2013 01:32:00 PM

Note: I'll post a graph for light vehicle sales once all of the data is available. The data released so far looks pretty strong ...

From the WSJ: U.S. Car Sales Pace Hits Five Year High

U.S. auto sales rose at the strongest rate in more than five years in June, propelled by a surge in pickup truck demand, lending new confidence to industry executives' belief the nation's auto recovery has more room to run.And from CNBC: Trucks Power Strongest June Auto Sales Since 2007

General Motors Co predicted June's annualized selling clip would hit 15.8 million cars and light trucks. That would be the fastest selling pace since November of 2007. A total for June was not available early Tuesday because some auto makers were still calculating their sales figures.

The auto industry looks to have hit another gear when it comes to sales growth. In fact, the June sales pace is expected to be the strongest since December of 2007. This time though, the environment is completely different. Back then, automakers, especially the Big 3, were boosting sales by offering big incentives. That's not happening anymore.

"This time there is genuine demand," said former GM Vice Chair Bob Lutz. "The economy is improving and people are replacing their cars and trucks."

Existing Home Inventory is up 16.7% year-to-date on July 1st

by Calculated Risk on 7/02/2013 11:14:00 AM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for May). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 16.7%, and I expect further increases over the next few months.

Inventory is well above the peak percentage increases for 2011 and 2012 and this suggests to me that inventory is near the bottom. It now seems likely - at least by this measure - that inventory bottomed early this year.

It is important to remember that inventory is still very low, and is down 11.9% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), I expect price increases to slow.

CoreLogic: House Prices up 12.2% Year-over-year in May

by Calculated Risk on 7/02/2013 08:55:00 AM

Notes: This CoreLogic House Price Index report is for May. The recent Case-Shiller index release was for April. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Report Shows Home Prices Rise by 12.2 Percent Year Over Year in May

Home prices nationwide, including distressed sales, increased 12.2 percent on a year-over-year basis in May 2013 compared to May 2012. This change represents the biggest year-over-year increase since February 2006 and the 15th consecutive monthly increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 2.6 percent in May 2013 compared to April 2013.

Excluding distressed sales, home prices increased on a year-over-year basis by 11.6 percent in May 2013 compared to May 2012. On a month-over-month basis, excluding distressed sales, home prices increased 2.3 percent in May 2013 compared to April 2013. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that June 2013 home prices, including distressed sales, are expected to rise by 13.2 percent on a year-over-year basis from June 2012 and rise by 2.9 percent on a month-over-month basis from May 2013. Excluding distressed sales, June 2013 home prices are poised to rise 12 percent year over year from June 2012 and by 2 percent month over month from May 2013.

...

“It’s been more than seven years since the housing market last experienced the increases that we saw in May, with indications that the summer months will continue to see significant gains,” said Dr. Mark Fleming, chief economist for CoreLogic. “As we approach the half-way point of 2013, home prices continue to respond positively to the reductions in home inventory thus far.”

Click on graph for larger image.

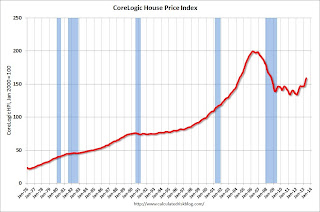

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 2.6% in May, and is up 12.2% over the last year. This index is not seasonally adjusted, and this is usually the strongest time of the year for price increases.

The index is off 21% from the peak - and is up 18.7% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for fifteen consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for fifteen consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

This was another very strong month-to-month increase. Note: CoreLogic notes that prices are up year-over-year in all 50 states excluding distressed sales, and up in 97 of the 100 largest metro areas: "Of the top 100 Core Based Statistical Areas (CBSAs) measured by population, 97 were showing year-over-year increases in May, up from 94 in April 2013."

Monday, July 01, 2013

Tuesday: June Auto Sales

by Calculated Risk on 7/01/2013 09:00:00 PM

More grim news from Europe: Joblessness Edges Higher To Hit a Euro Zone Record

Unemployment in the euro zone continued its steady rise in May ... The jobless rate in the 17 countries that belong to the euro zone was 12.1 percent in May, adjusting for seasonal effects, according to a report from Eurostat, the European Union statistics agency. That figure compared with 12 percent in April ...That is the "good news"? Oh my ... epic failure. Here is the Eurostat unemployment data.

Joblessness in the euro zone has been rising almost without interruption since early 2008, when the financial crisis began, declining only briefly at the beginning of 2011. And analysts see little prospect for a sustained decline anytime soon ... Unemployment rates in Spain and Greece were about 27 percent in May, with youth unemployment remaining well above 50 percent. ... If there was any good news, economists said, it was that unemployment may not go up much more.

Tuesday:

• All day: Light vehicle sales for June. The consensus is for light vehicle sales to increase to 15.5 million SAAR in June (Seasonally Adjusted Annual Rate) from 15.3 million SAAR in May.

• At 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for May. The consensus is for a 2.0% increase in orders.